Navigating Tax Returns: Tips and Key Focus Areas for Family Law Attorneys and Divorcing Individuals/Business Owners – Part II

Part II of III- Schedule A (Form 1040) Itemized Deductions

This is the second of the three-part series where we focus on the key areas of tax returns to assist family lawyers and divorcing parties. Part II concentrates on Schedule A (Form 1040) Itemized Deductions. Part I discussed Form 1040 and can be found here.

Schedule A (Form 1040) Itemized Deductions is an attachment to Form 1040 for taxpayers who choose to itemize their tax-deductible expenses rather than take the standard deduction.

Why Would Schedule A (Form 1040) Itemized Deductions Be Important In Divorce Proceedings?

Schedule A provides information regarding marital property – assets and debts – and may reveal information about the taxpayer’s lifestyle and financial position. Reviewing the detailed information can potentially lead to further investigation such as uncovering dissipation of assets, discovering hidden assets, or providing an overview of true historical spending.

Taxpayers have the option on Line 12 of Form 1040 to elect the standard deduction or the itemized deductions from Schedule A. At the time of publication of this article, the standard deduction ranges from $12,400-$24,800 depending on the selected filing status of the taxpayer(s). Both deductions reduce the amount of Taxable Income on Line 15 on Form 1040. If the taxpayer’s qualified itemized deductions are greater than their standard deduction, the taxpayer typically forgoes the standard deduction and files Schedule A with Form 1040. For divorce purposes, reviewing the taxpayer’s elections over a historical period may also provide further insight into the financial snapshot of the estate over time.

Key Areas of Focus for Family Law Attorneys and Divorcing Parties

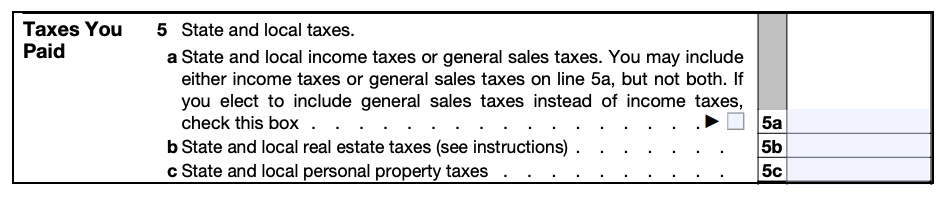

Lines 5b and 5c: State & Local Real Estate Taxes, State & Local Property Taxes – Entries on Lines 5b and/or 5c show taxes paid on property. Line 5b focuses on state and local taxes paid on real estate owned by the taxpayer(s) that were not used for business, while Line 5c concentrates on state and local personal property taxes paid on a yearly basis based on the value of the asset alone.

If these lines are filled, it should lead to further questioning about what these properties are and if they are marital property. The amount of tax paid could also give insight into the taxpayer’s assets. Greater state and local real estate taxes entered on Line 5b usually indicate more expensive real estate. Similarly, a larger entry in Line 5c representing taxes on personal property indicate high-priced assets, such as an expensive car.

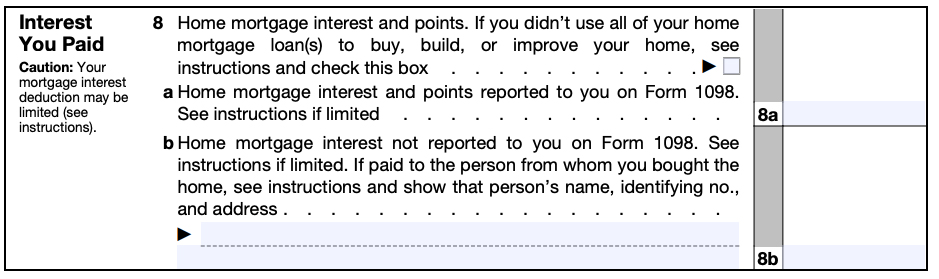

Line 8: Home Mortgage Interest – A home mortgage represents any loan that is secured by the taxpayer’s main home or second home. A “home” can be a house, condominium, mobile home, boat, or similar property as long as it provides the basic living accommodations. The rules for deducting interest vary, depending on whether the loan proceeds are used for business, personal, or investment activities. The deduction for home mortgage interest depends on factors such as the date of the mortgage, the amount of the mortgage, and how the mortgage proceeds are used.

An entry in Lines 8a-e indicates the taxpayer(s) has a home mortgage loan and documentation of the loan should be requested. This line is an indication of property ownership, and therefore, a potential marital asset (or separate asset if that scenario is applicable). Form 1098, the Mortgage Interest Statement, will provide more detailed information.

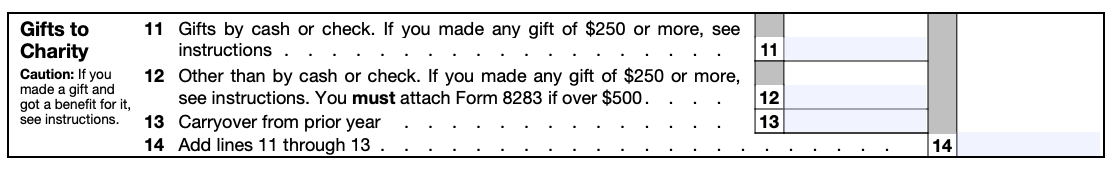

Line 14: Gifts to Charity – A charitable contribution is a donation or gift made voluntarily to, or for the use of, a qualified organization without expecting to receive anything of equal value. Qualified organizations include but are not limited to nonprofit groups that are religious, charitable, or educational.

Sometimes we see charitable giving allocated as a line item in a divorcing individual’s future budget. While this may not necessarily be an expense necessary for traditional living expenses, if, historically, the parties donated significant monies, this can be captured on historical charitable donation deductions and ought to be evaluated on a case-by-case basis. As a tip, sometimes these gifts may be captured elsewhere than a personal tax return, such as a trust’s estate tax return.

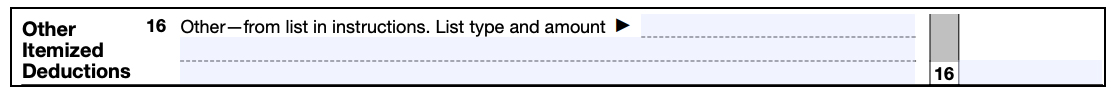

Line 16: Other Itemized Deductions – Only certain expenses qualify to be deducted as other itemized deductions including gambling losses, casualty and theft losses, among others. If there is an entry in Line 16, more detailed information on these deductions may be necessary.

A common “other itemized deduction” is for gambling losses, which may lead to further questioning and could potentially be dissipation of marital assets. Another example is the federal estate tax on income in respect of a decedent. Income in respect of a decedent (IRD) is income that was owed to a decedent at the time he or she died. Examples of IRD include retirement plan assets, IRA distributions, unpaid interest, dividends, and salary, to name only a few.

Along with other estate assets, IRD is eventually distributed to the beneficiaries. While most assets of the estate are transferred free of income tax, IRD assets are generally taxed at the beneficiaries’ ordinary income tax rates. However, if a decedent’s estate has paid federal estate taxes on the IRD assets, the beneficiary may be eligible for an IRD tax deduction based on the amount of estate tax paid. This is an example of a potential separate asset, however, the IRD could also be a marital asset depending on the beneficiary designation and/or potential commingling of assets.

Items included within other itemized deductions should typically be reviewed and potentially further investigated as they may represent assets, liabilities, and/or sources of income, whether marital or separate.

Conclusion

Understanding how to navigate key areas of Schedule A (Form 1040) can be very helpful in divorce proceedings. Information within Schedule A can provide support for marital assets and liabilities, sources of income and potential further analyses. Reviewing multiple years of tax returns and accompanying supplemental schedules may provide helpful information on trends and/or changes and could indicate the need for potential forensic investigations.

Mercer Capital is a national business valuation and financial advisory firm. While we do not provide tax advice, we have expertise in the areas of financial, valuation, and forensic services.