Royalty Interests: First in Line, Last in Conversation

When the price of oil started its descent during 2014, the majority of media attention was, and still is, focused on exploration, production, and oil field services companies. While bankruptcy courts are busy deciphering reorganization plans and perhaps liquidations of companies, one group of oil and gas participants are getting little attention: royalty owners. While the last two years have been a rough ride, opportunities do exists for forward thinking royalty owners and investors.

Although they are first to receive money from production, for the most part, royalty owners have been left to fend for themselves during this commodity price downturn. The lucky ones, holding their breath hoping their operator doesn’t go bankrupt, watched their monthly distributions fall to fractions of their 2014 payments. The unlucky ones haven’t seen a payment in months only to learn through media sources that their operator entered bankruptcy. When this situation occurs, many questions surface:

- What will happen to my royalty payments?

- What will happen to the lease contract?

- What legal action should I take?

While Mercer Capital does not provide legal advice we can provide guidance on valuing royalty interests in the current environment. For some guidance on the legal questions, refer to the the first end note.

Each of the questions above indicates uncertainty. As uncertainty increases, risk increases as well. As risk increases, the value of a given asset declines. But let us back up. When understanding the value of a royalty interest, it is important to understand its origin and its financial features.

Origin

Royalties typically originate from an agreement between a land owner and an exploration and production (E&P) company. E&P companies that approach the owners of the property where they seek to drill wells, have two options: (1) purchase the land from the current owner; or (2) acquire the rights to drill and produce. Option two is typically cheaper, initially. The monetary components of a contract between the land owner and the E&P company is usually comprised of two components: (1) an up-front cash payment (commonly referred to as a lease bonus); and (2) a royalty interest in all future wells on the property.

Financial Features

The financial features of a royalty interest are best described in the definition of a royalty as follows: Ownership of a percentage of production or production revenues, produced from leased acreage. The owner of this share of production does not bear any of the cost of exploration, drilling, producing, operating, marketing, or any other expense associated with drilling and producing an oil and gas well.2

Generally, royalty payments are made on a monthly basis for the production generated in the prior month. As the definition above indicates, royalty interests are not exposed to the costs of drilling, producing, or operating the well. In simplified terms, there are three main inputs driving the monthly royalty payment: (1) commodity price; (2) monthly production; and (3) royalty interest percentage. Royalty interest percentage typically will stay the same throughout the contract life, unless amendments are made. Therefore, any changes in the paystub come from changes in commodity price and production levels.

Valuation of a Royalty Interest

As the financial features suggest, valuation of a royalty interest can be a straight forward exercise for an experienced professional with knowledge of the nuances. Typically there are two methods used to estimate the value of a royalty trust: (1) income approach and (2) market approach.

Income Approach

A discounted cash flow analysis is based on the theory that the value of any investment is equal to the present value of its expected future economic benefit stream. In order to calculate the value one must project the future expected cash flows and discounts them back at an appropriate discount rate. Expected cash flows must project both anticipated production of the resource and anticipated prices for the resource. However, a discounted cash flow analysis is only as good as its inputs and as we discussed in our previous blog post, NYMEX future prices are no more than informed speculation. Thus the discount rate must appropriately compensate for the risk.

Market Approach

Another method used to calculate the value of a royalty interest utilizes market transactions of royalty interests in similar oil and gas resource plays. This can be done in two ways: (1) observing direct transactions of royalty interests; and (2) publicly traded royalty trusts.

As a primer for O&G royalty trusts, these trusts hold various royalty and net profit interests in wells operated by large exploration & production companies. These trusts have little in the way of operating expenses, have defined termination dates, and can be an investment to provide exposure to oil and gas prices. This Motley Fool article, from 2014, explains the pros and cons of investing in this sort of vehicle.

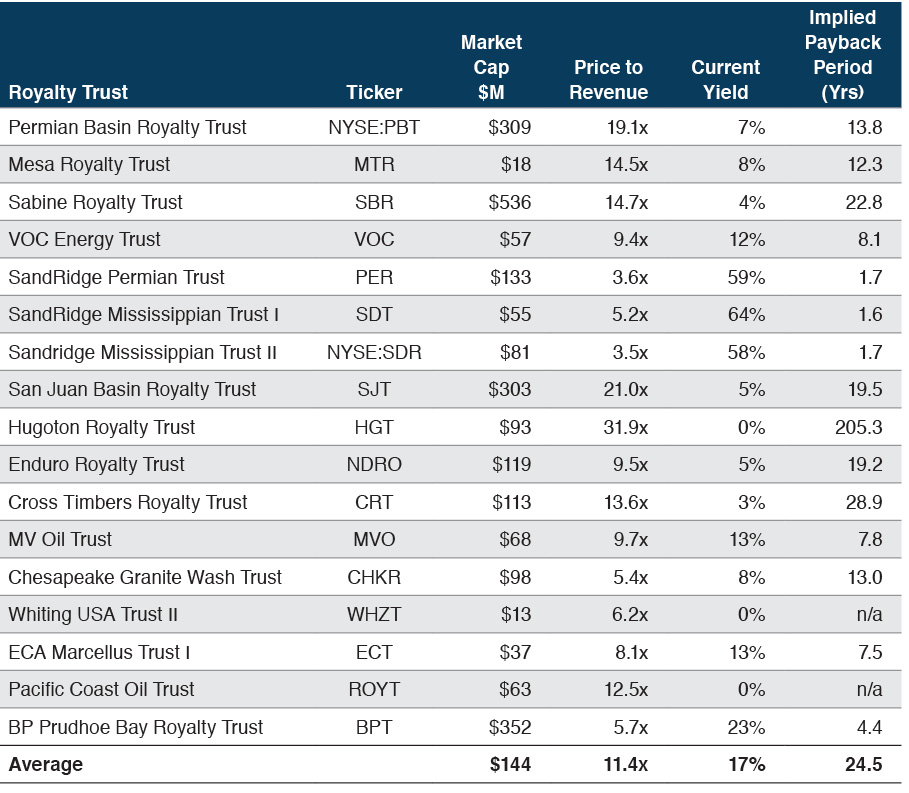

Market indications are available in the form of publicly traded oil & gas (“O&G”) royalty trusts. There are approximately 17 oil and gas focused royalty trusts publicly traded, as of the date of this article.

Market Observations

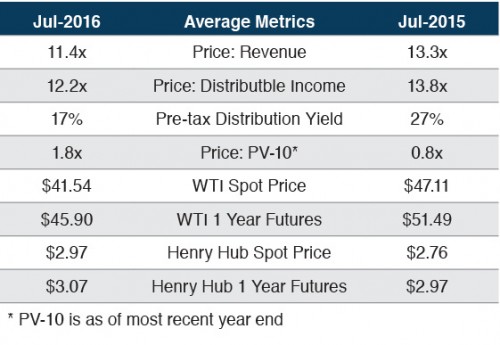

Royalty trusts, like the rest of the oil and gas industry, have been hit hard as the price of oil fell. Here is a comparison of the 17 publicly traded royalty trusts’ metrics today versus one year ago.

Observations and disclaimers:

- Price to revenue and price to distributable income indicate, on average, the trusts are cheaper now than a year ago.

- Yields were higher last year as trailing yields had not caught up to the quickly falling market price (from August 2014 to July 2015, the group was down 40% to 60%).

- Market prices have leveled off and yields have had a chance to catch up, resulting in lower yields compared to a year ago.

- Price to PV 10 is higher this year compared to last, primarily the result of timing differences between the releases of reserve reports (end of fiscal year, which for most is calendar year) the mid-year date we captured and the market price.

- The remaining observations are for commodity prices, both current and futures contract for the 12 month.

- Disclaimer: no two of the above royalty trusts are alike. Differences abound in asset mix, asset location, term, resource mix, just to name a few. In future blog posts, we will explore each trust individually and discuss their uniqueness.

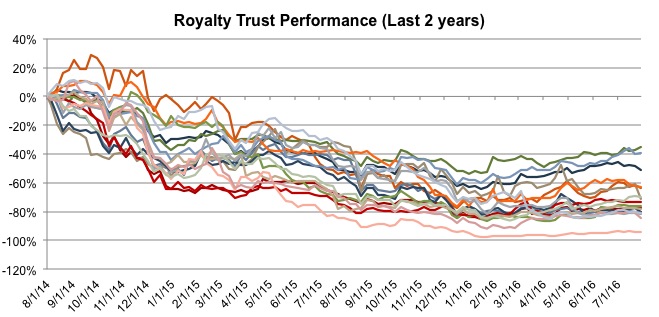

Below is a chart of the market price performance for each royalty trust over the last two years.

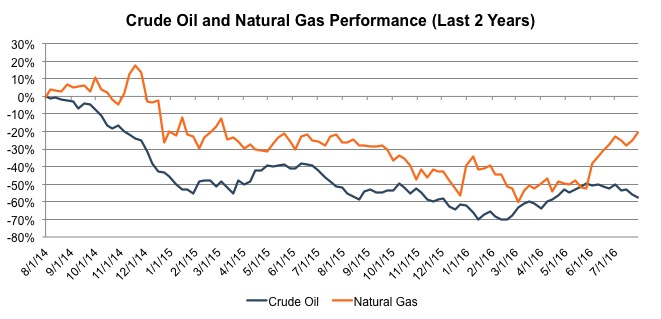

The above chart looks very similar to the performance of the price of oil and gas over the same time period. Royalty interest owners have seen their monthly payments move in the same manner, and possibly have not experienced the small rebound over the first six months of 2016.

The above chart looks very similar to the performance of the price of oil and gas over the same time period. Royalty interest owners have seen their monthly payments move in the same manner, and possibly have not experienced the small rebound over the first six months of 2016.

Uncertainty is high as operators have been forced to file bankruptcy after commodity prices have remained low for too long for them to survive. Depending on your situation, the current pricing environment may provide excellent planning opportunities as market prices are relatively low. With the Treasury Department attempting to change the way gift and estate planning can be performed, it is even more timely to execute a transfer plan. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

End Note

1 See the article, “Protecting Oil & Gas Royalties in the Event of Bankruptcy” from the Dallas Bar Association on the topic or the article, “Bankruptcy In The Oil Patch” by the Oil and Gas Financial Journal.

Energy Valuation Insights

Energy Valuation Insights