Trends in MedTech Valuation Step-Up Multiples 2024

The last several years have been interesting in the venture capital space. Venture capital financing increased rapidly in 2020 and 2021 and has fallen sharply since the 2021 peak. Less free-flowing capital for start-ups and early-stage companies has led to companies abandoning the “growth-at-all-costs” approach and instead looking for ways to improve profits in order to survive the lower growth post-covid environment. As a result, valuations have contracted, and many early-stage companies have had to raise down-rounds. Not only has start-up financing tightened over the last couple of years, but the step-up in valuation between rounds has also tightened in recent years.

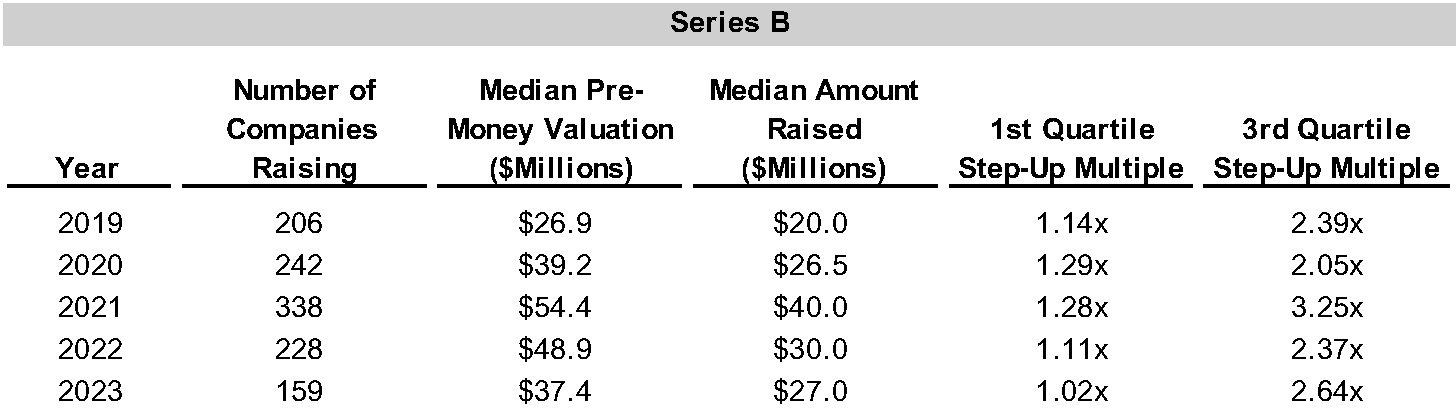

The medtech industry followed the overall venture runup in 2020 and 2021 and was not immune to the drop in funding in 2022 and 2023; medtech venture funding fell 38% in 2022 and decreased a further 35% in 2023. Medtech funding has rebounded slightly in 2024 but is on track to remain well below levels seen in 2021. Against this backdrop, we look at the trends in valuation step-up multiples in this article.

Figure 1 :: Medtech Venture Funding has Decreased Sharply Since 2021 ($Billions)

Click here to expand the image above

What Are Valuation Step-Up Multiples?

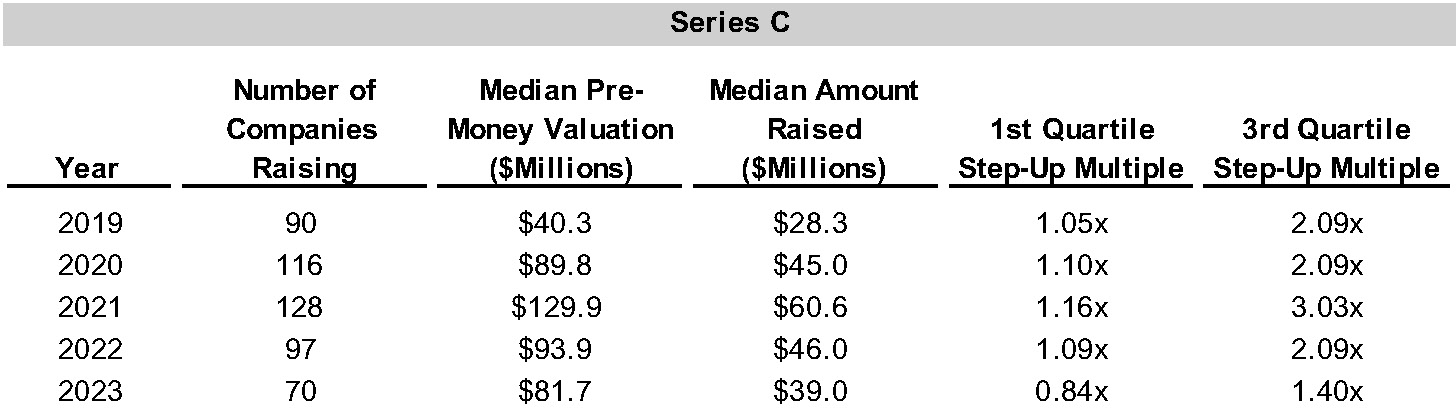

Valuation step-up multiples are a representation of the increase, or decrease, in a company’s valuation between rounds of funding. The multiple is calculated by dividing the most recent round’s implied valuation by the previous round’s implied valuation.1 For example, consider an early-stage company valued at $25 million (post-money) in its Series A funding round and valued at $50 million (pre-money) in its Series B funding round. The valuation step-up from Series A to Series B for this company would be 2.00x ($50 million/$25 million). In other words, the valuation at Series B was two times the valuation at Series A. As illustration, the following charts provide examples that illustrate the valuation history and implied step-up multiples for Therapymatch, Inc. (d/b/a Headway) and Brightside Health, Inc.2

Figure 2 :: Funding Evolution for Headway and Brightside Health

Click here to expand the image above

The valuation of an early-stage company can be influenced by many factors including technical milestone achievements, revenue growth, profitability profile, management team, industry trends and conditions, and the overall economy. Step-up multiples allow us to analyze how a company’s valuation has changed over time and between funding rounds. Step-up multiples greater than 1.0x imply that the company increased in value between rounds (up-round) while step-up multiples less than 1.0x imply that the company decreased in value between rounds (down-round). An increase in valuation between rounds can be because of exceeding financial performance expectations and/or achieving key milestones. And a decrease in valuation between rounds can signal that a company underperformed expectations and did not achieve specific milestones or benchmarks.

Why Are Valuation Step-Up Multiples Important?

It is important for management teams and operators to understand valuation step-up multiples because having knowledge of these multiples allows operators to diligently plan out the financing path of the company. Incorporating an understanding of valuation and the change in valuation between rounds informs how much capital an early-stage company needs to raise and when. The goal of a management team in raising the next round of financing for a company is to maximize the amount of money raised per percent of dilution. In other words, the goal is to raise the minimum amount of money in order to achieve the next milestone so that current owners do not unnecessarily give away ownership in the business. Step-up multiples provide a benchmark for operators to use to guide them while planning and evaluating the financing path of the company.

Investors also need an understanding of valuation and valuation step-up multiples. These also act as benchmarks for investors when evaluating investment opportunities and determining if a certain valuation is reasonable relative to others in the industry. Step-up multiples that are outside (either higher or lower) the range observed in a certain industry may need additional examination, and being able to spot these outliers can help investors find opportunities or avoid underperforming investments. Step-up multiples can also be a useful portfolio planning tool to help investors plan out potential investments in later rounds of a company, especially if they intend to participate in follow-on rounds.

Medtech Step-Up Multiples

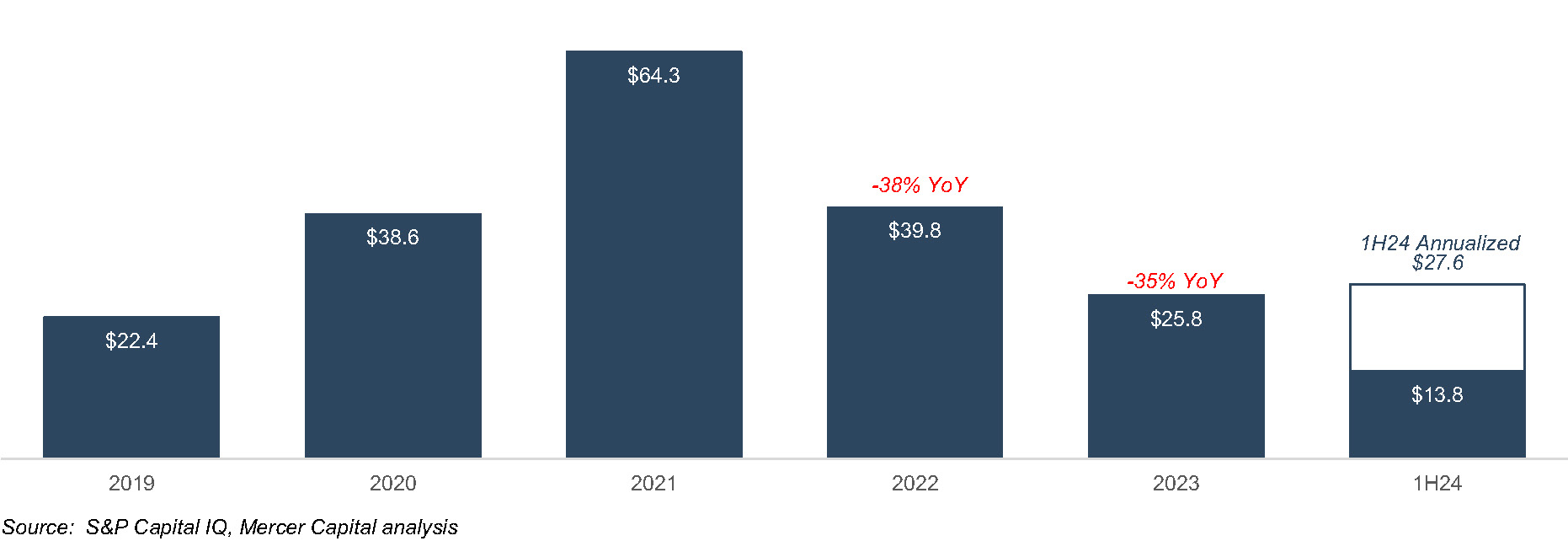

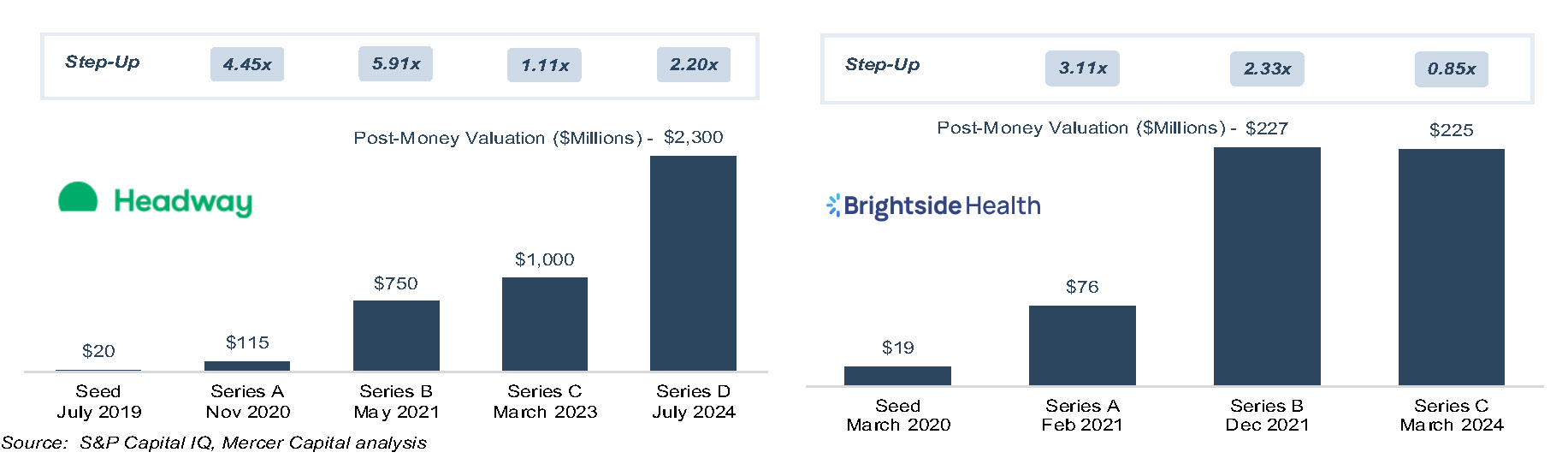

Step-up multiples for an industry can vary over time due to industry conditions and overall economic conditions. Step-up multiples in the medtech space generally increased from 2019 to 2021 and then decreased from 2021 to 2023. The following graphs present the change in step-up multiples for early-stage medtech companies from 2019 to 2023 for Series A, Series B, and Series C rounds.

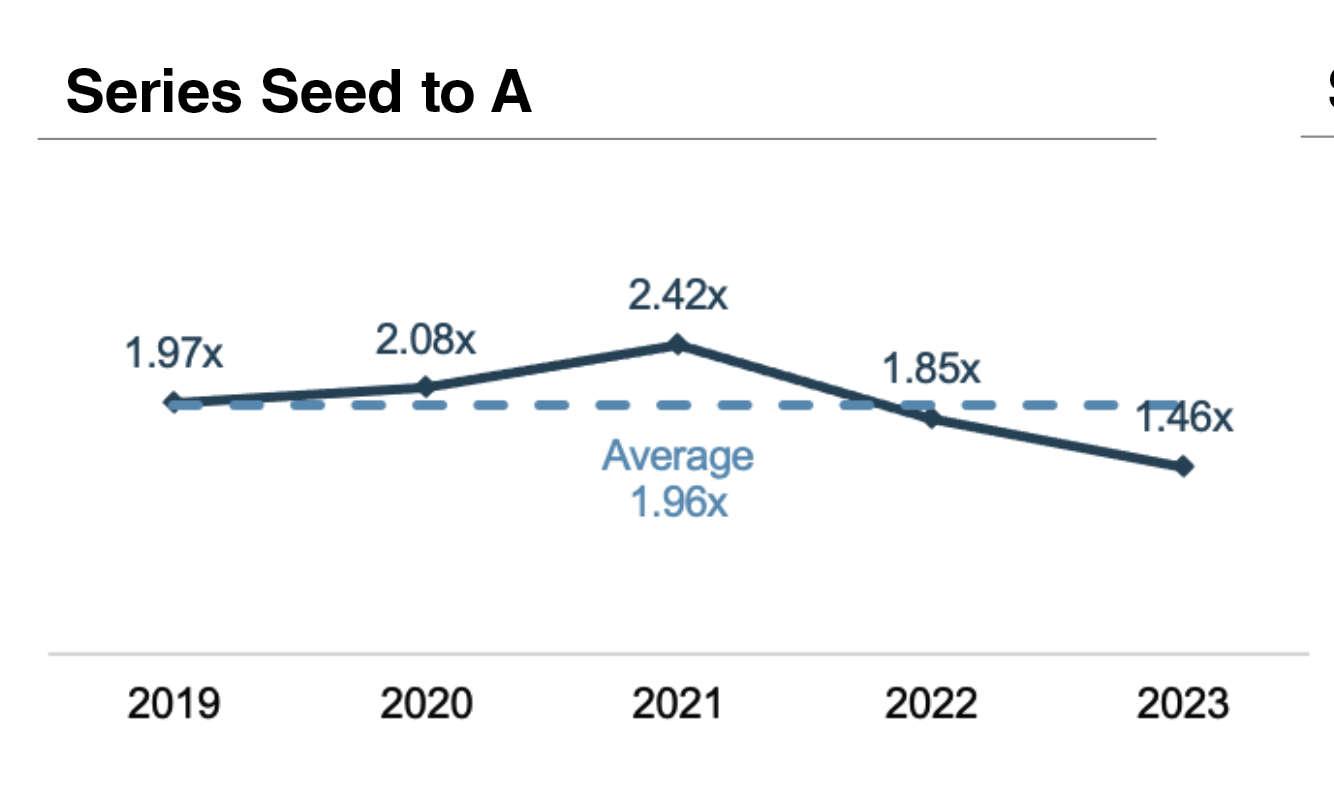

The median Series A medtech step-up multiple increased from 1.97x in 2019 to 2.42x in 2021 before falling to 1.46x in 2023 which represents a 40% decrease from 2021. The average step-up over the period was 1.96x.3

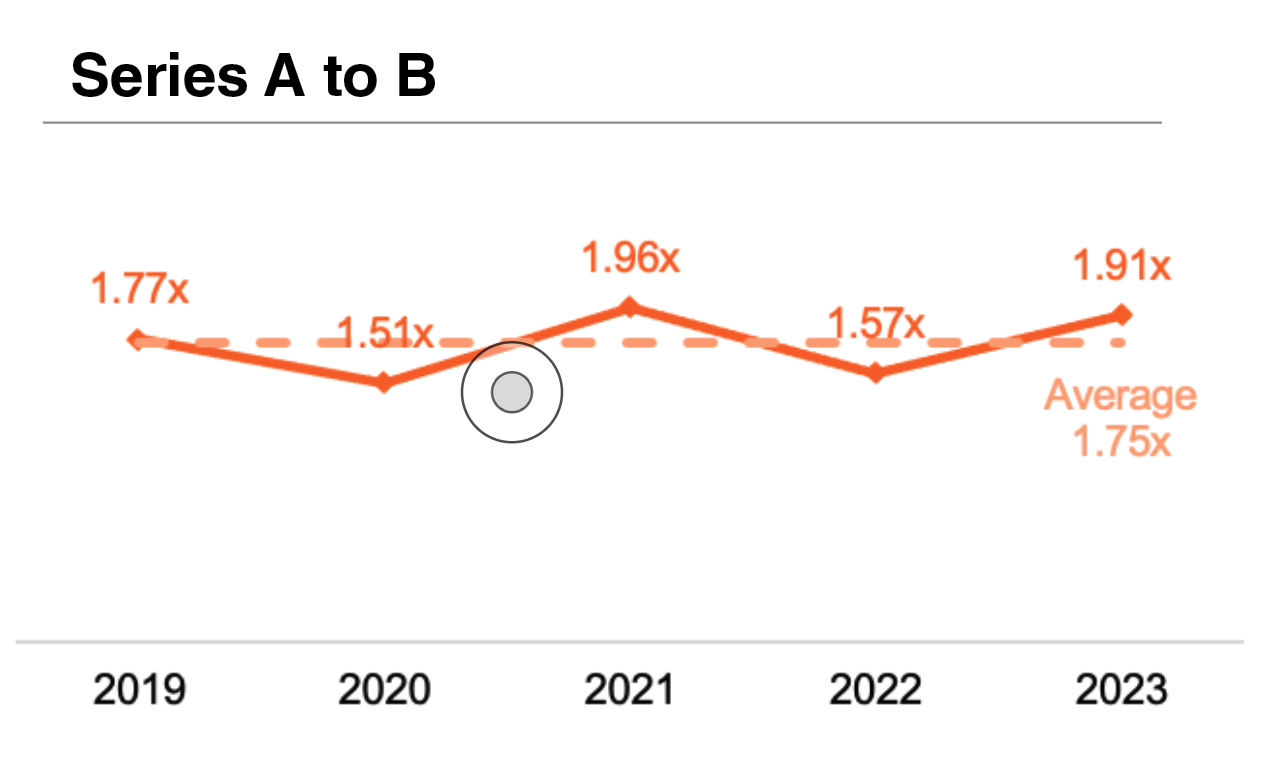

The median Series B medtech step-up multiple increased from 1.77x in 2019 to 1.96x in 2021 before falling to 1.91x in 2023. The average step-up over the period was 1.75x.4

Interestingly, the median Series C medtech step-up multiple peaked in 2019 at 1.70x and fell every year except for 2021. The median Series C step-up multiple in 2023 was 1.16x, and the average step-up over the period was 1.35x. 5

As medtech industry conditions evolve, we will keep a watchful eye on the development of step-up multiples in the future and publish periodic updates.

Figure 3 :: Medtech Step-Up Multiples

Endnotes:

1 Step-up in valuation is defined as

Usually, valuation refers to total equity value, although on a fully-diluted basis this should be equivalent to using per share prices.

2 Headway operates a platform that connects patients with in-network licensed therapists and mental health professionals. Brightside Health operates a platform that offers online therapy sessions, personalized treatment plans, and medication management.

3,4,5 The following summarizes additional data underlying Figure 3 (source: S&P Capital IQ).