Analysis of the Spirit Fairness Opinions re the JetBlue Acquisition

As participants and observers in transactions, the pending acquisition of Spirit Airlines, Inc. (NYSE: SAVE) by JetBlue Airways Corporation (NASDAQGS: JBLU) offers a lot of fodder for us to comment on. In this post, we look at the fairness opinions delivered by Morgan Stanley and Barclays to the Spirit board before approving the deal and then ask a key transaction-related question.

On July 28, 2022, Spirit agreed to be acquired by JetBlue for cash consideration of $33.50 per share, or $3.8 billion. Inclusive of net debt, the transaction at announcement had an enterprise value of $7.6 billion. Deal multiples included 25.5x analysts’ consensus EPS for the next 12 months and 12.3x NTM EBITDA.

The deal value excluding ticking payments that could push the total consideration to $34.15 per share, represented a 38% premium to Spirit’s closing price on July 27 of $24.30 per share; however, the announcement was not a surprise because Spirit had been in play since February 5 when the company agreed to be acquired by Frontier Group Holding, Inc. (NASDAQGS: ULCC) for 1.93 Frontier shares and $2.13 per share of cash, which was then valued at $25.83 per share.

JetBlue subsequently made an unsolicited cash offer on March 29 (disclosed on April 5) of $33.00 per share that was rejected on May 2. JetBlue then commenced a $30.00 per share tender on May 16, noting the price was less than the $33.00 per share offer because of the board’s “unwillingness to negotiate in good faith with us.”

Ultimately, the Frontier deal was terminated on July 27, and Spirit then entered into an agreement with JetBlue that provided for the following:

- $33.50 per share of cash, including $2.50 per share payable upon approval of the transaction by Spirit stockholders;

- Monthly ticking fee of $0.10 per share up to $0.65 per share commencing January 2023 through mid-July 2023 whether the transaction is consummated or terminated; and

- Downside protection via $70 million payable to Spirit and up to $400 million, or $4.30 per share payable to stockholders inclusive of the approval payment and ticking fees in the event the merger agreement is terminated for failure to obtain regulatory approval.

The Barclays and Morgan Stanley Fairness Opinions

The proxy statement dated September 12 enumerated the reasons the Spirit board approved the merger agreement, including the fairness opinions that opined the consideration to be received by shareholders was fair from a financial point of view to the shareholders. Interestingly, both banks were retained by Spirit in late 2019 to assist in a review of strategic options that was interrupted by COVID.

A fairness opinion provides an analysis of the financial aspects of a proposed transaction from the point of view of one or more parties to the transaction, usually expressing an opinion about the consideration though sometimes the transaction itself. Ideally, the opinion is provided by an independent advisor that does not stand to receive a success fee, especially when the transaction is a close call or involves real or perceived conflicts. In the case of the JetBlue-Spirit transaction, both Spirit advisors will receive much larger contingent fees if the transaction is consummated compared to the fixed fee fairness opinions.[1]

Let’s look at a high-level comparison of each bank’s analysis, some of which were explicitly included in the fairness analyses and some of which were presented for reference only. (A link to the proxy statement can be found here.)

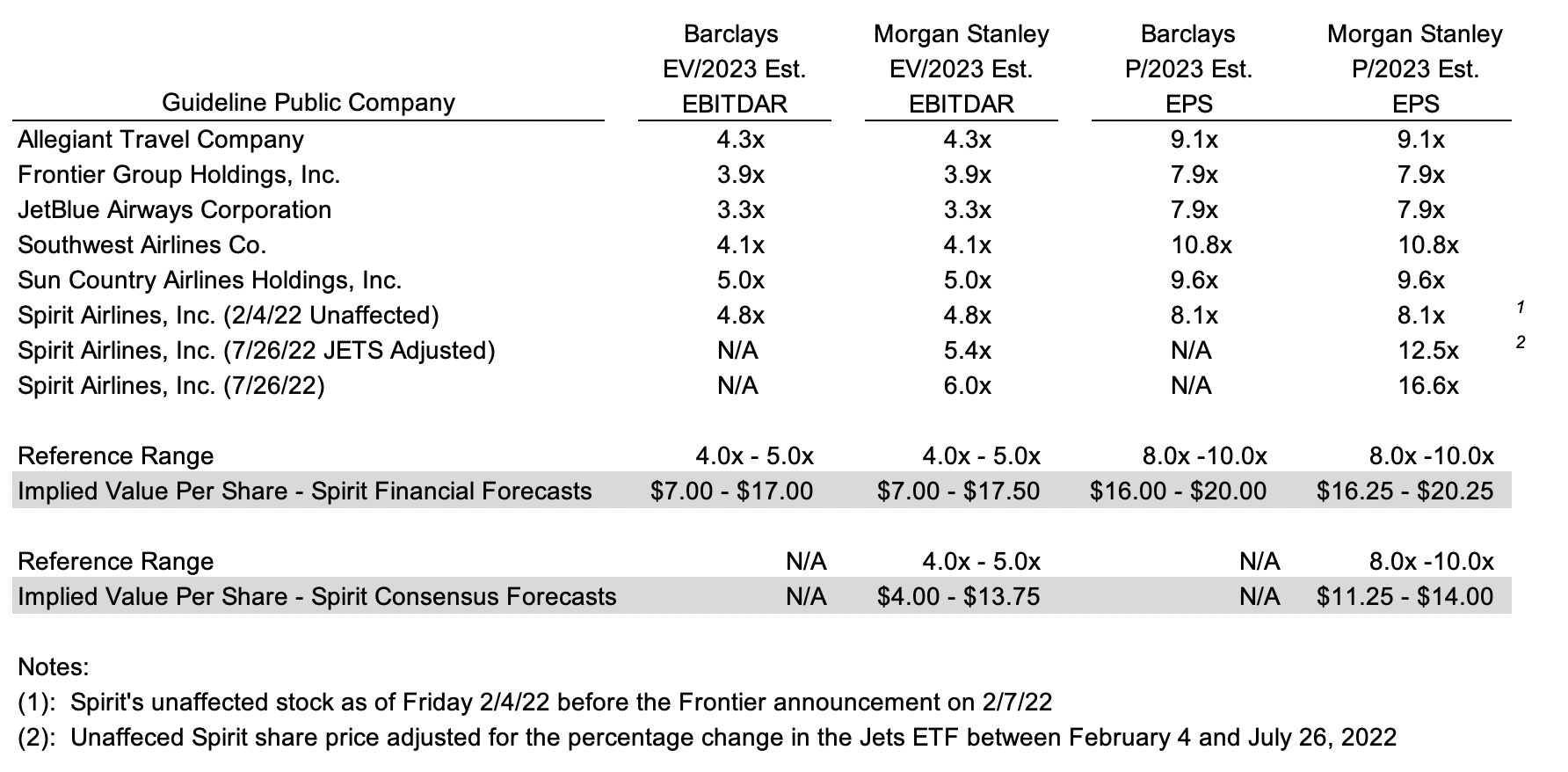

Guideline Public Company (“GPC”) Analysis

Barclays and Morgan Stanley reviewed and compared specific financial and operating data relating to Spirit with selected GPCs deemed comparable to Spirit. The following table compares the selected GPCs, the then-current multiples, the relevant multiple range, and indicated range of value for Spirit as calculated by each bank.

Click here to expand the image above

Both banks relied upon management’s forecast for net income and EBITDAR; however, Morgan Stanley also considered the Street’s consensus forecast for 2023. Spirit is included in the comp group to develop the applicable multiples with both banks relying upon pricing in early February immediately before the Frontier deal was announced; however, Morgan Stanley included alternate multiples based upon Spirit’s price as of July 26 and as of July 26 based upon the change in the industry ETF (JETS) from February 4. Nonetheless, the indicated values each developed based upon management’s forecast were the same.

Guideline Transaction (M&A) Analysis

The opinions did not include guideline transactions, presumably because there is limited M&A data involving U.S. carriers. The most recent significant acquisitions include Northwest Airlines and Continental Airlines in 2008, AirTran Holdings in 2010, and Virgin America in 2016. Nonetheless, we find it odd that a GT analysis was not addressed in the proxy.

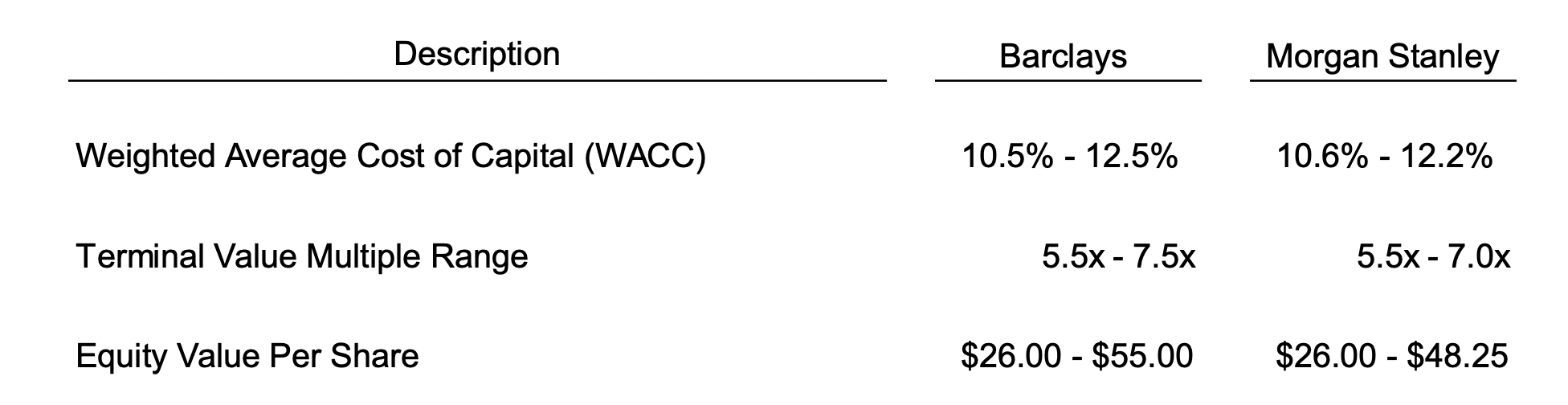

Discounted Cash Flow Analysis

Both banks included a DCF analysis, a valuation method that is standard in virtually all valuation analyses. The gist of the analysis reflects the discounting of unlevered cash flows over a discrete period (2H22-2026) and the projected debt-free value of the company at the end of the projection period to present values based upon the weighted average cost of capital. Net debt is then subtracted to derive the indicated equity value.

Discounted Equity Analysis

Morgan Stanley but not Barclays derived indicated ranges of value per share by discounting management’s forecasted 2025 EBITDAR and EPS to present values based upon a 12.9% equity discount rate. If Spirit paid common dividends, the present value of the dividends through 2025 presumably would have been included, too. The analysis is similar to the DCF method except that cash flows are viewed from the perspective of what is received by shareholders compared to enterprise-level cash flows in the DCF analysis. Morgan Stanley derived a range of $24 to $43 per share based upon 5.0x to 6.5x EBITDAR and $39 to $47 per share based upon 9.0x to 11.0x forecasted 2025 EPS.

Historical Share Price Analysis

Both banks reviewed the 52-week trading history for Spirit for the period ended July 26, 2022 ($16-$29 per share) and in the case of Morgan Stanley for the 52 week period ended February 4, 2022 ($20-$40 per share). Although seemingly an important consideration for the fairness analyses, neither bank’s proxy write-up discussed the deal price premium relative to Spirit’s recent trading on a stand-alone basis or compared to M&A involving publicly traded midcap companies. The proxy did note that the board considered the premium in approving the merger agreement, however.

Research Analyst’s Price Targets

Both banks reviewed sell-side analysts’ one-year price targets ($24-$36 per share). Morgan Stanley discounted the price targets to a present value range of $21 to $32 per share using a discount rate of 12.9%, though the analysis was presented only for reference.

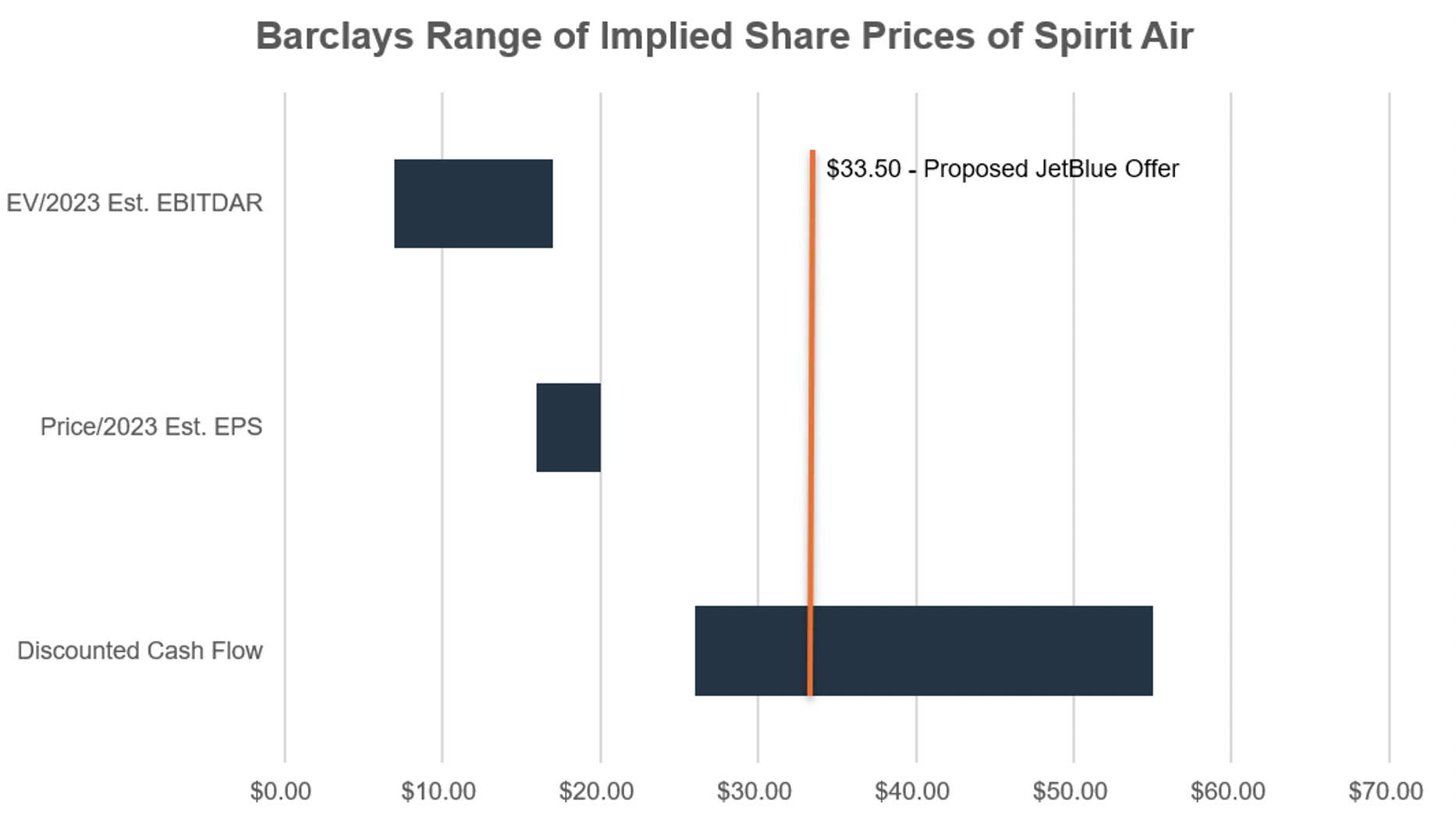

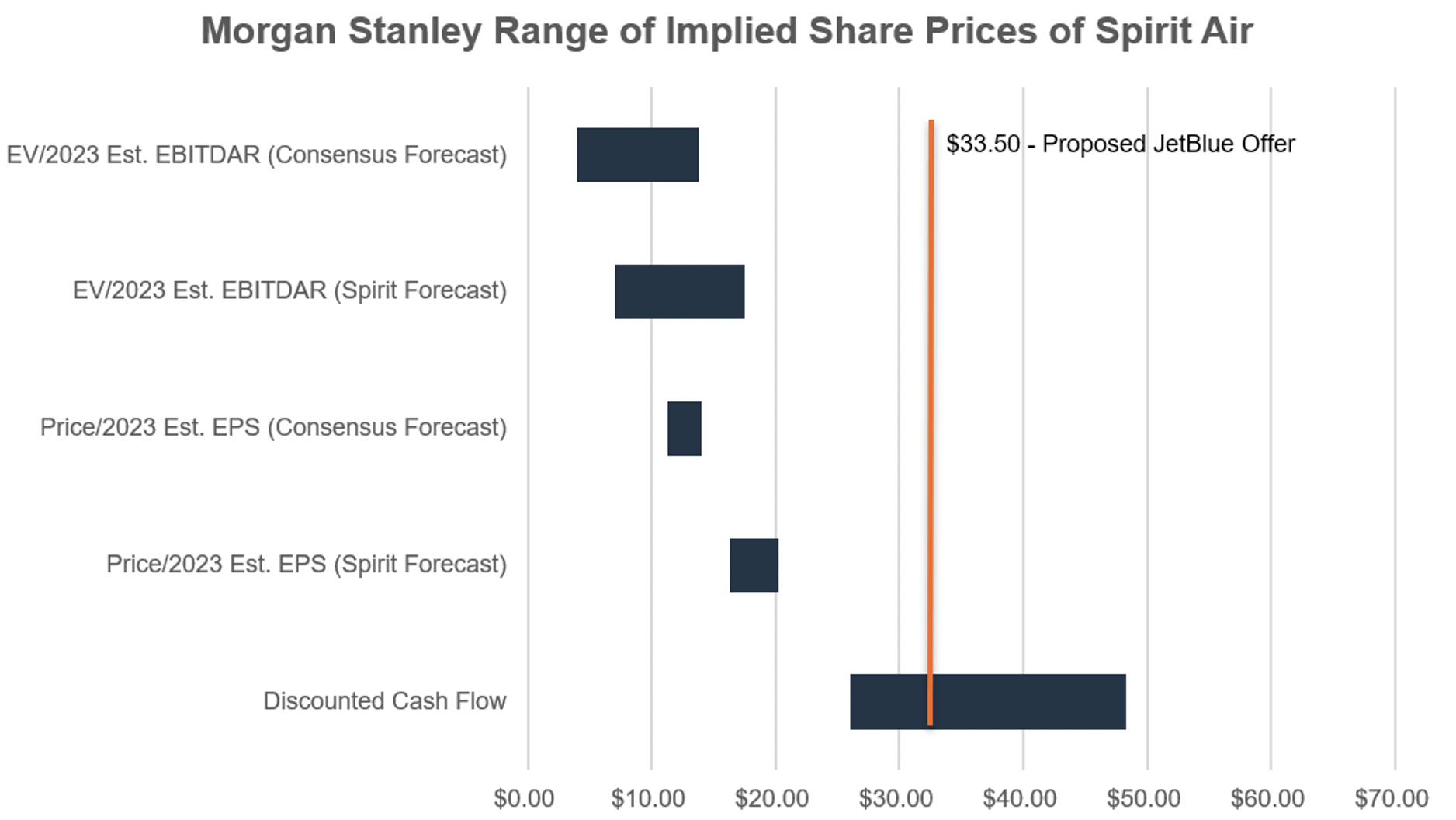

Barclay’s and Morgan Stanley’s Conclusion

Both banks opined that, from a financial point of view, the consideration to be received by the stockholders of Spirit in the proposed transaction is fair to such stockholders. As can be seen in the graph below, the $33.50 share price falls within the range of values determined by both banks and decidedly above trading-based indications of value vs management’s forecast as reflected in the DCF valuations.

Current Status of the Transaction

Given the price and terms of the JetBlue deal, rendering the fairness opinions appears to have been a straightforward exercise; however, one deal point a board must always consider is the ability of a buyer to close. This begs the question: Can JetBlue close the deal?

The market’s answer to the question is “no” given the deep discount Spirit trades to the acquisition price net of the approval payment. The deep discount reflects the growing likelihood that the U.S. Department of Justice will sue to block the deal because it would eliminate another low-cost carrier and position JetBlue-Spirit as the USA’s fifth-largest airline behind American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines.

Among the factors the board considered that weighed against approving the deal was the risk that regulators would block the deal. These concerns were voiced by Frontier and some investors when JetBlue made its unsolicited offer nearly a year ago, but the board approved the transaction nonetheless, perhaps figuring JetBlue offered downside payments and that Frontier would still be an option if Washington nixed the JetBlue transaction.

And for what it is worth, the terminated Frontier deal would be valued around $23 per share, with its shares trading near $11 per share as of February 21.

Source: S&P Global Market Intelligence

Click here to expand the image above