Stryker Corporation (SYK): Many Acquisitions in 2024

Stryker Corporation (NYSE:SYK) is a global leader in medical technologies, offering products and services in MedSurg, Neurotechnology, and Orthopedics that help improve patient and healthcare outcomes. Divestiture of the Spine division was completed in 2025. The company sells its products to physicians, hospitals, and other healthcare facilities through company-owned subsidiaries and branches, as well as third-party dealers and distributors in approximately 75 countries. The company is based in Portage, Michigan.

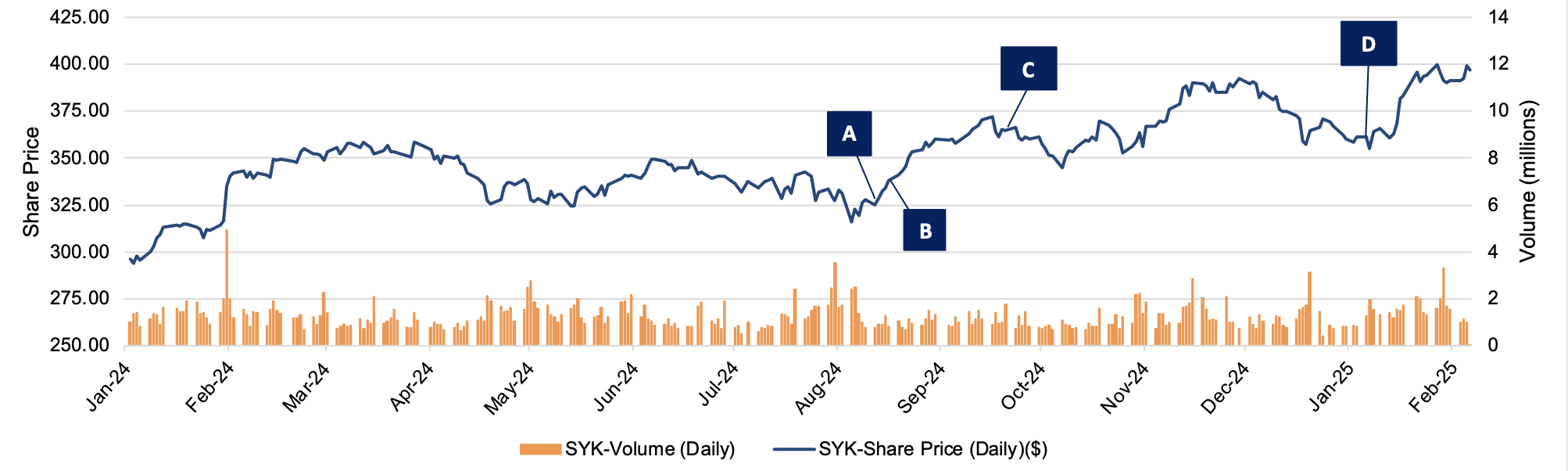

During 2024, Stryker Corporation completed a number of acquisitions, with a further announcement in early January 2025. Since the beginning of 2024, Stryker’s stock price has grown 34% from $296.23 per share to $397.17 per share in early February 2025. Stryker CEO Kevin Lobo highlighted the company’s recent acquisitions in October 2024, stating that he expects the acquisitions to contribute $300 million to its 2025 sales. Additionally, Mr. Lobo stated Stryker has “significant financial capacity for future deals,” having already spent $1.6 billion, and that “M&A will be the number one use of the company’s cash going forward.” On the following page, we summarize our observations related to some of Styker’s recent acquisitions and the company’s stock price at the relevant dates.

Click here to expand the image above

(A): Stryker Corporation agreed to acquire 100% of Webdr.ai Inc. (fka Care.ai inc.), a Florida-based company, on August 12, 2024. The acquisition was completed on September 17, 2024. The terms of the deal were undisclosed. On the day of announcement, Stryker’s stock price was $325.20 per share. Webdr.ai develops and operates a sensor-based platform that detects and evaluates a range of patient behaviors. Primarily, it offers an artificial intelligence (AI) powered platform that detects and predicts adverse events. The acquisition aims to strengthen Stryker’s growing healthcare IT offering and wirelessly connected medical device portfolio.

(B): Stryker Corporation agreed to acquire 100% of Vertos Medical Inc. (fka X-Sten Corp.), a California-based company, on August 22, 2024. The acquisition was completed on October 1, 2024. The terms of the deal were undisclosed. On the day of announcement, Stryker’s stock price was $350.72 per share. Vertos, a medical device company, develops minimally invasive treatments for lumbar spinal stenosis. The Vertos acquisition aims to strengthen Stryker’s Orthopedics and Spine segment.

(C): Stryker Corporation acquired 100% of NICO Corporation, an Indiana-based company, on September 20, 2024. The terms of the deal were undisclosed. Stryker’s stock price at the transaction date was $364.81 per share. NICO designs and develops technology and products for the field of corridor surgery, including cranial, ENT, spinal, and otolaryngology. It offers its products through distributors to physicians and hospitals in North America, the Middle East, Israel, Oceania, Australia, and New Zealand. The acquisition aims to complement Stryker’s Neurotechnology and Spine segments.

(D): Stryker Corporation agreed to acquire 100% of Inari Medical, Inc. (NASDAQGS:NARI), a California-based company, on January 6, 2025 for a total of $4.8 billion. Under the terms of the offer, Stryker will commence a tender offer for all outstanding shares of common stock for $80 per share in cash. On the day of announcement, Stryker’s stock price was $361.36 per share. Inari builds minimally invasive, novel, and catheter-based mechanical thrombectomy devices and accessories for specific diseases in the United States. This acquisition should be accretive to Stryker’s Neurovascular business, per management. Mr. Lobo noted “the acquisition of Inari expands Stryker’s portfolio to provide life-saving solutions to patients who suffer from peripheral vascular diseases.” At announcement, the deal’s enterprise value to total revenue multiple was 8.37x.