Last month, we published a post chronicling the auto industry’s trends in 2023 in a parody of Clement Clarks Moore’s “A Visit from St. Nicholas.” This month, we focus on automotive trends impacting auto dealers and consumers in 2024. But before we go forward, we must look back at where we came from, as those times may be a predictor of what is to come.

We’ve just witnessed two and a half years of unprecedented times for auto dealers, perhaps best summed up by a line in The Nightmare Before Christmas where Jack Skellington exclaims, “I can’t believe my eyes. I must be dreaming.” Specifically, the auto industry experienced a combination of high demand, low supply, and low-interest rates. The combination of these forces allowed auto dealers to sell vehicles and realize profits at all-time levels.

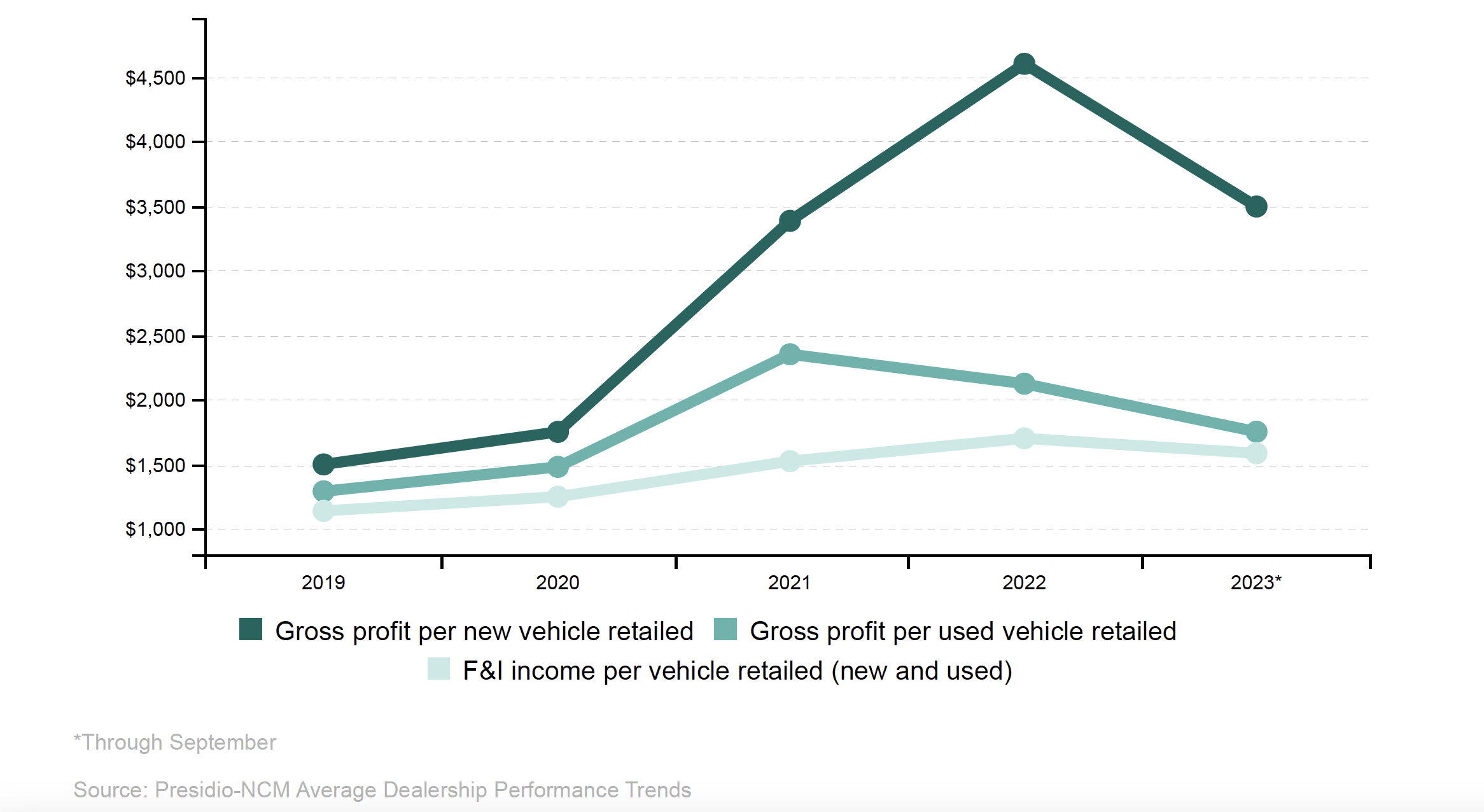

These trends began to soften and revert during the second half of 2023. Automotive News recently released third-quarter 2023 data illustrating that dealership pre-tax profits declined by approximately 20% compared to 2022. Further, gross profit margins for the first nine months of 2023 also declined by nearly 24% for the new vehicle, used vehicle, and finance and insurance (F&I) departments, as illustrated in the graph below.

What to Expect in 2024

What can auto dealers and consumers expect in 2024 with new vehicle supply, incentives, transaction prices, and overall profits? Will we see any shifts in the vehicle ownership paradigm? What can we expect from the car-buying process? We tackle each of these in this week’s post.

New Vehicles – Supply | Incentives | Transaction Prices | Profits

According to a forecast by Cox Automotive, new inventory is expected to rise to nearly 3 million units in 2024. Over the last two years, we’ve wondered whether the OEMs would resume production back to pre-pandemic levels; perhaps this is the first prediction that they will approach those levels again. Coupled with improvements in supply, manufacturer incentives have been on the rise and are expected to continue that climb. While Cox’s most recent SAAR prediction is 15.7 million units for 2024, those levels won’t necessarily translate to higher margins for auto dealers. In fact, Cox and other analysts predict the opposite – margins and profits for auto dealers will continue to be compressed due to the following factors:

- Discounts to Manufacturer’s Suggested Retail Prices (MSRPs) – Along with incentives, analysts expect consumers to demand discounts to MSRPs for new vehicle purchases.

- Higher Interest Rates – Increased interest rates lead to increased floor plan or inventory carrying costs for auto dealers. Auto dealers once experiencing a net credit or a relatively low floor plan expense have now seen that trend reverse into a sizeable expense. In some cases, dealers are even turning down monthly allocations due to the high inventory carrying costs for vehicles they know will not turn quickly.

- EV Investment – Many dealers are being forced to spend funds in connection with infrastructure to facilitate the sales and retailing of electric vehicles.

- Wage Increases – Following the UAW strike, wages have increased for many OEMs, including the Big 3. Analysts have estimated these wage increases would lead to $900 in additional labor costs for each Ford Vehicle. Further, OEMs and auto dealers will likely be unable to pass these costs to consumers in the current environment or find efficiencies to counterbalance the increased costs.

Vehicle Ownership Paradigm

Recently released data from Cars.com suggests that the vehicle ownership paradigm may be shifting by population segment. Transaction prices and affordability continue to impact the decision to purchase a new or used vehicle. Trade-in values remain high, particularly for “newer” used vehicles, those that are one to five years old. Conversely, consumers still face steep prices from the used vehicles that auto dealers are retailing.

The survey reveals that Millennials, defined as those individuals born between 1981 and 1996, generally prefer to use rideshare or public transportation rather than own a vehicle outright. Conversely, Gen Z, defined as those individuals born between 1997 and 2012, are opting to own vehicles outright. Specifically, 42% of Gen Zers purchased their first vehicle between the ages of 16 and 18, compared to only 32% of Millennials during those same ages.

The survey data also provides insights into the car-buying process, which we will discuss along with the results of the recently released 2023 Car Buyer’s Survey by Cox Automotive.

Car Buying Process

Cox Automotive’s Car Buyer Journey Study (CBJ) was released this week and highlights trends in consumer behavior involving the car buying process. It found that buyers continue to seek vehicle purchases based on the aging of an existing vehicle. However, 15% of buyers cited the need for an additional vehicle in the household as the primary reason for purchase, up from 11% from the prior study.

Over the last several years, the buying process has expanded to include alternative options, including online purchasing and omnichannel, featuring both in-person and digital components. Some key takeaways from this year’s CBJ Study and their impact on auto dealers are as follows:

- Buyers typically considered two vehicles and visited two dealerships during their buying process.

- 74% of all vehicle buyers and 79% of new vehicle buyers were satisfied with the retail experience at auto dealers, which ties the highest mark in the study’s history.

- For those buyers included in the survey, 50% completed their entire purchase in person, 7% completed all the steps online, and 43% preferred a mix of online and in-person.

- EV buyers are skewed even more towards digital and online, with 69% completing their purchase through an omnichannel process and 16% entirely online.

Conclusion

Following the auto industry rollercoaster of the past two and a half years, perhaps 2024 will be a return to the times before the pandemic. If not, this could be our new normal. Margins and profitability have already declined in the latter half of 2023. The buying process for vehicles has forever changed, offering online and omnichannel options to the traditional in-person experience at the dealership. While inventory supply from the OEMs continues to improve, will it level off, or will it also climb back to pre-pandemic levels in 2024?

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.