As the current bull market has extended into its sixth year and the S&P 500 continues to reach record highs, have goodwill impairment charges declined? Conventional wisdom would suggest that as markets rise and valuation multiples expand, companies’ goodwill values might be protected. Furthermore, various regulatory entities have recently proposed relaxing standards for goodwill impairment (see PCC’s proposal to revise private company GAAP) as if higher equity markets have rendered impairment a thing of the past. While this hypothesis might hold true for large cap stocks, this may not be the case for small cap stocks.

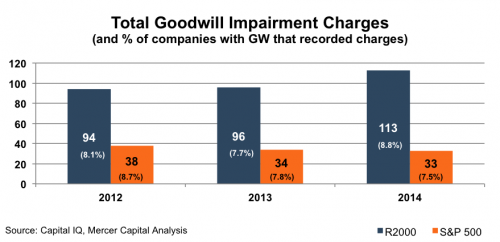

Approximately 87% of the companies in the S&P 500 carried goodwill in 2014 compared to 65% for companies in the Russell 2000. The largest American companies, as represented by the S&P 500, have seen a year over year decrease in the number of companies recording impairment charges since 2012. In contrast, companies in the Russell 2000 (with an average market capitalization of just over $1.0 billion) recorded 113 charges amongst constituents in 2014, the highest level in three years. The percentage of companies with goodwill that then went on to record impairment charges was also higher for the Russell 2000 than for the S&P 500.

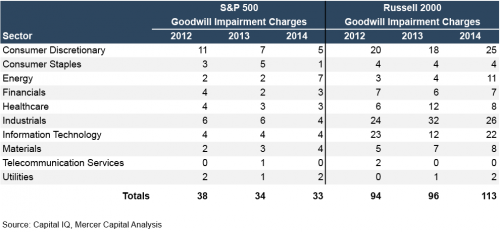

When breaking each index into sectors, two sectors present notable trends over the course of the last three years. The Energy sector of the Russell 2000 and the S&P 500 predictably saw a sharp increase in impairments charges during 2014, as oil prices fell in the latter half of the year. In contrast, the Consumer Discretionary sector of the S&P 500 saw a decline in charges while the same sector saw an increase in the Russell 2000. In a sector where consumer tastes drive successful businesses, the larger, more established firms of the S&P 500 Consumer Discretionary sector tended to avoid impairment charges in recent years. The smaller firms of the Russell 2000 may be more influenced by specific company factors that outweigh the general momentum of rising equity markets.

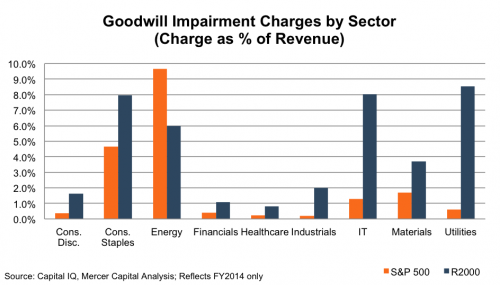

The chart above shows the median effect of impairment charges on the margins of companies that reported a charge in 2014. With the exception of the energy sector, the smaller companies of the Russell 2000 are impacted to a greater degree when recording an impairment charge.

The data shows that impairments do not necessarily taper off with the rising tides of favorable equity markets. Especially for smaller companies, it is prudent to regularly examine the factors that may lead to a triggering event for goodwill impairment testing. Rising industry multiples cannot always override specific company risk factors. The valuation specialists at Mercer Capital have experience in implementing both the qualitative and quantitative aspects of goodwill impairment testing. To discuss the implications and timing of triggering events, please contact a professional in Mercer Capital’s Financial Statement Reporting Group.

Related links

- Goodwill Impairment: Good, Bad, or Indifferent?

- Pulling the Trigger: Interim Goodwill Impairment Testing

- 24-Hour Impairment: Merck’s Drug Deal with Cubist

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.