Divorce is often an emotionally and financially draining process, and estate planning may be the last thing on the minds of the divorcing parties. However, reviewing estate plans during a divorce can be a step in preparing for the future. Like many aspects of divorce, timing matters and there are both advantages and drawbacks to updating your estate documents while the divorce is still pending.

The Pros of Estate Planning During Divorce

Divorce proceedings can take months or even years. During that time, the current spouse may still have legal authority over health care decisions, financial matters, and inheritances under a preexisting estate plan. Updating documents such as power of attorney, health care proxy, and beneficiary/trustee/guardian designations (if legally allowable as discussed later) can ensure that soon-to-be exes do not have unwanted control over affairs in the event of incapacitation or death before the divorce is finalized. There can also be a form of “reverse” estate planning, such as placing restrictions on certain persons as beneficiaries under a trust.

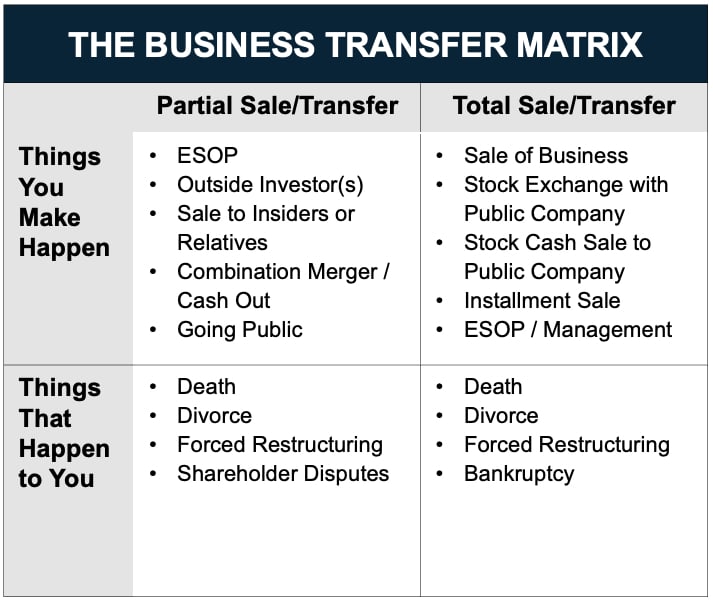

While everyone wants to know the value of their privately held business, it can be costly, which leads many business owners to go years without a valuation. As seen in our graphic “The Business Transfer Matrix”, death and divorce are two events that lead to the valuation process.

Revising an estate plan contemporaneous to on-going divorce proceedings may lead to efficiencies for divorcing and gifting parties. When a couple owns a business or multiple business interests, the expert fees associated with valuing the businesses can pile up quickly, particularly when there are competing experts, and two sets of attorneys preparing for a contentious trial.

Contrast this to the parties agreeing on one expert to value a business interest which is then transferred for the benefit of the divorcing couple’s children. While this approach may result in lower costs, it may also result in a significant benefit of reduced acrimony in settlement discussions. The in-spouse (the one who stays involved with the business post-divorce) does not want to overpay their spouse just as the out-spouse wants to receive as much in equitable distribution. By transferring the economic interest (perhaps even structuring such that one of the divorcing parties maintains operational control of the business), this can “take valuation off the table” because the business interest would no longer be part of the marital estate in addition to the many benefits of estate planning absent a divorce proceeding.

Transferring the business interest out of the marital estate may also become a last resort if the two valuation experts have irreconcilable valuations for the business. There is the added benefit of potential tax benefits available to married couples such as gift-splitting that will no longer be available post-divorce. While estate planning during divorce is not a one-size-fits-all approach, it can be a creative way to get a case settled and save money in the long-run.

The Cons of Estate Planning During Divorce

Some states impose “automatic temporary restraining orders” (ATROs) during divorce proceedings, which can limit the ability to change beneficiary designations or transfer assets. These rules are designed to prevent one spouse from hiding or dissipating marital property but may also restrict legitimate estate planning modifications. This is an appropriate safeguard and further highlights the need for cooperation to be able to embark upon estate planning during a divorce – something that is frequently not observed. For estate planning to realize optimal outcomes in a divorce process, a proper team should be assembled on the front end of a divorce process, as both parties are well-served to preserve end-goals such as tax planning, rather than have the dispute fall into a process of manipulation for personal-benefit reasons in the divorce process.

Until the divorce is finalized, the parties’ individual financial picture is in flux. We typically assist with the determination of asset values (like a business), equitable distribution, alimony, and child support obligations, that can make it hard to plan accurately for future asset composition. Premature changes to an estate plan might also conflict with the eventual divorce settlement or require costly revisions in the future, particularly if both parties initially agree, then one or both back out of the estate planning process.

One financial concept to think about is “core” and “surplus” capital, a framework that frequently arises in our discussions with wealth advisors. During an estate planning process, it’s important to know how much you can comfortably transfer to future generations or charitable causes. While reducing taxes and increasing proceeds for future generations is an admirable goal, this should not come at the expense of financial uncertainty. Stated plainly, advice we’ve heard is “don’t give away more than you can afford to realize your personal financial objectives”.

The divorce process already introduces a significant amount of uncertainty, going from one family budget to two households, among a host of other changes. Estate planning requires clear thinking and careful consideration — two things that may be in short supply during a divorce. For some, adding another layer of legal work may overcomplicate the process and lead to unwanted delays. This complexity reminds us of estate planning some business owners do in advance of selling their business.

To accomplish successful estate planning during divorce, respective legal counsel may collaborate on certain issues. While some family law groups are part of larger law firms, many others focus exclusively on family law. Firms that possess capabilities in both estate planning and family law may have a built-in advantage to realize a mutually acceptable estate plan during a divorce, but it ultimately comes down to communication amongst the attorneys, and being part of the same firm is not a prerequisite for good communication. Even firms that offer both legal disciplines may not represent the most efficient course of action if an estate plan was already drafted by another firm as it may be easiest to have the initial drafting firm update the documents based on discussions with the family law attorneys.

From a valuation perspective, a firm that is well versed in both family law and estate planning is best positioned to navigate the labyrinth of issues that lead to equitable outcomes. Mercer Capital’s senior professionals are members of the American Academy of Matrimonial Lawyers (AAML) Foundation Forensic & Business Valuation Division and are also regularly engaged by the nationally prominent estate planning attorneys. Our extensive valuation work for both family law and estate planning matters keeps us well informed of material developments in each field and how they may affect valuation and planning strategies.

Conclusion

In short, while estate planning during divorce adds complexity, in the right circumstances it can also be a vital resource — one worth considering depending on the size and composition of the marital estate as well as the cooperation opportunities amongst the divorcing parties. In all scenarios, seasoned legal counsel is advised. Combined with experienced valuation assistance, consideration of estate planning techniques in the midst of a divorce may result in a novel solution to the inherently complex and contentious divorce process.