April 2022 SAAR

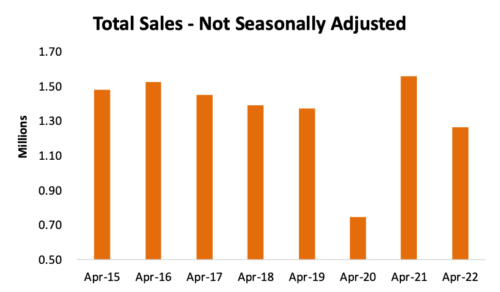

The April 2022 SAAR was 14.3 million units, up 6.5% from 13.4 million in March but down 21.9% from the recent high April 2021 SAAR of 18.3 million units. The last three April SAAR figures (’20, ’21, and ’22) are interesting to compare to one another, as dynamic conditions resulted in three very different narratives surrounding the SAAR.

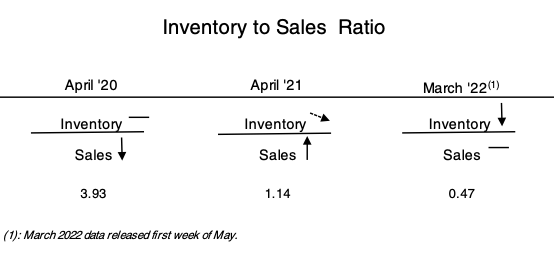

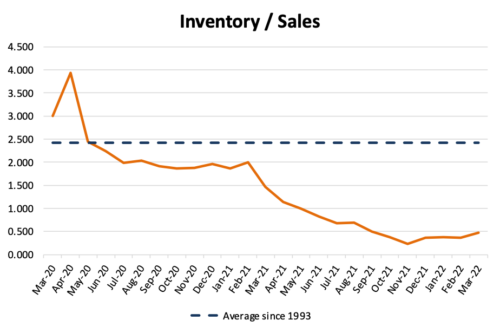

- In April 2020, the COVID-19 pandemic had taken its grip on the world economy, stifling the demand for vehicles as economic uncertainty pushed consumers to hold off on vehicle purchases. This pause in activity kept potential buyers off dealer lots despite adequate inventory levels across the entire industry. Cooled conditions resulted in very low sales and a relatively high inventory to sales ratio (3.93) compared to the all-time high of 4.64 in January 2009. It may be hard for some to remember, but dealers were turning as much inventory as they could even at lower GPUs in order to shore up their cash position.

- In April 2021, demand had more than recovered. Pent up demand from the pandemic was showing its face, resulting in the highest ever recorded level of April raw sales. Inventory balances would have been considered healthy but declining due to strong demand. Sales outpaced the rate of OEM vehicle production.

- In the current environment, the tables have now completely turned from the observed conditions in April 2020. Demand has continued to stay strong, but historically low balances of inventory have restricted raw sales numbers well below what was observed in April 2021. While there may be some signs or reasons to expect some pullback in demand, it is still overwhelming when compared to historically constrained supply.

Thomas King, president of the data and analytics division at J.D. Power shared his takeaways from April:

“The April sales pace may look disappointing compared with April 2021, but last April’s record sales pace was enabled by the combination of extremely strong consumer demand and enough inventory (nearly 1.7 million units) to turn that demand into actual sales. This April, demand remains strong, but with fewer than 900,000 units in inventory at dealerships, sales volumes will necessarily be well below year ago levels.”

As the last three Aprils have shown us, striking a balance between the number of available vehicles on dealer lots and the demand that exists in the market has been difficult over the last two years and will likely continue to be difficult until the supply/demand dynamics of the auto market align more closely.

During the valuation process of several engagements, many of our auto dealer clients have spoken about the sales pace on their lots compared to their limited stock of vehicles. We are seeing that most of these dealerships ended April with just about the same inventory balance as the start of the month while selling at almost a 1:1 relationship between inventory-in and inventory-out. This is due to a high number of pre-order sales, which brings lot-time for these vehicles close to essentially zero days. It is truly impressive that dealers can sell more vehicles in a month than they had sitting on their lots at the start of the month. A sign of the times.

Keeping with the trend over the last year, year-over-year growth in profits has been observed as high as 20%, hammering home the fact that dealers continue to thrive in this high price environment. Many consumers may balk at transaction prices that continue to run up the charts, but it is worth noting that the demand for vehicles has seemed much less elastic (sensitive to price changes) than many previously thought.

Speaking of transaction prices, the industry average remained elevated at $45,232 per unit, up 18.7% from this time last year and an April record. The all-time record was set last December and there have only been small incremental changes up and down since then. High transaction prices have come alongside decreasing incentive spending per vehicle. April’s incentive spending per unit came in at $1,034, an all-time low. See below for a comparison of the last seven April’s incentive spending per unit:

The cost of financing a vehicle has also worsened for consumers as rising interest rates have pushed monthly payments up to an April high of $685. The Federal Reserve, after already having introduced a rate hike in the first quarter of 2021, opted to raise rates by half a percentage point on May 4. This increase is twice the size of a typical rate hike due to the Fed’s aggressive strategy against inflation. The Fed has also announced that it expects to raise rates further over the summer. Despite interest rates adding fuel to the fire, monthly payments are only up 15.6% from this time last year while transaction prices have increased 18.7% over the same period. This can be attributed to longer terms on loans, as 72 and 84 month terms become more commonplace. Lower and middle-income buyers will have to weigh the rising costs of financing a vehicle as affordability challenges limit the options that these buyers have available.

May 2022 Outlook

Mercer Capital’s outlook for the May 2022 SAAR is consistent with the last several months. Industry supply chain conditions continue to stagnate. Sales volumes will likely continue to be closely tied to production volumes as vehicles leave lots within days of arriving. Elevated profitability across the entire industry will likely continue as high prices boost margins on vehicle sales. Stay tuned for more updates on next month’s SAAR blog.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights