Valuations for Gift & Estate Tax Planning

Managing Complicated Multi-Tiered Entity Valuation Engagements

When equity markets fell in early 2020 due to the onset of the COVID-19 global pandemic, many business owners and tax planners contemplated whether it was an opportune time to engage in significant ownership transfers. Although equity markets have recovered to all-time highs, a confluence of three factors may make 2021 an ideal time for estate planning transactions for owners of private companies:

- Depressed Valuations. Valuations for many privately held businesses remain somewhat depressed due to significant supply chain challenges and hiring difficulties.

- Low Interest Rates. Applicable federal rates (AFRs) are at historically low levels, allowing business owners to make leveraged estate planning strategies more efficient.

- Political Risk. The Biden administration’s proposal to lower the gift and estate tax exemption and increase the capital gains tax rate may prompt some individuals and businesses to take advantage of currently favorable tax conditions before any adverse changes are made.

Mercer Capital has been performing valuations for complicated tax engagements since its inception in 1982. For many high net worth individuals and family offices, complex ownership structures have evolved over time, typically involving multi-tiered entity organizations and businesses with complicated ownership structures and governance. In this article, we describe the processes that lead to credible and timely valuation reports. These processes contribute to smoother engagements and better outcomes for clients.

Defining the Engagement

Defining the valuation project is an important step in every engagement process, but when multiple or tiered entities are involved, it becomes critical. It is insufficient to define a complicated engagement by referring only to the top tier entity in a multi-tiered organizational structure. The engagement scope should clearly identify all the direct and indirect ownership interests that will need to be valued. This allows the appraiser to plan the underlying due diligence and analytical framework to design the deliverable work product.

For example, will the appraiser need to perform a separate appraisal at each level of a tiered structure? Or, can certain entities or underlying assets be valued using a consolidated analytical framework? Planning well on the front end of an engagement leads to more straightforward analyses that are easier to defend.

Collecting the Necessary Information

During the initial discussion of the engagement, the appraiser will usually request certain descriptive and financial information (such as governing documents, recent audits, compilations, and/or tax returns) to determine the scope of analysis needed to render a credible appraisal for the master, top-tier entity and the underlying entities and assets.

Upon being retained, one of the first things an appraiser will do is to prepare a more comprehensive information request list designed to solicit all the documentation necessary to render a valuation opinion. Full and complete disclosure of all requested information, as well as other information believed pertinent to the appraisal, will aid the appraiser in preventing double-counting or otherwise missing assets all together.

Information Needed for Complex Multi-Tiered Entity Valuation

Requested information for complex multi-tiered entity valuations typically falls into three

broad categories:

- Legal documentation. The legal structure and inter-relationships in complex assignments are essential to deriving reliable valuation conclusions. In addition to the operating agreements, it is important to have current shareholder/member lists. A graphical organization chart is often a very helpful supplement to the legal documents and helps ensure that everyone really is “on the same page” regarding the objectives of the valuation assignment.

- Financial statements. A careful review of the historical financial statements for each entity in the overall structure provides essential context for the cash flow projections, growth outlook, and risk assessment that are the basic building blocks for any valuation assignment. Depending on ownership characteristics and business attributes, it may be appropriate to combine financial statements for multiple entities to promote efficiency in project execution.

- Supplementary information. For operating businesses, supplementary information may include financial projections, detailed revenue and margin data (by customer, product, region or some other basis), personnel information, and/or information pertaining to the competitive environment. For asset-holding entities, supplementary data may include current appraisals of real estate or other illiquid underlying assets, brokerage statements, and the like.

The ultimate efficiency of the project often hinges on timely receipt of all requested information. Disorganized information or data that requires a lot of handling or interpretation on the part of the appraiser adds to project cost, and more importantly, can make it harder to defend valuation conclusions that are later subject to scrutiny.

In short, providing high quality information in response to the appraiser’s request list promotes a more predicable outcome with the IRS and with other stakeholders.

The Importance of Reviewing the Draft Appraisal

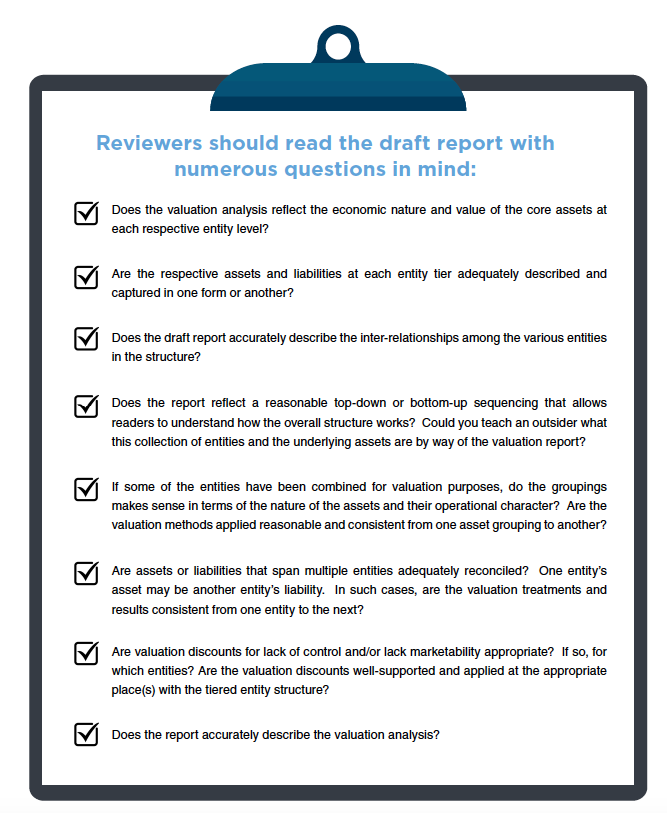

Upon completing research, due diligence interviews with appropriate parties, and the valuation analysis, the appraiser should provide a draft appraisal report for review. The steps discussed thus far – careful planning and timely information collection – are not substitutes for careful review of the draft appraisal report. The complexity of many multi-tiered structures increases the need for relevant parties to review the draft appraisal for completeness and factual accuracy.

Engagements involving complicated entity and operational structures are not easily shoehorned into typical appraisal reporting formats and presentation. Unique entity and asset attributes may require complex valuation techniques and heighten the need for clear and concise reporting of appraisal results. Regardless of the

complexity of the underlying structure and valuation techniques, the appraisal report should still be easy to read and understand.