Forecasting Future Operating Results for an Oilfield Services Company

In our prior two Energy Valuation Insights blog posts, we detailed the specifics of “what is” and “what are the characteristics of” an oilfield equipment/services company (“OFS”), and detailed the typical approaches and methodologies utilized in valuing OFS companies. This week, we’ll address some of the special considerations that must be given attention in the appraisal of OFS companies. Specifically, the challenges in forecasting the future operating results for an OFS company.

In the appraisal of an OFS company, the application of the income approach often includes the application of a discount cash flow (“DCF”) methodology. Actually, one might make the argument that the application of the income approach in appraising an OFS company should nearly always include the application of a DCF methodology, as opposed to relying solely on a capitalization of earnings methodology (“capitalization method”). While application of a capitalization method can provide a reasonable indication of value for companies in many industries, doing so for an OFS company can be problematic due to the inherent cyclicality of the OFS industry. One can attempt adjustments to a capitalization method indication of value to account for future deviations in cash flow growth rates (such as those caused by OFS industry cyclicality), but doing so can involve unnecessary subjectivity, resulting in an indication of value that may lack reliability. Typically, the better, and often more reliable, option is to utilize a DCF method using a forecast of future operating results rather than a capitalization method with imprecise adjustments.

Understanding Industry Cyclicality is an Important Factor in Valuing an OFS Company

In applying the DCF method, the starting point is, of course, the development of a forecast of future cash flow for the subject company, which typically begins with a forecast of future revenues. Here we run into the first of several challenges in the appraisal of OFS companies. The OFS industry is of the most cyclical of industries that analysts can cover. Not just cyclical with the general economy of the region, nation or world, but cyclical in a way that is much more difficult to predict fluctuations in the price of oil (or natural gas) tied to a whole host of factors including technological, political, and even geopolitical factors can make forecasting complicated very quickly.

Several varying forces can make predicting the future demand for oil from a particular region, and therefore, the demand for OFS products/services, quite difficult.

Demand for oil and gas, and therefore demand for OFS products/services, can be as simple as the fact that in a robust economy more goods are being bought by end users and consumers. More purchases of goods, means more goods have to be transported to the end user/consumer, which requires more fuel to facilitate that transportation. Technology can impact the supply side of the equation as oilfield technology advances can lower the cost of oil production, thereby encouraging greater production even when oil prices are stable, or possibly even in decline, all else being equal. Local and national politics can impact demand as well. In the U.S., recent differences in positions on the use of coal as a power source have inserted a new dynamic into the economic demand for oil. In the geopolitical realm, bans on the importation of oil from certain countries (Iran or Venezuela, for example) have created shifts in demand for oil from other oil-producing countries.

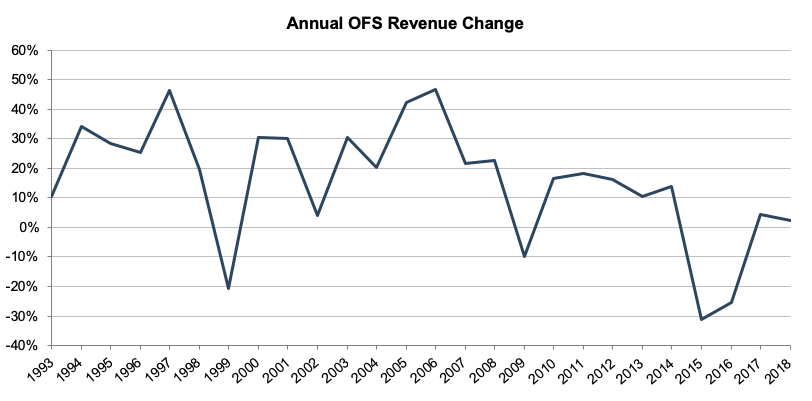

These varying forces can make predicting the future demand for oil from a particular region, and therefore, the demand for OFS products/services in that region, quite difficult. As indicated in the chart below, the timing and magnitude of cycles in the OFS industry can vary significantly.

Forecasting OFS Company Revenues

In forecasting OFS company revenues, one must distinguish between the short-term forecast and the long-term forecast. The short-term forecast will be primarily focused on the current direction of industry revenues, the typical length of industry cycles in estimating the timing of a current down-cycle bottom (or current up-cycle peak), and expectations for the subject company’s revenue cycle relative to that of the OFS industry as a whole (lagging or leading). The long-term forecast for the subject company will be more focused on the expected timing of a return to the mid-cycle level of revenues and the subject company’s particular expected mid-cycle level of revenue, with a potential adjustment for possible changes in the subject company’s market share.

