Toronto-Dominion Bank and First Horizon National Merger

FHN is a tough call for the merger arbitrage community: $25 per share of cash if the current deal closes; regulators reject the deal, causing FHN’s shares to trade freely in a tough market for bank stocks; or the parties extend the merger agreement again, but does the price get renegotiated?

In the February edition of the Transaction News Update, we featured an article discussing how Spirit Airlines Inc. (NYSE: SAVE) may not have sufficiently considered whether JetBlue Airways Corp. (NYSE: JBLU) could obtain regulatory approval to acquire when it agreed to the JetBlue offer over a deal with Frontier Group Holdings, Inc. (NASDAQGS: ULCC) that was viewed as more obtainable from a regulatory perspective.

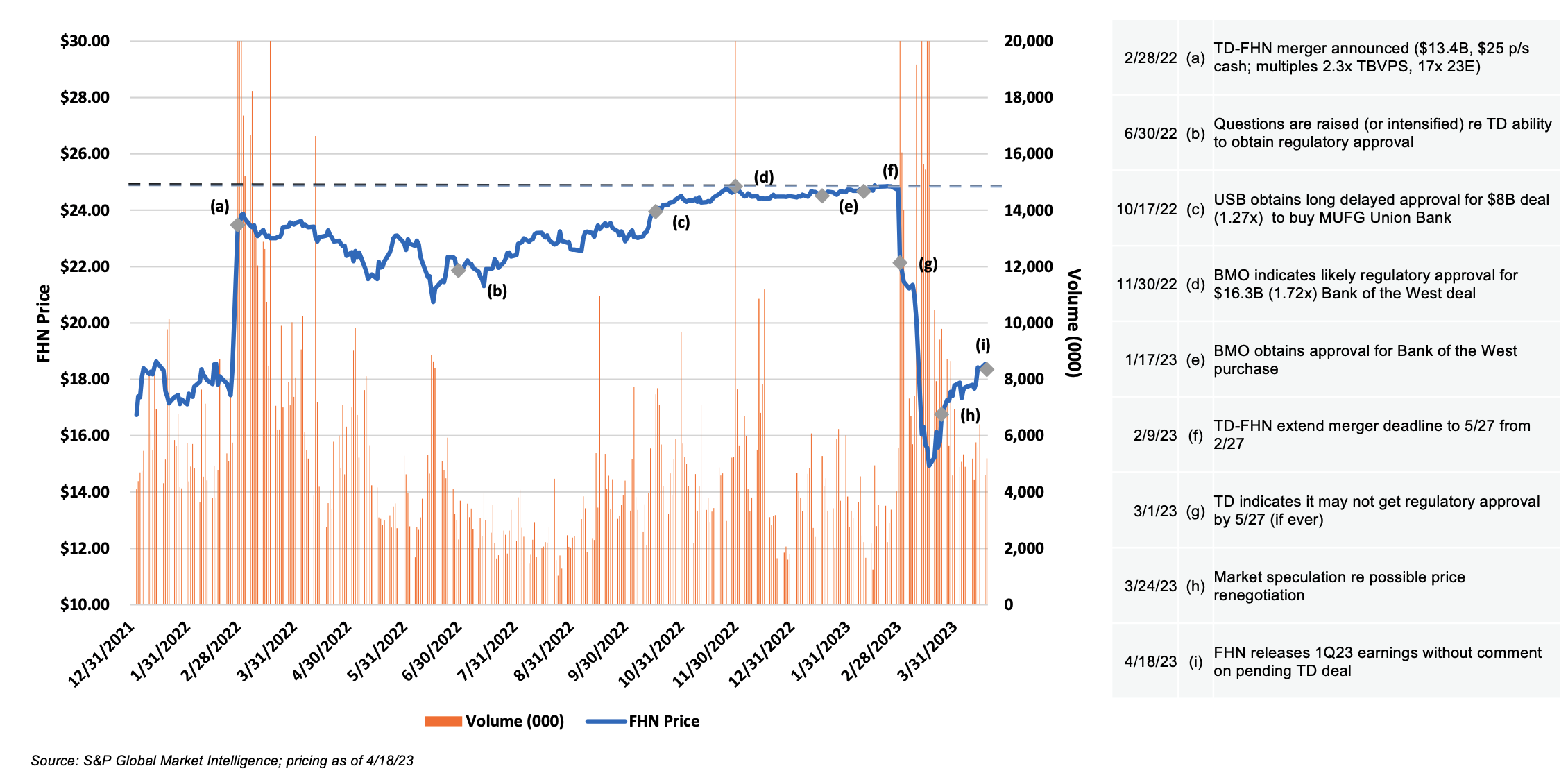

Ability to close is a key consideration for any board entertaining an acquisition or merger proposal. Memphis-based First Horizon National Corporation (NYSE: FHN) faces that question as it relates to its pending deal to be acquired by The Toronto-Dominion Bank (TSE/NYSE: TD) for $13.4 billion cash, or $25.00 per share, announced on February 28, 2022. Pricing at announcement equated to 2.27x year-end 2021 tangible BVPS and 16.6x the then consensus 2022 EPS estimate.

As shown below, the deal has been a tough one for the merger arbitrage community because the parties extended the termination date to May 27, 2023, from February 28 earlier this year when it was clear that regulatory approval would not be forthcoming by the one-year anniversary. On March 1, FHN disclosed in its 10-K that TD did not know when it would obtain regulatory approval. When FHN released 1Q23 earnings on April 19, management did not provide any updated commentary with the release (FHN discontinued quarterly conference calls once the deal was announced.)

Click here to expand the image above

At the time of announcement, a few on Wall Street questioned whether TD could get regulatory approval given a tougher review process promulgated by the Biden Administration to approve deals among large banks (TD-FHN would be the third largest deal since the GFC). However, the concerns were not reflected in the market because FHN’s shares rose 29% on February 28, 2022, to $23.48 per share from $18.25 per share the day before as seen above. The discount to the cash (out) price by the close on 28th was 6.5%, a level that is consistent with Mercer Capital’s experience with merger arbitrage discounts when a transaction involves small regionals and publicly traded community banks. Historically, such discounts have been modest because regulators almost always approve such deals, and deal attorneys will offer some level of informal assurance regarding approval.

We do not have any unique insight into the pending TD-FHN deal, but the deal offers two distinct outcomes for FHN’s share price: regulators soon approve the deal, which would push FHN’s shares to near the $25 per share cash-out price; or regulators reject the deal or the parties terminate the deal given an inability to obtain approval and FHN’s shares trade as an independent company in a depressed market for bank stocks with presumably no immediate acquisition prospects. A third outcome involves a second extension of the merger agreement deadline while awaiting regulatory approval if it is perceived to be obtainable, though some TD shareholders are pushing for a lower price in an extension scenario.