Appalachian Basin Finds Its Footing

Key Takeaways

- Steady Production Growth in Appalachia

Appalachian (Marcellus and Utica) production rose 6% year-over-year, supported by balanced drilling activity and improved takeaway capacity, notably following the Mountain Valley Pipeline’s 2024 start-up. - Market Dynamics and Price Volatility

Natural gas prices fluctuated between $2.80 and $4.50 per MMBtu amid weather-driven demand and storage shifts, while oil prices declined due to signaling of higher Saudi output and trade tensions. Despite volatility, Appalachian operators maintained stable activity. - Improving Investor Sentiment

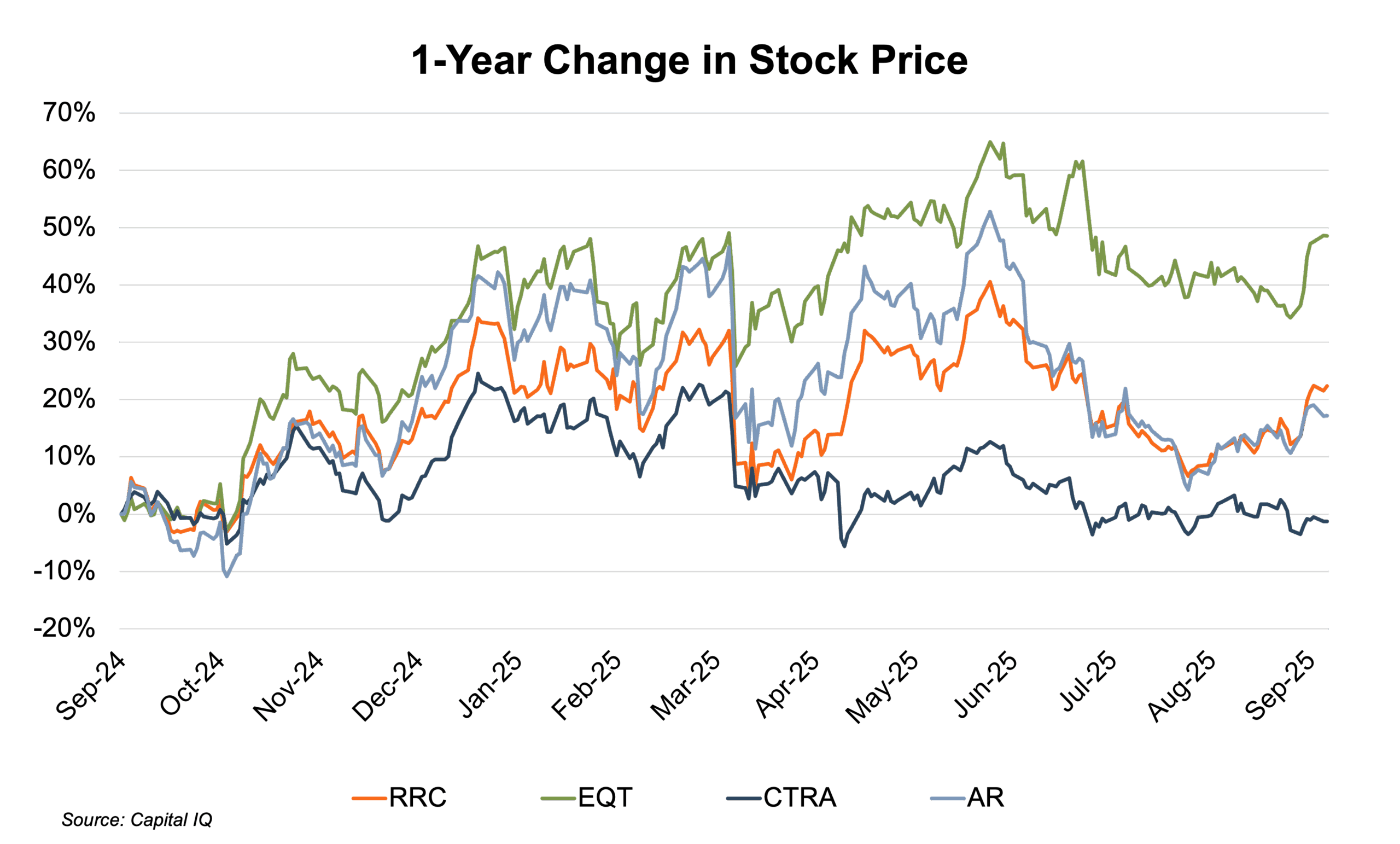

Public Appalachian operators—especially EQT, Range Resources, and Antero—recorded substantial stock price gains tied to better infrastructure, LNG export prospects, and disciplined capital management, signaling renewed investor confidence heading into 2026.

The economics of oil and gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Haynesville, and Appalachian plays. The cost of producing oil and gas depends on the geological makeup of the reserve, the depth of the reserve, and the cost to transport production to market. These factors drive meaningful differences in costs across regions. This quarter, we take a closer look at the Appalachian.

Production and Activity Levels

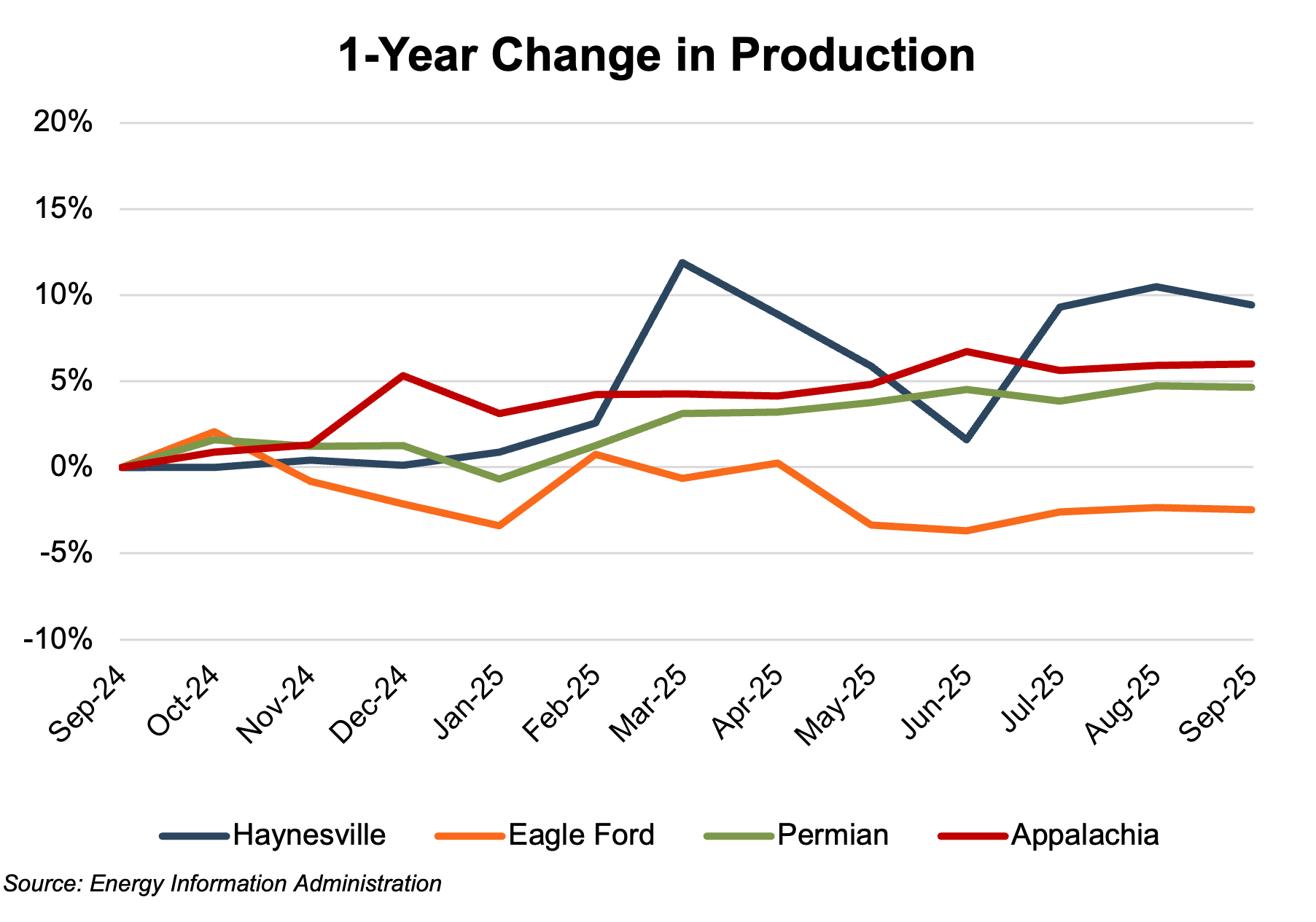

Appalachian production (on a barrels of oil equivalent, or “boe,” basis) increased approximately 6.0% over the latest twelve-month (“LTM”) period, rising from 5,998 mboe/d in September 2024 to 6,358 mboe/d in September 2025. Appalachian production showed fairly steady growth over the review period, with modest jumps in the growth rate in December 2024 and June 2025. Both growth rate jumps were immediately followed by declines that put production back on the year-over-year (“YoY”) trendline. The gradual improvement reflected both steady operational activity and moderate recovery in regional natural gas demand following last spring’s storage surplus.

Among the other major basins included in our analysis, the Haynesville led production growth with a 9.4% LTM increase, while the Permian followed with a 4.6% gain. The Eagle Ford was the only basin to post a decline, down 2.5% for the same period. Haynesville production was by far the most volatile, resulting from timing mismatches tied to Gulf Coast gas supply, pipeline development, and LNG export demand. In general, the oil-weighted regions posted slower growth in response to weaker crude prices, and gas-weighted basins regained momentum from early-year lows.

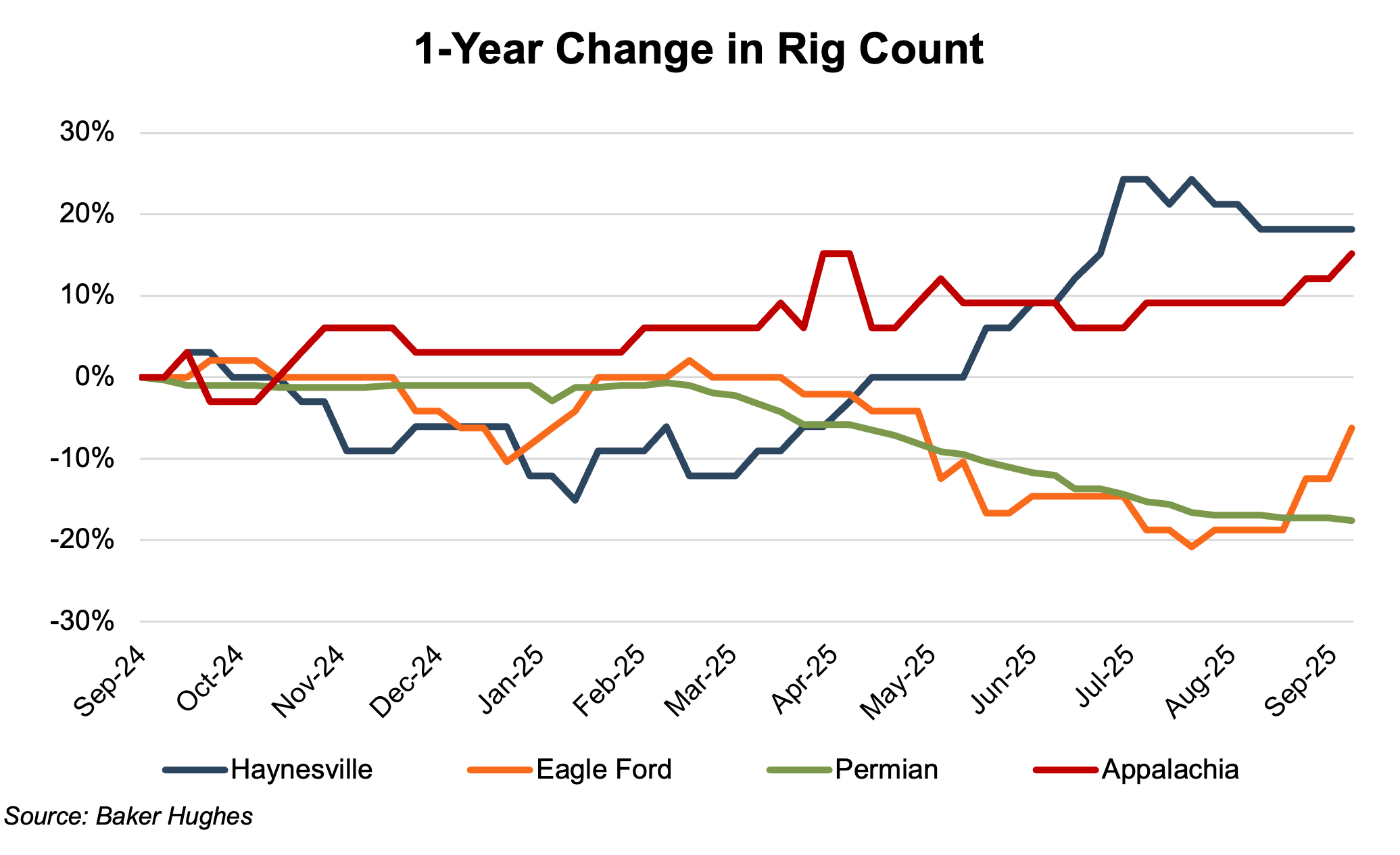

YoY changes in rig counts across the regions were differentiated by commodity. The gas-weighted regions showed 15% to 18% increases (Appalachia and Haynesville, respectively), while the oil-weighted regions posted 6% and 19% declines (Eagle Ford and Permian, respectively). Appalachian rig counts increased from 33 rigs in September 2024 to 38 rigs in September 2025, with only minor variations from the trendline over the period. The increase follows last year’s notable slowdown, which left several operators with deferred drilling programs now being reactivated under more balanced market conditions. The Haynesville region generally trended downward over the first half of the review period, with rig counts falling from 33 to 28. From mid-March to mid-July, the trend was sharply upward, with the rig count reaching 41. The Haynesville count ended the period at 39.

The Permian rig count held fairly steady between 298 and 307 through early March, before trending downward by an average of nearly eight rigs per month through September 2025. Other than a short-lived loss of 4 rigs from early December 2024 to mid-January 2025, the Eagle Ford count held steady at 47 to 49 rigs through early April. After that point, the Eagle Ford count trended downward to 38 rigs in August, followed by a recovery to 45 rigs at the end of the review period.

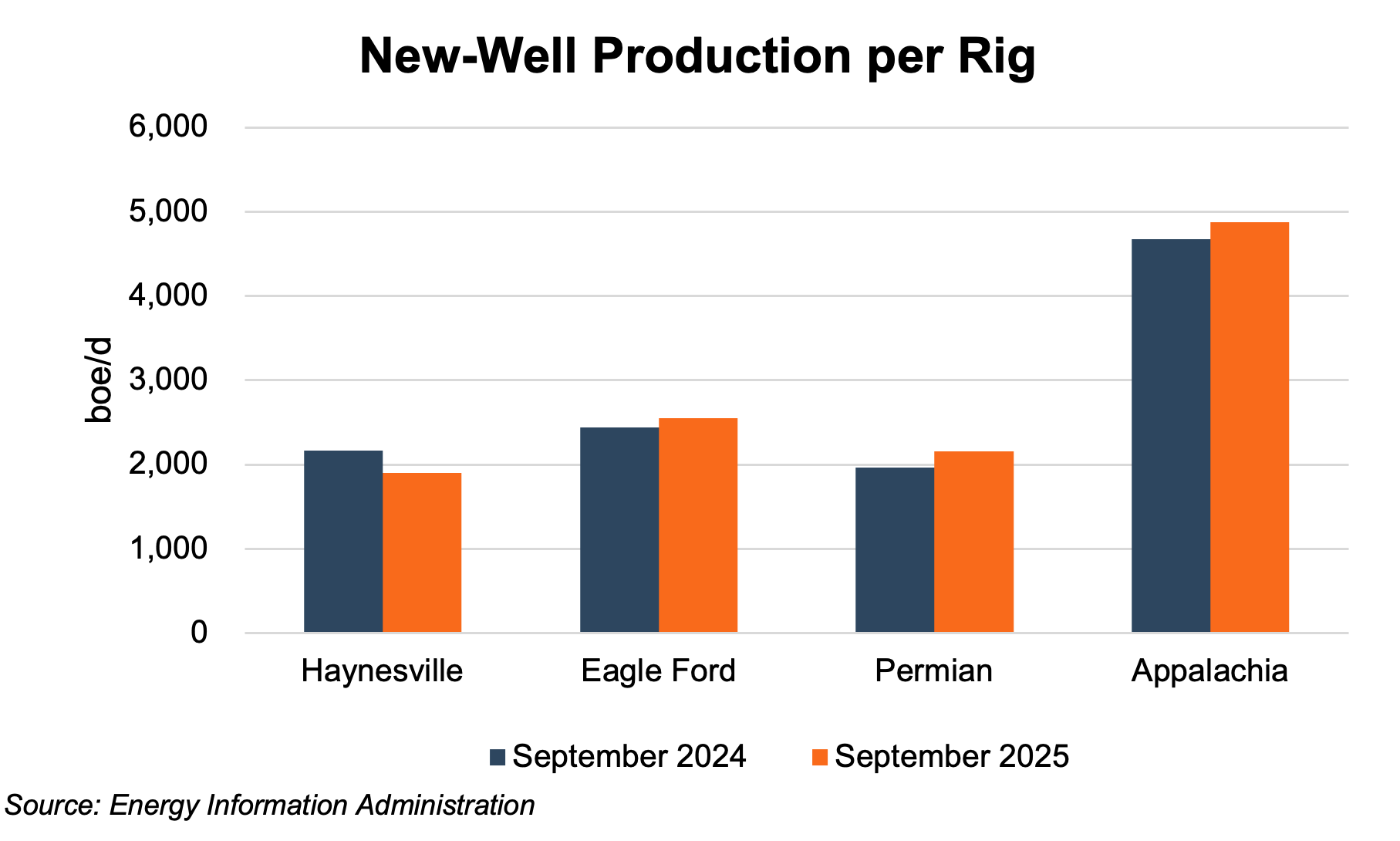

Efficiency trends varied across regions. Appalachian new-well production per rig rose 4% year-over-year, from 4,677 boe/d in September 2024 to 4,876 boe/d in September 2025. While the Permian and Eagle Ford posted gains of 10% and 5%, respectively, the Haynesville experienced a 12% decline.

