Richard Fuld, Spirit Airlines, and Fairness

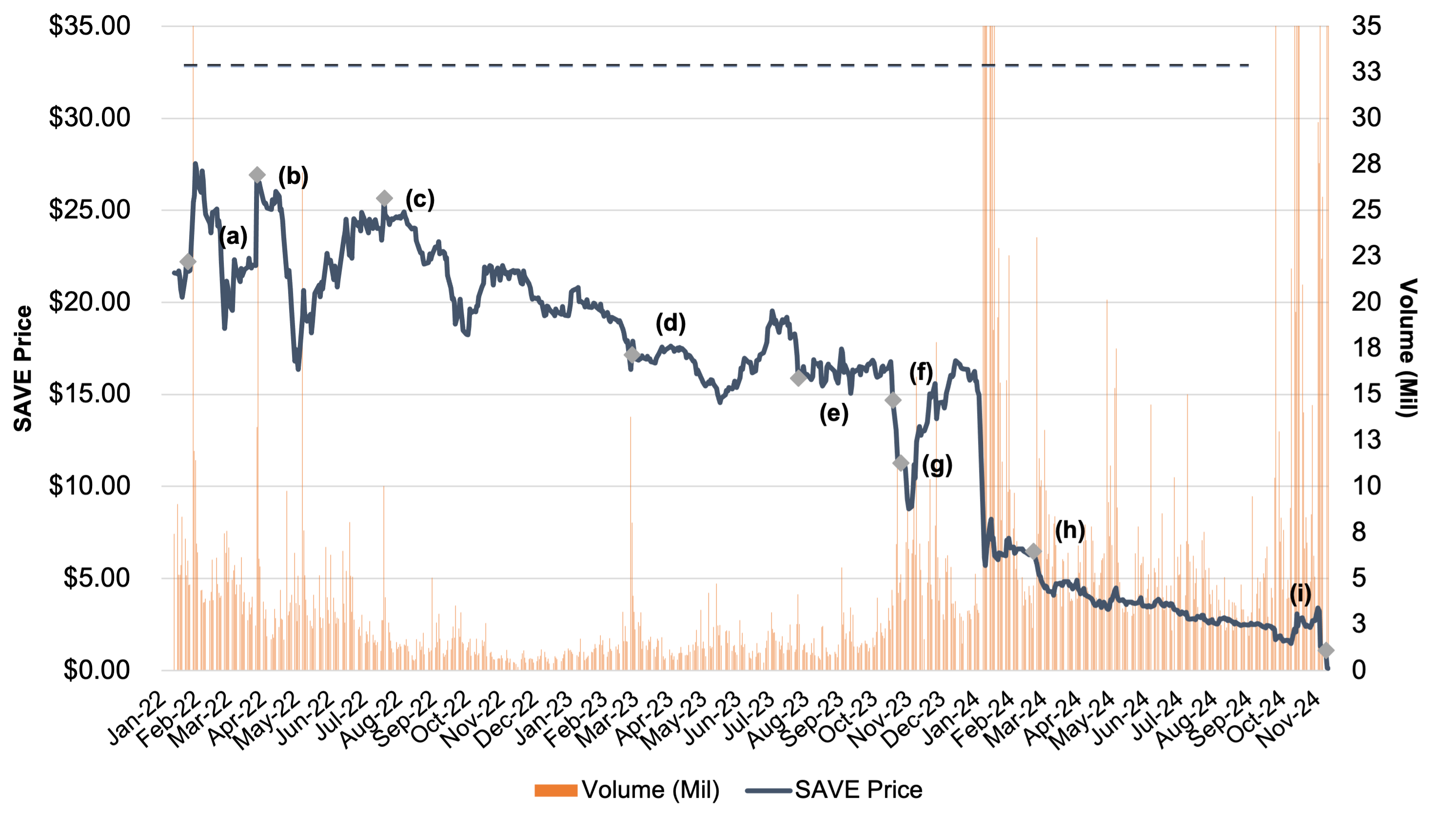

Spirit Airlines, Inc. (OTCEM:SAVE.Q) filed for bankruptcy protection on November 18, 2024. Spirit’s journey to bankruptcy illustrates two saws about M&A: time is the enemy of all deals; and most surprises are negative when the subject matter is M&A.

The prepackaged filing in which creditors will equitize $795 million of debt and inject an additional $350 million of equity brings closure to a long running corporate saga that began in February 2022 when Spirit agreed to be acquired by Frontier Group Holdings, Inc. (NASDAQ:ULCC) for a combination of stock (1.93 exchange ratio) and cash ($2.13 per share) that at announcement equated to $25.83 per share ($2.9 billion).

JetBlue Airways Corp. (NASDAQ:JBLU) subsequently made an unsolicited $33 per share all cash offer in April 2022 that was initially rejected. However, the Spirit board terminated the Frontier deal during July 2022 after JetBlue sweetened its offer to provide a) $33.50 per share of cash ($3.8 billion) with $2.50 per share payable upon approval of the deal by Spirit shareholders; b) a monthly ticking fee of $0.10 per share up to $0.65 per share commencing in January 2023; and c) $70 million termination fee if the agreement was terminated for failure to obtain regulatory approval.

In our first prior posts on the matter (here and here), we speculated that the Spirit board may have calculated that JetBlue was a risk worth taking because

- The offer was 30% greater than Frontier’s offer;

- JetBlue provided $425 million ($4.30 per share) of downside protection; and

- A jilted Frontier presumably would be willing to reengage Spirit if the JetBlue deal failed.

Spirit shareholders ultimately received $3.65 per share of cash from JetBlue upon shareholder approval of the deal and payment of the ticking fees, while the termination fee was paid to Frontier in March. Nonethless, Spirit’s shares never traded remotely close to the announced deal value because investors correctly concluded that the Department of Justice would successfully challenge a merger that would eliminate a low-cost carrier while positioning JetBlue as the fifth largest carrier.

While the Frontier deal was not a sure bet either, investors at the time viewed the Frontier-Spirit combination as more likely to avoid or prevail in a Department of Justice challenge because the deal represented a combination of two small low-cost carriers that would result in a stronger company focused on budget conscious consumers.

From the perspective of Spirit’s common shareholders, the decision to terminate the Frontier deal in favor of JetBlue was a colossal mistake by the board of directors. Aside from the DOJ challenge that was initiated in March 2023, industry profitability weakened materially during 2H23 due to excess capacity, rising costs and issues with Pratt & Whitney engines that grounded some Airbus planes, including some of Spirit’s.

Assuming the Frontier transaction closed during the first quarter of 2023, the deal value would have been worth $21 to $27 per share based upon Frontier’s trading range. Shareholders could have sold their Frontier shares for cash, or continued to hold Frontier shares that today would be worth about $11 per share plus have $2.13 per share of cash before considering taxes.

Hindsight is easy of course. Richard Fuld, CEO of Lehman Brothers from 1994 until the company filed for bankruptcy in September 2008, had opportunities to sell the company in 2007 and early 2008 before the financial crisis intensified. Even in the months prior to the filing, one or more transactions appeared possible until it was too late. Fuld and the board (or Fuld leaning on the board) held out for a better deal or a rescue organized by the Fed. Neither happened.

Likewise, the Spirit board took a risk that it could get a better deal than Frontier’s and thereby wiped out its common shareholders in the bankruptcy filing. While JetBlue’s offer was clearly superior because it was all cash and higher than the Frontier offer, Frontier’s shares never traded meaningfully higher once JetBlue made its initial unsolicited $33 per share offer in April 2022. The market signaled that the board would be taking a sizable risk in terminating the Frontier merger agreement.

Given the price and terms of the JetBlue deal, rendering fairness opinions by Spirit’s financial advisors (Morgan Stanley and Barclays) in July 2022 should have been a straightforward exercise; however, one deal point a board must always consider is the ability of a buyer to close. Morgan Stanley’s and Barclay’s fairness opinions addressed the fairness of the proposed consideration to be paid to Spirit’s shareholders. The opinions did not assign any probability to JetBlue’s ability to close other than assume the merger would be consummated under the terms specified in the Merger Agreement.

Among the factors the board considered that weighed against approving the deal was the risk that regulators would block the deal. These concerns were voiced by Frontier and some investors when JetBlue made its unsolicited offer in April 2022; however, the board approved the merger anyway, perhaps figuring JetBlue offered downside payments and that Frontier would still be an option if Washington nixed the JetBlue transaction.