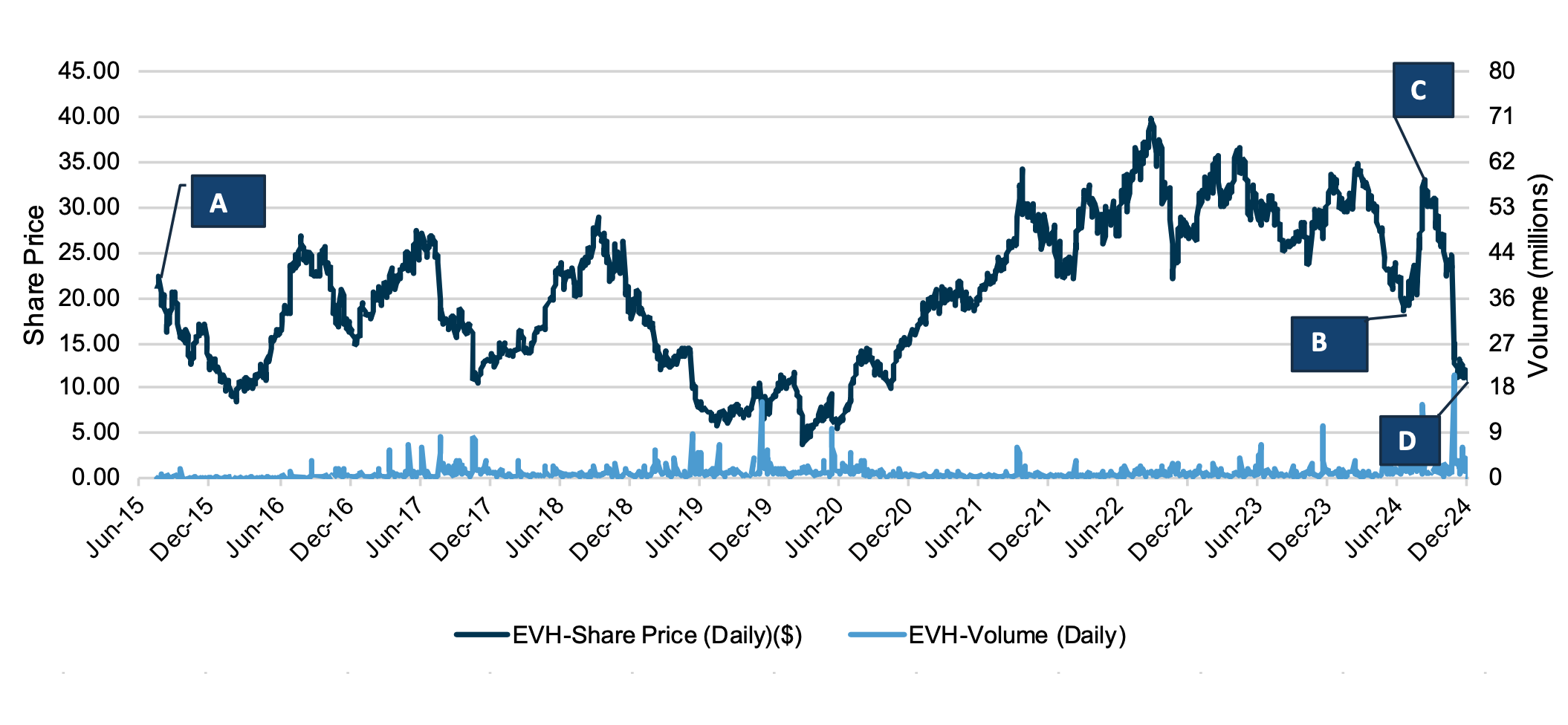

Anatomy of Volatility: Evolent (EVH)

In our Q3 newsletter, we noted that Evolent Health, Inc. (NYSE:EVH) reported a large quarterly drop in stock price during 2Q24. Over 3Q24, EVH made up almost all of the ground lost in 2Q24 as the stock price increased by around 48%. However, the stock has languished since, closing on December 13 down almost 60% from the end of the third quarter.

Evolent Health, Inc. Stock Chart

Click here to expand the image above

A few notes on EVH price volatility in recent quarters – we remain observers and may report further notable developments in future editions of this newsletter.

(A): Evolent Health, Inc. debuted on the New York Stock Exchange on June 5, 2015, raising $195 million and registering almost a $1 billion market cap.1 The stock price was $21.33 per share on July 31, 2015. EVH provides clinical and administrative technology services to help providers and payers with care management and the transition from fee-for-service to value-based care. The revenue model is a mix of risk-based (capitated) and subscription-based products, with the latter expected to contribute higher margins and the majority of EBITDA

over time.2

(B): EVH’s stock price fell approximately 42% from $32.79 per share at 1Q24-end to $19.12 per share at 2Q24-end, even as the Company reported first quarter revenue that beat expectations and adjusted EBITDA in line with prior guidance. The decline in price likely reflected risks around higher costs due to increased utilization in certain specialties, as well as general uncertainty due to an industry-wide disruption caused by a ransomware cyberattack on a large revenue cycle management company.3

(C): Evolent’s stock price rebounded in 3Q24, reaching a high of $31.98 on August 30, 2024 before closing at $28.28 at quarter end. Towards the end of August, the Company indicated it had received takeover interest from a number of private equity firms, including TPG, CD&R, and KKR.4

(D): EVH stock fell significantly after releasing 3Q24 earnings – revenue fell slightly short of expectations with more meaningful declines in adjusted EBITDA and guidance for the full year. The Company attributed the weaker performance to an unexpected $42 million increase in medical costs related to (risk-based) specialty services.5

1 “Software maker Evolent Health’s IPO priced at $17/share: underwriter,” available at https://www.reuters.com/article/technology/software-maker-evolent-healths-ipo-priced-at-17share-underwriter-idUSKBN0OK2I9/

2 Evolent Investor Day presentation, May 23, 2023 available at https://filecache.investorroom.com/mr5ir_evolent/117/IR-DAY-May-23-2003-FINAL.pdf

3 “1Q24 Beat and Raise on the Top Line with Three New Contracts Announced Demonstrating Strong End Market Demand,” J.P.Morgan North America Equity Research note May 9, 2024.

4 “Exclusive: Evolent Health in sale talks after receiving takeover interest, sources say”, Reuters Online available at https://www.reuters.com/markets/deals/evolent-health-sale-talks-after-inbound-interest-sources-say-2024-08-22/

5 “Evolent Announces Third Quarter 2024 Results,” available at https://ir.evolent.com/2024-11-07-Evolent-Announces-Third-Quarter-2024-Results