M&A in the Permian

Big Deals and Bigger Opportunities

The Permian Basin is one of most prolific oil basins in the world and is the engine driving the resurgence of U.S. energy output. According to the latest EIA Drilling Productivity Report, anticipated oil production for June 2019 in the U.S. is almost 8.5 million barrels per day with the Permian alone accounting for nearly 4.2 million. The importance and impact of this basin to U.S. energy cannot be overstated.

Operators in the play have had to pay a premium to access the black gold mine, and companies are still lining up for a chance to get in on the action. While the industry as a whole has been moving into a period of rapid consolidation, a substantial portion of this acquisitive activity has been in the Permian, far more than any of the other major basins.

Targets with highly contiguous holdings and acreage have been of particular note to acquirers in the Permian. While acreage continuity has not always been the most important aspect of a potential deal, it has certainly become more of a focal point recently.

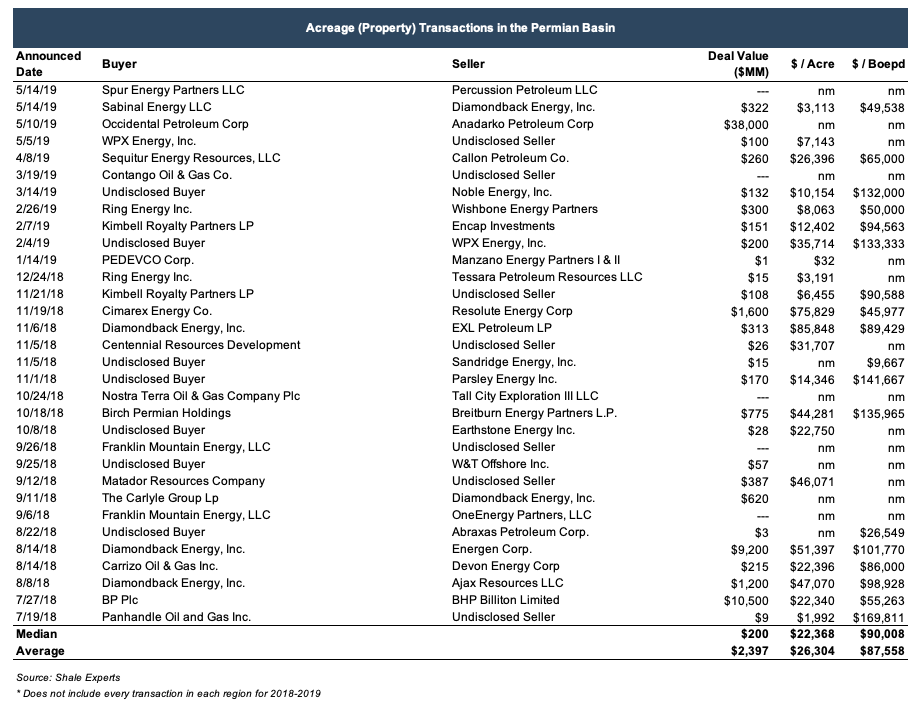

Recent Transactions in the Permian Basin

Details of recent transactions in the Permian Basin, including some comparative valuation metrics are shown below.

Oxy to Acquire Anadarko in $38 Billion Deal

On May 10, 2019, Anadarko Petroleum signed a deal to be acquired by Occidental Petroleum (“Oxy”) in a cash/stock deal worth $38 billion. This deal was by far the largest and most newsworthy to come out of the Permian Basin, or any other region, for the year.

The transaction creates a $100+ billion “global energy leader” with 1.3 million barrels of oil equivalent per day of production.

The agreement concludes one of the most closely-watched bidding wars in recent history with Oxy battling with Chevron to acquire the Permian assets of Anadarko. A month earlier, Chevron announced an agreement to purchase Anadarko for $33 billion in a cash/stock deal. Oxy soon joined the fray with a deal that was more accretive to Anadarko shareholders. The price ultimately became too much for Chevron, who received a $1 billion termination fee as part of the initial deal struck with Anadarko. Some lauded Chevron for not raising their offer and potentially overpay for the assets, but as it stands, Oxy is the big winner of the prized Permian assets which present plenty of synergies with its existing acreage portfolio.

According to Occidental, the transaction creates a $100+ billion “global energy leader” with 1.3 million barrels of oil equivalent per day of production. The company also said the deal provides “compelling strategic and financial rationale for all stakeholders.”

Oxy is expected to fund the cash portion of the consideration through a combination of cash and fully committed debt and equity financing, which also includes a $10 billion equity investment by Berkshire Hathaway, Inc in the form of 100,000 shares of cumulative perpetual preferred stock at $100,000 per share. The investment from Berkshire comes at a steep cost though with a warrant to purchase up to 80 million common shares at $62.50 per share as well as a preferred stock dividend of 8% annually.

Potential for Takeover

Although the Permian is far and away the most covered oil patch in the U.S. by analysts and journalists alike, the Occidental and Anadarko deal has brought some increased scrutiny to the basin particularly in assessing what other potential big deals could be out there. And the analysis seems to point to quite a few.

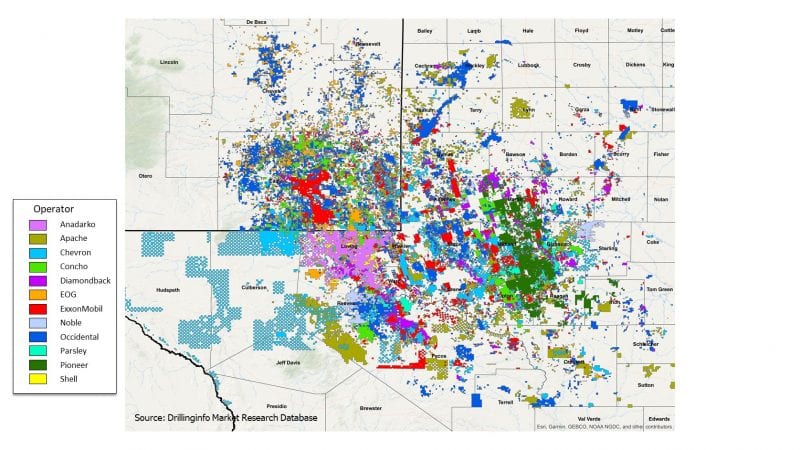

DrillingInfo produced the map below (as of April 30, 2019) of acreage by major operators within the Permian. An interesting observation here is that several of these operators have assets and land that is largely connected.

Concentrated assets and contiguous acreage make several of these companies very attractive targets for takeover. Pioneer Natural Resources, for example, has been hard at work becoming a pure-play Permian Basin operator. With the April 26 announcement that it is to sell off the remaining assets in the Eagle Ford, the company has made itself a more attractive takeover target because of its concentrated asset base in the Delaware Basin within the Permian.

Contiguous acreage allows operators to drill longer lateral lengths, which are more productive and cost-effective given recent advancements in drilling technology.

There are several benefits in owning such contiguous acreage. First, operators can take advantage of economies of scale, as contiguous acreage provides access to subsurface minerals with fewer well pads required, reducing costs. Logistically, mineral rights considerations are also simplified by consolidation. Contiguous acreage also potentially allows operators to drill longer lateral lengths, which are more productive and cost-effective given recent advancements in drilling technology.

Costs are further streamlined as the oilfields are less encumbered by multiple operators each bringing in their own drilling crews. Additionally, armies of tanker trucks for hauling away wastewater for various operators in a crowded field are replaced with efficient networks of surface pipes for wastewater disposal. Companies such as those with adjoining acreage to Pioneer could consider the advantages and synergies of such networks and efficiencies, especially if the infrastructure is already in place.

EOG Resources, one of the largest independent operators, owns acreage that borders against Chevron and Occidental in multiple areas. Given the recent loss in the bidding war with Occidental for Anadarko’s assets, Chevron has additional cash (set aside for the prior merger attempt as well as the break-up fee) that could be used for another takeover attempt, and EOG would be an attractive target for the reasons described above.

Other pure-play companies such as Diamondback or Concho Resources also have highly contiguous acreage adjacent to large companies who could take advantage of these economies of scale and efficiencies. These companies have been active consolidators in the basin, with Diamondback’s 2018 acquisition of Energen and Concho’s takeover of RSP Permian earlier in that year.

Conclusion

The trends for the Permian are apparent. Companies have been working to establish firm footholds in this basin and are willing to pay premiums to get in and stay in. The basin is also in an interesting position that due to the layout of operator acreage and assets, large takeovers of neighboring operators with contiguous acreage and established efficiencies create the opportunity for higher return on investment.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights