Industry Consolidation Drives Further Gains in RIA Dealmaking

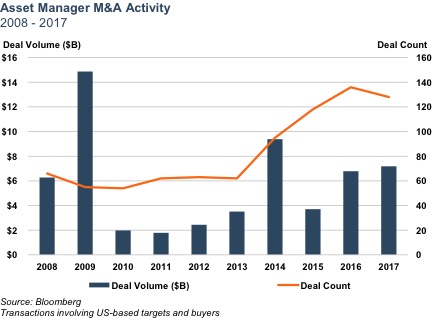

Asset manager M&A remained robust in 2017 against a backdrop of rising markets and higher AUM balances for most industry participants. Total (disclosed) transaction value was up 6% from 2016 levels despite a 6% reduction in the number of deals. Several trends, which have driven the uptick in sector M&A, have continued into 2017, including revenue and cost pressures and an increasing interest from bank acquirers.

The underpinnings of the M&A trend we’ve seen in the sector include increasing compliance and technology costs, broadly declining fees, and slowing organic growth for many active managers. While these pressures have been compressing margins for years, asset manager M&A has historically been muted, due in part to challenges specific to asset manager combinations, including the risks of cultural incompatibility and size impeding alpha generation. Nevertheless, the industry structure has a high degree of operating leverage, which suggests that scale could alleviate margin pressure for certain firms.

Consolidation pressures in the industry are largely the result of secular trends. On the revenue side, realized fees continue to decrease as funds flow from active to passive. On the cost side, an evolving regulatory environment threatens increasing technology and compliance costs. Over the past several years, these consolidation rationales have led to a significant uptick in the number of transactions as firms seek to gain scale in order to realize cost efficiencies, increase product offerings, and gain distribution leverage.

Acquisition activity in the sector has been led primarily by RIA consolidators, with Focus Financial Partners, Mercer Advisors (no relation), and United Capital Financial Advisers each acquiring multiple RIAs during 2017. While these serial acquirers account for the majority of M&A activity in the sector, banks have also been increasingly active acquirers of RIAs in their hunt for returns not tied to interest rate movements. Despite a rising yield curve which should make banks a little more comfortable with their core business, we suspect that RIAs will remain attractive targets for bank acquirers due to the high margins (relative to many other financial services businesses), low capital requirements, and substantial cross-selling opportunities.

Recent increases in M&A activity come against a backdrop of a now nine-year-old bull market. Steady market gains have continued throughout 2017 and have more than offset the consistent and significant negative AUM outflows that many active managers have seen over the past several years. In 2016, for example, active mutual funds’ assets grew to $11 trillion from $10.7 trillion, despite $400 billion in net outflows according to data from Bloomberg. As a result of increasing AUM and concomitant revenue growth, profitability has been steadily rising despite industry headwinds that seem to rationalize consolidation.

It is unclear whether this positive market movement has been a boon or a bane to M&A activity. On one hand, many asset managers may see rapid AUM gains from market movement as a case of easy come, easy go. In that case, better to sell sooner rather than later (and vice versa from a buyer’s perspective). On the other hand, as long as markets trend upwards, margin and fee pressures are easy to ignore. In that case, a protracted market downturn could lead to a shakeout for firms with cost structures that are not sustainable without the aid of a bull market (as was the case in 2008 and 2009).

With no end in sight for the consolidation pressures facing the industry, asset manager M&A appears positioned for continued strength or potential acceleration regardless of which way the markets move in 2018, although a protracted bear market, should it materialize, could highlight consolidation pressures and provide a catalyst for a larger wave of M&A activity. With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for consolidation. An aging ownership base is another impetus, and recent market gains might induce prospective sellers to finally pull the trigger. More broadly, the recent tax reform bill is expected to free up foreign-held cash, which could further facilitate M&A’s upward trend into 2018.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights