Carvana Is Looking More Like Icarus

How the Pandemic Darling May Have Flown Too Close to the Sun

Lately, Carvana has been in the news for all the wrong reasons.

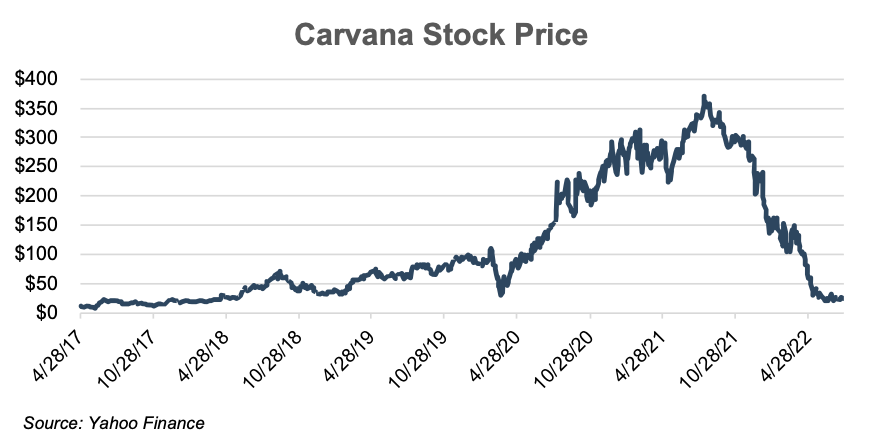

Its share price is down over 90% since its pandemic peak and currently sits below the low levels of March 2020.

This post provides an abbreviated history of Carvana from its founding in 2012 to 2022 and discusses what its successes and struggles mean for traditional auto dealerships.

Where It All began

The company was founded by Ernie Garcia III in 2012. Garcia sought to improve the vehicle buying experience for consumers. He attributed the idea partly to how cars are bought and sold at wholesale auctions. These auctions are key sources of supply for auto dealers, particularly used vehicle dealers with limited opportunities to acquire cars via trade-ins. Garcia noted it took dealers all of 30 seconds of seeing a vehicle to purchase it. His vision was to bring this ease of acquisition mainstream.

Prior to founding Carvana, Garcia began working at DriveTime Automotive Group in 2007, an auto giant owned by his father. This is where he got the idea of selling cars online, though it would take years for this idea to take off.

What Makes Carvana Unique

Carvana has become known for its iconic car vending machines which debuted in late 2015. These worked as a centralized location for customers to pick up vehicles, lowering delivery costs. It was also a novel concept with marketing benefits for the brand. Compared to a traditional dealership, going vertical reduced the upfront investment in real estate compared to large, expansive lots that are largely sitting empty in the current inventory shortage.

Another thing that makes Carvana stand out is its online-first presence. Carvana operates as an online platform to buy and sell used cars, but this option for consumers isn’t new. The difference with Carvana is that the company acts as the dealership rather than taking a fee for simply listing the vehicles. The company also earns a substantial amount of its gross profit from financing rather than the actual sale of vehicles. Vehicle financing has increasingly become a key aspect of profitability for traditional dealerships as well.

While Carvana fixes the vehicles it purchases prior to reselling them, they don’t provide after-sale services like repair and maintenance, a key driver of profitability for traditional dealerships.

Scaling the Business

Carvana seeks to provide a uniform buying experience with price transparency, an oft-cited pain point with traditional auto sales for consumers. To achieve this, the company needed to significantly increase scale in order to be profitable.

A few years after its founding, the company struggled to gain traction. It resorted to two tactics instrumental to the company’s success. First, it subsidized consumers by selling vehicles at or sometimes below cost. This, of course, raised the company’s sales from a volume perspective and contributed to significant growth. The company has for years sold a growth story like many other online companies. The thought process is that it can increase its prices once it achieves sufficient scale using its aggressive pricing strategy.

Carvana’s strategy was to use its aggressive pricing (selling cars at or below cost) to create scale. From there they could increase prices and reach profitability.

Carvana’s second tactic was listing its inventory in numerous markets. While it had fewer cars to sell than its competitors, it began using virtual addresses in order to appear to have a presence in more markets than it actually did. Consumers surveying their options might go into a dealership if they know the brand they want but aren’t sure about the model. Before Carvana, third-party listing sites were a better way to start the research process for consumers that were brand-agnostic.

Carvana’s strategy enabled its vehicles to show up in more markets, and they subsidized the cost of shipping the vehicle once a sale was recorded. While this strategy was not sustainable from a profit perspective, the investment paid off and generated significant traction. The company’s IPO in 2017 further increased its visibility, and its growth story and positioning as a “disruptor” captured public attention in an industry with room for improvement in the customer experience.

Flying Too Close to the Sun

The company rode its growth story to a stock price of $110 in February 2020. In less than a month, concerns around the COVID-19 pandemic led the stock price to decline 73% to $29. Less than a week later, the stock was back to $63 as the market, at large, sought to reprice all stocks based on uncertain expectations of the path forward.

By June 2020, the stock peaked again as the company was viewed as an early “winner” from the pandemic. Auto sales plummeted in March and April 2020 as dealers were thrust into the world of online sales as a means of survival. For Carvana, the forced shift to online played directly to their strengths.

Prior to the pandemic, the online market for purchasing vehicles was presumed to be relatively small. While online retail works great for certain products, large purchases like cars and mattresses were supposed to be impervious to the “Amazon-ification” of retail. There were two main reasons for this thesis: life cycle of the purchase and cost.

It has long been held that consumers spending large sums of money on products they intend to use for years want to touch and feel what they’re buying to ensure they like it. The last thing you want to do is get a bad night’s sleep on a bed the first night after you’ve just shelled out $100s of dollars for a new mattress. The same can be said for the style and feel of automobiles, which is why dealers keep so much inventory on the lots for consumers to test drive various options.

Consumer financing for cars can also be difficult to complete online. Having a dealer walk people through their options or direct them to more affordable options is beneficial to the dealer who still gets the sale and the consumer that needs help wading through the financing process. Carvana appeared to solve both of these problems with easy-to-use online financing tools and a 7-day test drive period. This was a plus compared to the traditional ~30 minutes a consumer spends with a vehicle prior to purchasing it from a dealership.

Before the end of 2020, it was clear that auto dealers (both traditional and online) were benefiting from the economic environment caused by the pandemic as sales bounced back and an increased reliance on technology and lower headcount, interest rates, and advertising led to lower costs. As the pandemic continued, auto dealerships saw heightened profitability, and Carvana’s stock price soared to a high of $370 in August 2021. Conditions were so strong that the growth-focused Carvana actually reported positive earnings per share in Q2 2021. This appeared as though it could be the turning point for the company. Maybe it was reaching the necessary scale to generate large profits in the future.

Unfortunately, the wind has been taken out of its sales as the macro environment has changed in 2022 with rising interest rates and now fears of a recession. At $25 as of last Friday (July 22, 2022), the stock now sits lower than it did in the depths of the pandemic and is closer to where it traded in the first half of 2018.

It’s fair to raise the question: “If the company couldn’t make money in the most ideal of conditions for auto dealers (in addition to forced adoption of online retail), what is its ultimate path to sustained profitability?” While the company’s innovative ideas generated plenty of traction with consumers, they did not lead to a moat for its operations. Stated plainly, other companies can copy Carvana’s offerings, reducing or removing all of its competitive advantages from being the first-mover.

Recent Struggles

Matching stock price declines, headlines about Carvana are becoming increasingly negative as its fairy tale ride may be coming to an end. Recently, the company has announced layoffs in order to preserve cash. However, a smaller staff may only exacerbate the back-end paperwork issues the company is currently facing. While the company downplays the pervasiveness of the issue, an article in Barron’s (subscription may be required) chronicles consumers’ struggles with registration delays and issuance of multiple temporary license plates from various states enabling it to sell vehicles for which it had not yet received the title. In many states in which the company does business, such sales are illegal. For these consumers, the relative ease of front-end purchase as compared to in-store dealerships may not be worth the back-end headaches as Carvana seeks to straighten out these issues. Long-term, Carvana is selling a better customer experience, which will extend beyond the initial purchase by getting all the necessary paperwork completed to be street legal.

Anecdotally, we had a colleague last week who spent the better part of a day at the DMV attempting to get his car registered after temporary plates could no longer be extended by law. While the DMV may have shared in some of the blame in this situation, he has yet to receive a title four months after purchase. Interestingly, there were about ten other people at the DMV with similar Carvana issues, though many of them were happy, loyal customers that raved about the front-end experience despite the back-end frustrations.

Carvana’s core profitability lever (financing) is seeing demand cool.

In addition to back-end issues, the company’s core profitability lever (financing) is seeing demand cool. While Carvana is well-known for its vending machines and no-haggle pricing on its website, its earnings (or lack thereof) are more dependent on its financing. Instead of marking up the vehicles, it sells to market levels, the company subsidizes lower purchase prices to scale and also makes money on the auto loans it originates. Rather than holding these on its balance sheet, the company packages or “securitizes” these loans and sells them to investors.

With near-zero interest rates and a strong economic environment, there was plenty of demand for the increased yield offered on these loans. However, with concerns about the financial strength of consumers and rising interest rates, there is less demand for the loans generated by Carvana. In the second quarter, Carvana didn’t sell a pool of non-prime loans. In previous quarters, it had securitized both prime and non-prime loans. The company is due to report “earnings” on August 4, and some analysts are pessimistic.

Takeaways for Auto Dealers

Despite its issues, Carvana is the poster child for many consumer-centric shifts in the car buying space.

Consumers across the country now have numerous options to buy vehicles online, with extended test drive options becoming more available. Carvana’s decentralized approach and lower investment in real estate may also change the level of investment needed for the dealership of the future, though one could argue the current inventory shortage situation may have pushed the industry in this direction even without Carvana.

The auto dealer industry will continue to rely on and require investments in technology, particularly technology centered around the online buying experience. Dealers unwilling or unable to make these investments may opt to divest their dealership while profits and values are at relative peaks.

The fortunate thing for dealers is their access to new and used vehicles, in addition to financing and servicing of vehicles, ultimately means there are numerous potential profit centers that provide downside protection through all economic cycles. Online retailers like Carvana are seeking to disrupt the industry, but their lack of new vehicles and service departments put them at a distinct disadvantage that even explosive growth may not be able to overcome.

Mercer Capital follows the key players in the auto industry in order to stay current with the operating environment of our privately held auto dealer clients. To see how these trends may impact your dealership, contact a Mercer Capital professional today.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights