Understand the Market Approach in a Business Valuation

What Is the Market Approach and How Is it Utilized?

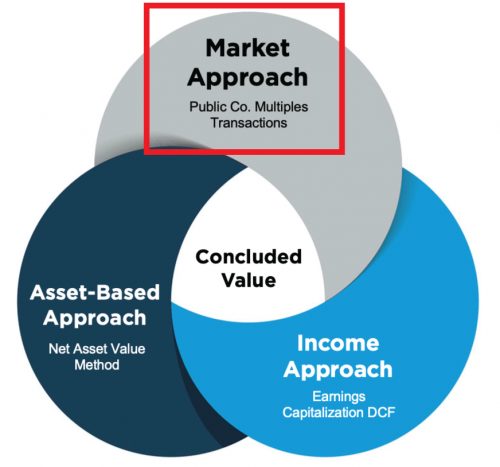

A thoughtful business valuation will likely rely on multiple approaches to derive an indication of value. While each approach should be considered, the approach(es) ultimately relied upon will depend on the unique facts and circumstances of each situation. This article presents a broad overview of the market approach, which is one of the three (the other two being asset and income) approaches utilized in business valuations.

The market approach is a general way of determining a value indication by comparing the subject company or ownership interest to similar businesses, business ownership interests, securities, or intangible assets that have been sold. Within each of the three approaches, there are varying methodologies. Within the market approach, there are two primary methods: the guideline public company method (based on valuation multiples derived from publicly traded companies in similar industries), and the guideline transactions method (based on valuation multiples derived primarily from merger & acquisition transactions involving companies similar to the subject company). Historical transactions in the stock of a company being valued can also be considered under the guideline transactions method.

Guideline Public Company Method

The guideline public company method develops an indication of value based on consideration of publicly traded companies that provide a reasonable basis for comparison to the subject company. The valuation professional will typically conduct a search to identify a group of guideline public companies based on subject company’s industry, and review operating, financial, geographical, industry, and/or market characteristics to ensure that they are reasonable for inclusion.

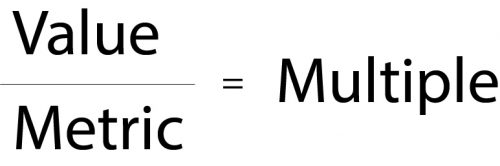

Analysts express the relationship between the value of a company and a corresponding performance metric in the form of a valuation multiple, as shown in the following equation.

Applied to the subject company, the equation becomes:

The valuation professional must select the most relevant valuation multiples based on a number of factors, including the subject company’s size, profitability, growth prospects, industry, and capital structure. Common valuation multiples include EV (enterprise value) to sales, EV to EBITDA (earnings before interest, taxes, depreciation, and amortization), and Price to Earnings (P/E).1 Additionally, the valuation professional may deem it appropriate to adjust valuation multiples for size, risk, growth, and/or other attributes of the subject company relative to the guideline public companies from which the multiples were derived.2

The guideline public company method relies on objective, empirical data that can be used to draw inferences about a subject company’s value. And given that public company stocks trade daily, there won’t be a meaningful gap between the relevant valuation date and the data used in the analysis.

However, the method also has drawbacks. Depending on the subject company’s industry, there may be not sufficiently comparable publicly traded companies. Public companies are typically much larger than a private subject company. Public companies will also often have more product and/or geographic diversification. No two companies are identical, so operational, financial, and market factors must be assessed by the valuation professional. Also, two valuation professionals may deem different companies as comparable or not comparable.

While some commonalities may appear obvious, the guideline public company method requires considerable research and diligence. Access to databases that consolidate public company information like Bloomberg, Capital IQ, and TagniFi is helpful, as well.

The valuation professional also needs to understand the general economic environment and how it impacts the subject company and its industry. In a volatile year (such was the one we have experienced with COVID), earnings metrics may approach (or go below) zero, yielding multiples that are sky-high or negative, rendering this method, and potentially the entire market approach, unreliable and inappropriate for use.

A guideline public company group can sometimes provide useful valuation benchmarks. However, it is ultimately left to the analyst to determine if this method is appropriate given the facts and circumstances of subject companies. If deemed appropriate, then the analyst must develop valuation multiples for a subject company based upon a thorough review of a selected guideline group relative to the subject company.

Guideline Transactions Method

The guideline transactions method is similar to the guideline public company method. However, instead of deriving values from public company stock prices, values are derived from transaction consideration in mergers & acquisitions. It is even sometimes referred to as the M&A method.

Unlike public company stock prices, which can be viewed on a daily basis, guideline transactions occur at a single point in time. As such, market conditions may have changed between the guideline transaction date and the subject company valuation date. Timing is one important consideration. Reliability and accuracy of data is another.

The data for market transactions is typically sourced from various databases, with varying databases for public or private deals. While the providers of private deals attempt to ensure that data is accurate, the underlying information they source is typically self-reported, or sometimes provided by business brokers or investment bankers, instead of being derived from audited and publicly available financial statements for public companies. Additionally, transactions involving comparable companies may in fact take place, but details regarding transaction consideration and/or the target company’s earnings or performance metrics may not be disclosed, making it impossible to use these transactions for valuation inferences.

Market transactions can also have complexities not present in the guideline public company method (which is based on a public company’s common stock price). A market transaction may be structured with an earnout, in which the seller will receive additional consideration at a later date if the acquired company achieves certain financial or operating milestones. A transaction could include a lucrative employment agreement for the primary shareholder, which may influence how much the shareholder is willing to accept for the overall business. Additionally, the seller may provide attractive financing, influencing how much the buyer is willing to pay.

Without knowing all the details of guideline transactions, it is difficult to quantify the impact of these items on transaction consideration, and is often unclear, especially regarding earnouts, how transaction databases incorporate these items.

Additionally, a strategic buyer could have specific motivations to acquire a company due to various synergistic or strategic benefits. Data from strategic transactions are not generally useful in fair market value determinations, which typically do not include strategic benefits.

However, the guideline transactions method has its merits. While guideline public companies are typically much larger in size than private companies, market transactions take place across the size spectrum. Data can be filtered based on the size of the subject company. If the data set is large enough, further filters can be applied based on the subject company’s geographic location and other attributes. This results in companies likely being more directly comparable to the subject company relative to the larger guideline public companies. Ultimately, it is up to the valuation professional to determine the appropriateness of using the guideline transactions method.

Transactions in the Stock of the Subject Company

Transactions in the stock of a subject company can be used as a subset of the guideline transactions method to develop value indications. With public companies, the best indication of value for shares of a company’s stock, e.g., Microsoft, is the current trading price for its shares.

While private companies, by their very nature, do not have an active trading market for their stock, there are certain circumstances where the guideline transactions method can be applied. However, an important requirement for the application of the guideline transactions method is that the transaction was “arm’s length,” meaning that it took place between independent parties acting in their own self-interests. Transfers among family members or grants to employees are not necessarily representative of fair market value. Timing is also important. How much time has passed since the transaction? In what condition is the business and industry at the valuation date relative to the time of said transaction?

Sometimes we value startup companies, which come with additional considerations. If the company has recently been raising capital, the terms of recent investments can be used to imply a value for an interest. However, the valuation professional must take care to understand any differences between the interest acquired in the transactions and the interest that is being valued. Venture capital investments will often be in the form of preferred stock, which may have attributes that make the shares more valuable than the corresponding shares of common stock (e.g., liquidation preferences, anti-dilution provisions, etc.). Because of the complex nature of pricing preferences in venture capital and private equity transactions, a skilled valuation professional should be involved.

Conclusion

The market approach can be one of the most straightforward and compelling ways to derive the value of a subject company. However, each method within the market approach has its own merits and drawbacks, and thus a competent valuation expert is needed to ensure that the methods are applied in a thoughtful and appropriate manner given the unique facts and circumstances regarding the subject company.

________________________

1 The appropriate value for the numerator is based on whether the metric in the denominator is reflective of all capital providers (in which case enterprise value or total capital value is appropriate), or just equity holders (in which case just the equity value should be included in the numerator). Mercer Capital’s Chairman, Chris Mercer, discusses the distinction between enterprise and equity multiples in more detail here.

2 This is often referred to as a “fundamental adjustment.” A detailed discussion of the fundamental adjustment is outside the scope of this article, though Mercer Capital has a primer on the topic here.