In performing the company level analysis, it’s always important to be aware of past transaction activity, changes in product/service, mix, or changes in markets served.

In support of both the short-term and long-term forecasting considerations, an analysis of past OFS industry cycles and of the subject company’s past revenue cycles is warranted. With access to certain specialized databases, a detailed analysis of industry cycles (or industry participant cycles) can be readily performed. The same cycle analysis regarding the subject company is possible if the company has a long-enough operating history. In performing the company level analysis, it’s always important to be aware of past transaction activity (acquisitions, or divestitures), changes in product/service, mix, or changes in markets served, that might influence the results.

Based on these analyses, the appraiser must determine reasonable estimates for the following:

- The time until the then current up-cycle will peak, or current down-cycle will bottom

- The revenue level at the current up-cycle peak, or current down-cycle bottom

- The time to reaching the next mid-cycle point, or mid-cycle level of revenue

Estimates based on a sound analysis of historical industry and subject company data will result in a reasonable revenue forecast.

Forecasting Considerations

Beyond the industry-wide considerations necessary in developing the OFS company forecast, one must also consider a number of more specific, non-industry-wide factors. These may include the target market (geographic), the subject company’s specific product/service offerings, the mix of product/service offerings, and the subject company’s ability to weather a current industry down-cycle.

Geographic Target Market

Unlike participants in many other industries, OFS industry participants expect that future operating results can be significantly impacted by the geography of their target market, or, more specifically, the geology of their target market. The cost of extracting oil/gas can vary significantly depending on the basin being served. Similarly, the cost of processing (refining) oil from different basins can vary significantly, based on the quality of the oil being produced. For example, according to a 2016 EIA study, lower production costs were more prevalent in the Delaware Basin and Appalachian Basins while higher production costs were more standard in the Eagle Ford and Midland Basins1.

The differences in production costs were partially a factor of the geology of the basins, which impacts the specific processes necessary in order to extract the reserves. In the Marcellus Basin, shallow formations and pad drilling techniques allow for lower cost production, while in the Eagle Ford Basin, deeper and more technically challenging formations tended to result in higher production costs. This changes over time with experience and technology accelerators, as the Eagle Ford’s costs have come down for several producers in the past year.

Cost differentials can result in potentially significant differentials in drilling and production activities across the various basins, depending on prevailing oil prices.

These cost differentials can result in potentially significant differentials in drilling and production activities across the various basins, depending on prevailing oil prices. Proximity to refiners also plays a role as transportation costs can add up. Prices at $60/bbl, for example, may spur activity in one basin while another basin remains at markedly lower activity levels, often captured in “break-even” prices. As such, in estimating future operating activity levels of an OFS company, one must be aware of the expected oil prices and the level of activity that would be expected in conjunction with those prices in the basins served by the subject company.

OFS companies can mitigate some of the cyclicality by diversifying across basins. Operating in multiple markets can spread costs over more operations as well. OFS companies concentrated in one particular basin, on the other hand, would likely experience more volatile swings, particularly if they operate in a high-cost basin.

Specific Product/Service Offerings

The specific products and services offered by the subject OFS company must also be considered, as some services will only experience increased demand at higher oil price points, that justify the operator incurring the additional expense. For example, even in a period of rising production, a provider of services related to more expense stimulation techniques may not see a significant increase in the demand for its services until a certain price point is achieved. On the other hand, providers of services that are necessary for more general production activities would be expected to experience cyclical demand for its services more in-line with the general OFS industry. Some may even be insulated from price declines as E&P companies will continue to demand certain services regardless of price.

Mix of Product/Service Offerings

Similar to the impact of diversification of basins served, diversification across products and services offered can potentially contribute to reduced cycle extremes. An OFS company might see greater cycle extremes for certain exploration and production services. However, offering multiple services not tied to those same exploration and production activities can provide needed diversification which may mute cycle highs and lows.

Financial Condition of the Subject Company

The subject company’s financial condition is often given inadequate consideration in forecasting future operating results; however, it can be critical when appraising companies in industries that commonly experience more significant cycle highs and lows, such as the OFS industry. This is particularly important when the subject industry is facing a material downturn in activity in the early portion of the forecast period.

Consideration of a company’s financial condition can be critical when appraising companies in industries that experience significant cycle highs and lows, such as the OFS industry.

During an industry downturn, certain expenses can’t be avoided, and the subject company may generate negative cash flows until demand returns. As such, an analysis of the company’s financial condition is important in determining its ability to weather the downturn and participate in the expected improved conditions as the industry cycle swings back to more favorable conditions.

Companies that have ample cash reserves, low levels of debt, or a significant ability to reduce fixed costs will be more likely to overcome the impact of the down cycle. Companies that have little cash reserves, substantial leverage, or are less able to cut costs may have to take more significant actions to weather the downturn. Such actions may impact the degree to which they’re able to participate in the industry’s next upswing in demand. In forecasting future operating results, one must include an analysis of the subject company’s financial condition and consider what actions may be necessary in order for the company to deal with the short-term cash outflows. Those actions may, if more extreme, result in the subject company participating to a lesser degree in the eventual industry recovery.

Forecasting OFS Company Cash Flow

Next, is the task of deriving a cash flow forecast from the revenue forecast, through the forecasting of cost of sales and operating expenses. In both cases, a greater level of analysis is warranted for OFS industry participants than for participants in industries less subject to large cycles. The reason being that depending on the relative level of fixed and variable expenses in cost of sales and operating expenses, those expenses, as a percentage of revenues may fluctuate significantly over the course of the industry’s cycle. As demand for labor, materials, and products will be high near the peak of the industry cycle, their cost will potentially increase relative to revenues, resulting in higher cost of sales relative to revenue and lower gross margins. The opposite would be expected for time periods near the bottom of the cycle, with demand at a low point and cost of sales lower relative to revenues, resulting in higher gross margins. Operating expenses can be tied to these peaks and valleys in the industry cycle as well, but the impact may not be as severe, since they have a larger ratio of fixed versus variable components relative to the cost of sales expense.

Unlike companies participating in less cyclical industries where it may be reasonable to forecast cost of sales and/or operating expenses as a static, or near static, percentage of revenues, forecasting OFS company expenses (cost of sales and operating) typically requires an analysis of past operating results in order to identify cycles and ranges of company expenses relative to revenue. The question to be addressed is essentially, what will my cost of sales percentage (of revenues) be at the level of revenue forecasted for each discreet period in the forecast and what will my operating expense percentage be at the level of revenue forecasted for each period in the forecast? Note that due to the likely presence of a greater fixed/variable expense ratio in operating expenses (than cost of sales), the change in operating expenses as a percentage of revenues over the forecast period will likely be more pronounced than for cost of sales.

Extreme Industry Condition Implications

Rare indeed is the industry that is subject to the potential cyclical extremes of the OFS industry. As indicated in the chart below, in 2008 oil prices surged to unprecedented levels for several months (that haven’t been seen since) resulting in a significant spike in OFS product/service demand. Shortly thereafter, in 2009, oil prices dropped sharply to levels that hadn’t been seen since 2003, only to be followed by a sharp increase to a level generally in-line with the price trend that had been established during the 2004 to 2007 period.

Due to these fluctuations in commodity prices, and therefore OFS activity levels, one must be cautious in applying the DCF method. While typical cycle highs and lows can be dealt with through an analysis of historical industry cycles, periods of extreme highs, or extreme lows, create unusual challenges for OFS forecasting. No matter the level of industry experience, extreme industry activity (high or low), can easily lead to forecasts that result in unreliable indications of value. In such instances, while application of an income approach DCF methodology may be warranted and appropriate, it may be the case that reliance on the indication of value derived from this methodology should be afforded less weight relative to the weight afforded indications of value from other valuation methods – likely a market approach guideline company methodology.

Conclusion

As indicated, the unpredictable cyclicality of the OFS industry requires careful consideration of many industry-wide and company-specific factors in developing a reasonable forecast of future operating results. While consideration of such factors should be part of the analysis in the appraisal of businesses in all industries, the impact of these considerations is magnified in highly cyclical industries such as that served by OFS businesses.

Mercer Capital has a breadth and depth of experience in the appraisal of businesses in the oil and gas industry that is rare among independent business appraisal firms. Our Energy Team is led by professionals with 20 to 30+ years of experience involving upstream businesses (E&Ps, oilfield product manufacturers and oilfield service providers), midstream (gathering systems, pipeline MLPs, pipeline processing facilities), and downstream (refining, processing, and distribution). Feel free to contact us to discuss your valuation needs in confidence.

1 EIA: Trends in U.S. Oil and Natural Gas Upstream Costs – March 2016

Energy Valuation Insights

Energy Valuation Insights