Don’t Waste This Crisis

Tune Your Business Model for Greater Resiliency

Comfortable enough for 3,000 miles with Lucy Ricardo: 1955 Pontiac Star Chief (photo c/o Wikimedia commons)

Travel is one of the freedoms of normal life which I miss these days. One of the earliest celebrations of the great American road trip was a series of shows from the television comedy, “I Love Lucy.” In those episodes, the Ricardos and their neighbors, the Mertzes, drive from their home in New York to Los Angeles, where Ricky Ricardo is embarking on a film career. The 3,000-plus mile journey would have taken nearly two weeks in the pre-interstate 1950s. The couples traveled in style in a gorgeous 1955 Pontiac Star Chief convertible, but the search for gas stations, food, and lodging along the way were more than a challenge without smartphones or GPS.

Where Are We?

These days, the RIA industry is on its own road trip, and everyone’s searching for “the” map (Hint: there isn’t one). In the third week of March, I think I heard from every single media outlet that covers the investment management industry, wanting to know how the current crisis (COVID-19 pandemic, market swoon, and consequent recession all rolled into one) would threaten RIA valuations and M&A activity. I talked to lots of reporters and said lots of things. No one really asked about the challenges firms face these days just to operate their businesses, and that is the most important topic for now. Valuation and M&A will sort themselves out over time.

Road Work Ahead

To put it mildly, the operating environment for RIAs of every stripe is disorienting. Equity markets took a 30+% plunge, and now (as I write this), we’ve retraced about half of that. Debt markets have been even more erratic than equities, and many commodities markets have experienced even greater price fluctuations than debt. (Does anyone else notice that the relative asset volatility in the global capital stack seems backward?) It’s hard to find anyone who thinks there’s a quick way out of this, despite the Treasury Department carpet bombing the economy with money. The perma-bears are the only happy people in finance because they’ve been invited back on CNBC. Meanwhile the press is debating what letter of the alphabet best represents the future of the markets (value-added stuff).

How Are You Doing?

The value of RIAs and the future of transactions in the industry ultimately comes down to the health of the individual firms. Fortunately, there is a relatively straightforward way to assess the financial well-being of your firm, and ways of taking corrective action if your firm’s future is threatened.

RIAs have a unique business model in that it is possible, on any given day, to assess whether or not a firm is profitable. Doing so simply requires an assessment of ongoing revenue and expenses.

Start with your current expense base. The easiest way to do this is to take your last month’s P&L. Your biggest expense is labor and benefits; it’s not unusual to see labor costs comprising two-thirds or more of an RIA’s total operating costs. For the purpose of this exercise, just look at the fixed cost of salaries and benefits. Leave out discretionary bonuses or other personnel-related costs that are unlikely to be realized in a bear market. Once you’ve quantified total personnel costs, look at other fixed costs like rent, research, compliance, technology, systems, etc. Adding all of that together will derive your annualized expense base.

Most businesses can compute a run-rate of expenses, but the beauty of the RIA model is that you can also know, on any given day, what annualized revenue is. Take closing AUM as of the most recent trading day, filter it through your fee schedule, and you can tell, based on that day’s market pricing of your client assets under management, what annualized revenue is.

With annualized revenue and expenses calculated, you know whether or not you’re profitable, and by how much.

Margin for Error

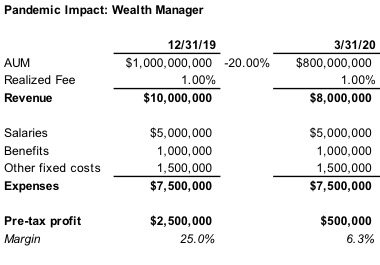

Profit margins have a number of functions, but one which is often forgotten is that margins enable a business to sustain itself during a downturn. Most RIAs have lots of “operating leverage” in their P&Ls which allows them to retain a considerable degree of upside in revenue as profitability. Symmetrically, though, operating leverage means that most investment management firms also lose profitability on a near dollar-for-dollar basis as revenues decline. The good news is that the degree of operating leverage in different types of investment management firms tends to be offset by their level of “normal” profit margin.

Wealth management (and independent trust company) margins tend to be more modest than those of asset managers and hedge funds, but the impact of a bear market on wealth managers is usually moderated by portfolios with healthy allocations to fixed income securities. In a market decline like we’ve had recently, a fixed income allocation might effectively hedge about a third of the loss in AUM and revenue.

Asset managers focused solely on equities, on the other hand, are positioned to face the full fury of a bear market. Fortunately, asset managers usually start with higher profit margins, which allows them to better absorb the loss of revenue.

Note that, in both examples, salaries comprised half of revenue in the base case (pre-bear market). Investment management is labor intensive, and we commonly see substantial fixed compensation expense. The real operating leverage for asset managers comes from non-personnel related costs, which are usually fairly minor as a percentage of revenue.

In any event, this is a good time to stress-test your profitability to see, on a day-to-day basis, what kind of market activity threatens the sustainability of your firm. Then you can decide what to do about it.

Never Waste a Good Crisis

If you check your ongoing margin and it isn’t what you’d like, then what? We won’t try to forecast how deep this bear market will go, or how long it will last. Regardless of the forward look, the magnitude of the current situation presents an opportunity to build some flexibility into your business model that makes it more adaptable to any environment.

In the credit crisis of 2008-09, we had more than one client cut compensation across their ranks, usually more for upper level staff and partners than for more junior members of their team. One client went so far as to use the opportunity to reset relative levels of compensation, restoring salary levels for some employees but not others after the market recovered.

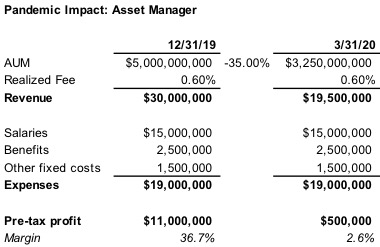

To us, the current environment illustrates the value of flexible compensation plans, with bonus compensation tied to the profitability of the business. To pick up on the examples shown above, if our example wealth management firm were to reduce fixed compensation by half, and then split half of pre-bonus profits with staff in the form of quarterly bonuses, compensation expense could then adjust to market conditions and margins would become more stable.

This example is a little extreme (cutting salaries by 50% is rarely an option), but it illustrates how tying an RIA’s largest expense at least partially to profitability can improve the resiliency of the firm and, ultimately, the job security of the firm’s employees.

The Ultimate Road Trip

Every bear market is scary in its own way, but the current one threatens our physical health as well as our financial health, so it wears on our psychology much more than most economic downturns. We hope that all of our blog’s readers are safe and well. And while you’re at home, take a moment to think about what unique opportunities might present themselves in the age of COVID-19.

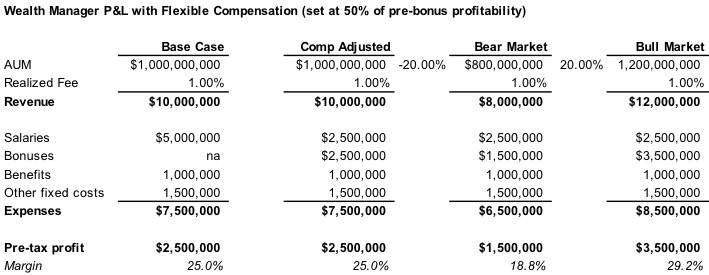

No doubt the cast of “I Love Lucy” wouldn’t try to spend two weeks traveling together in the middle of this pandemic, but one team realized that the currently uncrowded roads of America offered the chance for a new coast to coast speed record, and drove a modified Audi A8 from New York to Los Angeles in 26 hours and 38 minutes, quite a bit faster than the Ricardos and the Mertzes. We would urge our clients to find other outlets for their ingenuity.

RIA Valuation Insights

RIA Valuation Insights