Mortgage Banking’s Next Chapter: Is a Recovery Taking Root?

A little over four years ago, we published a two-part series entitled Mortgage Banking Lagniappe (Lagniappe is the Cajun word for “bonus” or “a little extra”) as all-time lows in rates powered big mortgage earnings for banks and non-banks. Since then, a multi-year hangover has developed that causes us to ask: do rates have to fall materially for mortgage bank earnings to “normalize” and begin to contribute to bank earnings?

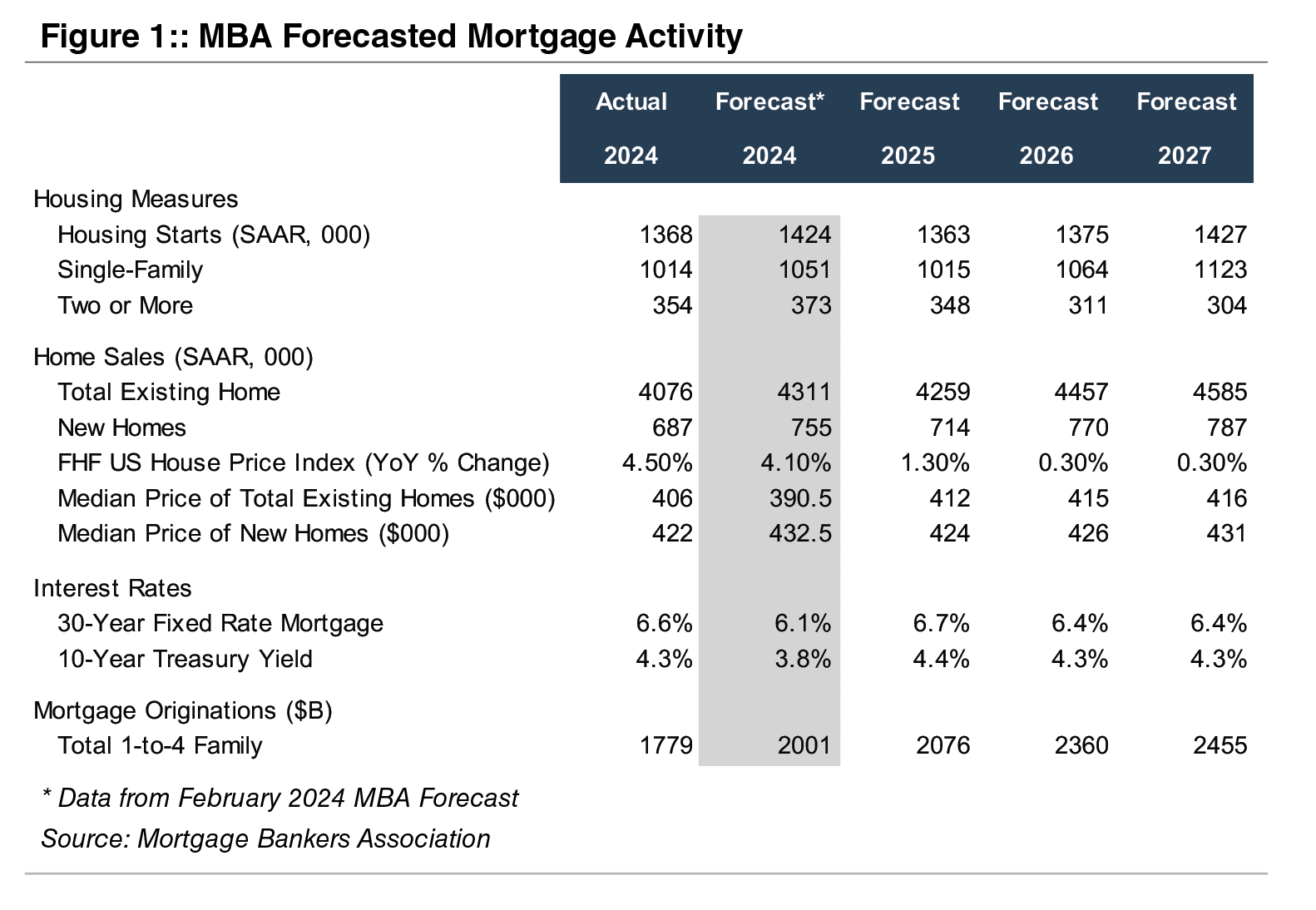

Figure 1, below, shows the level of and trends in key housing/mortgage data for 2024 and the Mortgage Banking Association’s (MBA) three-year forecast.

Like many forecasts, our observation of the MBA forecast tends to suffer from recency bias. Around year-end 2023, MBA’s forecast for 2024 projected a much stronger year than occurred because mortgage rates did not decline much even though the Fed cut its overnight policy rates by 100bps.

As a result, housing starts and sales of existing new homes were well below MBA’s forecast. However, the median price of existing homes was $406 thousand at year-end 2024, which equated to a 4.5% increase from the year prior and exceeded the 4.1% forecast increase.

Although inventories of unsold homes are increasing and in some areas are surging, MBA expects home prices to increase modestly in the coming three-year period as mortgage rates are projected to remain in the mid-6 range for a 30-year mortgage. By 2027, home sales are expected to be 12% above 2024 reported figures while mortgage volume is expected to increase nearly 40% as the refi-share picks up. If that comes to pass, mortgage banking earnings may transition to being accretive to commercial bank earnings.

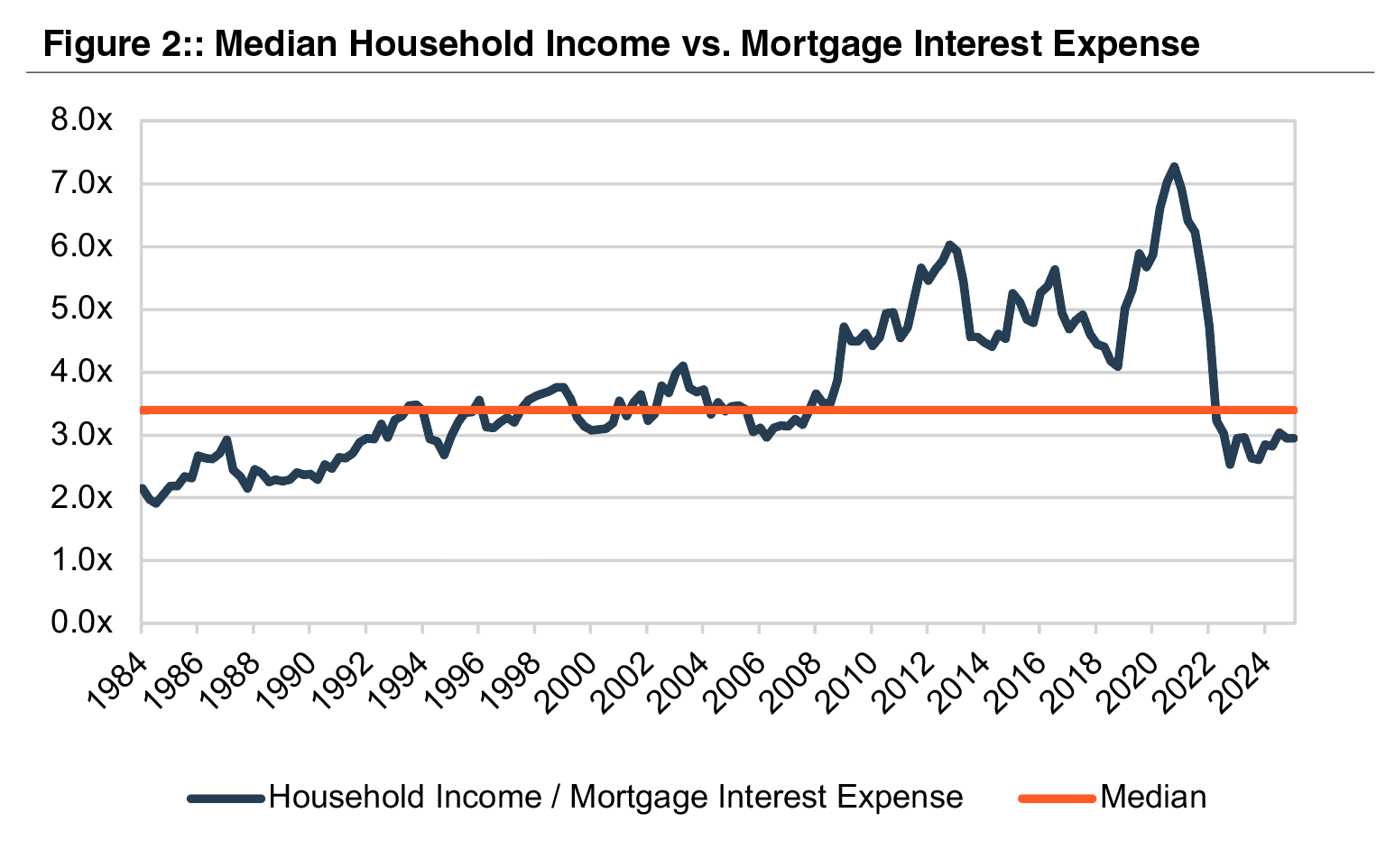

Mortgage rates were around 20% briefly in the early 1980s. Conversely houses were much cheaper. The analysis in Figure 2, on the next page, compares mortgage interest expense (using 30-year average mortgage rates and median U.S. transaction prices) to median household income, since the early 1980s.

As shown, housing was the most expensive at the beginning of this analysis when interest rates were in the mid-teens but trending lower. From 1984 to 1994, affordability improved as housing prices and income increased in-step but rates were nearly cut in half. From 1994 until the beginning of the GFC, relative affordability hugged the median (3.4x) as income and home prices, again, increased together while mortgage rates ranged from 6%-8%.

From the GFC until COVID, income growth outpaced the increase in housing prices while interest rates nearly halved, leading to improved affordability though post-GFC “reforms” made it more difficult to obtain a mortgage.

During COVID, the Fed engineered a sharp drop in long-term rates mortgage rates by buying over $2 trillion of Agency MBS. As a result, home prices skyrocketed but affordability as measured by household income as a multiple of mortgage interest expense rose to nearly 7x vs. a long-term average of 3.4x.

This was a bit of a mirage since 30-year mortgage rates for a while were below 3%; today it is around 6.5% after peaking near 8% in 2023. With normalization of rates since 2022, the household income-to-mortgage interest expense ratio has fallen back to near the long-term average of 3.4x yet housing is unaffordable for many.

So, it may take further increases in housing supply and a mild (or worse) recession to push mortgage rates lower and power a pick-up in mortgage refinancing and origination activity that would thereby drive better mortgage earnings. Some combinations of the following might work: rates down to the high 5s, housing prices decline 10-15%, or income increases 15-20%.

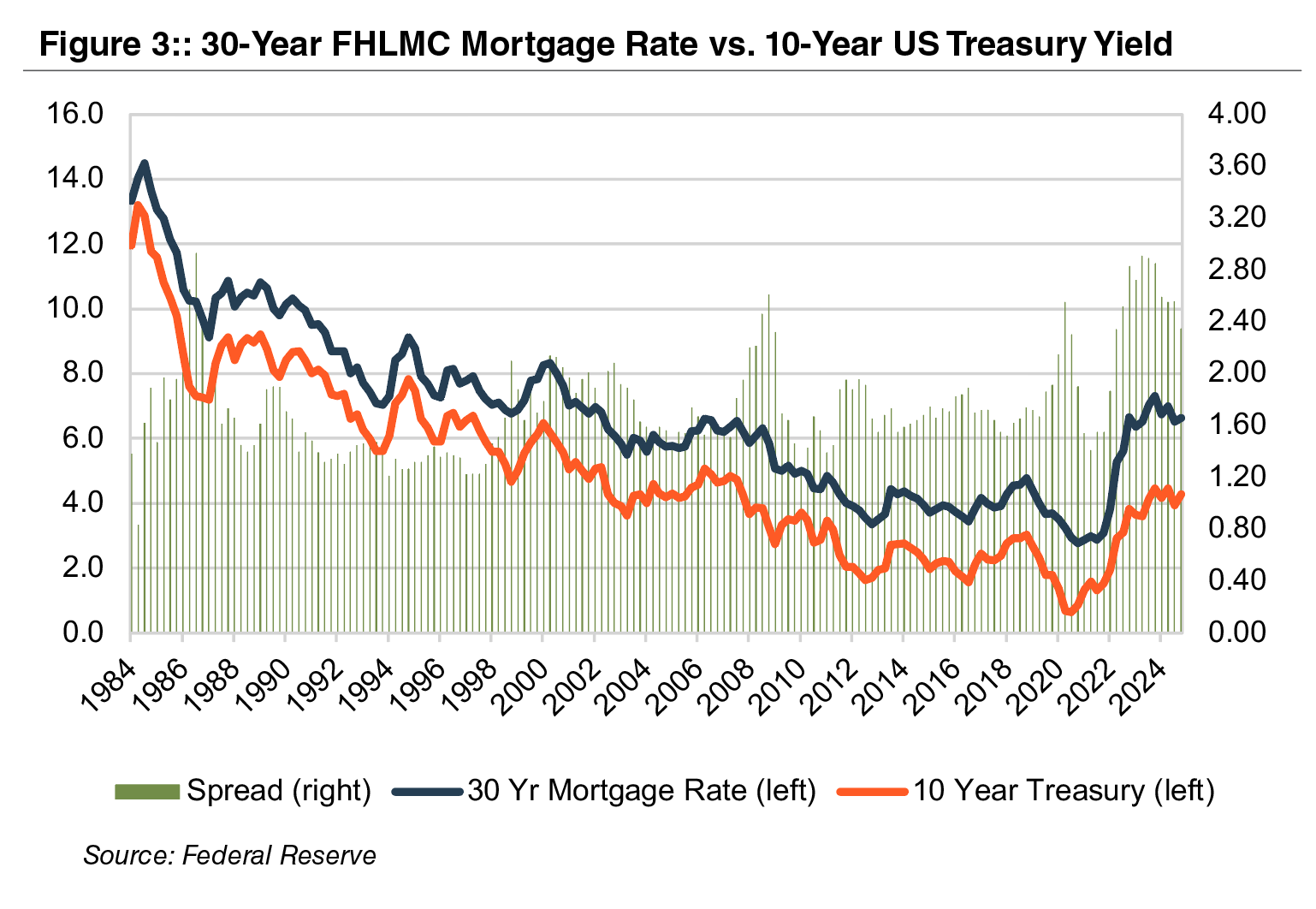

An additional technical factor in the market is working against an improvement in mortgage rates and therefore earnings derived from mortgage banking is the spread between the 10-year UST and mortgage rates.

During the past 40 years, the average spread was 175bps. Once the Fed engaged in “Quantitative Easing” in the post GFC years, the spread began to widen; however, it has gapped to around 250bps the past couple of years as MBS investors are concerned about the potential for the Fed to become an insensitive seller as it presumably needs to shrink its Agency MBS portfolio to make room for more USTs. A return to the 175bps spread average would, all else equal, cause mortgage rates to fall below 6%.

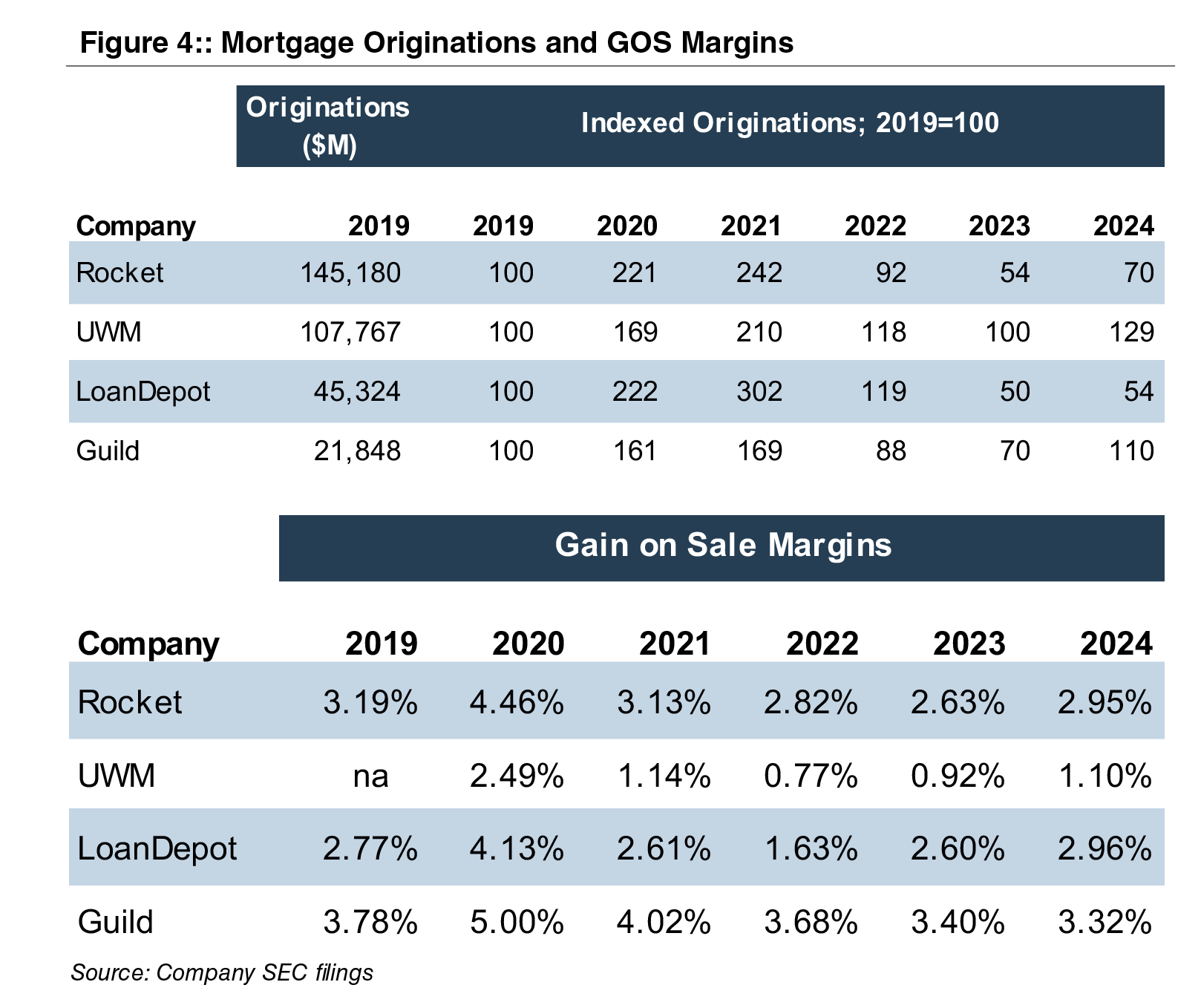

One result of the GFC reforms is that non-bank mortgage companies now originate the majority of residential mortgages. The data in Figure 4 succinctly summarizes the impact of falling and rising rates on origination volumes and gain on sale margins. Not shown is the share of originations that are refinancings, which, since 2022, when rates began to rise, are very low (and consumers switched to draws on HELOCS). Nonetheless, 2024 was somewhat better than 2023 when long-term rates peaked and 2025 may be somewhat better than 2024.

A vote of confidence in the future of mortgage banking has been registered by the largest originator, Rocket Companies, Inc. (NYSE:RKT). On March 10, 2025 RKT announced a $2.4 billion acquisition of Redfin Corporation (NASDAQ:RDFN), the online real estate brokerage business with 50 million monthly viewers. RKT then announced a $9.4 billion acquisition of Mr. Cooper Group Inc. (NASDAQ:COOP), bringing together the largest mortgage originator and servicer in the nation, on March 31. Consideration paid to both RDFN and COOP shareholders will consist solely of RKT common stock, which will result in about 25% ownership dilution to RKT shareholders.

The transaction may signal the bottom is in or maybe was put in 2023 with better times to come for mortgage banking and banks that have meaningful mortgage banking units.