Dealership Working Capital

A Cautionary Tale Against Rigid Comparisons

We have previously written about six events that can trigger the need for a business valuation. In each of these examples, the valuation will consider the dealership as a going concern or a continuing operation. The valuation process considers normalization adjustments to both the balance sheet and the income statement, as we discussed in our whitepaper last summer. For the balance sheet, normalization adjustments establish the fair market value of the tangible assets of the dealership and also identify and bifurcate any excess or non-operating assets. Non-operating assets are anything of value owned by the company that is not required to generate earnings from the core operations of the dealership.

Even if a dealer is considering a potential sale of the business, the other assets and liabilities not transferred in the proposed transaction still have value to the seller when they consider the total value of operations. These non-core assets would then be added back to the value of the dealership operations determined under the other valuation methods. Profitable dealerships will accrue cash on their balance sheets over time. While these profits tend to either be reinvested into the business or distributed to owners, we frequently find that auto dealerships will carry a cash balance in excess of the needs of the core operations which could but have not yet been distributed. This excess is considered a non-operating asset, and as we discuss in this post, there are numerous considerations in determining the extent that cash buildup may represent an excess.

Working Capital on the Dealer Financial Statement

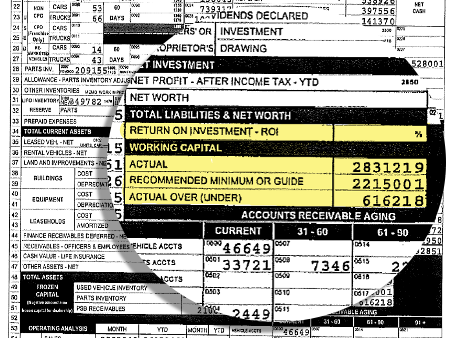

Cash (and contracts in transit) and inventory tend to be the two largest components of working capital (current assets minus current liabilities) for auto dealers. However, inventory is offset by floor-plan debt, requiring little actual upfront investment on the part of dealers. Still, there is a certain level of working capital required to maintain operations. Most factory dealer financial statements list the dealership’s actual working capital, along with the requirements or “guide” from the manufacturer on the face of the dealership financial statement, as seen in the graphic below.

A proper business valuation should assess whether the dealership has adequate working capital, or perhaps an excess or deficiency. Comparisons to required working capital should not always be a rigid calculation. An understanding of the auto dealer’s historical operating philosophy can assist in determining whether there is an excess or deficiency as different sales strategies can require different levels of working capital, regardless of factory requirements. Often, the date of valuation coincides to a certain event and may not align to the dealership’s year-end. The balance sheet at the valuation date could represent an interim period and may reflect certain seasonality of operations. A proper assessment of the working capital should consider the sources and uses of cash including anticipated distributions, capital expenditures, accrued and off-balance sheet liabilities, etc. For many reasons, it may not be appropriate to simply take the $616,218 from above and call this amount a non-operating asset.

Additional Challenges to Working Capital Assessment Caused by Industry Conditions

Since the start of the pandemic, the auto dealer industry has continued to rebound after initial declines caused by lockdowns and shelter in place orders. The industry has benefited from increased gross profit margins on new and used vehicles, reduced expenses in advertising, floor plan maintenance and staffing, and funds provided by the PPP. All have contributed to record performance for dealerships. The PPP funds pose additional challenges to assessing the working capital of a dealership; are the funds reported on the dealer’s financial statement or are they held in accounts not reflected on those financial statements? Is there a corresponding liability for the PPP loan on the balance sheet or has that loan been forgiven? The date of valuation and what was known/knowable as of that date frame the treatment of these and other items in business valuation. For dates of valuation later in 2020 and early 2021, the loan portion of the PPP funds may be written off to reflect either its actual or likely forgiveness, and the removal of the corresponding PPP loan can increase the dealership’s working capital.

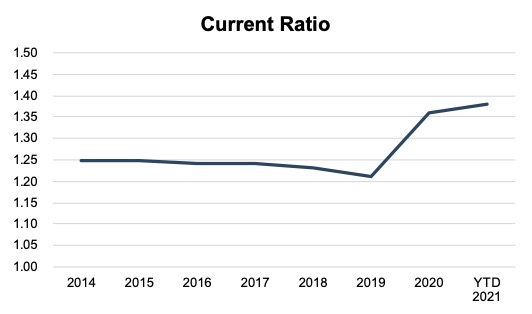

The increased profitability of dealerships can also be viewed in the rise of current ratios (current assets divided by current liabilities) over historical averages. According to the data provided by NADA, the average dealership’s current ratio has risen to 1.38, from prior averages around 1.24. Statistical data from 2014 through February 2021 can be seen below:

So how should the working capital of an auto dealership be assessed? Let’s look to a case study of a recent project to determine the factors to consider. Certain figures have been modified to improve the discussion and protect client information.

Case Study

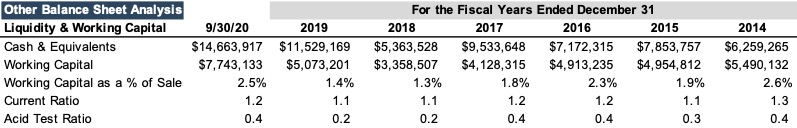

Consider a dealership with a date of valuation of September 30, 2020 compared to their typical calendar year-end. In a review of historical financial statements and operational performance, the Company reported increasing cash totals as seen below.

A quick review reveals that cash has increased by over $6 million in 2019 and $9 million from 2018 through the valuation date. Would the entirety of this increase represent excess working capital? Digging deeper, let’s examine the actual levels of working capital and working capital as a percentage of sales for the same company over the same historical period. As we can see above, working capital increased as a percentage of sales. A rigid comparison of the latest period’s working capital to the prior period might indicate excess working capital either on the order of $2.7 million or 1% of sales.

We can also look at the manufacturer’s requirement. This particular dealership had a net worth requirement and the more traditional working capital requirement. These are simple figures indicating whether a dealership is properly capitalized considering both liquidity and solvency.

All of these financial calculations and cursory level reviews of working capital and net worth fail to consider the specific assets and liabilities of the Company, the timing of the interim financial statements, and the anticipated uses of cash. It is critical to conduct an interview with management to discuss these items and the operating level of cash and working capital needed for ongoing operations.

Importance of Management Interview

In this example, management indicated that the ongoing cash needed to facilitate day-to-day operations would approximate $5 million. Deducting from the $14.7 million, would that indicate $9.0+ in excess cash based on comparison to the actual cash balance as of the date of valuation?

Management also provided details of a related party note payable to one of its owners not readily identifiable on the dealer financial statement. The note was a demand note that was callable at any time and was expected to be paid in the short-term. This is considered a non-operating liability, offsetting the excess cash. Management also anticipated heightened capital expenditures for the fourth quarter in the amount of $325,000. This type of information would be nearly impossible to discern from just analyzing the financials as this expenditure is an off-balance sheet item.

After learning this information, we chose to assess working capital utilizing three different methods. First, we assessed working capital in the context of net worth based upon the requirements from the manufacturer because the Company can’t distribute excess cash to the level that would reduce equity below this figure. This method resulted in an assessment of excess working capital of approximately $1.4 million as seen below:

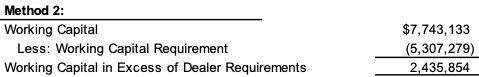

Next, we looked at the dealer’s working capital position compared to OEM requirements. This method showed closer to $2.4 million in excess working capital. While this shows the dealership may have ample liquidity to facilitate operations with less cash in the business, the excess cash cannot materially impair the required book value above.

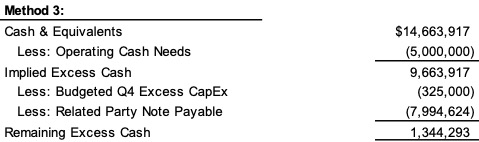

The final assessment of working capital focuses directly on the cash and equivalents. As discussed, management indicated that the Company had operational cash needs of $5 million. Additional uses of cash prior to year-end included the likely repayment of the related party demand note and the cash required for the capital expenditures. This method resulted in an assessment of working capital of approximately $1.3 million, compared to a rigid calculation of $9.6 million when only considering actual cash less operating level needs as seen below:

Ultimately, we concluded the Company in this example had excess working capital in the form of approximately $1,350,000 in excess cash. While there was more cash on the balance sheet than historical periods, our other valuation methods assume appropriate investment in the business to sustain operations. As such, we would be double counting value to add back too much cash without considering necessary improvements to the business to generate profits in the future.

This example highlighted a dealership with excess working capital that was reflected in excess cash. Occasionally, an analysis might indicate excess working capital, but the Company’s cash is not elevated above a sufficient level to fund operations. As discussed above, excess and non-operating assets are those that could theoretically be distributed while not affecting the core operations of the dealership. However, non-cash current assets, such as Accounts Receivable and Inventory, are either not readily distributable or doing so might jeopardize the core operations.

For a valuation performed in March 2021, industry conditions would also impact these calculations. Many dealerships likely have excess cash from increased profitability caused by inventory shortages. While cash balances would be higher when compared to historical levels, overall working capital may not be too unchanged as dealers struggle to maintain adequate inventory. Extracting value in the form of excess cash in this environment would need to be balanced with appropriate consideration of ongoing sales abilities with constrained inventories. As we’ve shown throughout this case study, none of these figures can be viewed in isolation.

Conclusions

Working capital and other normalization adjustments to the balance sheet are critical to the valuation of an auto dealership. The identification and assessment of any excess or deficiency in working capital can lead directly to an increase or decrease in value. Valuable datapoints to measure working capital include the requirements by the manufacturer and the Company’s actual historical cash and working capital balances, along with its current ratio and working capital as a percentage of sales. None of these data points should be applied rigidly and should be viewed in the context of future sources and uses of cash, the presence of non-operating assets or liabilities, and the seasonality of an interim date of valuation. Additional challenges for current valuations can be posed by PPP funds and prevailing industry conditions including scarce inventory and heightened profitability.

The professionals of Mercer Capital’s Auto Dealership Team provide valuations of auto dealers for a variety of purposes. Our valuations contemplate the necessary balance sheet and income statement adjustments and provide a broader view to determine the assumptions driving the valuation. For a valuation of your auto dealership, contact a professional at Mercer Capital today.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights