December 2022 SAAR

The December SAAR was 13.3 million units, down 5.3% from last month but up 4.7% from this time last year. This month’s SAAR data is a bit concerning for the auto industry, as supply chain improvements do not seem to be translating to improvements in vehicle sales pace as quickly as the last couple months have indicated. Over the past month, it has seemed more and more likely that plummeting trade-in equity, persistently-high interest rates, and growing fears of an economic recession are keeping the sale of automobiles low, which could spell trouble for auto dealers that have thrived in a high-price environment over the past eighteen months.

Suppose the demand side of the auto sales equation is truly deteriorating just as supply seeks to turn the corner. In that case, dealers may be forced to return to many pre-pandemic sales practices like negotiating sticker prices and offering incentives to buyers. If auto dealers are looking for a crystal ball, they can look to the housing market, which has shifted from a “seller’s market” to a “buyer’s market” in most regions across the country over the last few months.

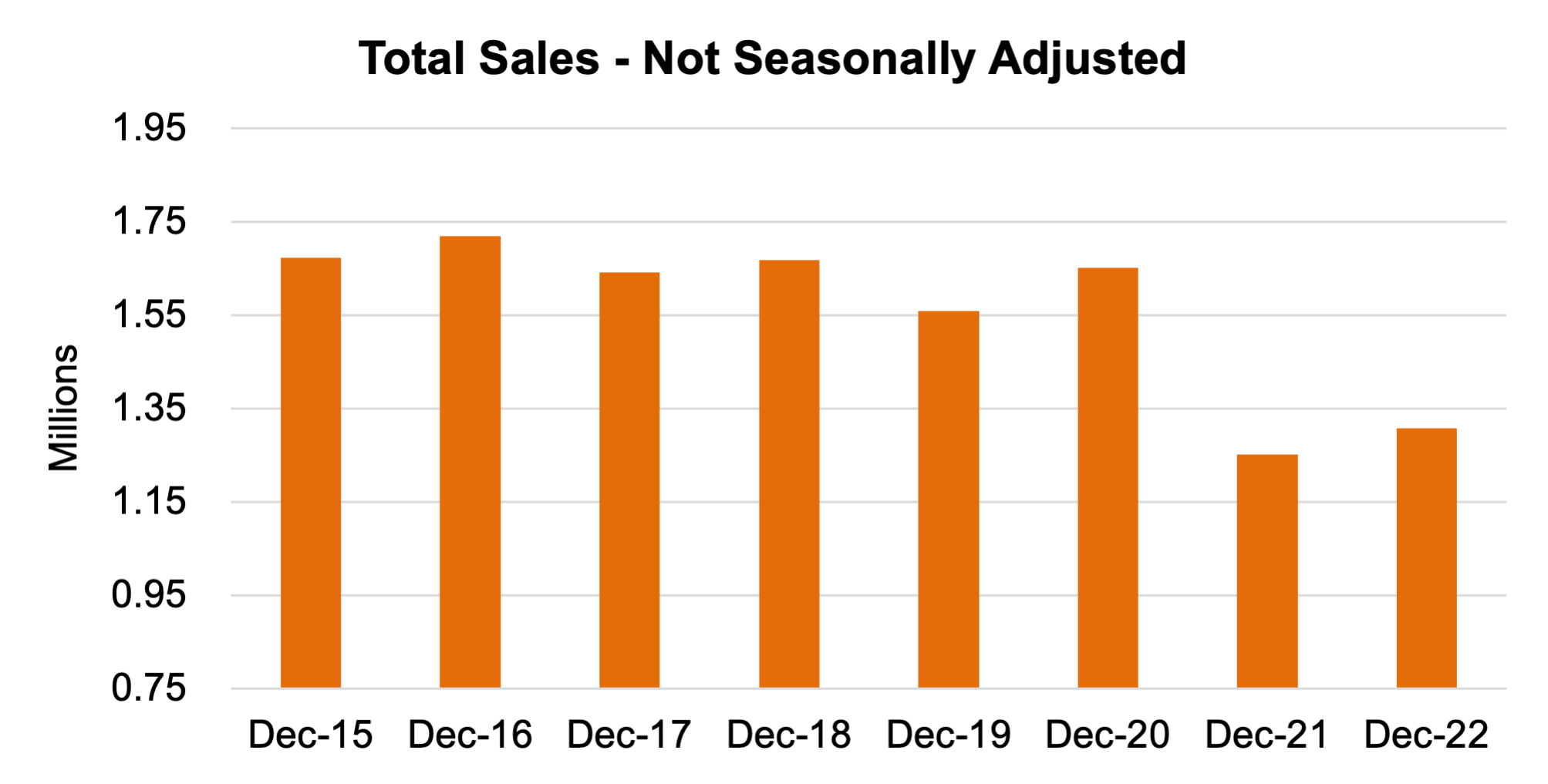

The full year 2022 SAAR ended at 13.77 million units, the lowest full year of light vehicle sales since supply-constrained 2011, and 8.2% lower than last year. When we look back at 2022, the story has mainly been the same the entire year. Supply chain disruptions kept inventories low while industry-wide demand remained unknown as the year played out. Industry experts posited that pent-up demand was present at the beginning of 2022, but there was no real way to confirm that hypothesis until inventory balances improved and pent-up demand was given a chance to play out in the market. Now that dealer lots are filling back up, the narrative needs some fine-tuning. General economic conditions have deteriorated in 2022, which seems to have become more acute over the last few months. Auto dealers may need to consider getting ahead of a potential recession by conceding to buyers in ways they can afford. It remains to be seen whether elevated profits in previous years were a pull-forward of earnings, given the impact inflated vehicle prices will have on returned leases and higher magnitudes of negative equity on trade-ins.

Inventory

To keep with the recent trend, industry-wide inventory continued to improve over the last month. According to Wards Intelligence, inventory on the ground and in transit at the end of December 2022 is forecast to total 1.7 million units, an increase of 51% compared with December 2021. While improvements of this magnitude are not expected to continue throughout 2023, it seems more and more likely that a recovery of the auto supply chain is in its final act.

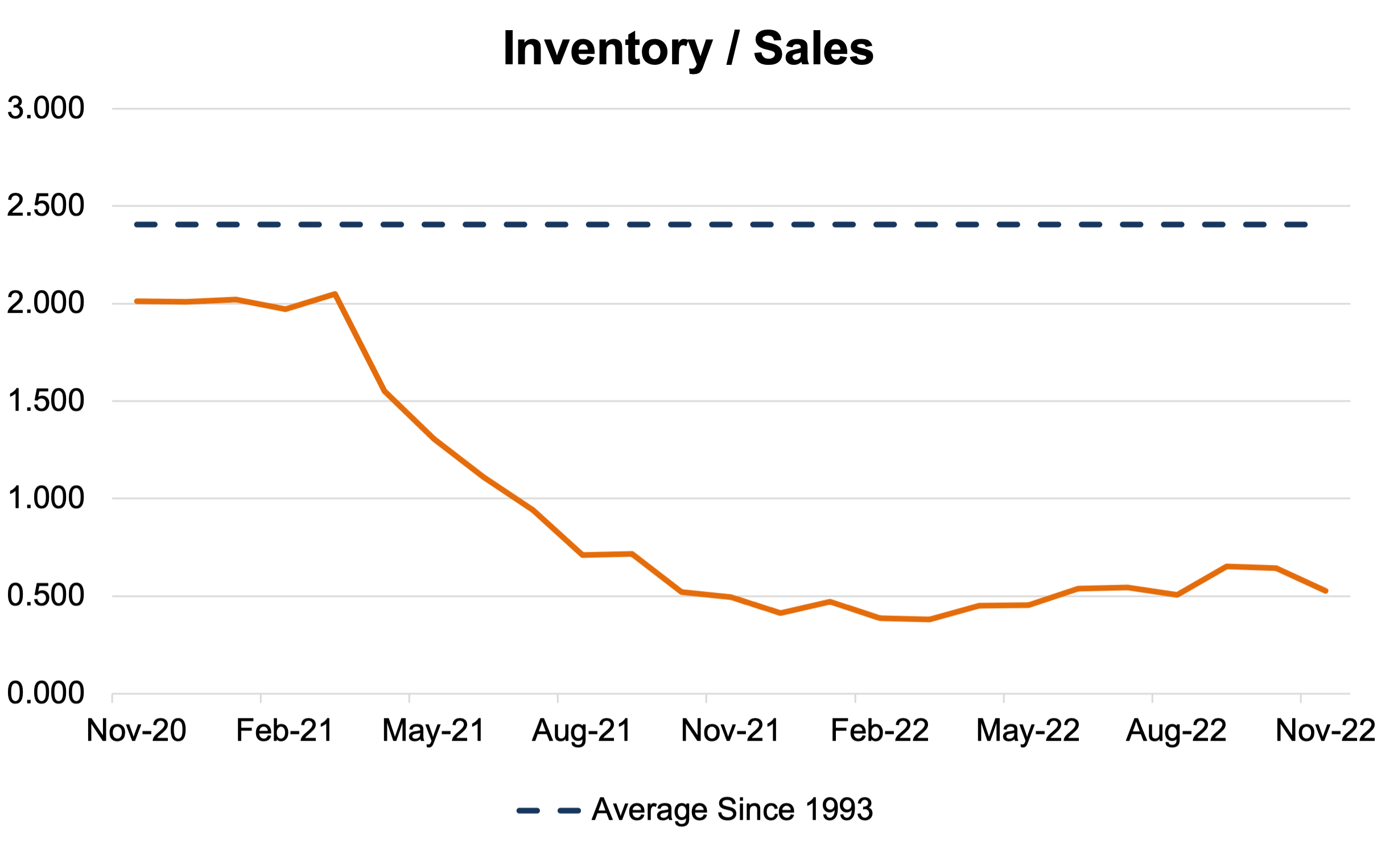

The industry’s inventory-to-sales ratio has remained low despite improvements in raw inventory numbers over the last few months. While this might seem counter-intuitive, a bounce-back to pre-pandemic levels will take significant time to achieve. As 2023 plays out, we expect this ratio to continue to creep upward toward its long-run average of 2.4x.

Transaction Prices and Incentive Spending

Despite pressures that may push vehicle prices down in 2023, the price of a new vehicle remained high in December. According to J.D Power, the average new vehicle price over the last month was $46,382, an increase of 2.5% compared to this time last year. Given the current inflationary environment, vehicle pricing will likely remain sticky compared to other key inputs that affect vehicle affordability, as input prices are the most significant determinant of sticker prices.

On the other hand, incentive spending has already turned the corner. After six straight months of under $1,000 in incentive spending, December’s average per unit of $1,187 marked the second month with over $1,000 in incentive spending. We find it likely that incentive spending per unit will continue to increase over the next year, given affordability issues.

LIFO Relief Incoming?

Around half of the nation’s dealerships use the LIFO method of inventory accounting, but dealerships of all sizes are facing large income tax bills this year due to LIFO. Why is that so? LIFO accounting works for dealers when there is a steadily increasing supply of inventory on the lot year after year, keeping the deferment of income afloat and lowering tax bills. However, a sharp decrease in inventory due to supply chain and chip shortage issues during the COVID-19 pandemic means that auto dealers will likely be subject to LIFO Recapture Taxes, meaning that the LIFO reserve is “recaptured” and taxed as ordinary business income. This creates a tax bill without commensurately increased cash flow, causing a cash crunch for auto dealers.

Consider a dealership with a $2 million LIFO reserve, normally carrying 200 vehicles in inventory. Currently, it’s only carrying 20 vehicles in inventory due to supply shortages. This dealership will likely have to recapture most of its LIFO reserve. We previously wrote about this potential issue when the legislation was in its early stages.

NADA and AICPA Seek Relief

The National Automobile Dealers Association (NADA) and the American Institute of Certified Public Accountants (AICPA) issued letters to the U.S. Treasury concerning this issue and its possible solutions. Section 473 of the IRS Code, amended in 1980, outlines three scenarios where LIFO could be temporarily paused, allowing dealerships to replenish their inventories to normal levels. One of the scenarios states that LIFO can be paused if there is a “major foreign trade interruption,” which could describe the supply chain disruption that occurred in the auto industry.

Senate Passes LIFO Relief Bill, House of Representatives Punts to Next Session

According to the NADA, on December 22, 2022, the Senate passed the “Supply Chain Disruptions Relief Act,” a bipartisan piece of legislation with 174 co-sponsors (including members from the House) in the nation’s capital. In practice, this bill would allow auto dealers to recompute their tax liability for fiscal 2021 and 2022 such that there are no LIFO recapture taxes. This refiling would come without the expense of filing an amended tax return. Any LIFO recapture taxes paid up to this point will be deemed prepaid taxes by the IRS.

While there was no significant opposition to the bill in the House of Representatives, consideration of the bill continues to be delayed by procedural complications and last-minute Treasury Department revisions to the legislation, which were deemed unacceptable and later dropped. The bill is set to be re-introduced during the legislative session in January.

It will be interesting to see if the bill can make it through the House this month, especially as the legislative body works through other key issues like electing a new Speaker of the House. No matter which direction the vote goes, auto dealers will want to keep an eye on the result as they plan their payment of taxes for the last two years.

January 2023 Outlook

Mercer Capital’s outlook for the January 2023 SAAR continues to be optimistic. Industry supply chain conditions are improving. However, sales volumes will likely continue to be closely tied to production volumes, although less so than a few months ago. High profitability across the entire industry will likely continue as high prices boost margins on vehicle sales. Consumer activity may begin to cool off as affordability becomes an issue for many prospective buyers, but at this point, we have to see it to believe it.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights