An Estate Planning Primer

Why Auto Dealers Need to Start Thinking About Estate Planning Again

We started our auto blog just after the last leap year, so it’s either our first or fourth birthday, depending on how you view it. Our blog start coincided with the beginning of the pandemic, and auto dealers (and all of us) have been on a wild ride in the four years since.

One thing we’ve hardly written about in this space is estate planning, in part because dealerships have experienced record performance. However, as record profits have receded towards more normalized levels, and with the significant cliff looming at the end of 2025, it’s time for auto dealers to revisit their estate planning.

What Is the Current Estate Tax Exemption Limit?

Around Christmas 2017, the Trump Administration delivered its most consequential pre-pandemic legislation: the Tax Cuts and Jobs Act (“TCJA”). This reduced the corporate income tax to 21%, lowered individual tax rates, raised standard deductions, and more than doubled the estate lifetime exclusion, among other changes.

This meant that auto dealers would need an estate exceeding $11,180,000, or double that for married couples. Pre-pandemic that significantly limited the number of auto dealers who might need to do estate planning.

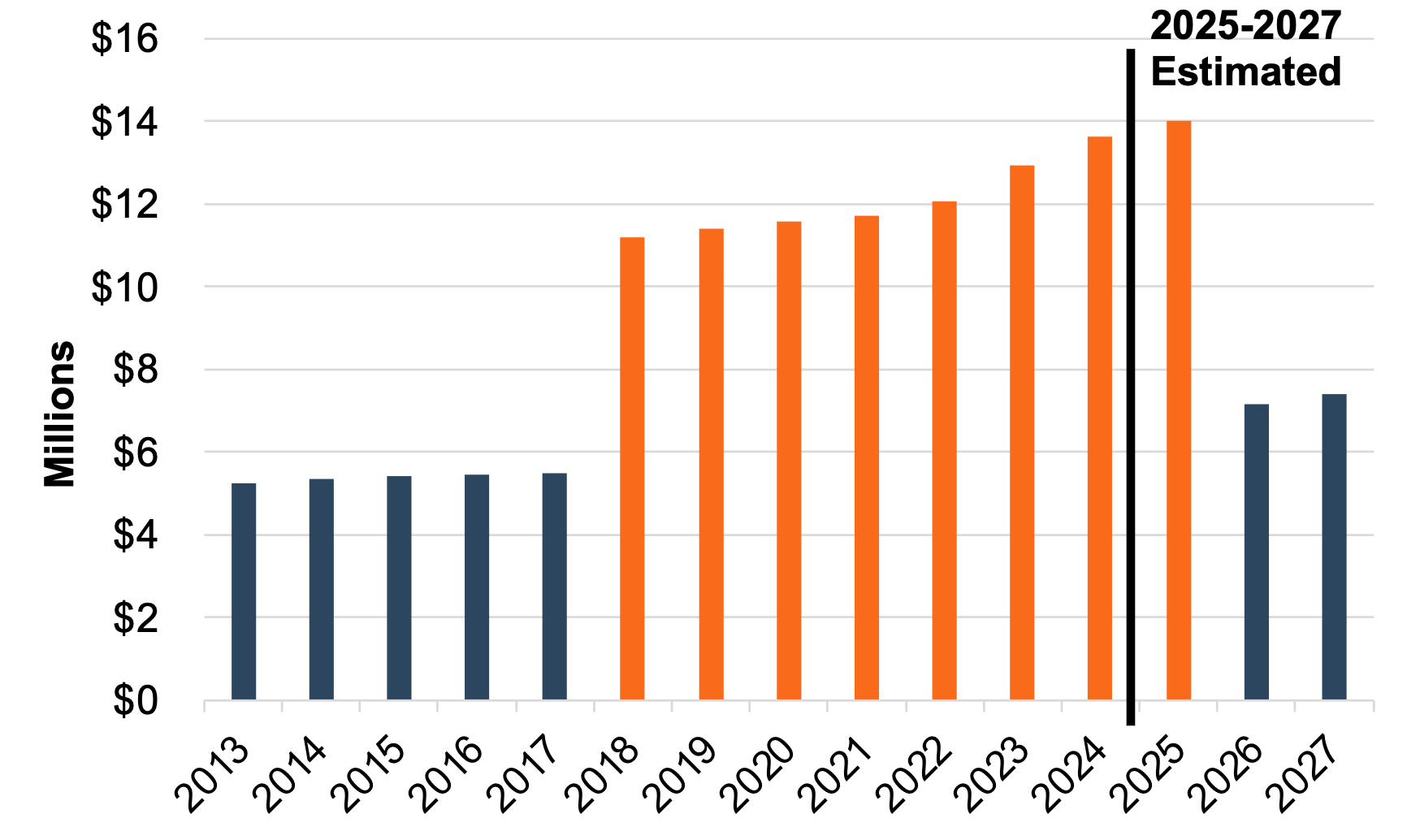

After record profitability in the past few years, and with these provisions set to expire, many more dealers will now be in the crosshairs. See the graph below, dating back to 2013, when the top marginal tax rate increased to 40%.

Has This Happened Before? What Happened Last Time?

Predicting political winds can be a fool’s errand, particularly speculating on what new legislation might look like. In this case, there is no uncertainty of what could happen.

With no further action by Congress, the estate tax exemption will be reduced to what the limit would have been if the exemption had simply grown by inflation since 2017, an estimated $7 million threshold.

Has the estate tax exemption faced a sunset before? Yes, the last time was in 2012, when there was significant uncertainty. The gift/estate tax exemption looked like it would decline from $5.12 million to $1 million, and the estate tax rate would increase from 35% to as high as 55-60%.

Appraisers were swamped with activity leading up to what ended up being mostly a non-event: Congress did act, adjusting the exemption to $5.25 million but raising the top tax rate to 40%.

What’s Changed Since Last Time?

No matter what side of the aisle you might find yourself on, we think most people in the country would agree that the political climate has become significantly more divided since the last sunset scare in 2012.

It’s also important to remember that the TCJA itself barely passed, with a 51-49 vote in the Senate after the legislation was considered dead before coming together quickly at year-end.

It’s very unlikely that a Democratic president elected in 2024 would stop the provisions from sunsetting. However, a Republican president might struggle to get a bill through Congress, which is split relatively evenly heading into the election.

In our view, significant changes may not be enacted, regardless of the outcome of the election. And if there is any sort of controversy as to the winner, the political capital typically gained in the first 100 days of office may instead be spent reconciling a fractured electorate.

Should I Wait It Out?

We are recommending to our clients and their advisors that waiting may not be in their best interest. Appraisers and attorneys will stop accepting calls in the latter part of 2025 for estate planning valuations and gifting administration needed by year-end.

Waiting for more certainty from the political landscape may mean missing the boat.

In preparation for the uptick in activity, the AICPA recently released its FVS Estate and Gift Toolkit (subscription/credential required), which will be beneficial to appraisers trying to meet the increased demand. It covers important topics including but not limited to defining the engagement, pertinent case law, and discounts for lack of control and marketability.

A thorough and reasonable valuation report is highly recommended to avoid an IRS audit. For auto dealers, you want an appraiser who frequently values auto dealerships rather than a generalist.

It’s worth noting that this type of planning can be beneficial even if the estate tax exemption does not decrease. For auto dealers, equity discount rates can vary widely, though all else equal, they cluster in mid-to-high teens depending on geography, brand, performance, and other factors.

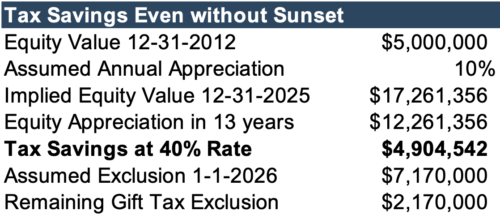

On the conservative side, consider an auto dealership with an equity value of $5 million as of 2012, just before the provisions did not decrease. Assuming annual appreciation of 10%, by year-end 2025, the equity value would have appreciated to $17.3 million compared to a projected exclusion amount of $7.2 million.

That’s a significant appreciation that will not be subjected to the 40% estate tax, an estimated savings of $4.9 million in taxes.

Conclusion

It’s been a while since auto dealers had to consider their own mortality. Estate planning is a complicated issue, and some may prefer to put it off. However, there can be significant impacts on the legacy of family-owned dealerships if the estate tax causes liquidity issues when families are at their most vulnerable state.

Contact your attorney or a Mercer Capital professional to discuss whether estate planning makes sense for you, your family, and your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights