2024: Five Trends to Watch in the Medical Device Industry

Medical Devices Overview

The medical device manufacturing industry produces equipment designed to diagnose and treat patients within global healthcare systems. Medical devices range from simple tongue depressors and bandages to complex programmable pacemakers and sophisticated imaging systems. Major product categories include surgical implants and instruments, medical supplies, electro-medical equipment, in-vitro diagnostic equipment and reagents, irradiation apparatuses, and dental goods.

The following outlines five structural factors and trends that influence demand and supply of medical devices and related procedures.

1. Demographics

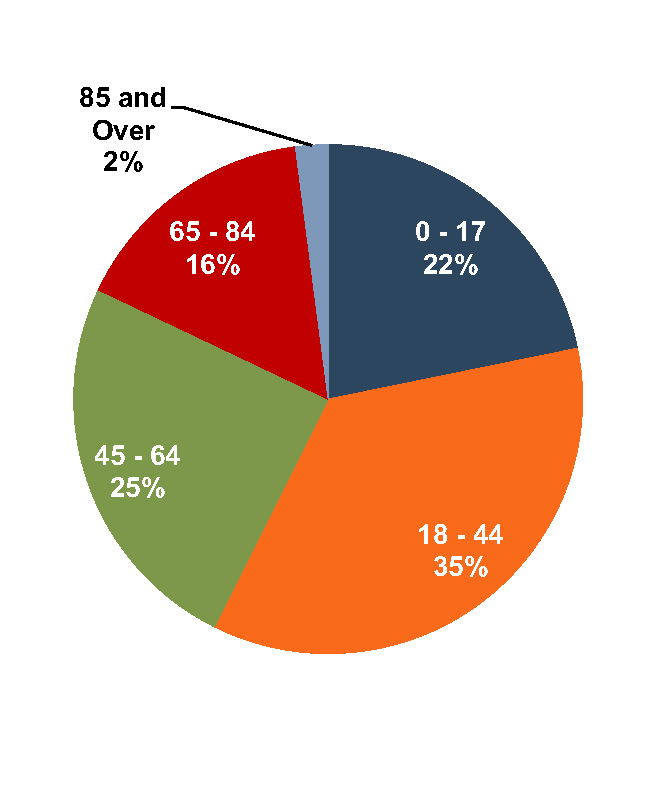

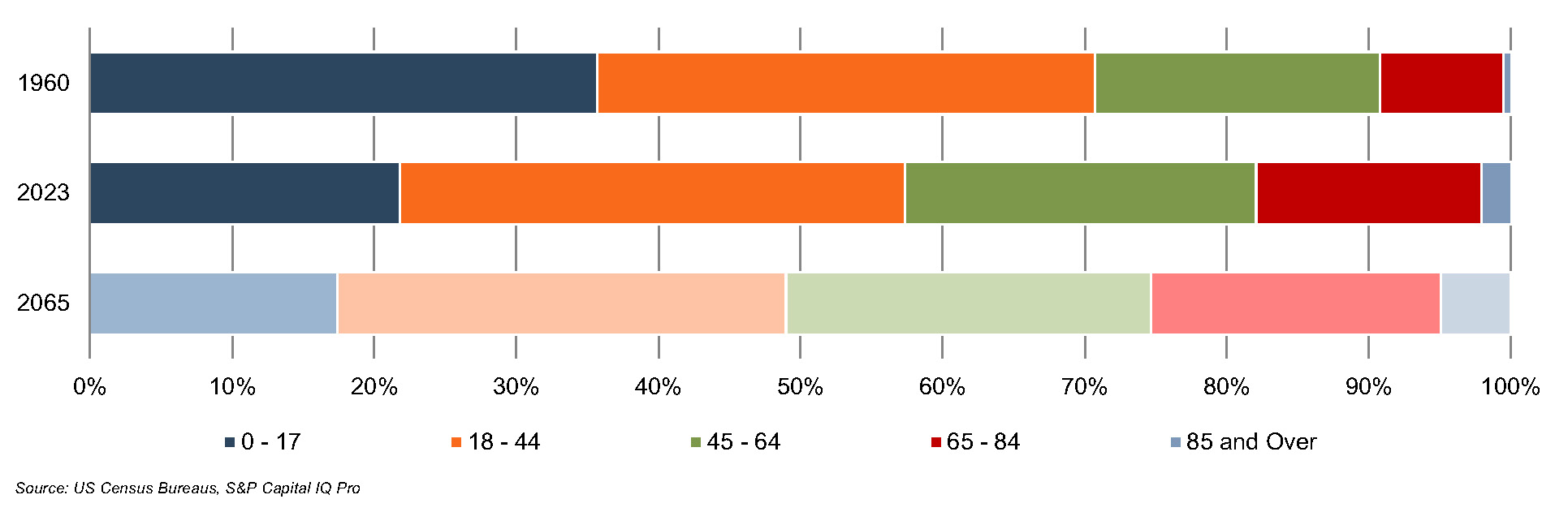

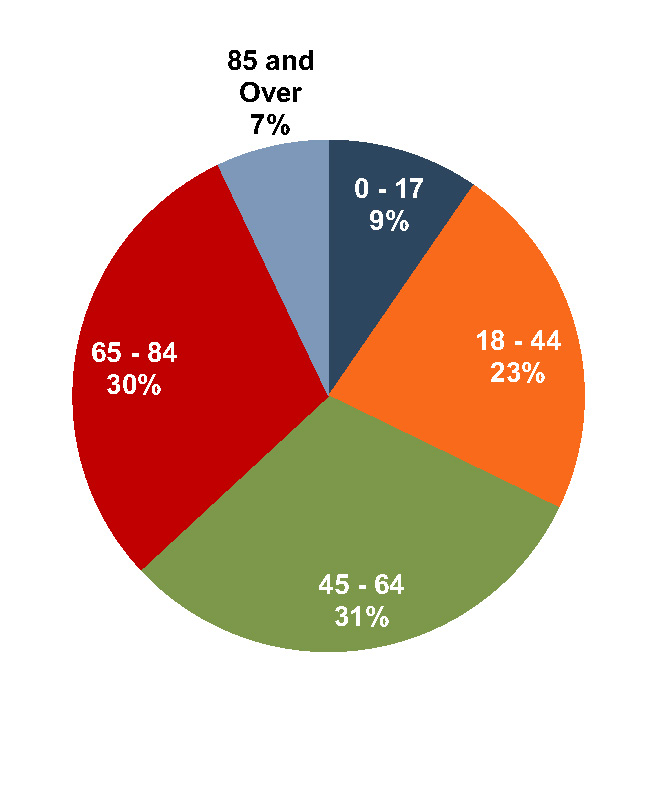

The aging population, driven by declining fertility rates and increasing life expectancy, represents a major demand driver for medical devices. The U.S. elderly population (persons aged 65 and above) totaled 60 million in 2023 (18% of the population). The U.S. Census Bureau estimates that the elderly will number 92.7 million by 2065, representing more than 25% of the total population.

U.S. Population Distribution by Age Group

The elderly account for nearly one third of total. Personal healthcare spending for the population segment was approximately $22,000 per person in 2020, 5.5 times the spending per child (about $4,000) and more than double the spending per working-age person (about $9,000).

U.S. Population Distribution by Age

U.S. Healthcare Expenditure by Age

Source: U.S. Census Bureau, Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group

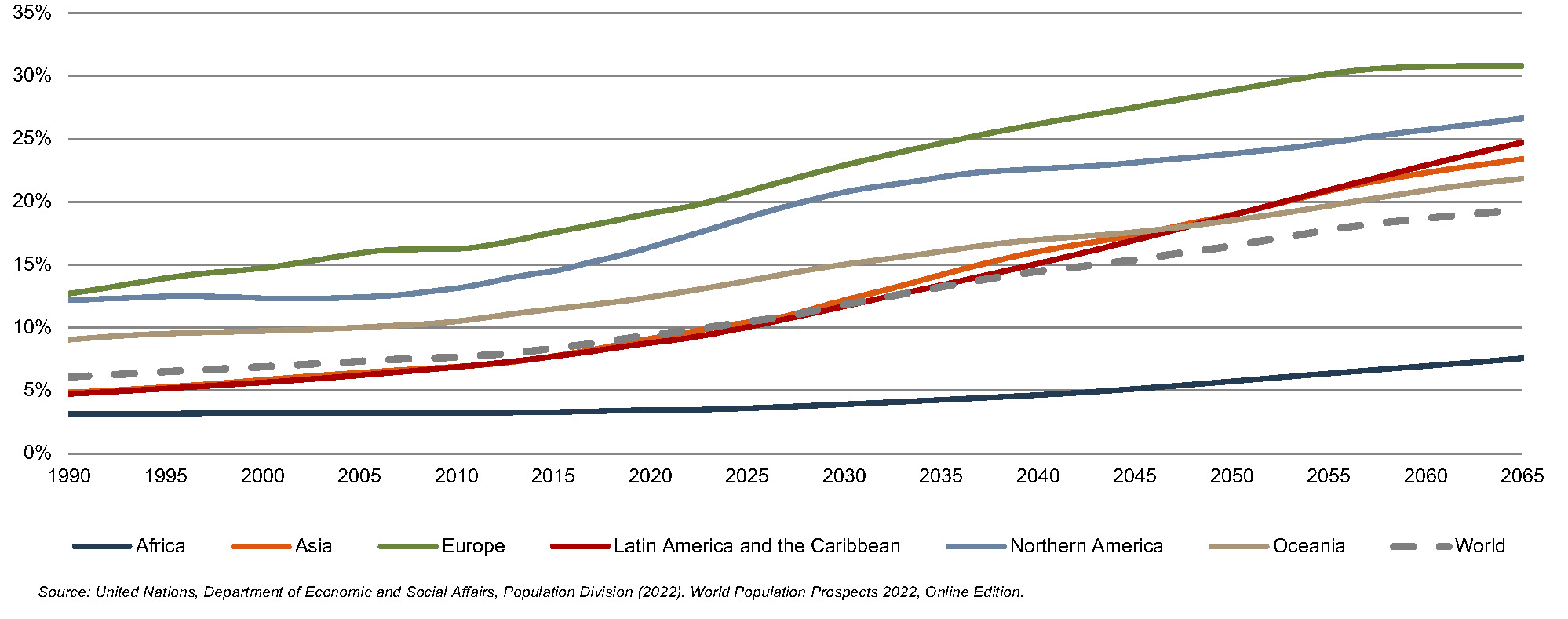

According to United Nations projections, the global elderly population will rise from approximately 808 million (10% of world population) in 2022 to 2.0 billion (19.4% of world population) in 2065. Europe’s elderly made up 20% of the total population in 2022, and the proportion is projected to reach 31% by 2065, making it the world’s oldest region. Latin American and the Caribbean is currently one of the youngest regions in the world, with its elderly at 9% of the total population in 2022, but this region is expected to undergo drastic transformations over the next several decades, with the elderly population expected to expand to 25% of the total population by 2065. North America has an above-average elderly population as of 2022 (17%) and is projected to expand to 27% by 2065.

World Population 65 and Over (% of Total)

Click here to expand the image above

2. Healthcare Spending and the Legislative Landscape in the U.S.

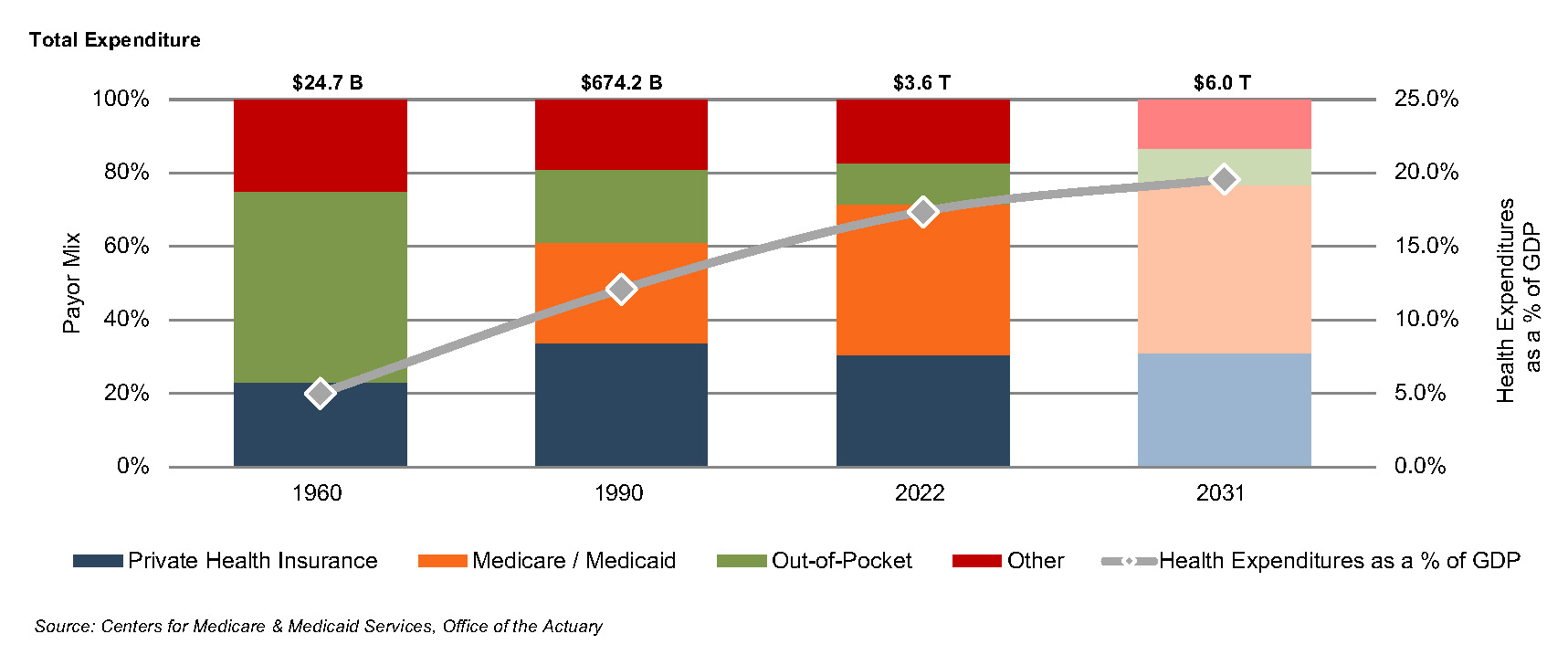

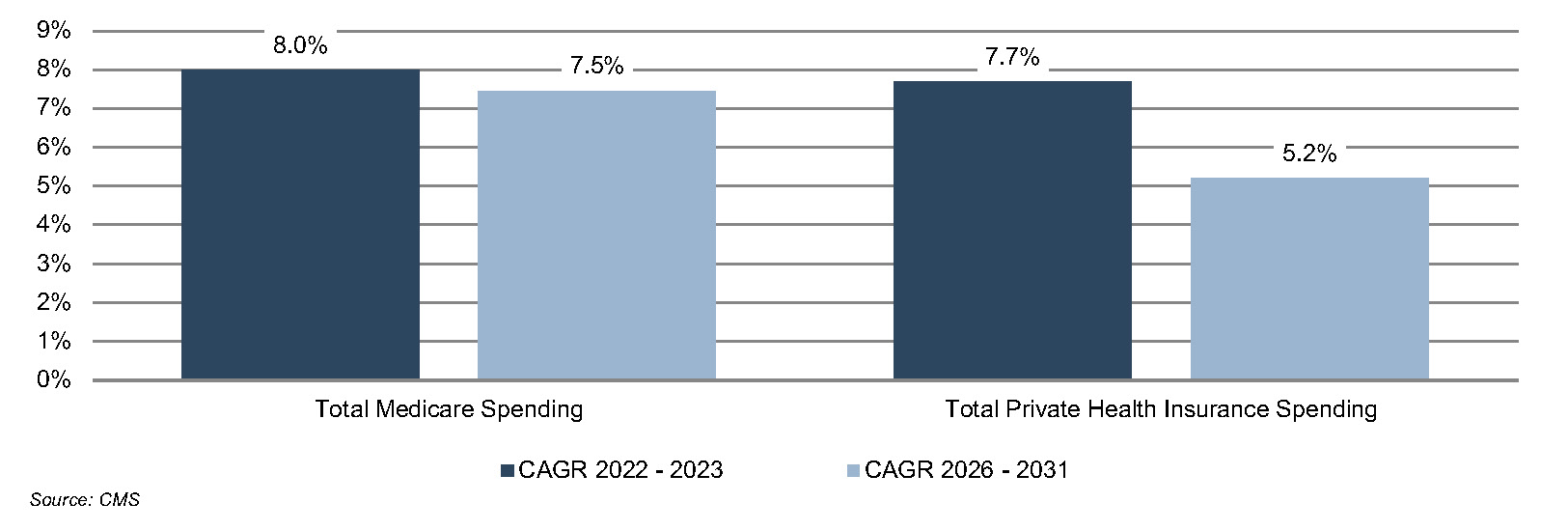

Demographic shifts underlie the expected growth in total U.S. healthcare expenditure from $4.4 trillion in 2022 to $7.2 trillion in 2031, an average annual growth rate of 5.5%. This projected average annual growth rate is slightly higher than the observed rate of 5.1% between 2013 and 2021, suggesting some acceleration in expected spending. Projected growth in annual spending for Medicare (7.5%) and Medicaid (5.0%) is expected to contribute substantially to the increase in national health expenditure over the coming decade. Growth in national healthcare spending, after significant growth in 2020 of 10.2%, slowed to 2.7% in 2021. Healthcare spending as a percentage of GDP is expected to increase from 18.3% in 2021 to 19.6% by 2031.

Since inception, Medicare has accounted for an increasing proportion of total U.S. healthcare expenditures. Medicare currently provides healthcare benefits for an estimated 65 million elderly and disabled people, constituting approximately 10% of the federal budget in 2021. Spending growth is expected to average 7.8% from 2025 to 2031. The program represents the largest portion of total healthcare costs, constituting 21% of total health spending in 2021 and 10% of the federal budget. Medicare accounts for 26% of spending on hospital care, 26% of physician and clinical services, and 32% of retail prescription drugs sales.

U.S. Healthcare Consumption Payor Mix and as % of GDP

Average Spending Growth Rates, Medicare and Private Health Insurance

Due to the growing influence of Medicare in aggregate healthcare consumption, legislative developments can have a potentially outsized effect on the demand and pricing for medical products and services. Medicare spending totaled $944.3 billion in 2022 and is expected to reach $1.8 trillion by 2031.

The Inflation Reduction Act (“IRA”) was signed into law on August 16, 2022 by the Biden administration. Among other items, the IRA aims to lower prescription drug costs and improve access to prescription drugs for Medicare enrollees. Two healthcare spending-related items in the IRA include out-of-pocket caps for insulin products (capped at $35 for each monthly subscription under Part D and Part B) and a $2,000 out-of-pocket annual spending cap for drugs under Medicare Part D. These provisions could have significant effects on the growth rates for out-of-pocket spending for prescription drugs, which are projected to decline by 5.9% and 4.2% in 2024 and 2025, respectively.

3. Third-Party Coverage and Reimbursement

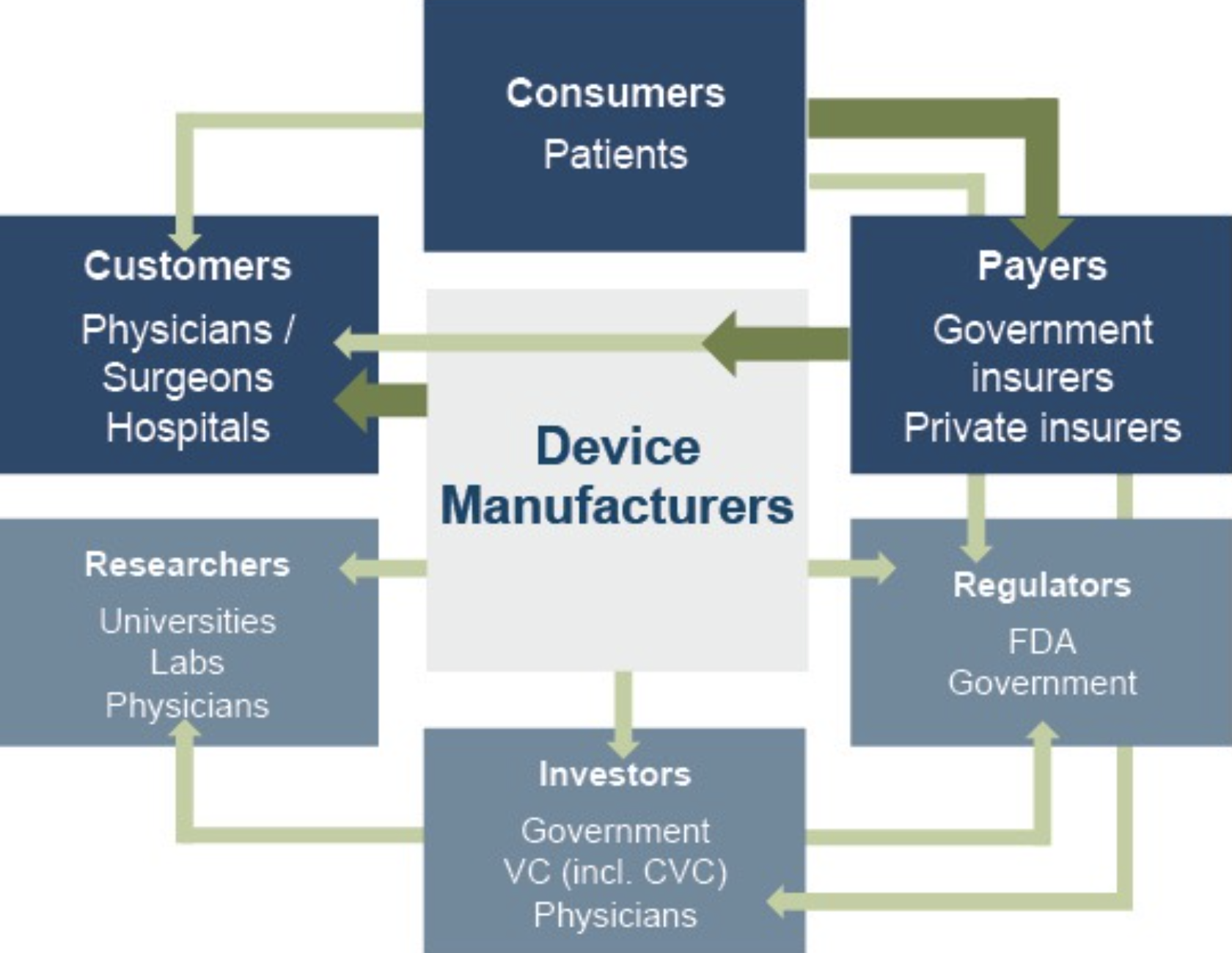

The primary customers of medical device companies are physicians (and/or product approval committees at their hospitals), who select the appropriate equipment for consumers (patients). In most developed economies, the consumers themselves are one step (or more) removed from interactions with manufacturers, and, therefore, pricing of medical devices. Device manufacturers ultimately receive payments from insurers, who usually reimburse healthcare providers for routine procedures (rather than for specific components like the devices used). Accordingly, medical device purchasing decisions tend to be largely disconnected from price.

Third-party payors (both private and government programs) are keen to reevaluate their payment policies to constrain rising healthcare costs. Hospitals are the largest market for medical devices. Lower reimbursement growth will likely persuade hospitals to scrutinize medical purchases by adopting 1) higher standards to evaluate the benefits of new procedures and devices, and 2) a more disciplined price bargaining stance.

The transition of the healthcare delivery paradigm from fee-for-service (FFS) to value models is expected to lead to fewer hospital admissions and procedures, given the focus on cost-cutting and efficiency. In 2015, the Department of Health and Human Services (HHS) announced goals to have 85% and 90% of all Medicare payments tied to quality or value by 2016 and 2018, respectively, and 30% and 50% of total Medicare payments tied to alternative payment models (APM) by the end of 2016 and 2018, respectively. A report issued by the Health Care Payment Learning & Action Network (LAN), a public-private partnership launched in March 2015 by HHS, found that 48.9% of (traditional) Medicare payments were tied to Category 3 and 4 APMs in 2022, compared to 40% in 2021 and 35.8% in 2018.

In 2020, CMS released guidance for states on how to advance value-based care across their healthcare systems, emphasizing Medicaid populations, and to share pathways for adoption of such approaches. CMS states that value-based care advances health equity by putting focus on health outcomes of every person, encouraging health providers to screen for social needs, requiring health professionals to monitor and track outcomes across populations, and engaging with providers who have historically worked in underserved communities. Ultimately, lower reimbursement rates and reduced procedure volume will likely limit pricing gains for medical devices and equipment.

The medical device industry faces similar reimbursement issues globally, as the EU and other jurisdictions face similar increasing healthcare costs. A number of countries have instituted price ceilings on certain medical procedures, which could deflate the reimbursement rates of third-party payors, forcing down product prices. Industry participants are required to report manufacturing costs, and medical device reimbursement rates are set potentially below those figures in certain major markets like Germany, France, Japan, Taiwan, Korea, China, and Brazil. Whether third-party payors consider certain devices medically reasonable or necessary for operations presents a hurdle that device makers and manufacturers must overcome in bringing their devices to market.

4. Competitive Factors and Regulatory Regime

Historically, much of the growth of medical technology companies has been predicated on continual product innovations that make devices easier for doctors to use and improve health outcomes for the patients. Successful product development usually requires significant R&D outlays and a measure of luck. If viable, new devices can elevate average selling prices, market penetration, and market share.

Government regulations curb competition in two ways to foster an environment where firms may realize an acceptable level of returns on their R&D investments. First, firms that are first to the market with a new product can benefit from patents and intellectual property protection giving them a competitive advantage for a finite period. Second, regulations govern medical device design and development, preclinical and clinical testing, premarket clearance or approval, registration and listing, manufacturing, labeling, storage, advertising and promotions, sales and distribution, export and import, and post market surveillance.

Regulatory Overview in the U.S.

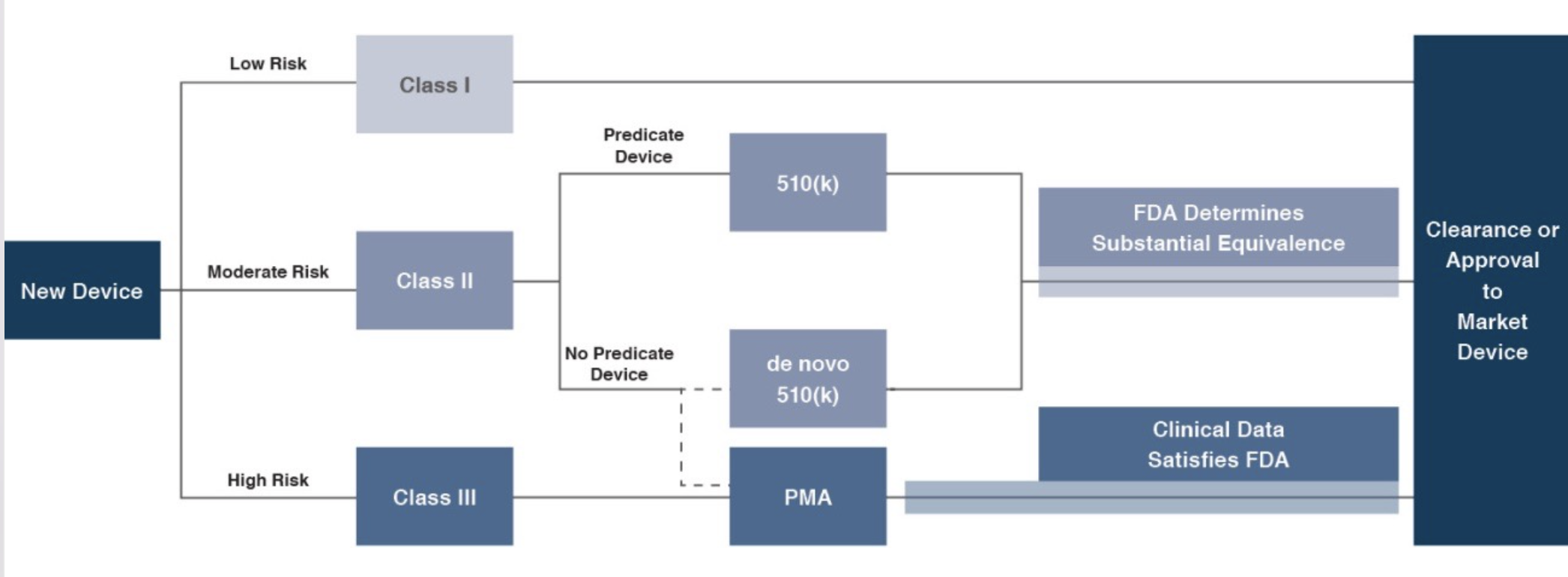

In the U.S., the FDA generally oversees the implementation of the second set of regulations. Some relatively simple devices deemed to pose low risk are exempt from the FDA’s clearance requirement and can be marketed in the U.S. without prior authorization. For the remaining devices, commercial distribution requires marketing authorization from the FDA, which comes in primarily two flavors.

- The premarket notification (“510(k) clearance”) process requires the manufacturer to demonstrate that a device is “substantially equivalent” to an existing device (“predicate device”) that is legally marketed in the U.S. The 510(k) clearance process may occasionally require clinical data and generally takes between 90 days and one year for completion. In November 2018, the FDA announced plans to change elements of the 510(k) clearance process. Specifically, the FDA plan includes measures to encourage device manufacturers to use predicate devices that have been on the market for no more than 10 years. In early 2019, the FDA announced an alternative 510(k) program to allow medical devices an easier approval process for manufacturers of certain “well-understood device types” to demonstrate substantial equivalence through objective safety and performance criteria. In February 2020, the FDA launched its voluntary pilot program: electronic Submission Template and Resource (eSTAR) as an interactive submission template that may be used by the medical device submitters to prepare certain pre-market submissions for a device. Starting in October 2023, all 510(k) submissions were required to be submitted using eSTAR unless exempted.

- The premarket approval (“PMA”) process is more stringent, time-consuming, and expensive. A PMA application must be supported by valid scientific evidence, which typically entails collection of extensive technical, preclinical, clinical, and manufacturing data. Once the PMA is submitted and found to be complete, the FDA begins an in-depth review, which is required by statute to take no longer than 180 days. However, the process typically takes significantly longer and may require several years to complete.

Pursuant to the Medical Device User Fee Modernization Act (MDUFA), the FDA collects user fees for the review of devices for marketing clearance or approval. The current iteration of the Medical Device User Fee Act (MDUFA V) came into effect in October 2022. Under MDUFA V, the FDA is authorized to collect $1.8 billion in user fee revenue for the five-year cycle, an increase from the approximately $1 billion in user fees under MDUFA IV, between 2017 and 2022. A significant change from MDUFA IV to MDUFA V relates to performance goals for De Novo Classification requests (requests for novel medical devices for which general controls alone provide reasonable assurance of safety and effectiveness for the intended use). There has also been updated PMA guidance, with the FDA conducting substantive reviews within 90 calendar days for all original PMAs, panel-track supplements, and 180-day supplements.

Regulatory Overview Outside the U.S.

The European Union (EU), along with countries such as Japan, Canada, and Australia all operate strict regulatory regimes similar to that of the FDA, and international consensus is moving towards more stringent regulations. Stricter regulations for new devices may slow release dates and may negatively affect companies within the industry.

Medical device manufacturers face a single regulatory body across the European Union: Regulation (EU 2017/745), also known as the European Union Medical Device Regulation (EU MDR). The regulation was published in 2017, replacing the medical device directives regulation that was in place since the 1990s. The requirements of the MDR became applicable to all medical devices sold in the EU as of May 26, 2021. The EU is the second largest market for medical devices in the world with approximately €150 billion in sales in 2022, only behind the United States. The EU MDR has introduced stricter requirements for medical device manufacturers, including increased clinical evidence and post-market surveillance. Consequently, there is an increased risk for longer approval processes and delays in manufacturing of these devices.

5. Emerging Global Markets

Emerging economies are claiming a growing share of global healthcare consumption, including medical devices and related procedures, owing to relative economic prosperity, growing medical awareness, and increasing (and increasingly aging) populations. According to the WHO, middle income countries, such as China, Turkey, and Peru, among others, are rapidly converging towards outsized levels of spending as their income scales. When countries grow richer, the demand for health care increases along with people’s expectation for government-financed healthcare. Upper-middle income countries accounted for 16.6% of total global healthcare spending in 2021, up from 8.2% in 2000.

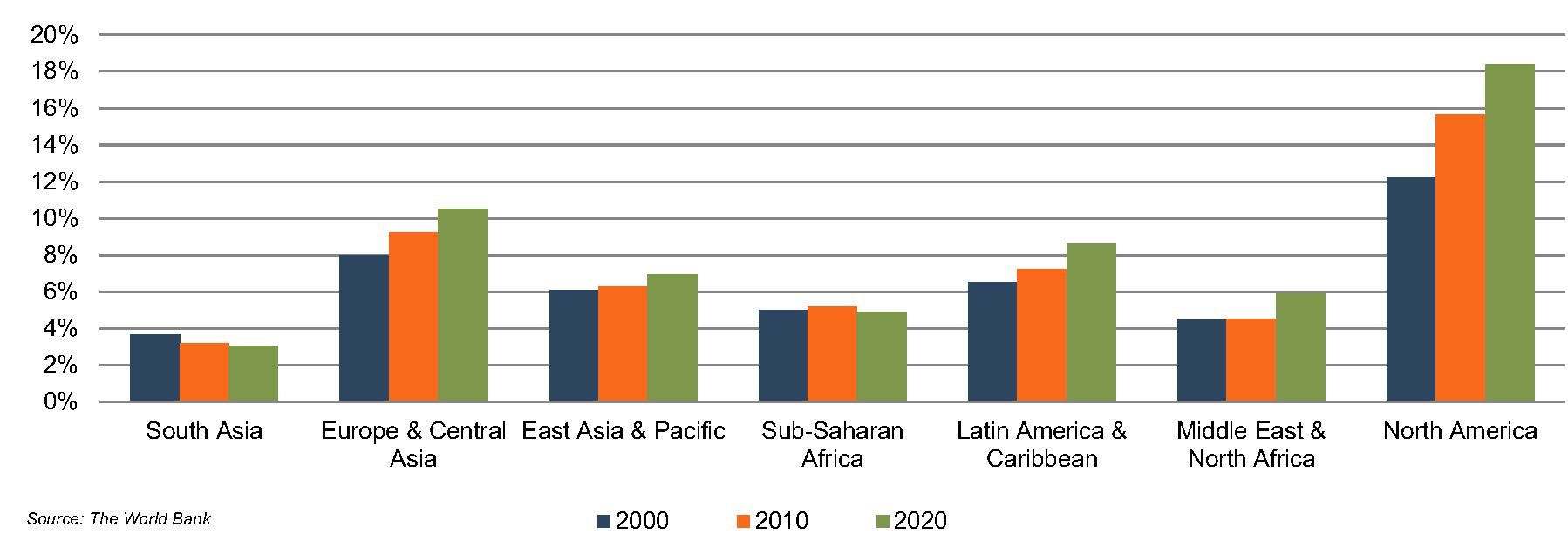

As global health expenditure continues to increase, sales to countries outside the U.S. represent a potential avenue for growth for domestic medical device companies. According to the World Bank, all regions (except Sub-Saharan Africa and South Asia) have seen an increase in healthcare spending as a percentage of total output over the last two decades.

World Health Expenditure as a % of GDP

Global medical device sales are estimated to increase 5.9% annually from 2023 to 2030, reaching nearly $800 billion according to data from Fortune Business Insights. While the Americas are projected to remain the world’s largest medical device market, the Asia Pacific market is expected to expand at a relatively quicker pace over the next several years.

Summary

Demographic shifts underlie the long-term market opportunity for medical device manufacturers. While efforts to control costs on the part of the government insurer in the U.S. may limit future pricing growth for incumbent products, a growing global market provides domestic device manufacturers with an opportunity to broaden and diversify their geographic revenue base. Developing new products and procedures is risky and usually more resource intensive compared to some other growth sectors of the economy. However, barriers to entry in the form of existing regulations provide a measure of relief from competition, especially for newly developed products.

Post-Script – 2024 Outlook

The medical device industry looked to have put the effects of COVID-19 behind by 2023. A large number of elective procedures were deferred in the early part of the pandemic and a measure of catch-up in procedure volumes was reported in subsequent periods. Back to focusing on the longer-term demographic and other trends?

Well, maybe not quite so fast. It was always likely that the pandemic-induced disruptions would linger just a bit longer, creating some uncertainty around consumers’ needs and preferences. But the industry awakened to a different type of potential disruption in mid-2023. Would GLP-1 drugs alter long-term demographic trends by reducing massive obesity rates? And would the industry face widespread lower demand for bariatric surgery devices, glucose monitors, cardiovascular devices, orthopedic implants and other equiptment? A mid-year swoon in medtech stock prices was attributed, at least by some, to the wonder drugs. As 2023 came to a close, however, many appear to have reversed course from that early response. We may or may not get more clarity on the longer-term effects of these treatments in 2024 but, surely, they will also bring opportunities to go along with potential challenges for device makers.

Taking a broader view, some trends from recent periods will likely persist in 2024. Companies will continue to focus on profitability and profitable growth in a (relatively) higher-interest rate environment. Some observers suggest that an expected but measured decline in rates over 2024 (if it materializes) may not do much for medtech stock prices, further underscoring the need to shore up margins. On the flip side, since the period of rapid interest rate increases appears to be behind us, transaction volume should pick up from the low levels of the past two years. Finally, innovation, as always, will continue to be part of the conversation as novel treatments that serve unmet needs will help to unlock new markets.

2024 Outlook reading list:

- What To Expect From Medtech In 2024 (McKinsey & Company)

- 5 Medtech Trends To Watch In 2024 (MedtechDive)

- 2024 Outlook For Life Sciences: GenAI, Drug Prices, Economy Likely To Influence Strategy (Deloitte)