Three Reasons to Consider a Valuation of Your FinTech Company

“Nowadays people know the price of everything and the value of nothing.”

– Oscar Wilde, The Picture of Dorian Gray

The above quote seems especially apt in the FinTech industry because the implied values of high-profile, private FinTech companies are often mistakenly reported by the media based on the share price paid by investors in a recently completed funding round. The problem with applying the pricing of the most recent raise to all shares is that the media rarely knows about investor preferences attributable to each funding. As a result, the value of the company is most likely overstated. Capital structures and shareholder preferences matter. Pari passu is not a given although it is often implicitly implied in media reports.

Consider the following example. Investors in a late-stage funding invest $100 million in return for 100,000 convertible preferred shares that represent 10% of the company’s post-raise fully diluted shares. The investors also get certain economic, control rights and other preferences with their preferred shares that earlier investors did not obtain. The headline notes that a new FinTech Unicorn has arrived because the implied value is $1 billion based upon the $100 million investment for the 10% interest; however, this simple calculation typically will overstate the Company’s value because the majority of the shares do not have the same rights and preferences as those purchased in the most recent financing round.

Valuing companies with limited if any operating history that involves a new technology is inherently difficult. The challenge increases when the subject has a complex capital structure. Nevertheless, valuations—whether reasonable or unreasonable—have very real economic consequences for investors, employees and other stakeholders, especially when new capital is injected into the equation. We are biased, but we believe private FinTech companies will be well served over the long-run to obtain periodic valuations from independent third parties. Reasons to do so include the following.

1. To Measure Value Creation Over Time

One of the best performance scorecard metrics to measure is value creation over extended time periods. For public companies, it is a simple process. Measure a company’s total return (percentage change in share price plus the return from reinvested dividends) and compare it to other benchmark measures such as the broader market, industry, and/or peers. For example, a publicly traded payments company whose shareholders have achieved a one-year total return of 10.0% can note on their scorecard that their performance has outpaced the returns from the S&P 500 and Mercer Capital’s FinTech Payments Index, which rose 4.0% and 4.6%, respectively, in the twelve months ended June 30, 2016.

For private companies, annual or more frequent valuations have to be obtained to create a realistic scorecard. Rules-of-thumb exist in every industry, but they are at best approximations and often haphazard guesses that do not take into account the key value drivers of earning power (or cash flow generation), growth, and risk. Some privately held financial services companies like banks may be able to proxy value creation without annual valuations by tracking growth in book value, ROE, and dividend payments, but even for homogenous entities such as banks these metrics say nothing about an institution’s risk profile. FinTech companies with little homogeneity among business models are poorly suited to measure value based upon rules-of-thumbs that are applied to revenues or even EBITDA. Every company is unique, and markets in which companies are valued are not static.

Also, there may be a tendency to overlook balance sheets beyond cash because FinTech balance sheets typically do not “drive” earning power as intangible assets, such as customer databases, intellectual property, patents, and the like, are not recorded unless there has been an acquisition. While understandable, ignoring the balance sheet can be a mistake because sometimes there are aspects to it that will impact value.

Additionally, dividends (the other element of shareholder return) and dividend paying capacity should be an important value consideration, even though FinTech companies often do not or cannot pay dividends in order to reinvest internally generated capital to fund future growth. Another benefit of the valuation process might be insight that suggests the board should shift to distributions from reinvestment because incremental returns are too low to justify.

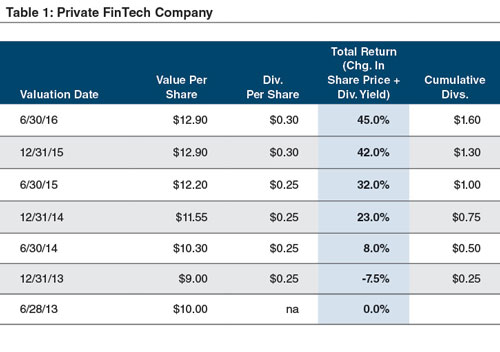

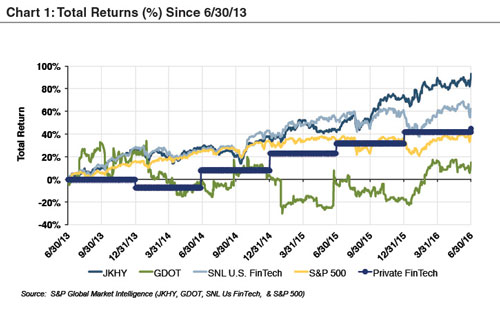

It is advisable for private FinTech companies to measure value creation by having annual or more frequent valuations performed by an outside third-party. For example, consider Table 1 for Private FinTech Company that tracks returns to shareholders based upon changes in the appraised value of the shares and dividends paid over a three-year period. While the hypothetical 45% total return outwardly appears attractive, there is no context. Comparisons with publicly traded FinTech companies, broad industry indexes and realized returns following an acquisition for public and private companies will provide further relevance to the scorecard (Chart 1).

2. For Planning Purposes

Projections for an early-stage FinTech company are a given. In theory so too are rising valuations as important milestones, such as targeted market penetration, users, revenues, and EBITDA, are met. Unless the company does not require significant capital and/or internal capital generation is sufficient, the projections should incorporate additional capital raises and expected dilution based upon implicit valuations. On a go forward basis periodic valuations can be overlaid with the initial and any refreshed forecasts to measure how the company is progressing in terms of value creation relative to plan and to alternatives (e.g., a strategy pivot to a collaborative partnership from disruptor). The key is to measure and compare in order to have a contextual perspective to facilitate decision making.

3. For Employee Ownership Plans

FinTech companies usually attract talent by offering stock ownership so that employees share in the upside should the company’s valuation improve over time. Plus, stock-based compensation lessens a company’s cash needs all else equal. Complex capital structures with private equity investors that have preferences vis-a-vie employees create another potential valuation wrinkle. Returns to the two groups usually will differ. Well documented, periodic valuations are critical. There have been examples where employees have lost money by paying taxes based upon valuations higher than the company realized in a sale. While downside exposure to a company’s faltering performance and/or market conditions is the risk that comes with the potential upside of equity ownership, it is important to have a formalized valuation process to demonstrate compliance with tax and financial reporting regulations. Certainly, scrutiny from auditors, the SEC, and/or the IRS are likely at some point, but very real tax issues also can result from poorly structured or administered equity compensation plans for employees.

Conclusion

If you are interested in discussing the valuation needs for your FinTech company, please contact us. Depending upon how it is defined FinTech is a relatively new industry “vertical.” Mercer Capital has been providing valuation and transaction advisory services to a wide swath of financial services companies for over 30 years that runs the gamut from banks to FinTech. Financials are our largest practice vertical. We have a deep bench and would be delighted to assist.

This article originally appeared in the Second Quarter 2016 issue of Mercer Capital’s Value Focus: FinTech newsletter.

Learn More