Appalachian Basin M&A Update: October 2024 to September 2025

A Quiet Consolidation Phase

Key Takeaways

- Appalachian Basin M&A activity remained subdued from October 2024 through September 2025, mirroring a broader U.S. slowdown in upstream deal flow.

- Buyers prioritized small, synergistic bolt-on acquisitions and selective consolidations over large-scale transactions to capture operational efficiencies and optionality.

- Midstream consolidation gained traction as operators sought scale and infrastructure control to enhance price capture and mitigate takeaway constraints.

- Investors increasingly employed creative, non-operated capital structures to balance exposure to Appalachia while minimizing operational and development risks.

- Tight liquidity and capital discipline continued to restrain deal volume, though potential pipeline expansions, AI-driven gas demand, and innovative financing could revive activity ahead.

Introduction

Over the October 2024 through September 2025 timeframe, merger and acquisition activity in the Appalachian Basin (Marcellus / Utica / associated plays) has been relatively muted, reflecting constrained upstream deal flow across the U.S. At the same time, selective bolt-ons, midstream consolidations, and creative capital structures have surfaced where synergies and niche value remain. In this post, we examine the notable transactions and thematic drivers emerging from this period.

To frame the backdrop, upstream M&A in the U.S. broadly decelerated in 2025: second-quarter upstream deal flow dropped ~21% quarter-over-quarter to ~$13.5 billion, with much of the value concentrated in a few large transactions. Though that statistic is for the broader U.S., it helps explain the reticence among buyers in Appalachia to deploy capital aggressively.

Below we catalog the meaningful transactions in Appalachia during that window and then discuss the themes shaping them.

Key Deals & Transactions

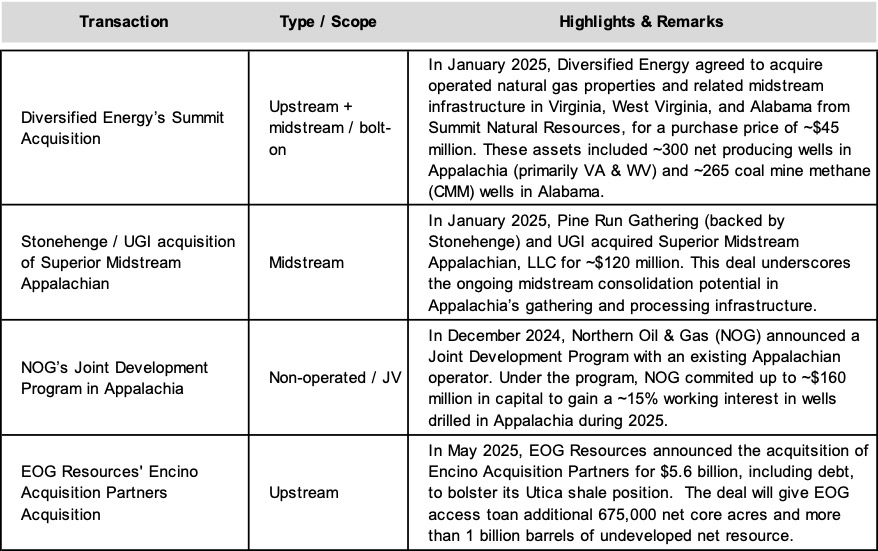

While deal volume was limited, several transactions stand out for their strategic nature, scale, or structure.

Outside these transactions, there appears to be no single significant asset sale or large E&P consolidation purely within Appalachia during the period.

Key Themes and Insights

From reviewing the deals and market environment, a few themes emerge that are relevant to deal advisors, investors, and corporate strategists in Appalachia.

- Bolt-on and consolidation value trumps large-scale acquisition: Given the paucity of full-basin targets, buyers are gravitating toward incremental, contiguous, or synergistic bolt-ons. Diversified’s Summit transaction is exemplary: small in absolute scale but high in strategic fit (overlap, infrastructure optionality, CMM credits). The modest price tag belies the upside optionality for integration, cost synergies, and environmental credit monetization.

- Midstream consolidation is a growth avenue: Appalachia’s gathering, processing, compression, and water-handling infrastructure remains fragmented. In constrained takeaway regimes, control or favorable contracts in midstream lines can unlock basis arbitrage and price capture. The Superior Midstream deal (Stonehenge / UGI) demonstrates that midstream operators see value in scale, wraparound coverage, and the power of optionality.

- Creative, non-operated capital structures mitigate downside: NOG’s JV program illustrates how investors can access Appalachia exposure without the full burden of operatorship risk. For non-operated investments, valuation metrics tend to be based on carry-adjusted rates of return, hurdle IRRs, and downside protections rather than pure reserve multiples. Such structures may require higher discount rates or hurdle premiums to account for operator counterparty risk, pace-of-development risk, and well performance variability.

- Liquidity constraints and public capital caution slow pace: Many potential Appalachia-focused acquirers are privately held, capital-constrained, or cautious in deploying capital in a low-margin gas environment. The broader slowdown in upstream M&A underscores the capital discipline prevailing in deal markets. Thus, fewer deals are getting done even where opportunities exist.

Outlook & Strategic Considerations

Looking ahead into the remainder of 2025 and into 2026, several developments may tilt the M&A landscape in Appalachia.

- Baseload pipeline expansions and capacity optionality: If additional infrastructure projects or expansions gain traction, buyers may revisit previously uneconomic blocks.

- Data center and AI-driven gas demand: As in-basin industrial demand solidifies, upstream and midstream assets capable of servicing those loads via contracted gas or firm access will command higher valuation multipliers.

- Renewed consolidation waves: Public E&Ps with Appalachia footprints may look to divest non-core inventory, creating pockets of supply for disciplined buyers.

- Innovative financing / securitization: The use of ABS, master trusts, and hedging overlays (as Diversified employed) may unlock liquidity for moderate deals that historically would have been too small to finance via traditional debt.

- Valuation compression sensitivity: Multiples on Appalachian assets will remain sensitive to basis outlooks, contract coverage, and integration risk. Buyers will demand robust downside protection on realized spreads.

Conclusion

Appalachian Basin M&A activity over the past year reflected a disciplined market focused on strategic fit rather than scale. Buyers and investors emphasized bolt-on acquisitions, midstream integration, and creative financing to manage risk and unlock value in a constrained capital environment. Looking forward, infrastructure expansions, rising in-basin demand, and innovative capital solutions may set the stage for a gradual resurgence in deal activity.

Mercer Capital has assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights