In August 2016, Pfizer (“PFE”) announced it would acquire the biopharmaceutical company Medivation (“MDVN”) for $81.50 per share, or a total enterprise value of approximately $14 billion, in an all-cash deal. The transaction made headlines for how the size of the deal escalated over a period of approximately six months prior to the PFE announcement, as well as the potential implications regarding the attractiveness of (relatively) smaller biopharmaceutical targets in an environment where larger deals face an inordinate amount of regulatory scrutiny. This blog post (and Part 2) will present a broad outline of the transaction and explore what a potential purchase price allocation would look like.

What did PFE buy? ¹

MDVN has one commercial product – Xtandi (enzalutamide) – which received FDA approval in 2012 for the treatment of an advanced form of prostate cancer (metastatic castration-resistant prostate cancer, or “mCRPC”). Xtandi is also approved in Europe and Japan for the treatment of mCRPC and CRPC, respectively. In addition, MDVN is engaged in several Phase 2 and Phase 3 clinical trials to evaluate extending enzalutamide use for other (earlier) forms of prostate and breast cancer. MDVN obtained an exclusive license for the intellectual property rights underlying Xtandi from the University of California (“UCLA”) in 2005. The patents covering Xtandi are slated to expire in 2027 in the U.S. and 2026 in Europe. The agreement with UCLA required MDVN to pay an annual maintenance fee, certain milestone payments (all of which were paid by December 31, 2015), 10% of sublicensing income, and a 4% royalty on global sales of Xtandi.

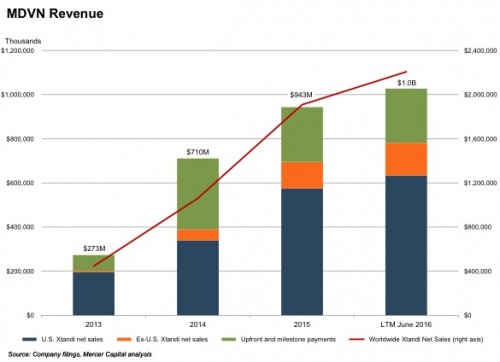

In turn, MDVN entered into a collaboration agreement to develop and commercialize Xtandi with Japan-based Astellas Pharma, Inc. in 2009. Under the terms of the collaboration agreement, MDVN splits U.S. revenues with Astellas, and receives royalties (ranging from the low teens to the low twenties) on the Xtandi sales outside the U.S. In addition, MDVN received an upfront payment and several milestone payments, and the two companies also share certain development costs. During 2015, worldwide Xtandi sales totaled $1.9 billion, while MDVN recorded total sales of $0.9 billion, including approximately $248 million in upfront and milestone payments.

How much room is there for Xtandi sales to increase? MDVN filings indicate that since 2010, four new agents in addition to Xtandi have been approved by the FDA for the treatment of mCPRC, while other are currently being studied. Since receiving approval in 2012, Xtandi has treated 64,000 patients in the U.S. That figure compares to an estimated 221,000 total new prostate cancer diagnoses in the U.S. (The number of new diagnoses total 580,000 when Europe and Japan are included in the count.) Since advanced mCPRC cases are a fraction (estimated to be 73,000 cases in 2012, per MDVN) of the total patient population diagnosed with prostate cancer, the current application of Xtandi appears to have already achieved significant market share.

However, once (if) the newer applications of enzalutamide become viable, the potential size of the addressable market would increase owing to the inclusion of patients with earlier stage diagnoses. Indeed, MDVN appeared to have been preparing for just such a scenario when it initiated an expansion of the Xtandi U.S. sales force to create separate urology and oncology teams. Urologists are generally involved in treating patients with earlier-stage diagnoses than oncologists. Incremental success in treating breast cancer cases would also expand the total addressable market for enzalutamide. Bringing all this together, MDVN management projects revenue could increase to $2.5 billion by 2020 (consensus estimates are closer to $1.8 million).

In addition to Xtandi (enzalutamide), the MDVN pipeline includes two more assets:

- Rights to Talazoparib were acquired from BioMarin Pharmaceuticals in the fourth quarter of 2015 for an upfront payment of $410 million, potential milestone payments of $160 million, and potential royalty payments. Phase 3 clinical trials for breast cancer is underway. MDVN recorded an In-Process Research & Development (“IPR&D”) intangible asset of $573 million for Talazoparib, or approximately 98.5% of total purchase consideration, at the time of the acquisition from BioMarin. During the first quarter of 2016, MDVN reported an expense related to changes in fair value of contingent consideration to BioMarin of $683 million, citing changes in estimated probabilities of success regarding the related development programs. The change suggests a talazoparib product is closer to completion and upon commercial launch would increase MDVN revenue (and diversify the revenue base).

- Rights to pidilizumab were acquired from CureTech in the fourth quarter of 2014 for an upfront cash payment of $5 million, contingent and milestone payments of up to $330 million, and potential royalty payments. Phase 2 clinical trials for large B-cell lymphoma is underway.

Deal Timeline

Significant events prior to the PFE announcement:

- On April 28, 2016, Sanofi made an unsolicited offer of $52.50 a share, or an enterprise value of $9.3 billion, which it claimed represented a 50% premium over MDVN share price for two months prior to takeover speculation. Using Sanofi’s logic, the pre-acquisition price would be approximately $35.00 per share, or an enterprise value of $6.2 billion. After bottoming at $27.32 a share in early February 2016, MDVN shares had climbed to $52.05 by April 27, 2016. In rejecting the bid, MDVN stated the Sanofi bid undervalued the company.

- On May 25, 2016, Sanofi called a vote to replace the entire board in an effort to engage MDVN in negotiations.

- On July 5, 2016 MDVN signed confidentiality agreements with a number of potential acquirers, reportedly including Celgene, Gilead, and Pfizer. MDVN also received a sweetened bid from Sanofi of $58.00 per share (enterprise value of $10.3 billion) and additional contingent consideration of up to $3.00 a share.

- The August 22, 2016 PFE offer of $81.50 per share all-cash offer represented a premium of more than 20% over the closing price of $67.16 on August 19, 2016.

Relative Pricing and Control Premium

Based on the results for the June 2016 quarter, the (annual) run rate of MDVN revenue attributable to Xtandi at the time of the PFE acquisition announcement was approximately $782 million, compared to $203 million for the fiscal year 2013. EBITDA for the twelve months prior to June 2016, excluding one-time items like milestone payments and the change in fair value of contingent consideration, was approximately $232 million (about a 30% margin). MDVN turned EBITDA-positive during fiscal 2015. Xtandi revenue and profitability have grown impressively since its approval by the FDA, which no doubt made it an attractive target for many potential suitors. Based on these metrics, the winning bid by PFE represents a 17.9x multiple of (adjusted Xtandi) revenue, which suggests the competitive process resulted in a full price for MDVN.²

The implied control premium provides another perspective on the attractiveness of the PFE price. As discussed in the prior section, the PFE bid represented a premium of more than 20% over the then-market price of MDVN. However, that figure does not capture the changes in MDVN price in the run-up to the August PFE announcement. Sanofi argued that the pre-acquisition was (should be?) $35.00 per share. Let us set this claim aside for a moment – even as the April bid by Sanofi did not include much of a premium over the then-existing market price, MDVN share price increased a further 30% prior the PFE acquisition announcement reflecting the heightened expectation of a transaction (at a more favorable price).

Within this context, does the base on which an analyst should estimate the control premium include expectations regarding the potential transaction itself? In the case of MDVN, is the pre-acquisition price $35.00, $52.50, or $67.16 per share – was the control premium closer to 130%, 55%, or 20%?

Part 2 of this series will use the observations around MDVN and the transaction to simulate a high-level allocation of the purchase price.

Related Links

- 5 Things to Know About the Draft AICPA Guide on In-Process Research and Development Assets

- 24-Hour Impairment: Merck’s Drug Deal with Cubist

- Perspectives from Purchase Price Allocations: Value of Intangible Assets

End Notes

¹ Sources include multiple MDVN filings including 10-Q (June 30, 2016), 10-K (December 31, 2015), and investor presentation titled, “Delivering Value Now and Into the Future”

² The revenue base in this multiple calculation is likely understated (the multiple is overstated) since it does not include potential revenue from other MDVN assets.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.