Part 1 of this series offered an overview of observed transaction premium data (from the 2016 Mergerstat Review) for acquisitions of public companies. That post also deliberated on one of five common avenues to incremental economic benefits that motivate market participants to transact. Part 2 walks through the four remaining variations on the incremental economic benefits theme, and offers some concluding thoughts on how to incorporate this sort of analysis into fair value measurements.

Travis W. Harms is a member of the Appraisal Foundation’s Working Group on control premiums, which recently released an exposure draft, The Measurement and Application of Market Participant Acquisition Premiums. The following analyses and opinions are those of Harms, and do not necessarily reflect the views of the other members of the Working Group.

Variation #2: Vertical Integration

Liberator Medical Holdings sells medical supplies, including urological catheters, on a direct-to-consumer basis, primarily to Medicare-eligible seniors. Liberator was acquired by C.R. Bard, a multinational developer, manufacturer and marketer of medical devices, including urology products such as those sold by Liberator. In contrast to the horizontal consolidation of companies in the same line of business, the acquisition of Liberator Medical by Bard is an example of a business combination as a vertical integration strategy. As a result, the relative margins of the buyer and seller are much less pertinent.

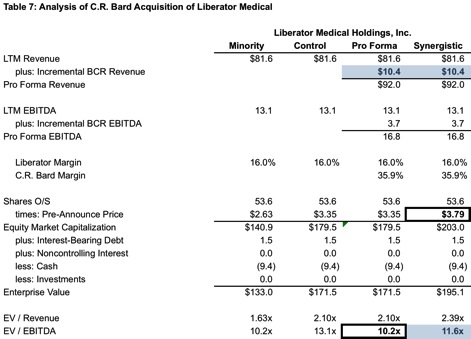

In Table 7, we have developed pro forma and synergistic cases for the Liberator transaction focused on increasing revenue to Bard as a result of the vertical integration.

Assuming no change in the buyer or seller margins, a pro forma EBITDA multiple of 10.2x implies $10.4 million of annual incremental revenue to Bard. Combining this estimate of pro forma EBITDA with Bard’s higher valuation multiple yields a potential synergistic enterprise value of $195 million. With robust revenue growth (~11.5% 4-year CAGR) and a growing base of recurring customers, Liberator presented a unique acquisition opportunity. As a result, it was able to extract a majority of the potential incremental value in the transaction.

Variation #3: Diversification

Two of the transactions illustrate acquisitions motivated by the desire to diversify.

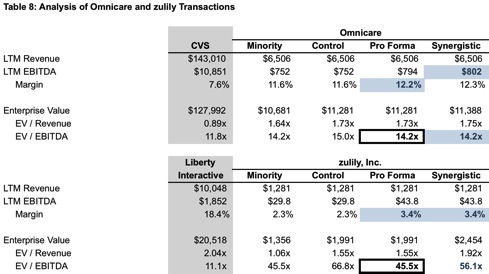

- CVS is a pharmacy company, providing both pharmacy benefit management and retail pharmacy services. In May 2015, CVS acquired Omnicare, Inc., a provider of pharmaceuticals and pharmacy services to long-term care facilities and specialty pharmacy and commercialization services for the biopharmaceutical industry.

- zulily, Inc. is an online retailer specializing in “flash” sales. From 2010 through 2014, zulily’s revenue grew from $18.4 million to $1.20 billion (a compound annual growth rate of nearly 185%). Liberty Interactive Media, Inc. operates the QVC television shopping network. Over the same period, Liberty’s revenue grew at a compound annual rate of 4.6%, reaching $10.5 billion in 2014.

Table 8 summarizes analysis for the Omnicare and zulily transactions. For diversification acquisitions, the cost savings are likely less significant than in consolidation transactions. Prior to the acquisition, Omnicare reported a higher EBITDA margin than CVS and was accorded a higher EBITDA multiple than CVS, suggesting that the primary levers available to support substantial premiums were lacking. Consistent with this observation, the observed premium was just 5.6% on an enterprise value basis (6.7% on an equity basis).

zulily had experienced rapid revenue growth since inception. As evident in the minority and control EBITDA multiples, the value of zulily was influenced by revenue growth potential much more than current profitability. We speculate that a portion of the motivation for Liberty was the expectation of a “halo” effect from the addition of the fast-growing zulily business to its portfolio of assets. Were the combination to add a quarter turn to Liberty’s EBITDA multiple, that would contribute an additional $463 million to the company’s market capitalization, which would help support the 45.8% enterprise value premium paid.1

Variation #4: Private Equity Acquisition

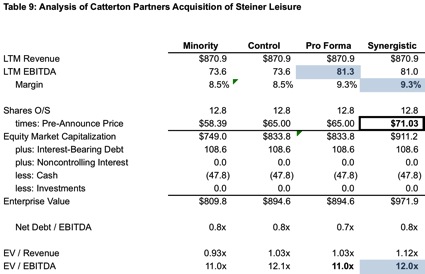

Steiner Leisure provides spa and ancillary aesthetic services aboard cruise ships and in other venues, sells beauty products, and operates schools. Steiner was acquired by Catterton Partners, a private equity firm, in a transaction announced in August 2015. Private equity funds are the prototypical financial, as opposed to strategic, buyers. 2

Table 9 compares the multiples implied by Catterton’s purchase to the pre-announcement trading value of Steiner’s minority shares. The transaction price implied an EBITDA multiple of 12.1x, compared to 11.0x on a pre-announcement basis.

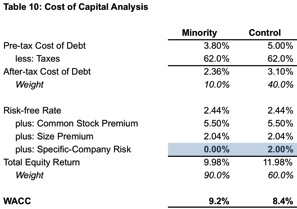

The multiple pick-up in the transaction likely corresponds to a reduction in the weighted average cost of capital on the order of 50 to 100 basis points. Even with the higher costs of debt and equity associated with more leveraged capital structures, the availability of favorable transaction financing can reduce the weighted average cost of capital for an acquirer like Catterton, as illustrated in Table 10.

Relative to the industry consolidation and vertical integration transactions, the enterprise value premium for the private equity transaction (10.5%) is more modest, reflecting the relative significance of financing versus cash flow benefits.

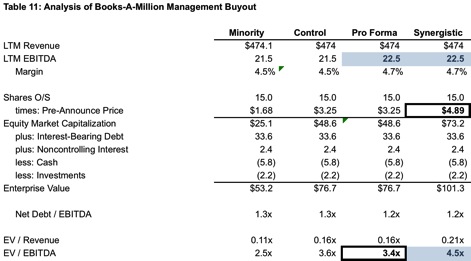

Variation #5: Market Inefficiency

Books-A-Million, Inc. operates 256 bookstores and 42 frozen yogurt shops, primarily in the eastern United States, reporting approximately $475 million of revenue during the fiscal year ended January 31, 2015. Despite being publicly-traded, the directors and executive officers of the company owned nearly 65% of the outstanding shares prior to the transaction. Since suspending dividend payments in 2011, the company’s share price fell from around $4.00 to a low of $1.40 per share in late 2014 before recovering modestly to $1.68 prior to the announcement that the Anderson family (founders and controlling shareholders) was proposing to take the company private. At that price, the aggregate market value of the shares held by outsiders was less than $9 million. As shown in Table 11, the pre-transaction share price implied an EBITDA multiple of 2.5x. In sum, there was no compelling reason for the company to be public.

Assuming $1 million of annual cost savings from relief of public reporting requirements, the implied EBITDA multiple from the buyout price was 3.4x. Applying a still-modest lower middle market transaction multiple of 4.5x to pro forma EBITDA yields a synergistic enterprise value of $101 million. Following an initial offer of $2.75 per share, the Anderson family increased its offer to $3.25 per share (a 92% premium to the pre-announcement price) to complete the transaction.

The Books-A-Million transaction illustrates how a substantial observed premium (92% on equity base; 42% on enterprise base) can reflect unusual circumstances surrounding trading in the subject company’s shares rather than significant synergistic benefits.

Concluding Thoughts

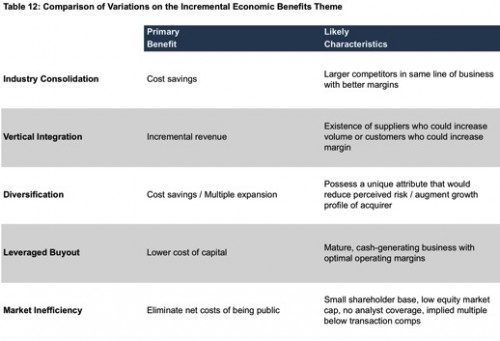

The recurring theme of the Appraisal Foundation’s control premium exposure draft is that transaction premiums are attributable to incremental economic benefits available to the control buyer. Examining observed transaction data for the retail industry from the 2016 Mergerstat Review, we identified five variations on this theme, as summarized in Table 12 below.

The fact that the market participant acquisition premium is an output, rather than an input, to a controlling interest fair value measurement does not render observed transaction premium data obsolete. It ought, however, to push valuation specialists to dig deeper into the transactions for which premiums have been observed. Evaluating the observed transactions through the lens of the five variations identified above will allow the analyst to develop a compelling narrative to support market participant assumptions regarding the incremental economic benefits available to a controlling buyer of the subject interest and assess the reasonableness of the resulting market participant acquisition premium.

Poll (some background here http://t.co/jUgFocQPu9):

Control premiums are:

— MercerFairValue (@MercerFairValue) August 8, 2016

Related Links

- Five Variations on a Theme: Analyzing Transaction Premium Data (Part 1)

- Measurement and Application of Market Participant Acquisition Premiums (Exposure Draft)

- Single-Serve Control Premium?

- What’s the Control Premium?

End Notes

1 Or, perhaps, they simply overpaid. That possibility cannot be discounted. Liberty’s share price fell from approximately $30 per share to $26 per share in the six weeks following the transaction announcement, and has generally been mired at that level since.

2 Most private equity firms do focus on particular segments of the economy. Catterton is no exception, focusing on consumer products and services companies. While operational expertise and the opportunity for cost savings through shared services is a potential source of incremental economic benefit, the opportunity for material margin enhancements is more limited than for strategic buyers.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter @MercerFairValue.