Venture Capitalists in the Family

Many family offices are built from the success of once fledgling businesses that many would now know as household names. Successor generations seek to maintain and build that wealth through prudent investments in equities, fixed income, and private equity investments in mature companies. In recent years, however, family offices have started taking notes from their entrepreneurial beginnings and are investing more in early-stage ventures. Though more often seen as LPs in traditional venture capital funds, family offices are also increasingly taking on the role of direct—and sometimes lead—venture investors.

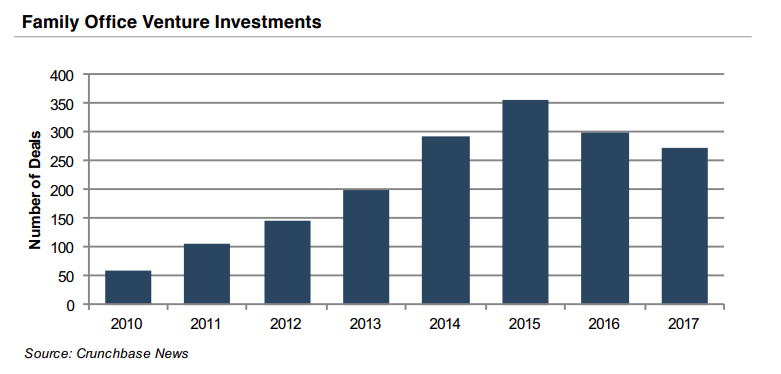

An analysis from Crunchbase News shows the progression of family office venture investment over the last few years. While this is a small sample, it helps demonstrate the growing trend. Crunchbase also notes several prominent family venture-backed exits including Twilio, Okta, Bitly, and Workday.

We have previously analyzed the rise of corporate venture capital and its effect on the funding landscape. So what does the increase in family office investors mean for venture capital? Here are a few of the characteristics that make venture investments from family offices unique.

Involvement

Despite an industry focus on the new wealth being built in the technology hubs of the U.S., abundant sources of potential investment lay in family offices all over the country. Family office investors are likely to source deals through their personal networks and professional ties with local business activity. Family offices typically take an active interest in each portfolio company and, therefore, may be likely to invest their capital in local ventures in order to better stay up-to-date with company developments. In order to maintain this involvement, a board seat may also be one of the requirements when a family office joins the cap table.

Motivation

Whether they hold a share of the original family company or a subsequent business investment, family offices often have a stake in mature industry players. Because of previous work within the space or an inside vantage point from an ownership position, family offices can often lend industry insight. They may also possess a unique perspective for identifying startups that could disrupt, or partner with, the incumbents in the industry. Family office investors typically enter with strategic motivations for investing, not just the lure of large returns.

Time Horizon

The primary focus of family offices is to preserve and grow capital for multiple generations. Family offices are, therefore, usually able to adopt a very long-term view of their overall portfolio. However, it should not be mistaken that family offices are willing to have their capital tied up forever. Like any other investment firm, family offices develop objectives and exit expectations for their various investments.

As family offices join the landscape of non-traditional investors in venture capital, startups may find that they have more options when it comes to funding. We expect to continue to see an increase in the diversity of funding sources, with cap tables boasting a combination of traditional, corporate, and family investors.

Originally published in Portfolio Valuation: Private Equity & Venture Capital Marks & Trends, Third Quarter 2018.