Z. Christopher Mercer, ASA, CFA, ABAR, Founder and CEO of Mercer Capital, maintains a business valuation-themed blog at ChrisMercer.net. This guest post first appeared on Chris’s blog on July 13, 2016.

What is the difference between a company’s total capital value and enterprise value? The difference between these two concepts is the treatment of cash. In the current market environment, many public companies have accumulated significant, even massive, amounts of cash. The treatment of cash, then, will impact multiples. In the following post, we examine the effect of cash on the relative valuation multiples of Apple (NASDAQ:APPL), Microsoft (NASDAQ:MSFT), and IBM (NYSE:IBM).

Subtracting current liabilities from the market value balance sheet provides market value of total capital (MVTC). Then, subtracting cash from MVTC provides an estimate of enterprise value. If we then subtract debt from enterprise value, we obtain market value of equity (operating). We can then add back the cash and arrive at the total value of equity for a company, private or public. Refresh your memory about these relationships here.

Three Public Companies

For this analysis, I intentionally began with Apple (AAPL) because of its mountains of cash ($230 billion). Microsoft (MSFT) is “related to” Apple according to Google, so this company, which has $106 billion of cash, is the second selection. Then I picked IBM, also “related to” Apple, as the third selection.

This sample is sufficient for our purposes now. The companies are not selected for their comparability with any private company, but to illustrate the impact of cash on valuation multiples and metrics.

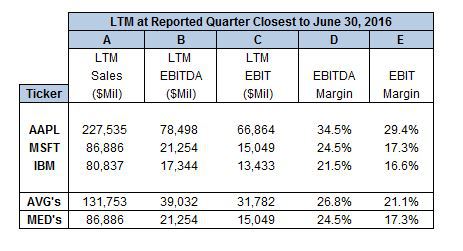

We begin by looking at the various indications of market value in the table below. Pricing is as of June 30, 2016 and financial metrics are as reported in Bloomberg as of that date.

Apple’s sales, at $228 billion for the most recent twelve months at June 30, 2016, are about 2.6x to 2.8x the sales of either Microsoft or IBM. Apple reported $78 billion of EBITDA, or a 34.5% EBITDA margin. Microsoft had only $21 billion of EBITDA and a 24.5% EBTIDA margin. IBM’s EBITDA of $17 billion reflects a 21.5% margin. All three companies are profitable, although Apple dominates in terms of size and earnings.

Market Valuations – Absolute

We will look first at the absolute equity and total capital valuations of the three public companies, and then, at their relative valuations.

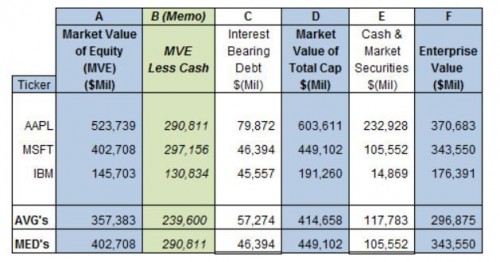

Apple’s market value of equity is $524 billion, or substantially larger than Microsoft’s $403 billion MVE (Column A). Apple is worth $121 billion more than Microsoft on the selected pricing date. IBM equity is valued significantly lower at $146 billion.

The next column (B) is interesting. It calculates MVE less cash. This is not a typical public company valuation metric, but it is commonly derived when valuing private companies. Recall in the last post that we determine the value of operating equity and then add cash to obtain total value of equity.

For this metric, Microsoft is slightly more valuable ($297 billion) than Apple ($291 billion). Assuming that the markets value each company’s cash on a dollar-for-dollar basis, Microsoft’s operating equity is slightly more valuable than that of Apple. This was, to me at least, an interesting perspective.

Market Value of Total Capital is derived in Column D (MVTC, or Column A plus Column C). MVTC is $604 billion for Apple compared to $449 billion for Microsoft. Looking at the respective cash and debt of Apple and Microsoft, we can infer that the majority of this difference is accounted for by Apple’s greater cash holdings.

Finally, we derive enterprise value in Column F (MVTC – cash). At this level Apple’s enterprise value of $371 billion is only about 8% greater than Microsoft’s EV of $344 billion. IBM’s MVTC is $191 billion and, given its modest debt, its enterprise value is $176 billion.

All of this discussion thus far is descriptive. We look next at relative values in the form of multiples of revenue, EBITDA and EBIT for further perspective.

Market Valuations – Relative

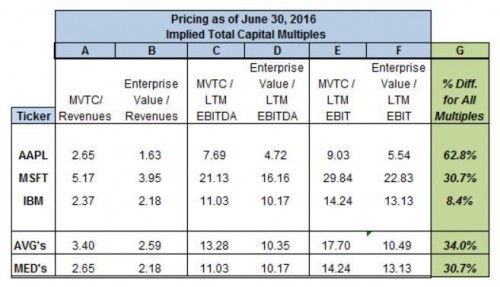

In the first table above, we provide the metrics of LTM sales, EBITDA and EBIT, as well as the respective EBITDA and EBIT margins for perspective. In the second table, we develop indications of MVTC and enterprise value. By relating these two tables, we can develop value relative to each metric to MVTC and to enterprise value and obtain valuation multiples, which are provided in the third table below.

On an absolute basis, Apple is clearly a more valuable company than Microsoft. However, Microsoft is relatively more valuable, and substantially so, than Apple. Focus on Column B and enterprise values. Microsoft’s EV/Revenues multiple at 3.95x is more than double that of Apple’s at 1.63x. The markets are pricing a dollar of revenue (albeit lower than Apple’s) for Microsoft at $3.95 and a comparable dollar of revenue for Apple at $1.63. Interestingly, on a relative basis, IBM is priced more dearly than is Apple at the enterprise level (but not so for MVTC because of Apple’s cash).

These relationships are maintained and get even more pronounced as we move to multiples of EBITDA and EBIT. Apple’s MVTC/EBITDA multiple is 7.69x. When cash is stripped out, its EV/EBITDA multiple is only 4.72x. The comparable multiples for Microsoft and IBM are substantially higher than for Apple.

What is the story here? If we look at revenues and margins, Apple is more valuable (absolutely) because it has about 2.5x more revenue and better margins than either Microsoft or IBM.

MVTC or Enterprise Value?

It is clear that the presence of cash in public companies used to employ the guideline public company method can create a distortion between MVTC and enterprise value multiples.

Surprisingly, there is no or virtually no discussion of either MVTC multiples or enterprise multiples or why appraisers should use one or the other in current valuation texts.

Most investment bankers use enterprise value multiples and add cash (and other non-operating assets) at the end of their analyses. Many business appraisers also use enterprise value multiples, adding cash at the end of the analysis. However, based on observation over the years, many other business appraisers use MVTC multiples to derive total capital multiples.

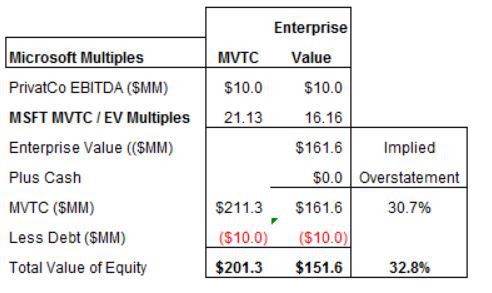

As I mentioned, the three companies were not selected because of their comparability to anything. But assume, for purposes of analysis, that a guideline company group had the characteristics underlying the multiples shown for Microsoft above. We will use Microsoft multiples for illustration.

Assume a private company has EBITDA of $10.0 million and debt of $10.0 million. Assume further that this company has no cash. It is profitable, but distributes all earnings not required for reinvestment in the business. The MVTC and EV multiples may seem a stretch, but they are illustrative.

Using the MVTC multiple (21.1) above, a MVTC of $211 million is calculated. After subtracting debt, the implied total value of equity is $201 million. However, if we use the enterprise value multiple (16.16), the implied enterprise value is $162 million. Since there is no cash, total value of equity is $152 million after subtracting debt.

The resulting overstatement of equity value is nearly $50 million, or 32.8%.

It could be difficult to explain this difference if one used MVTC, since the difference in that conclusion is accounted for entirely by the existence of cash at the public companies (assuming a group).

The implied overstatement of total equity value for our hypothetical private company is 79.7% if Apple’s MVTC and enterprise value multiples are used. The overstatement is only 9.3% if IBM’s multiples are used.

What’s an Appraiser to Do?

I know that in the past, I have used MVTC multiples to develop total capital value indications when employing the guideline public company group. I am certainly not the only appraiser who has done that. I’d like to think that when I did so and there was significant cash on the public group companies’ balance sheets, I recognized it and made an appropriate adjustment.

My current practice is to employ enterprise value multiples after subtracting cash from MVTC. We then add cash and any other non-operating assets into the total equity conclusion after subtracting any relevant debt.

Fair Value Applications

These concepts have relevance across the spectrum of corporate finance and financial reporting. In M&A, the inclusion of cash (or not) in a transaction can affect the implied valuation multiples just like it does in the public company examples above. Enterprise value and treatment of cash can also impact the results of a goodwill impairment test on a public or private company’s reporting units if the valuation specialist is not careful to make the appropriate adjustments. If you have additional questions about this or other valuation topics, please contact a Mercer Capital professional.

Related Links

- Market Value of Total Capital and Enterprise Value: Cash is the Difference

- Public Market Views of EBITDA: Exxon Mobil and Apple

- Pulling the Trigger: Interim Goodwill Impairment Testing

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.