Companies are allocating more money to developing nonphysical assets such as databases and brands than to building physical assets, such as new factories. With the rise of technology and professional service firms, which generate ideas and provide knowledge-based services, rather than physical assets, the U.S. marketplace is shifting from one which supplies goods to one which supplies ideas. The U.S. generates a large share of wealth from intangible assets such as patents, copyrights, and business processes. This store of value is essentially invisible to investors because internally generated intangible assets are not reported on the balance sheet. There is a growing gap in the balance sheet reflecting this shift from physical assets to intangible ideas and the Financial Accounting Standards Board (FASB) is considering adding the topic to its rule making agenda.

Under current accounting rules, companies only record acquired intangible assets on their balance sheet, because acquisition accounting requires that a purchaser allocate the consideration paid among all asset (tangible and intangible). It is not a new idea that intangible assets have worth. Macroeconomic theory asserts that technological change is the only way to increase factor productivity, and therefore GDP, over the long term. But accounting principles are not necessarily required to adhere to economic theory.

In 2013, the Bureau of Economic Analysis (BEA) took a leap and changed the way it calculated Gross Domestic Product (GDP) in order to capture the changing nature of the economy. The BEA reclassified research and development costs as investments, similar to the costs of building a factory, and they reclassified original works of art as long-lived assets. They reasoned that being able to effectively measure the role of research and such activities in the US economy would promote innovation. GDP is the yard-stick for our macro-economy, and the BEA argued that it is “better to be imprecisely correct than precisely incorrect.”

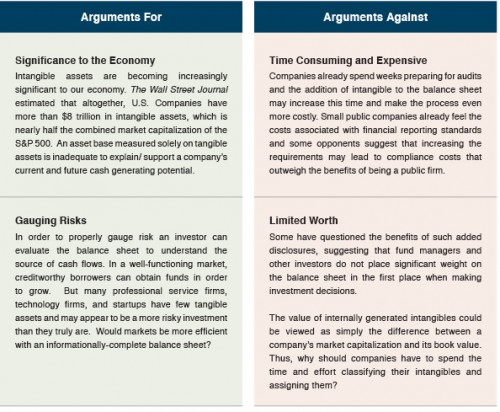

Two recent Wall Street Journal articles discussed this gap in a company’s balance sheet and the implications of recognizing these assets. The first concluded that the benefits of requiring the addition of intangibles to the balance sheet would be outweighed by the costs. The second discussed the ways in which intangible assets are actually valued in practice and notes some of the benefits of such undertakings.

This would not be the first time that the FASB has considered adding internally-generated intangibles to the balance sheet. Previously they were unable to resolve the issue of how companies would value intangibles; would it be based in fair value or cost? But, as previously mentioned, valuation specialists and consulting firms routinely measure the fair value of such assets, most often in the context of acquisition accounting and for bankruptcy purposes.

Valuation methods fall into one of three approaches: cost, market, or income. While a lack of sufficient data on comparable assets can make the market approach difficult in some industries, the cost approach and income approach are more often used to the value intangible assets.

Valuation under the cost approach requires estimation of the cost to replace the subject asset, as well as opportunity costs in the form of cash flows foregone as the replacement is sought or recreated. The income approach involves estimating the amount of cash flow produced annually by the subject asset, projecting those cash flows out over the expected life of the asset, and selecting an appropriate discount rate to determine the present value of the future benefits.

Ultimately, in order for the accounting community to reach a decision regarding the accounting for intangible asset, the purpose of the balance sheet may have to be reconsidered. The balance sheet currently serves as a record of cost and subsequent reductions in the values of (mostly tangible) assets. But, if the intended purpose of a balance sheet were to become an accounting for all of the income-generating assets of the firm, then clearly a new set of accounting standards would be required. This is a big issue, and one that would have considerable ramifications for existing practice and reporting. Nevertheless, the FASB is thinking about it – and so should stakeholders.

Related Links

- Perspectives from Purchase Price Allocations: Value of Intangible Assets

- What’s in a Name: Valuing Trademarks and Trade Names

- Valuation of Customer Related Assets

- Getting Brand Intangibles Rights

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.