Case Review: Observations From a Recent Auto Dealer Litigation

A recent Appellate Court decision was released from a case (Thomas A. Buckley v. Grover C. Carlock, Jr. et.al.) that we were directly involved in back in 2019. The case centered around a shareholder oppression issue involving a minority owner of an “ultra-high-line” auto dealership. Mercer Capital was hired by the Defendant to serve as the expert witness.

The company at issue, TLC of Franklin, Inc. (“the Company”), was an official auto dealer for Aston Martin, Alfa Romeo, Lotus, Maserati, Rolls-Royce Motorcars and Bentley. The valuation aspect of the case required both experts to determine the fair value of the oppressed shareholder’s 20% interest in the Company as of January 31, 2017.

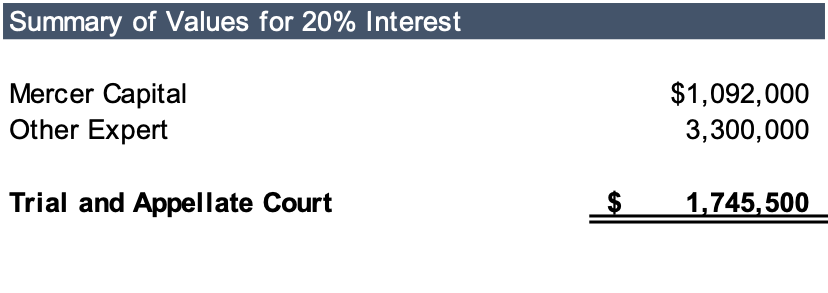

The Appellate Court upheld and affirmed the Trial Court’s determination of value of the 20% interest. A summary of each expert’s valuation opinion and the Court’s conclusion of value is as follows:

The nature of the Company’s underlying operations created several valuation challenges in this case. First, the unique set of the brands offered by TLC, that are referred to as “ultra-high-line,” is not as prevalent in auto dealerships across the country. Among the nearly 17,000 auto dealers in the U.S., there are very few that retail the premium brands offered by TLC of Franklin. Because of this, there is little published data on these franchises – from details of their historical profitability to market multiple representations of their value in transactions. The other challenge presented in this case was that the Company’s historical operations did not report consistent profitability during the reviewed period.

In this post, we highlight the differences in the assumptions and conclusions of both valuation experts, as well as provide observations regarding some of the commentary provided by the Trial and Appellate Courts in arriving at the ultimate conclusion of value. We also touch on normalization adjustments, valuation methodologies, and the way in which the Court decided its determination of value.

Normalization Adjustments to Earnings

What Are Normalizing Adjustments?

It is important in the valuation of an auto dealership to review the company’s financial statements to determine if any normalization adjustments should be made. Normalization adjustments take private company financials and adjust the balance sheet and income statement in order to view the company from the lens of a “public equivalent.” Typical normalizing adjustments to the income statement are made to non-recurring items, as well as discretionary expenses related to current management that would not necessarily be incurred by a hypothetical owner of that business. As mentioned previously, the actual historical operating performance of the Company was inconsistent during the reviewed period. In some years, the Company reported operating losses, making the determination of these adjustments difficult.

The Experts’ Application of Normalizing Adjustments

The experts disagreed with respect to the magnitude of normalization adjustments, though they agreed such a normalization adjustment would be necessary. For example, after directly identifying several adjustments to earnings, Mercer Capital selected a 1.5% normalization factor of pre-tax earnings-to-revenue based on the Company’s actual operating performance, similarly sized auto dealerships, and our experience valuing luxury and ultra-high-line dealerships. The Plaintiff’s expert determined a normalization factor of 5% of pre-tax earnings-to-revenue based on their experience valuing ultra-high-line dealerships.

The Trial Court’s Determination

The Trial Court selected a normalization factor of 2.8% – 2.9% of revenue based upon historical data for 2015 and 2016 as published by the National Auto Dealers Association (“NADA”). Specifically, the Court cited annual historical profitability for “Luxury” and “Import” brands noting they were the best comparison to TLC of Franklin. Until October 2021, NADA published monthly profitability data referred to as Dealership Financial Profiles for categories of auto dealerships, including average, domestic, import, mass market, and luxury, and the Trial Court relied heavily on this data.

The Use of Industry Comparable Data

The use of comparable data to compare a subject company to industry averages can be important to the valuation process. While NADA Dealership Financial Profiles is more specific than general industry profitability data, such as the Annual Statement Studies provided by the Risk Management Association (“RMA”), no single comparison is perfect, and appraisers should be careful in applying average percentages to their subject company.

The use of comparable data to compare a subject company to industry averages can be important to the valuation process.

TLC’s ultra-high-line brands were not included in the descriptions of the NADA Dealership Financial Profiles classifications, even among luxury dealerships, despite connoting a similar type of consumer. In reality, the representative average data in these studies is comprised of many dealers performing at higher or lower levels than the ultimate average. A rigid comparison to the average could potentially ignore the fact that the subject company has been performing below average since its operation or in recent history.

The other caution against a rigid normalization adjustment to an industry benchmark is the implied level of the resulting adjustment. In other words, by normalizing a company to a certain % of pre-tax earnings, what is the resulting dollar amount of the adjustment? Take, for example, a company with revenues of $35 million. To normalize earnings to a 5% pre-tax earnings level would imply that there are $1,750,000 of expenses to be normalized or added back.

The Plaintiff’s expert offered no evidence or specific expenses that would rise to that level in their review of the historical financial statements. Mercer Capital determined several normalization adjustments to earnings after reviewing the Company’s financial statements and discussions with management before making an overall normalization adjustment of 1.5% of earnings based on our experience with similar dealerships to TLC.

Valuation Methodologies Used

Income Approach

The income approach is a general way of determining the value indication of a business or ownership interest using one or more methods that convert anticipated economic benefits into a single present amount. The income approach allows for the consideration of characteristics specific to the subject business, such as anticipated earnings, level of risk, and growth prospects relative to the market.

Mercer Capital ultimately determined the value of the subject interest through the use of a capitalization of earnings method. Historical earnings were adjusted through a combination of direct normalization adjustments and an industry adjustment to 1.5% of revenues. The resulting value under the income approach represents the overall value of the dealership, both tangible and intangible. The difference between the overall value of the dealership under the income approach and the value of the dealership’s net tangible assets represents the implied value of the dealership’s intangible or Blue Sky value. Therefore, Mercer Capital’s income approach included and quantified the Blue Sky value of TLC.

The application of the income approach assumes that the company possesses the appropriate level of assets and liabilities to produce the level of anticipated earnings in the income approach. Only non-operating or excess assets are added to the value determined under the income approach. For example, some dealerships carry much more cash than needed for operations before eventually distributing it to owners. In such cases, the excess cash is added back on top of the indication of value under the income approach.

Mercer Capital did not identify any non-operating or excess assets owned by TLC. Therefore, no assets were added to our conclusion of value under this approach.

The Plaintiff’s expert did not employ an income approach in his determination of value.

Market Approach – Recent Transactions

One method under the market approach is to examine any transactions within the subject company’s stock. Appraisers will often examine whether any transactions have occurred, when they occurred, and at what terms they occurred. There is no magic number, but as with most statistics and data points, more transactions closer to the date of valuation can often be considered better indicators of value than fewer transactions further from the date of valuation.

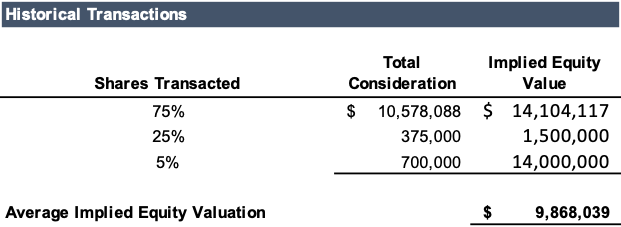

Three transactions occurred within the stock of TLC in the three to five years prior to the date of valuation. A summary of those transactions and their indicated equity values are as follows:

The Plaintiff’s expert used the internal transactions as one of his three valuation methods but only relied upon the first and third transaction in the figure above. All three transactions occurred in relatively similar proximity but obviously indicated materially different implications of overall value. Ironically, the second transaction that the expert excluded involved the plaintiff’s buy-in to the company.

The third transaction involved a minority sale to a celebrity, and no evidence was provided as to the motivations of the buyer and seller in that transaction or whether any financial information or due diligence was performed by the buyer. As such, it may be reasonable to consider this transaction less reliable as an indication of value than the other two.

The first transaction was for a 75% interest, which represents a controlling interest basis, which is a different level of value than the other two transactions. Since the subject interest is non-controlling, the level of value would be more comparable to the last two transactions in the table above.

Motivations of buyer and seller in internal transactions can be critical to their consideration in the overall valuation process.

Motivations of buyer and seller in internal transactions can be critical to their consideration in the overall valuation process. Motivations may not always be known, but it’s important for the financial expert to try to obtain that information. Suppose there have been multiple internal transactions, such as with TLC of Franklin. In that case, appraisers must determine the appropriateness of which transactions to include or exclude in their determination of value possibly. Without an understanding of the motivation of the parties and specific facts of the transactions, it becomes trickier to include some, but exclude others. The more logical conclusion would be to consider all of the transactions or exclude all of the transactions with a stated explanation.

The Trial Court was critical of the Plaintiff’s expert’s exclusion of transaction #2 and noted the material impact it would have on concluded values.

Mercer Capital observed the internal transactions of TLC but did not place any reliance on this method.

Market Approach – Blue Sky Method

Under the market approach, the Blue Sky method determines value by applying a brand-specific multiple to pre-tax earnings. This method estimates the intangible value or franchise rights of the specific brands they retail.

Blue sky multiples are published quarterly by two sell-side advisory firms in the auto dealership industry: Haig Partners and Kerrigan Advisors. Specific multiples are calculated and presented for each represented brand by quarter based on observed transactions. It should be noted that neither Haig nor Kerrigan publishes any multiples for ultra-high-line dealerships or any of the brands retailed by TLC.

The Plaintiff’s expert concluded a Blue Sky multiple of 8x based on reported multiples for luxury brands and applied that multiple to two different income streams. First, he applied the Blue Sky multiple to normalized earnings based on his 5% pre-tax figure described previously. Secondly, he applied the Blue Sky multiple to projected earnings based on figures from a management presentation.

The Trial Court was especially critical of the use of projections for TLC since it was not a start-up entity. Projections are rarely used in the valuation of auto dealerships. It should also be noted that no evidence was provided as to where the management projections came from, who produced them, and for what purpose. Blind or rigid reliance on management forecasts should be avoided especially if they are not discussed with management. Projections should be viewed with caution, especially in instances where projected results greatly exceed historical operating results or if the company has historically performed below previous projections or budgets. If projections must be used, appraisers typically account for this by using more conservative multiples to balance these lofty projected earnings.

To these approaches, the Plaintiff’s expert added back the net tangible assets of TLC since these methods estimate the intangible value or franchise rights of the brands represented by the dealership.

Mercer Capital did not rely on a direct Blue Sky method to value TLC since no published multiples exist for the brands represented by TLC. When applicable, we employ the use of a similar methodology to value dealerships in conjunction with or to support the valuation determined under another method, such as the income approach. The transaction multiples reported by Haig and Kerrigan are derived from negotiations between buyers and sellers. The ultimate consideration paid is determined by the buyer’s assessment of expected cash flows, the growth potential of those cash flows, and the anticipated rate of return. The multiple reflects the price paid in relation to a financial metric, in this case pre-tax earnings.

Courts’ Determination of Value

The Trial Court ultimately determined value through several calculations. The Court utilized the profitability data provided by the NADA Dealership Financial Profiles for luxury and import dealerships for 2015 and 2016 and applied profitability factors of 2.9% and 2.8% to TLC’s historical revenue for those years.

The Court concluded the use of an 8x multiple or factor to normalized pre-tax earnings to estimate value for TLC. The Court’s final conclusion of value for the subject 20% interest was $1,745,500. This conclusion included an average of those four calculations along with half of the adjusted net assets to reflect the inclusion of market and income methods. The Appellate Court affirmed the concluded value and methodology used by the Trial Court in this case.

Conclusion

As evidenced by this litigation case, the valuation of auto dealerships can be very challenging and complex. The subject company, in this case, provided additional challenges given the unique specialty of the brands that they retail, combined with their inconsistent and lack of historical profitability.

Mercer Capital provides valuation services to auto dealers and their advisors all over the country for litigation and non-litigation purposes. Contact a Mercer Capital professional today to learn more about the value of your dealership or if we can assist you in a litigation issue involving the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights