The Value of Carried Interest in Estate Planning: A Guide for Newly Formed Funds

As we stated in the March 2025 issue of Value Matters®, we believe that prudent federal estate and gift tax planning involves a lifetime horizon with adherence to best practices that yield optimal outcomes. When economic and market conditions present an opportunity for estate planning, assets with low current values and potential for significant appreciation should be considered for efficient estate planning. One type of asset that fits this category is carried interest.

This article explores the strategic incorporation of carried interests in estate planning, particularly for newly formed private equity funds. It discusses the benefits and complexities of leveraging such interests under current economic conditions and tax regulations to optimize estate outcomes. We will discuss specific valuation approaches and methods in the valuation of carried interests in a future article.

Carried Interest Explained

What is carried interest? It is the profits interest that a private equity, venture capital, or hedge fund principal receives if the fund exceeds certain performance benchmarks. Carried interest can also be referred to as performance allocation, incentive allocation, or promote interest in the case of real estate funds. Separately, fund principals also receive economics from management fees and direct investments in the fund.

Fund Structures and Carried Interest Allocation

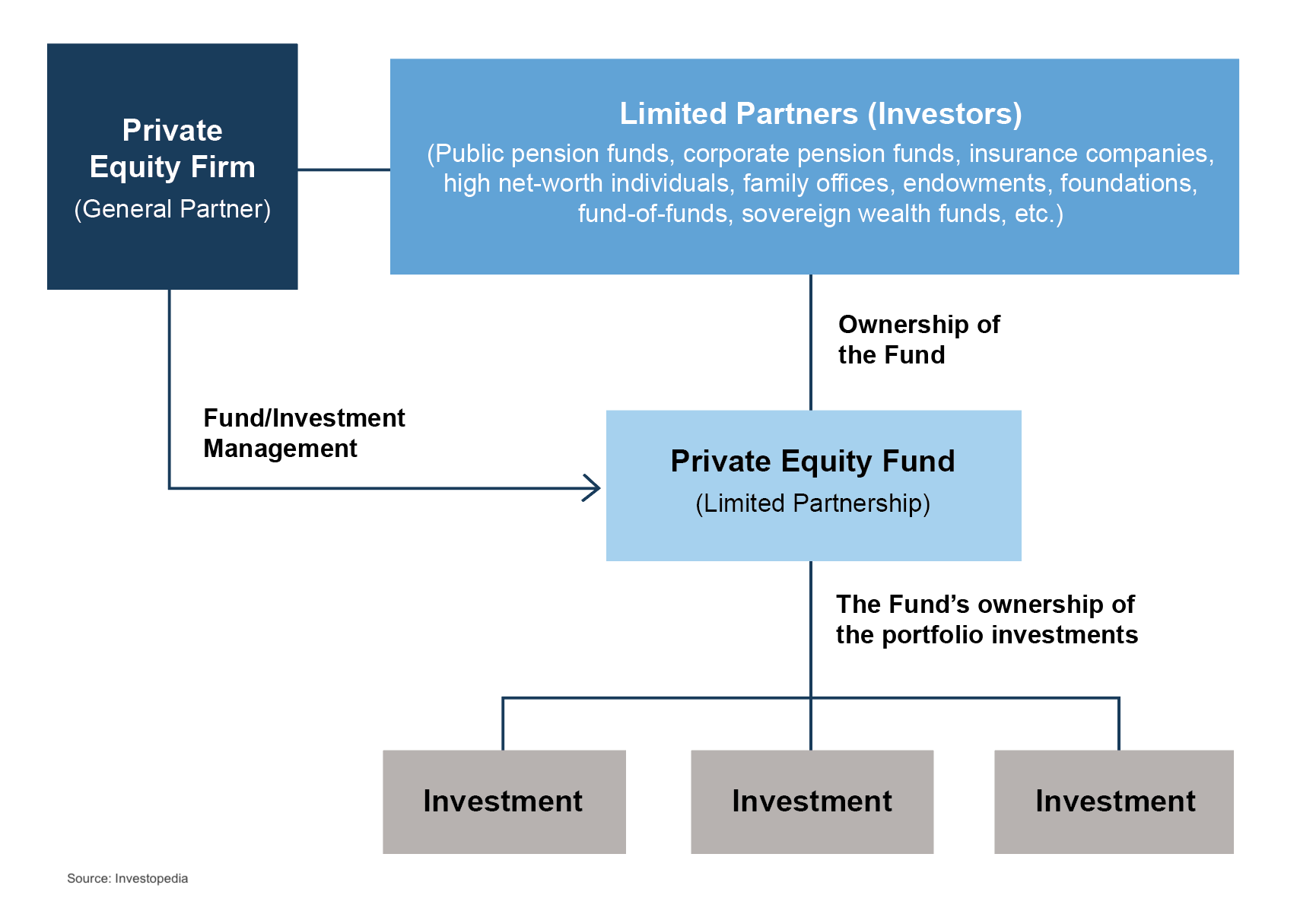

A basic private equity fund structure is shown below. Typically, the fund principals form a general partner entity and a management company entity. The principals then raise capital from limited partners and make investments over the term of the fund. The management company receives management fees, often around 2% per year, for investment management services provided. The general partner entity typically invests alongside the limited partners and receives its pro-rata share of returns along with the limited partners. If the fund exceeds certain benchmarks, the general partner also receives carried interest, often around 20% of fund returns beyond the benchmark.

It is important to note that private equity fund structures come in many forms, from basic to complex. Even though this article is focused primarily on private equity funds, similar concepts apply to certain hedge funds and venture capital funds.

Navigating Uncertainty and Valuation Challenges

Uncertainty exists regarding the fund’s performance, more so earlier in the fund’s life. When the fund entities are formed, and before capital is raised, there is also uncertainty regarding how much capital will be raised. These uncertainties result in low values for the fund entities at inception. The fund entity values will appreciate significantly if the fund is able to successfully raise capital and achieve strong investment returns.

Why would a newly formed fund entity have any value before capital is raised? The IRS’ Revenue Procedure 93-27 provides that if a person receives a profits interest for the provision of services to or for the benefit of a partnership in a partner capacity or in anticipation of being a partner, the IRS will not treat the receipt of such an interest as a taxable event for the partner or the partnership. It has been argued that 93-27 means that a profits interest has no value at issuance. However, the IRS has made it clear that 93-27 is not applicable to valuing carried interest.

Challenges in Valuing Interests in Fund Entities

A qualified appraisal prepared by a qualified appraiser with experience valuing carried interest is paramount when making estate planning transfers with newly formed fund entity interests given the complexity involved. In addition to fund structure, other items that require appraiser familiarity with carried interest include the following:

- Fundraising: What is the fund’s target size? What is the minimum required investment? Will the fund offer special terms for early investors or for a large “anchor” investor?

- Fund investment strategy: What types of investments will the fund make in terms of asset classes, industries, size of interests, number of investments, etc.? How will the investments shape expected returns for the fund? What is the expected holding period for the investments? Will capital from the sales of investments be reinvested? Will the fund use leverage?

- Fund terms: How is the management fee calculated and how often will it be assessed? Who will pay for fund expenses? Is there a general partner catch-up after the hurdle is reached? Are distributions made on a deal-by-deal basis, or on a cumulative basis? Can the general partner waive management fees associated with their direct investments in the fund?

Conclusion

In conclusion, carried interests in newly formed fund entities present a valuable estate planning opportunity, particularly during times of economic uncertainty and where there is potential for fund appreciation.

It is essential to work with qualified appraisers familiar with the complexities of fund structures and tax regulations to ensure optimal outcomes. Engaging with experienced advisors can significantly enhance the outcomes of your estate planning efforts.

The professionals at Mercer Capital have experience in the valuation of carried interests. For more information or to discuss a valuation issue in confidence, feel free to contact us.