Takeaways from AOBA 2019: “It was the best of times, it was the worst of times…”

I ventured into the Arizona desert again this year to Bank Director’s Acquire or Be Acquired Conference (“AOBA”) in Phoenix in late January. This year I was struck by the dichotomous outlook for the banking sector that reminded me of Dicken’s famous line: “It was the best of times, it was the worst of times…”

The Best of Times

The weather was lovely. Phoenix/Scottsdale is the place to be in late January, and this year did not disappoint with sunny weather and a high of around 70 each day. At the same time, much of the country was feeling the effects of a severe polar vortex that caused temperatures to plunge well below zero in the Upper Midwest and Great Plains. Many of the attendees from that area were forced to stay a day or two longer due to airline cancellations.

The operating environment for banks reflected a similar analogous dichotomy. Take the market for example. Most banks produced very good earnings in 2018, and many produced record earnings due to a good economy, the reduction in corporate tax rates, and margin relief as the Fed raised short-term interest rates four times further distancing itself from the zero interest rate policy (“ZIRP”) implemented in late 2008.

The Worst of Times

Nonetheless, bank stocks, along with most industry sectors, were crushed in the fourth quarter. The SNL Small Cap US and Large Cap US Bank Indices declined 16% and 17% respectively. Several AOBA sessions opined that valuations based on price-to-forward earnings multiples were at “financial crisis” levels as investors debated how much the economy could slow in 2019 and 2020 and thereby produce much lower earnings than Wall Street’s consensus estimates.

Within the industry the best of times vs. worst of times (or not as good of times) theme extended to size. Unlike past eras when small (to a point) was viewed as an advantage relative to large banks, the consensus has flipped. Large banks today are seen as having a net advantage in creating operating leverage, technology spending, better mobile products for the all-important millennials, and greater success in driving deposit growth.

Additionally, one presenter noted that larger publicly traded banks that are acquisitive have been able to acquire smaller targets at lower price/tangible book multiples than the multiple at which the shares issued for the target trade in the public market and thereby incur no or minimal dilution to tangible BVPS.

Technology

The most thought provoking sessions dealt with the intensifying impact of technology. Technology is not a new subject matter for AOBA, but the increasingly larger crowds that attended technology-focused sessions demonstrated this issue is on the minds of many bankers and directors. While technology is a tool to be used to deliver banking services, I think the unasked question most were thinking was: “What are implications of technology on the value of my bank?”

Several sessions noted big banks that once hemorrhaged market share are proving to be adept at deposit gathering in larger metro markets while community banks still perform relatively well in second-tier and small markets. Technology is helping drive this trend, especially among millennials who do not care much about brick-and-mortar but demand top-notch digital access. The efficiency and technology gap between large and small banks is widening according to the data, while both small and large banks are battling new FinTech entrants as well as each other.

Not all technology-related discussions were negative, however. Digital payment network Zelle (owned indirectly by Bank of America, BB&T, Capital One, JPMorgan Chase, PNC, US Bank, and Wells Fargo) has grown rapidly since it launched in 2017. Payment volume in dollar terms now exceeds millennial-favorite Venmo, which is owned by PayPal. Also, JPMorgan Chase rolled-out a new online brokerage offering that offers free trades for clients in an effort to add new brokerage and banking clients while also protecting its existing customer franchise.

Steps to Create Value

In addition to the best of times/worst of times theme, I picked up several ideas about what actions banks large and small can take to create value.

Create a Digital/FinTech Roadmap for Your Bank

There was a standing room only crowd for the day one FinXTech session: “The Next Wave of Innovation.” This stood in stark contrast to the first AOBA conference I attended which was during the financial crisis. Technology was hardly mentioned then and most sessions focused on failed bank acquisitions. Clearly, this year’s crowd proved that technology is top of mind for many bankers even if the roadmap is hazy. A key takeaway is that a digital technology roadmap must be weaved into the strategic plan so that an institution will be positioned to take advantage of the opportunity that technology creates to enhance customer service and lower costs. Further, emerging trends suggest that technology may help in assessing credit risk beyond credit scores. To assist banks in creating a FinTech roadmap, Bank Director recently unveiled a new project called FinXTech Connect that provides a tool bankers can use to consider and analyze potential FinTech partners.

Become a “Triple Threat” Bank

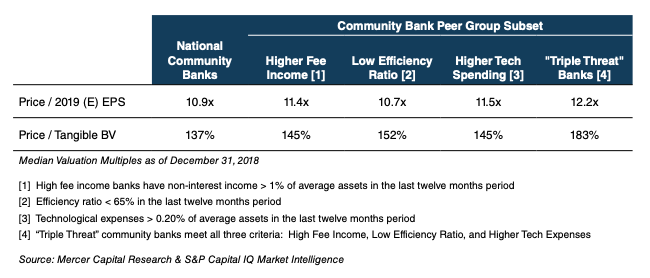

During our (Mercer Capital) session, Andy Gibbs and I argued for becoming a “triple threat” bank, noting that banks with higher fee income, superior efficiency ratios, and greater technology spending were being rewarded in the public market with better valuations all else equal (see table below). While we do not advocate for heavy tech spending as a means to an ill-defined objective, the evidence points to a superior valuation when technology is used to drive higher levels of fee income and greater operating leverage. For more information, view our slide deck.

Plan for the Good and Bad Times, Especially for the Bad Times

While there was a lot of discussion about an eventual slowdown in the economy and an inflection in the credit cycle, several sessions highlighted that a downturn will represent the best opportunity for those who are well prepared to grow. The key takeaway is to have a plan for both the good and the bad economic times to seize opportunity. Technology can play a role in a downturn by helping add customers at very low incremental costs.

Best Practices around Traditional M&A

On the M&A front, two M&A nuggets from attorneys stood out as well as a note about MOEs (mergers of equals):

- Sullivan & Cromwell’s Rodgin Cohen suggested that buyers should determine what the counterparty wants and structure the transaction to achieve the counterparty’s objectives. Also, buyers need to “ride the circuit” to meet with potential acquisition candidates well before a decision to sell is made, while sellers need to know what they want to achieve before launching a sales process.

- Howard & Howard’s Michael Bell, a leading attorney to credit unions, had an interesting session where he noted commercial bankers should actively court credit unions as potential acquirers in a marketing process because credit unions’ lower operating cost structures and tax-exempt status can produce a better cash price for the seller.

- A few sessions discussed the potential for MOEs to create value for both banks’ shareholders through creating scale and by combining banks with different areas of strength. In addition, MOEs create an opportunity to upgrade technology while addressing costly legacy systems, including extensive branch networks. All three themes were addressed in two large MOEs announced in 2019 by TCF/Chemical and BB&T/SunTrust.

Conclusion

We will likely be back at AOBA next year and hope to see you there. In the meantime, if you have questions or wish to discuss a valuation or transaction need in confidence, don’t hesitate to contact us.