Making Shareholder Communication a Family Business Priority

The following is an installment in our series “What Keeps Family Business Owners Awake at Night”

Communication determines the success of any relationship, and the relationships among shareholders of multi-generation family businesses are no exception. In the early years of a family business, communication is generally informal (and continual), since the dining room often doubles as the board room. As the business and family grow, the shareholder relationships become more complicated, and formal communication becomes more important.

For a multi-generation family business, communication is not optional. A failure to communicate is a communication failure. When communication is lacking, the default assumption of shareholders – especially those not actively involved in the business – will be that management is hiding something. Suspicion breeds discontent; prolonged discontent solidifies into rancor and, in some cases, litigation.

In light of the dire consequences of poor communication, how can family business leaders develop effective and sustainable communication programs? We suggest that public companies can provide a great template for multi-generation family businesses. It is perhaps ironic that public companies – to whom their shareholder bases are largely anonymous – are typically more diligent in their shareholder communications than family businesses, whose shareholders are literally flesh and blood. While public companies’ shareholder communications are legally mandated, forward-thinking public companies view the required shareholder communications not as regulatory requirements to be met, but as opportunities to tell their story in a compelling way.

There are probably only a handful of family businesses for which shareholder communication needs to be as frequent and detailed as that required by the SEC. The structure and discipline of SEC reporting is what needs to be emulated. For family businesses, the goal is to communicate, not inundate. At some point, too much information can simply turn into noise. Family business leaders should tailor a shareholder communication program along the following dimensions:

- Frequency. Public companies communicate results quarterly. Depending on the nature of the business and the desires of the shareholder base, less frequent communication may be appropriate for a family business. The frequency of communication should correspond to the natural intervals over which (1) genuinely “new” information about the company’s results, competitive environment, and strategy is available, and (2) shareholders perceive that the most recent communication has become “stale”. As a result, there is no one-size-fits-all frequency; what is most important is the discipline of a schedule.

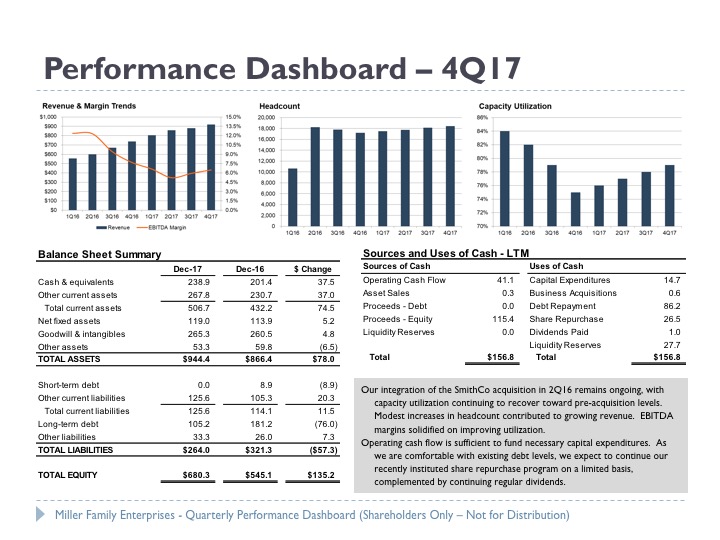

- Level of detail. Public company reports are quite detailed. Family business leaders should assess what level of detail is appropriate for shareholder communications. If the goal is to communicate, the appropriate level of detail should be defined with reference to that which is necessary to tell the company’s story. The detail needs to be presented to shareholders with sufficient supporting context regarding the company’s historical performance and conditions in the relevant industries and economy. A dashboard approach that focuses on key metrics, as illustrated below, can be an effective tool for focusing attention on the measures that matter.

- Format/Access. The advent of accessible webcast and data room technology makes it much easier for family businesses to distribute sensitive financial information securely. Use of such platforms also provides valuable feedback regarding what is working and what is not (since use of the platform by shareholders can be monitored). Some families may have existing newsletters that provide a natural and existing touchpoint for communicating financial results.

- Emphasis. The goal of shareholder communication should be to help promote positive shareholder engagement. To that end, the emphasis of the communication should not be simply the bare reporting of historical results, but should emphasize what the results mean for the business in terms of strategy and outlook for the future. It is probably not possible to re-tell the company’s story too many times. Shareholders that are not actively involved in the business will be able to internalize the company’s strategy only after repeated exposure. What may seem like the annoying repetitions of a broken record to management will for shareholders be the re-exposure necessary to “own” the company’s story.

Shareholder communication is an investment, but one that in our experience has an attractive return. To get the most out of the investment, family business leaders must provide the necessary training and education to shareholders so that they will be able confidently to assess and interpret the information communicated. With that foundation in place, a structured communication program can go a long way to ensuring that family shareholders are positively engaged with the business.

Through our family business advisory services practice, we work with successful families facing issues like these every day. Give us a call to discuss your needs in confidence.