Merger Arbitrage and Valuation

We are sometimes asked to value common equity securities where the target (usually our client) has agreed to be acquired but the transaction has not yet closed. The valuation could be required for a number of reasons: annual year-end ESOP/KSOP valuation, tax compliance matters, and litigation.

The valuation of such shares falls into the genre of “merger arbitrage” which on Wall Street is an “event-driven” asset strategy. Merger arbitrage strategies seek to capture a risk-adjusted return for the risk assumed that the transaction will not close. As time passes, discounts tend to narrow as the closing date approaches absent detrimental developments.

The S&P Merger Arbitrage Index produced total returns on an unlevered basis between 2018 and 2022 that ranged between 6.1% in 2021 and -4.2% in 2022. The five-year compound annual return was 3.2% or 1.9% over the average 90-day T-bill yield.

Given the uncertainty that an announced transaction will close for a variety of reasons (e.g., regulatory, shareholder actions, financing, etc.), acquisition targets that are publicly traded will usually trade at a discount to the acquisition price. In instances when a competing offer is expected, the target’s shares may trade at a premium, though this is unusual given the vetting process most boards undertake.

The valuation of privately held shares in a merger arb situation can be reduced to a binomial outcome: the deal closes, or it does not. The two outcomes may be close in value or they may be far apart, especially if minority and illiquidity discounts are to be considered in the no-deal scenario. Factors that may impact the discount between the target’s market price and the deal price include:

- Expected time to close;

- Cost of capital as reflected in short-term borrowing rates;

- Shareholder support (or opposition);

- Likelihood of regulatory approval;

- Ability to finance;

- Whether the buyer will pay ticking fees; and

- The delta between the acquisition price and no deal value of the target.

Our observation of bank stocks over several decades leads us to the conclusion that bank merger arbitrage discounts are modest in the order of high single digits to 10% or so on an annualized basis. However, it is important to note that fact patterns for individual transactions can cause discounts to be wider. Stated more succinctly: most announced bank deals close.

First Horizon’s Evolving Merger Arb Discount

The ability to close is a key consideration for any board entertaining an acquisition or merger proposal. In our February edition of Transaction News Update, we opined that Spirit Airlines Inc. (NYSE: SAVE) may not have sufficiently considered whether JetBlue Airways Corp. (NYSE: JBLU) could obtain regulatory approval to acquire Spirit when it agreed to the JetBlue offer over a deal with Frontier Group Holdings, Inc.

While small bank deals almost always close, large deals take longer and are subject to more scrutiny since the Biden Administration took office in early 2021. Among three large deals that were announced in 2021 and early 2022, only two of the three closed: $125 billion asset MUFG Union Bank by U.S. Bancorp (NYSE: USB) on December 1, 2022, and $92 billion asset Bank of the West by Bank of Montreal (TSE/NYSE: BMO) on January 17, 2023.

On May 4, 2023, The Toronto-Dominion Bank (TSE/NYSE: TD) and First Horizon Corporation (NYSE: FHN) announced the termination of a definitive agreement that was signed on February 28, 2022 after TD could not provide assurance to FHN when or even if it could obtain regulatory approval to acquire. Subsequent press reports indicated that TD had compliance issues related to anti-money laundering reporting that precluded regulatory approval.

Figures 1, 2 and 3 provide perspectives on merger arb discounts and how discounts can change as facts, circumstances and market conditions change based upon the TD-FHN deal.

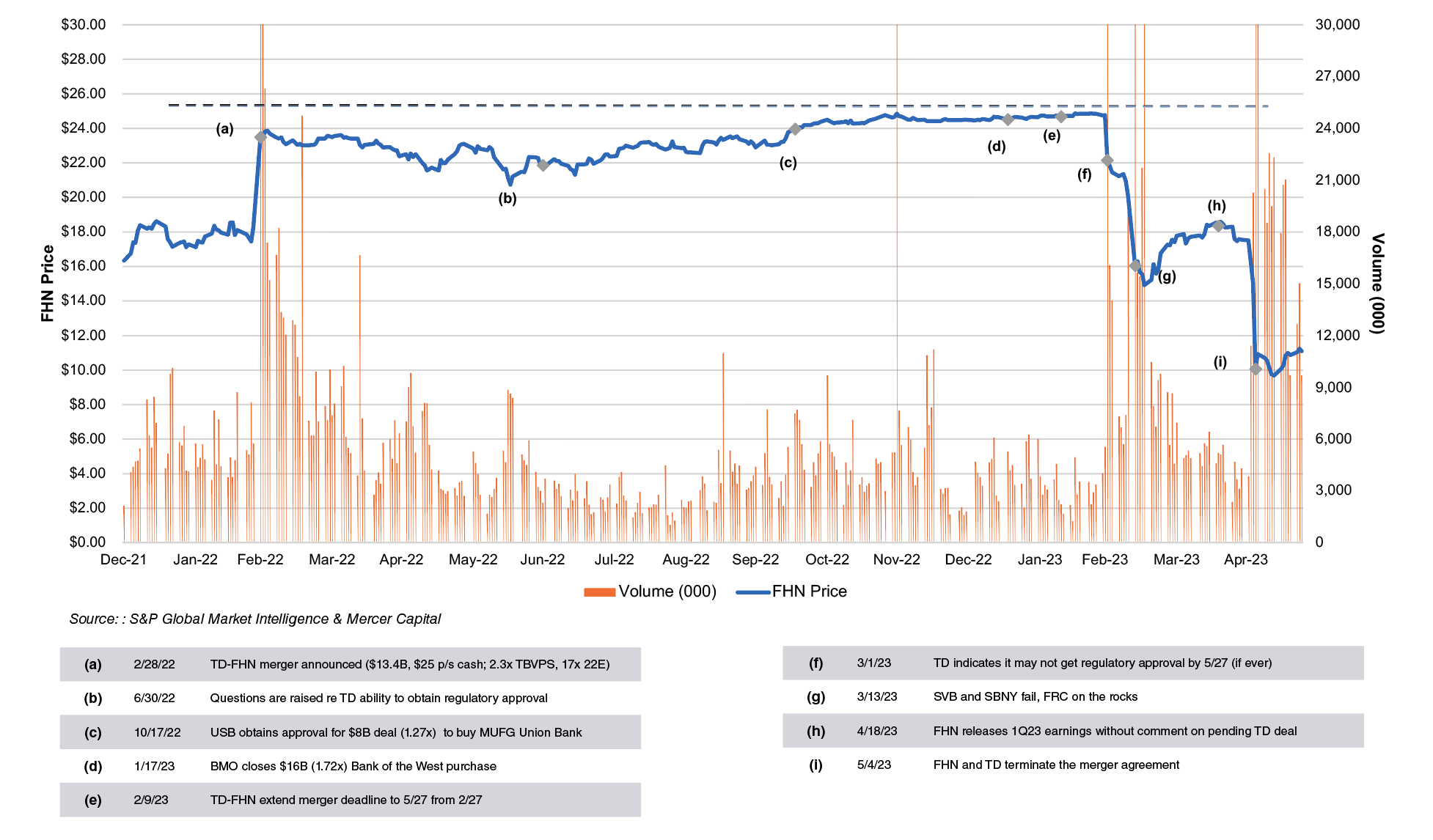

Figure 1:: FHN Common Share Price December 31, 2021 thru May 24, 2023

Click here to expand the image above

The merger agreement signed on February 28, 2022 provided for TD to acquire all of FHN’s common shares for $13.4 billion of cash, or $25.00 per share. Pricing at announcement equated to 2.27x year-end 2021 tangible BVPS and 16.6x the 2022 consensus EPS estimate.

If there was any concern about TD’s ability to get regulatory approval, market participants did not express it because FHN’s shares rose 29% on February 28, 2022, to $23.48 per share from $18.25 per share the day before as shown in Figure 1 (on page 4). The discount to the cash (out) price by the close on the 28th was 6.5%, a level that is consistent with the modest discount we have observed for most bank deals over the years.

Then a series of events would cause the discount to widen, narrow, then blow-out before the termination was announced.

During the summer of 2022, the discount widened as more voices began to question the ability of TD to obtain regulatory approval against the backdrop of USB and BMO facing uncertain approval for their large bank deals, too. However, FHN’s shares trended at the nearly $25 per share cash-out price by November as USB and BMO obtained regulatory approval to close.

On February 9, 2023 the parties extended the termination date to May 27, 2023, from February 28 when it was clear that regulatory approval would not be forthcoming by the one-year anniversary. As shown in Figure 1, FHN’s price dropped 11% on March 1 when it disclosed in its 10-K that TD did not know when it would obtain regulatory approval. The shares then dropped about 20% on March 13 as investors digested the implications of the failures of Silicon Valley Bank (SVB) and Signature Bank New York (SBNY).

When FHN released 1Q23 earnings on April 19 without any updated written commentary about the then pending TD deal (FHN discontinued quarterly conference calls once the deal was announced), the shares did not move much given the then 26% discount to the $25 per share cash price. However, the shares fell to about $10 per share with the announcement that the parties terminated the deal on May 4.

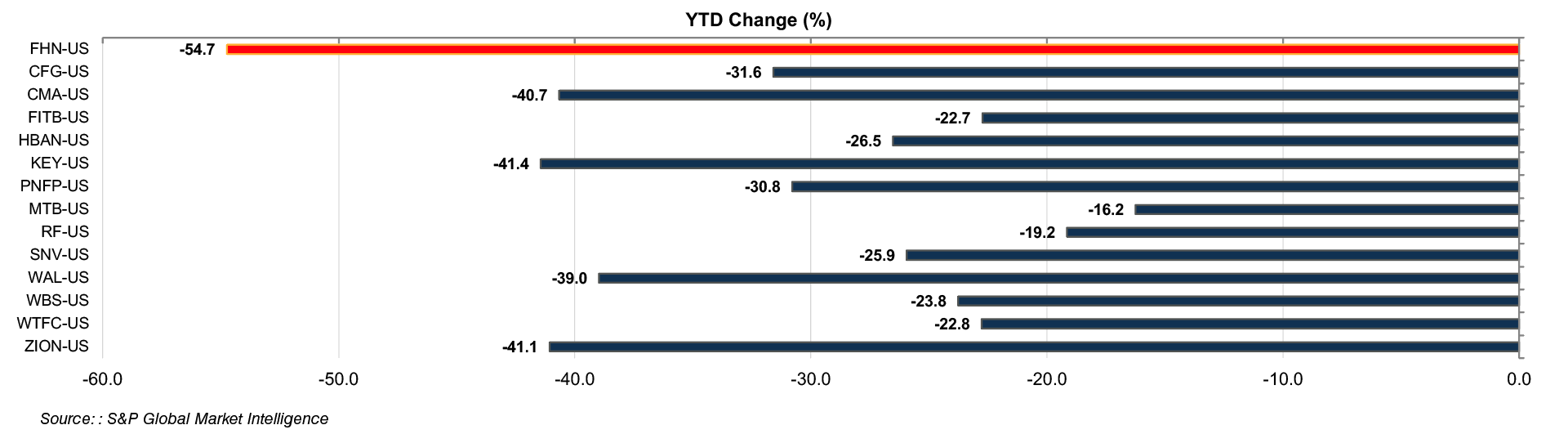

As shown in Figure 2, the year-to-date drop for FHN’s shares through May 24 was 55%, an amount that exceeded the 25-40% drop peers experienced.

Figure 2:: FHN vs Peers as of May 24, 2023

Click here to expand the image above

Figure 3:: P/E Multiples based upon 2023 Consensus Analyst EPS Estimates

Click here to expand the image above

Facts and circumstances can change merger arb discounts.

The impact of bank failures on investor psychology and possibly industry fundamentals was one factor. Another is a deteriorating earnings outlook as Fed rate hikes and sharply higher funding costs will cause 2022 margin expansion to flip to 2023 margin contraction. Also, Fed tightening has produced steep inversion of the yield curve, and inverted yield curves usually precede recessions by upwards of a year.

As a result, bank stocks have been revalued from low-to-mid teen P/E stocks when the TD-FHN deal was announced to single digit P/E stocks today even though analysts have been cutting estimates for nine months. The binominal outcomes for FHN and the merger arb community were wide: $25 if the deal closes or ~$10 per share if it does not close based upon 6-7x current year earnings.

About Mercer Capital

Mercer Capital is a national valuation and transaction advisory firm with a focus on non-publicly traded equities and debt securities. We render valuation, fairness and solvency opinions and provide M&A and other transaction advisory services to depository and other financial services companies. Please call if we can be of assistance.