Personal vs. Enterprise Goodwill: Issues to Consider in Divorce Valuations

This article discusses important concepts of personal vs. enterprise goodwill in valuations for divorce. It is important to understand the business, industry, and efforts of the divorcing spouse(s) & non-divorcing parties to perform a thorough, supportable analysis. It is also important to know how each state treats personal goodwill – some states consider personal goodwill to be a separate asset, and some do not make a specific distinction for it and include it in the marital assets. Additionally, while there are several accepted methodologies for determining % allocations to personal vs. enterprise, there are not uniform standards nor guidelines that govern the how-to’s; as such these analyses are complex and require subject matter expertise.

What Is Goodwill?

Goodwill is the difference between the value of a business less its tangible net assets such as fixed assets. Goodwill is synonymous with intangible assets, and the value of a business is the value of tangible assets + value of intangible assets. Some of the intangible assets can be separated and valued, such as assembled workforce; others fall into the catch-all goodwill category.

What Is Personal Goodwill?

Personal goodwill generally is interpreted as representing attributes that are unique to, and inseparable from, an individual, not able to be transferred. The other portion of goodwill, referred to as enterprise or business goodwill, generally is interpreted as representing value that is owned and/ or that has been created by an enterprise and that can be transferred.

Attributes typically classified within the personal goodwill category include the following:

- Personality

- Reputation

- Personal skill, expertise and knowledge

- Personal relationships

In essence, personal goodwill is represented by certain attributes that are deemed to be incorporated into the very being of an individual, and, therefore, are unable to be sold or transferred to another individual.

What Is Enterprise Goodwill?

Identifiable intangible assets typically classified within the enterprise goodwill category include the following:

- Trademarks and trade names

- Patented and unpatented technology

- Copyrights

- Customer lists and relationships (patient files/records)

- Contracts (employment, noncompete agreements)

- Phone number

- Leasehold

- Trained and assembled workforce

- Location

Why and How Is Personal Goodwill Important?

Many states identify and distinguish between personal goodwill and enterprise goodwill, and further allocate that . This may have a significant impact on the division of the marital estate. However, beyond the business valuation and division, the income derived from the personal goodwill may still be factored into division and/or future support, depending on the state.

Is Personal Goodwill More Common in Professional Services Industries?

Yes – personal goodwill tends to be more prevalent in certain industries than others and varies from matter to matter. The concept of personal goodwill is easier identified and more prevalent in professional service industries such as law practices, accounting firms, and physician practices. Does that mean it doesn’t apply to other industries such as retail, manufacturing, transportation, etc? In order to evaluate the potential carve-out of personal goodwill in an industry/business, the owner/ principal would have to exhibit a unique set of skills that specifically translates to the heightened performance of their business, unable to be transferred to another person/business.

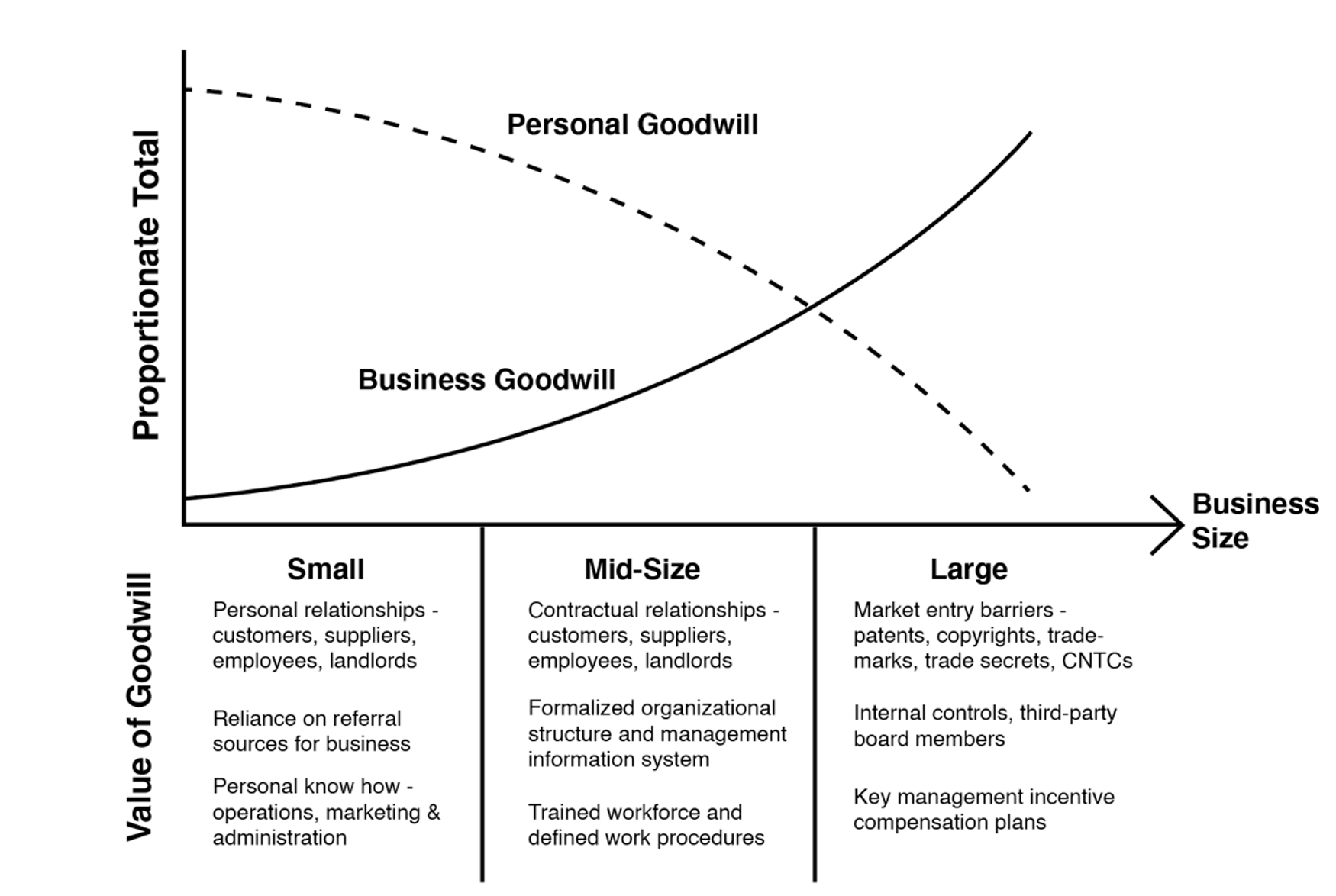

The Goodwill Transition from Personal to Enterprise, Relative to Business Size

The image below illustrates the relationship of changing attributes of business size relative to proportion personal versus business/enterprise goodwill.

Source: BVR’s Guide to Personal v. Enterprise Goodwill

The inverse relationship between business size and percentage allocation makes intuitive sense. One person can only work so much, and their personal impact cannot be scaled like an enterprise, increasing the value attributable to the platform, i.e. the business itself.

Conclusion

There is no one-size-fits-all methodology or approach to allocating personal vs. enterprise goodwill. It will depend on the industry, history of the company, and relative contributions of the divorcing spouse(s) as well as contributions of all other employees, among other factors. From a theoretical perspective, personal goodwill should show the difference in value of the business with and without the contributions from the divorcing party. Personal goodwill has become a common battleground and the need for supportable analyses and subject matter expertise can greatly assist the marital dissolution process. Mercer Capital has extensive experience in this complex topic across various industries and business sizes.