Navigating Tax Returns: Tips and Key Focus Areas for Family Law Attorneys and Divorcing Individuals/Business Owners – Part I

Part I of III- Form 1040

This is a three-part series where we focus on key areas to assist family lawyers and divorcing parties.

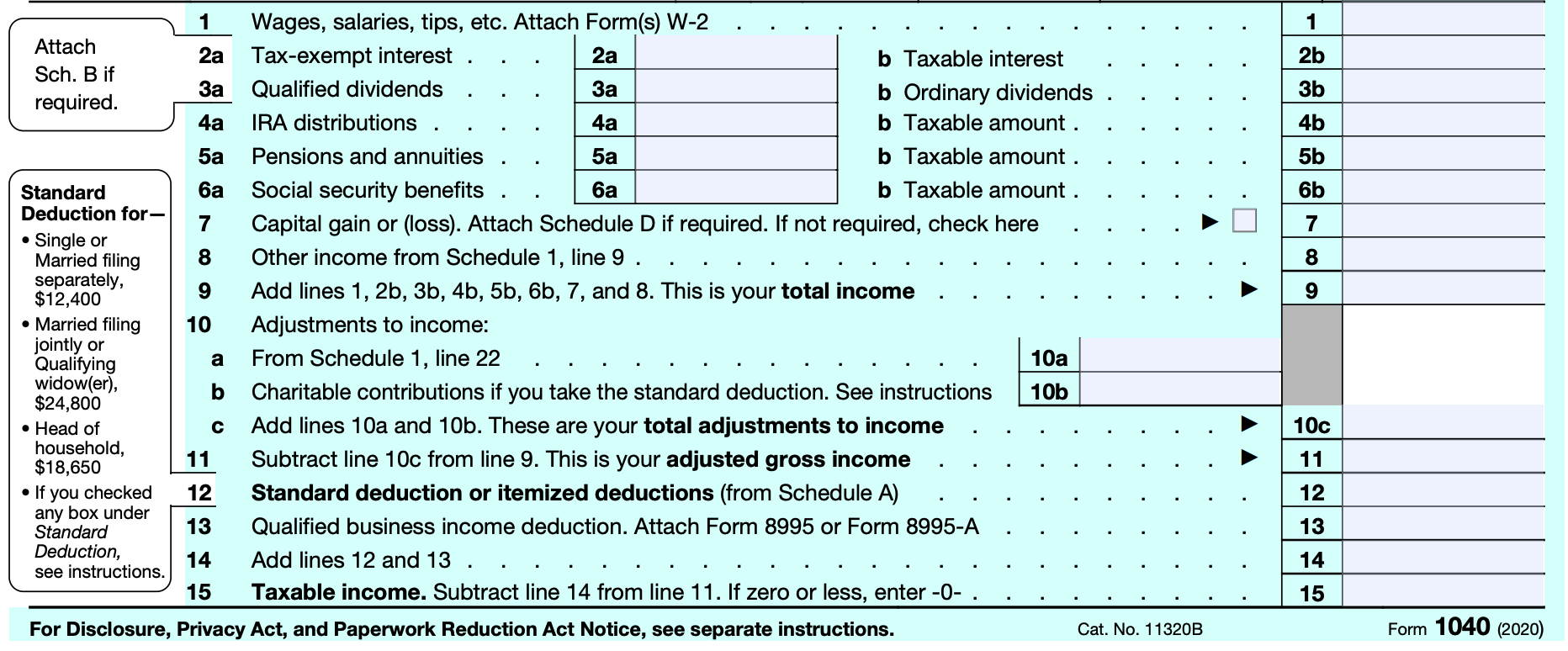

Form 1040 is used by taxpayers to file an annual income tax return. It calculates the total taxable income of the taxpayer(s) and determines the amount that should be paid or refunded. There are five filing statuses – single, married filing jointly, married filing separately, head of household, and qualified widow(er) with dependent children.

Why Would Form 1040 Be Important In Divorce Proceedings?

Form 1040 provides a general understanding of a taxpayer’s financial status and can be a guide to finding additional information about one’s finances. It can serve as a starting point to get a picture of an individual’s (or couple’s) income(s), assets and liabilities, and lifestyle. Form 1040 is supplemented with additional schedules and documentation which lend detail and insight into one’s lifestyle and financial matters. Ultimately, for divorce purposes, multiple years of tax returns should be reviewed and can be a source of inputs for the marital estate subject to division, as well as data for further financial analyses like income determination and lifestyle analysis/pay and need analysis.

Below is a snapshot from Form 1040:

Key Areas of Focus for Family Law Attorneys and Divorcing Parties

Line 1: Wages, Salaries, and Tips – Line 1 details wages, salaries, and tips. This amount should match the income reported in Box 1 of the Form W-2. The amount on Line 1 is not gross income. It is likely that there are pre-tax deductions, such as contributions to a 401(k) account. You should refer to the underlying W-2(s) for more information about these deductions as well as gross income.

Line 2 & Line 3: Interest and Dividends – An entry in Line 2 indicates interest income, while an entry in Line 3 indicates dividend income. Both point to ownership of assets and documentation of these assets should be requested. Furthermore, income earned from interest and dividends can be considered as a source of income when calculating spousal and child support. Details about interest and dividend income can be found on Schedule B, Form 1099-INT, and Form 1099-DIV

Line 4: IRA Distributions – An entry in Line 4 shows distribution from an individual retirement account, signaling that the taxpayer has an IRA account and documentation of these assets should be requested. A withdrawal from a retirement account may also point to possible dissipation of marital assets, if not readily identifiable or available by account documentation. Details about retirement distributions are on Form 1099-R.

Line 5: Pensions and Annuities – An entry in Line 5 indicates existence of pensions and annuities, which may be wholly or partially marital property. These must be carefully considered for property division as well as sources of income when calculating spousal and child support.

Line 6: Social Security Benefits – Like pensions, Social Security benefits should be considered as sources of income when calculating spousal and child support. Details can be found on Form SSA-1099, which is a form provided to the taxpayer who receives these benefits. Estimates of an individual’s future monthly payments can be extracted from the Social Security Administration website.

Line 7: Capital Gains or Losses – Line 7 indicates capital gains or losses, which means that an asset (or multiple assets) was sold and some sort of monies were made or lost on the transaction. Not only does this information indicate ownership of assets, it can also be important in tracing analyses as well as other forensic analyses when reviewing several years of tax returns. Details can be found in Schedule D and Form 8949.

Line 8: Other Income – An entry in Line 8 should be reviewed further as it often indicates income from gambling winnings or other unusual sources (for example, prizes, jury duty pay, or the taxable portion of disaster relief payments). Information about the sources of other income can be found in Form 1099-MISC (miscellaneous income) or Form W-2G (which is a form that records gambling winnings). However, these incomes are typically not recurring in nature, and are not always reported which may require scrutiny and potential forensic analyses.

Line 9: Total Income –This line is the summation of above lines and yields total income of the taxpayer and can give you information about how the taxpayer earns their income. This number may be used when determining spousal or child support as it does not include any adjustments.

Line 11: Adjusted Gross Income – Adjusted Gross Income (AGI) is the amount used to determine one’s taxable income. The AGI is total income less adjustments. A few common adjustments are deductions for educator expenses, health savings account deductions, and student loan interest deductions. Many of these adjustments are optional, and excessive use could potentially be used to skew spousal or child support amounts. Therefore, gross income (line 9) is often considered over AGI when determining spousal or child support amounts. More information on the adjustments claimed can be found on Schedule 1.

Line 13: Qualified Business Income (QBI) Deduction – If the taxpayer is taking this deduction, it indicates that they own a business, which should lead to requests for related business documents. The QBI deduction is for pass-through businesses, therefore, a Schedule C or Schedule K-1 should also be included with the tax return. Examples of pass-through businesses are sole proprietorships, LLCs, partnerships, and S-Corporations.

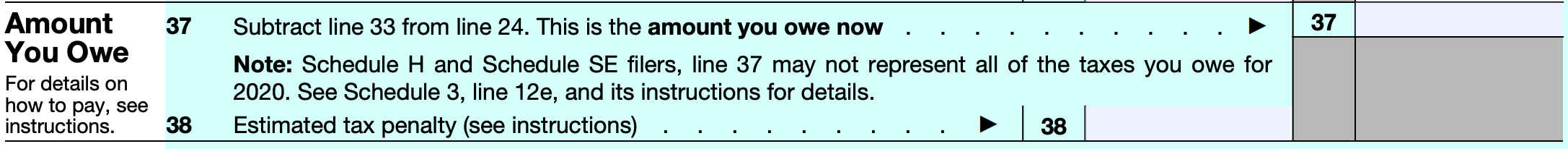

Line 37: Amount You Owe Now – Line 37 indicates the incremental amount owed based on the total tax liability less any federal tax withholding, estimated payments, and credits. Reviewing the amount owed or amount to be refunded over several years can potentially uncover intentional over or under payment. However, business owners or self-employed individuals who pay quarterly taxes may have fluctuating incomes from year to year. It is important to understand that quarterly tax payment estimates are based on prior year realized income levels, which may or may not be the reason for over or under payment. A financial expert can accurately assess these types of scenarios.

Conclusion

Knowing how to navigate key areas of Form 1040 can be quite useful in divorce proceedings. Information within the tax return can provide support for marital assets and liabilities, determination of spousal and child support, and potential further analyses. Reviewing multiple years of tax returns is typical as multi-year overviews may reveal trends, provide helpful information, and may even indicate the need for potential forensic investigations.

While we do not provide tax advice, Mercer Capital is a national business valuation and financial advisory firm and we provide expertise in the areas of financial, valuation, and forensic services.