Commodity Price Volatility

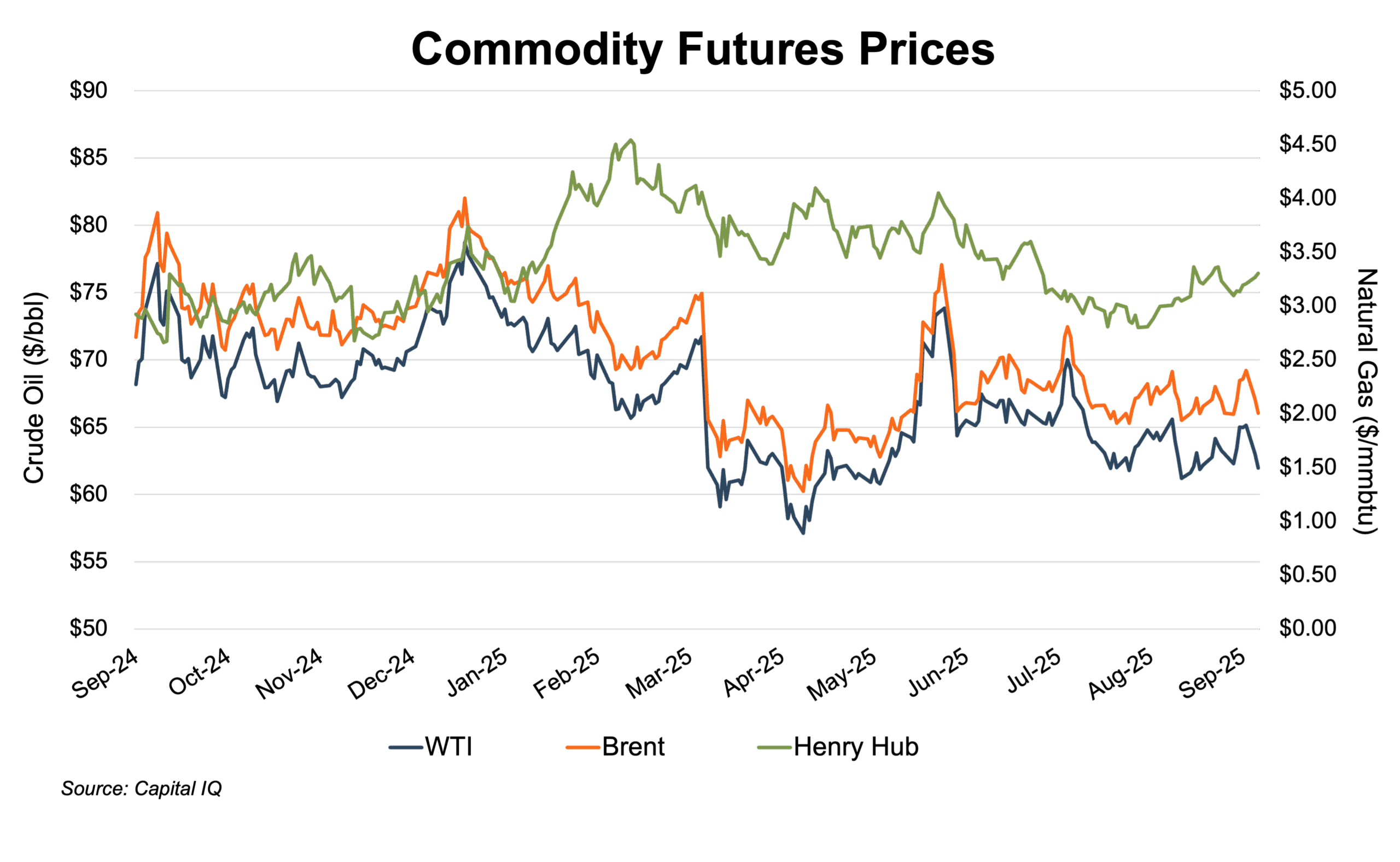

Henry Hub natural gas front-month futures prices began the period near $2.90 and trended upward through late December as early-winter demand increased. With temperatures plunging in February, the future prices rose rapidly, climbing from $3.04 at the end of January to $4.50 in mid-March. Wellhead freeze-offs and historically low gas storage inventories contributed to the run-up in prices. As the heating season ended and inventories recovered, Henry Hub futures began a five-month general decline, reaching a 2025 low of $2.80 in mid-August. Prices recovered modestly thereafter, ending September at $3.30.

Natural gas market dynamics over the review period were influenced by shifts in storage levels, flat LNG feed gas demand growth, and the continued contribution of associated gas volumes from oil-directed drilling programs. Despite subdued price levels compared to historical norms, operators in Appalachia and other gas-heavy basins maintained measured activity as midstream expansions and export expectations provided a longer-term offset to near-term pricing pressure.

Oil prices, as benchmarked by West Texas Intermediate (WTI) and Brent Crude (Brent) front-month future contracts, declined over the twelve-month period. The WTI price generally ranged from $67 to $75 during the first six months of the review period, but fell to a $60 to $70 range over the following six months. Brent followed a similar pattern, easing from $71 to $80, before shifting downward to a $63 to $73 range. The bulk of the mid-period decline occurred in early April, with the largest single-month price drop in over three years. The price plunge was spurred by Saudi Arabia signaling a move to higher production levels, on top of the Trump Administration tariffs undercutting expectations for fuel demand.

Financial Performance

The Appalachian public comp group saw a sharp reversal in market performance over the latest twelve-month period, with three of the four tracked operators posting strong price increases. EQT led the group with a 49% gain, followed by Range Resources at 22% and Antero at 17%. Coterra finished the period marginally lower at -1%. The rally in Appalachian-focused names contrasts sharply with the prior year’s declines and reflects improving investor sentiment tied to infrastructure developments in the basin.

The comp group’s prices trended upward through the first half of the review period, reaching first-half review period highs in early April (other than Coterra). The two-week drop in natural gas prices in mid-March triggered a two-day price plunge among the comp group, with prices falling 16% to 20%. Prices subsequently trended upward through late June when three of the four comp group’s stock prices hit their review period highs. During the last quarter of the review period, stock prices generally trended downward, save a modest recovery in late September.

EQT, one of the largest U.S. natural gas producers, benefited most directly from its scale, operational leverage, and exposure to expected long-term LNG export growth. Range Resources’ performance over the period was supported by a relatively low-cost structure and continued progress in debt reduction. Antero’s period price gain reflected balanced fundamentals but also the absence of meaningful hedge coverage, leaving it more exposed to spot market volatility. Coterra’s flat performance aligned with its greater oil exposure, which weighed on results amid weaker crude prices. Overall, the Appalachian group’s equity performance mirrored improved fundamentals across the basin, underscoring a cautious but stabilizing investor outlook heading into 2026.

Conclusion

Appalachian production improved modestly over the latest twelve-month period, supported by steadier drilling activity and incremental takeaway capacity following the mid-2024 start-up of the Mountain Valley Pipeline (“MVP”). The basin’s 6% year-over-year production increase came despite subdued natural gas prices for much of the year and ongoing supply competition from other U.S. shale regions. Activity levels were sustained as operators balanced capital discipline with expectations for gradually tightening fundamentals heading into 2026.

EQT, Range Resources, and other basin-focused producers continue to benefit from the MVP’s full operational ramp, which has begun to narrow regional basis differentials and improve flow reliability to downstream markets. Range CEO Dennis Degner has noted that rising data-center buildouts in the region provide incremental demand support for Appalachian gas. The project’s impact on realized pricing and takeaway flexibility is expected to remain a positive factor through next year.

Meanwhile, exploration in the Utica’s oil window continues to attract interest. EOG Resources’ expanded presence in eastern Ohio has drawn analyst attention, with Enverus Intelligence Research Director Andrew Dittmar noting that EOG’s acquisition of Encino increases its optionality across both oil and gas windows and reinforces its scale in the Utica play. These developments provide the basin with a potential source of long-term diversification beyond its core gas focus.

Overall, the Appalachian basin enters late-2025 on firmer footing than a year ago, characterized by stable production, recovering equity performance, and improving infrastructure fundamentals. Continued progress on export capacity and incremental LNG demand should provide a constructive backdrop for basin economics heading into 2026.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights