December 2023 SAAR

The December 2023 SAAR was 15.8 million units, up 3.2% from last month and up 16.8% compared to this time last year. After only two months of single-digit year-over-year improvements, the December SAAR returned to double-digit year-over-year growth. The December SAAR marks a strong finish to 2023, with growth in line with the double-digit percent increases seen from March to September. The December SAAR extended the streak of consecutive year-over-year improvements to 17 months.

Moving into 2024, as inventory strengthens and talks of rate cuts resume, we are likely to see improved affordability and lower vehicle pricing. While OEMs may experience lower per-unit profitability, greater affordability will likely drive sales and promote stability and strength in overall OEM profitability. Following a year of recovery in 2023, the SAAR maintains potential for growth in 2024.

Unadjusted Sales Data

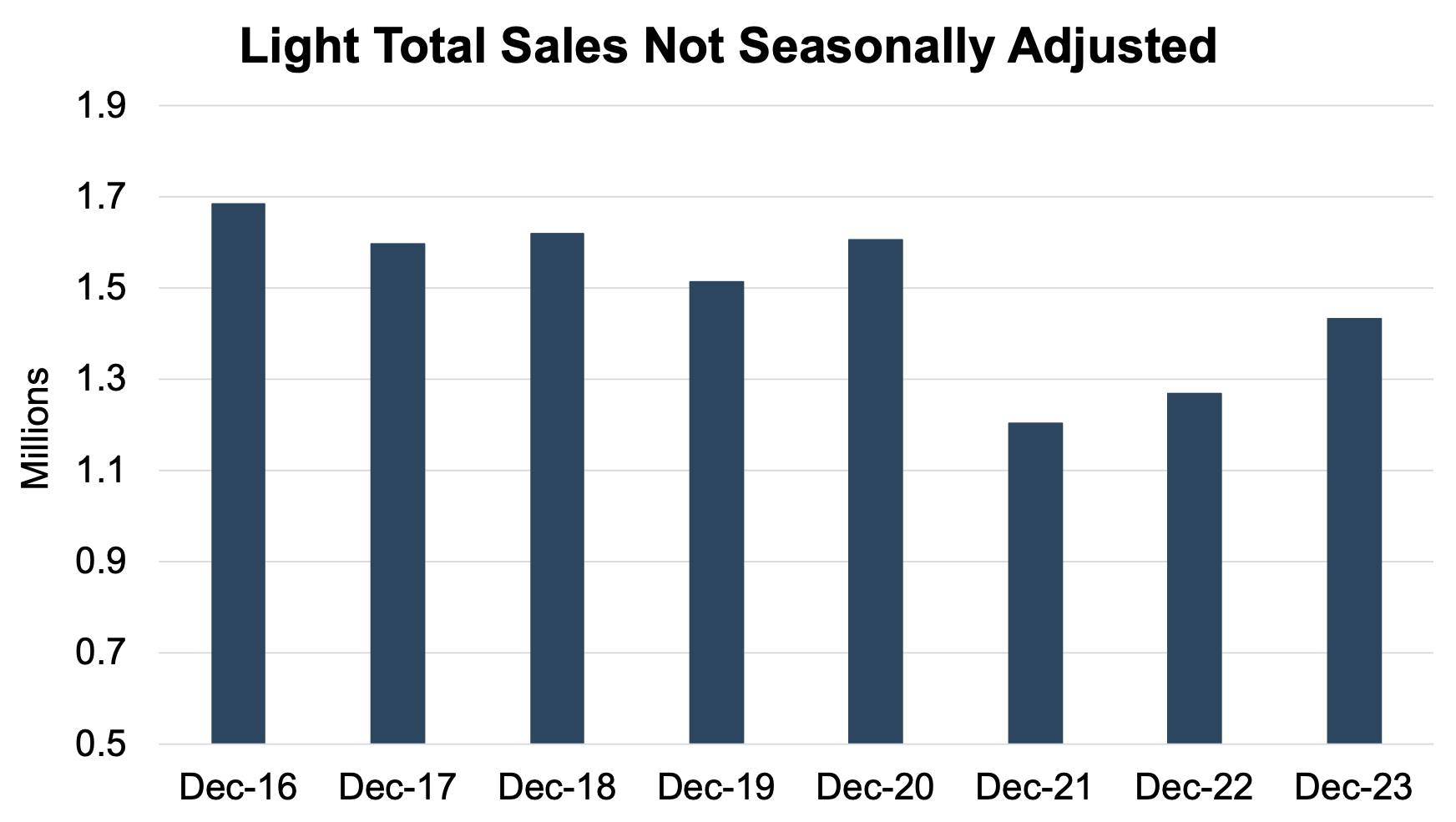

The chart below shows unadjusted total sales volumes for the last eight Decembers:

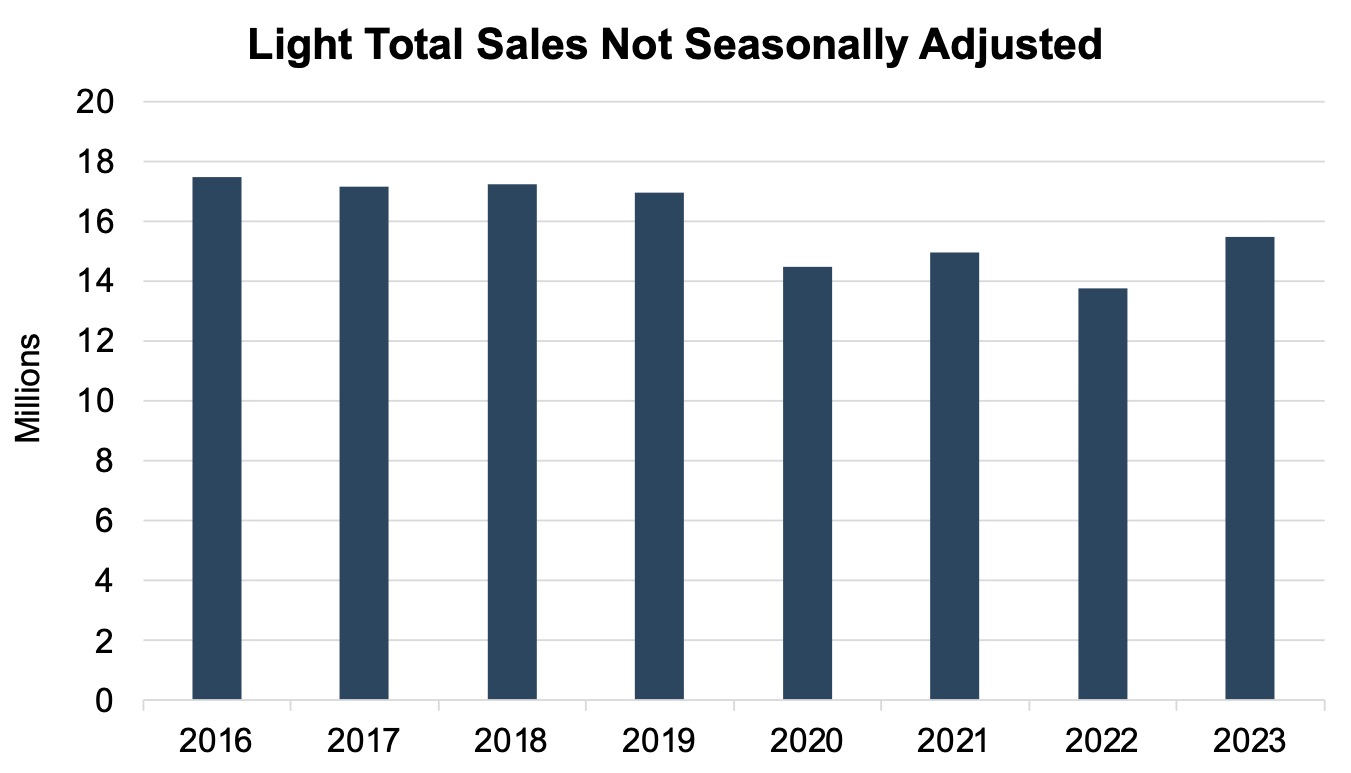

On an unadjusted basis, the industry sold 1.43 million total units last month, marking the highest level of December sales since 2020. The 2023 unadjusted total comes in at 15.5 million units, outpacing last year’s 13.8 million units and 2021’s 14.9 million units.

For the last four years, depressed inventory, elevated interest rates, and heightened inflationary pressures have impeded industry sales. While unadjusted industry sales have remained well below pre-pandemic levels, 2023 proved to be a year of recovery, finishing the year just shy of 16 million units. The chart below presents unadjusted total sales volumes for the last eight years:

Inventory and Days’ Supply

According to the NADA, new light vehicle inventory in December reflected a slight decrease from November. Even then, new light vehicle inventory saw year-over-year growth of 37.8% in December, emphasizing the significant progress that the industry has achieved over the last year.

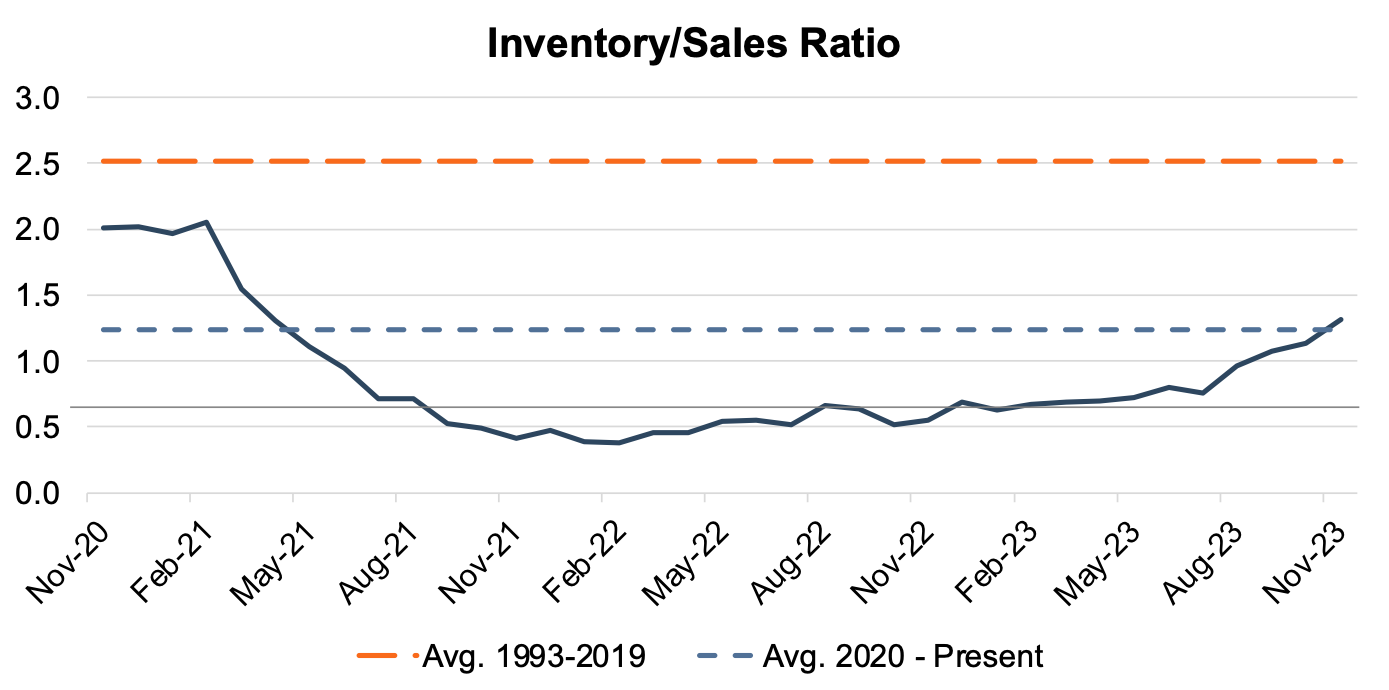

In recent months, the industry’s inventory-to-sales ratio crossed the 1.0x threshold. November 2023 data marks the third time the ratio has been above 1.0x since May 2021. For perspective, an inventory-to-sales ratio greater than 1.0x indicates that the seasonally adjusted inventory level at the end of the month was greater than reported sales. The November ratio of 1.31x signifies an expansion in nationwide inventory, contrasting with the suppressed inventory levels seen over the past few years. The chart below illustrates the industry’s inventory-to-sales ratio over the last three years.

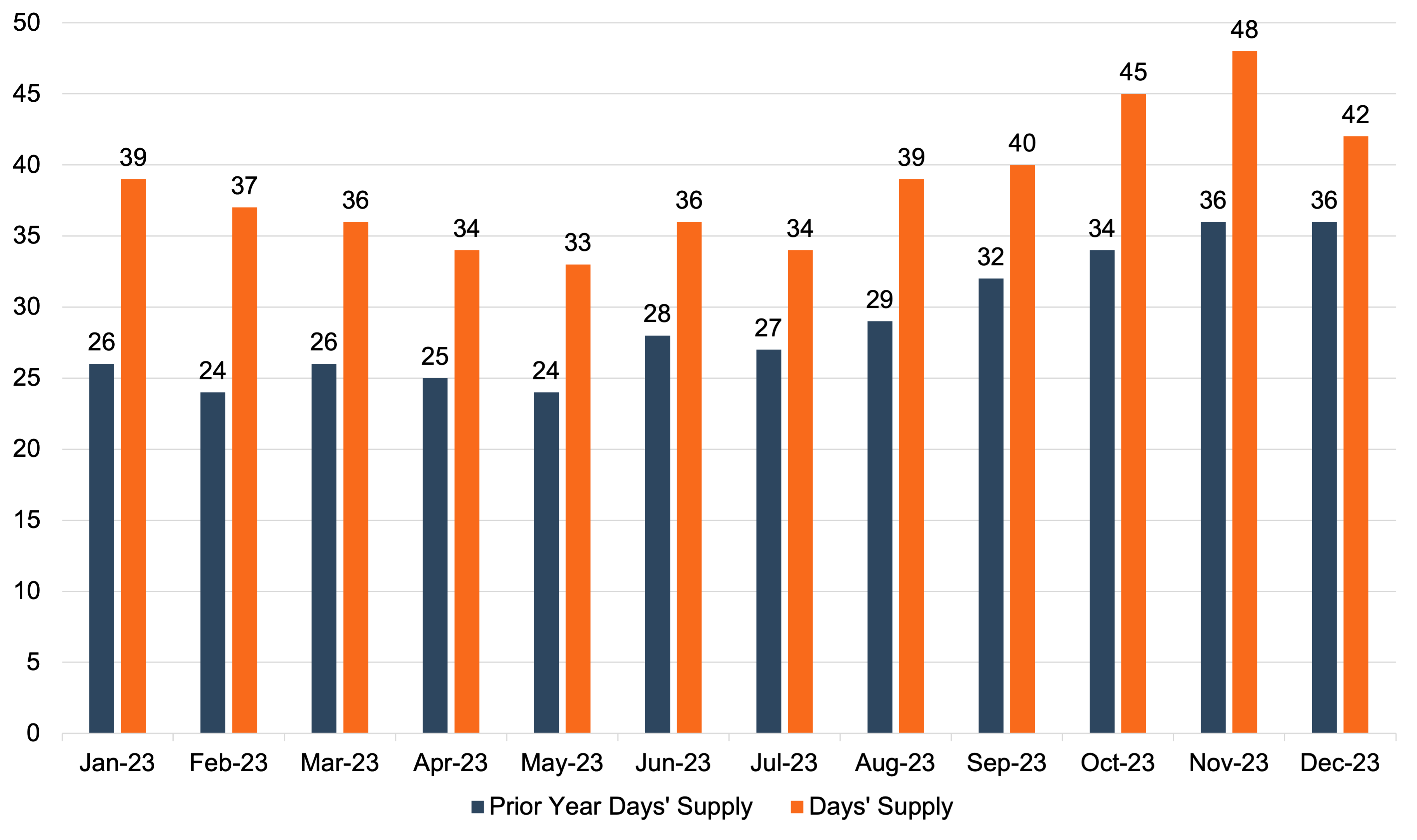

Days’ Supply, which has steadily increased over the past year, is another way to view the relationship between auto sales and inventory balances. In December 2023, Days’ Supply actually fell to 42 from the November 2023 high of 48. It remains to be seen whether this is a blip or a sign that inventory recovery may moderate. The chart below gives a closer look at Days’ Supply for U.S. Light Vehicles over the past year (per Wards Intelligence):

Thomas King, president of data and analytics at J.D. Power, made the following comments on December’s inventory levels and growth expectations for 2024:

“Sales growth for December is being enabled by improving vehicle availability and affordability. Retail inventory levels in December are expected to finish around 1.7 million units, a 7.6% increase from last month and 55.1% increase compared with December 2022, but still nearly 40% below pre-pandemic levels.”

“While retailers continue to pre-sell vehicles, rising inventory is enabling more shoppers to buy directly off dealer lots. In December, 35.5% of vehicles are projected to be sold within 10 days of their arrival at the dealership, which is down from the peak of 57% in March 2022. The average time that a new vehicle spends in the dealer’s possession before being sold is expected to be 38 days, up 13 days from a year ago, but still less than half the pre-pandemic average of 70 days.”

“In 2024, retail inventory is expected to keep rising and that increase in supply will lead to moderation in pricing. Additionally, anticipated interest rate cuts will also help affordability. This trend will drive an increase in sales, but at the expense of OEM and retailer per-unit profitability. This tradeoff between increased volume and lower per-unit profit means that total profitability for OEMs and retailers will remain very strong relative to historical levels.”

Transaction Prices

Mr. King also discussed the downward trend in average transaction prices for used vehicles in December:

“Average used-vehicle prices are forecasted to be $29,413 in December, reflecting a 2.6% or $786 decrease to December 2022. However, they remain 28.7% higher than the pre-pandemic level. The decline in used-vehicle values is translating to lower trade-in equity for consumers. The average trade-in equity is trending towards $8,521, down $780 from a year ago. It’s important to note that despite this decrease, trade-in equity remains nearly double the amount prior to the pandemic.”

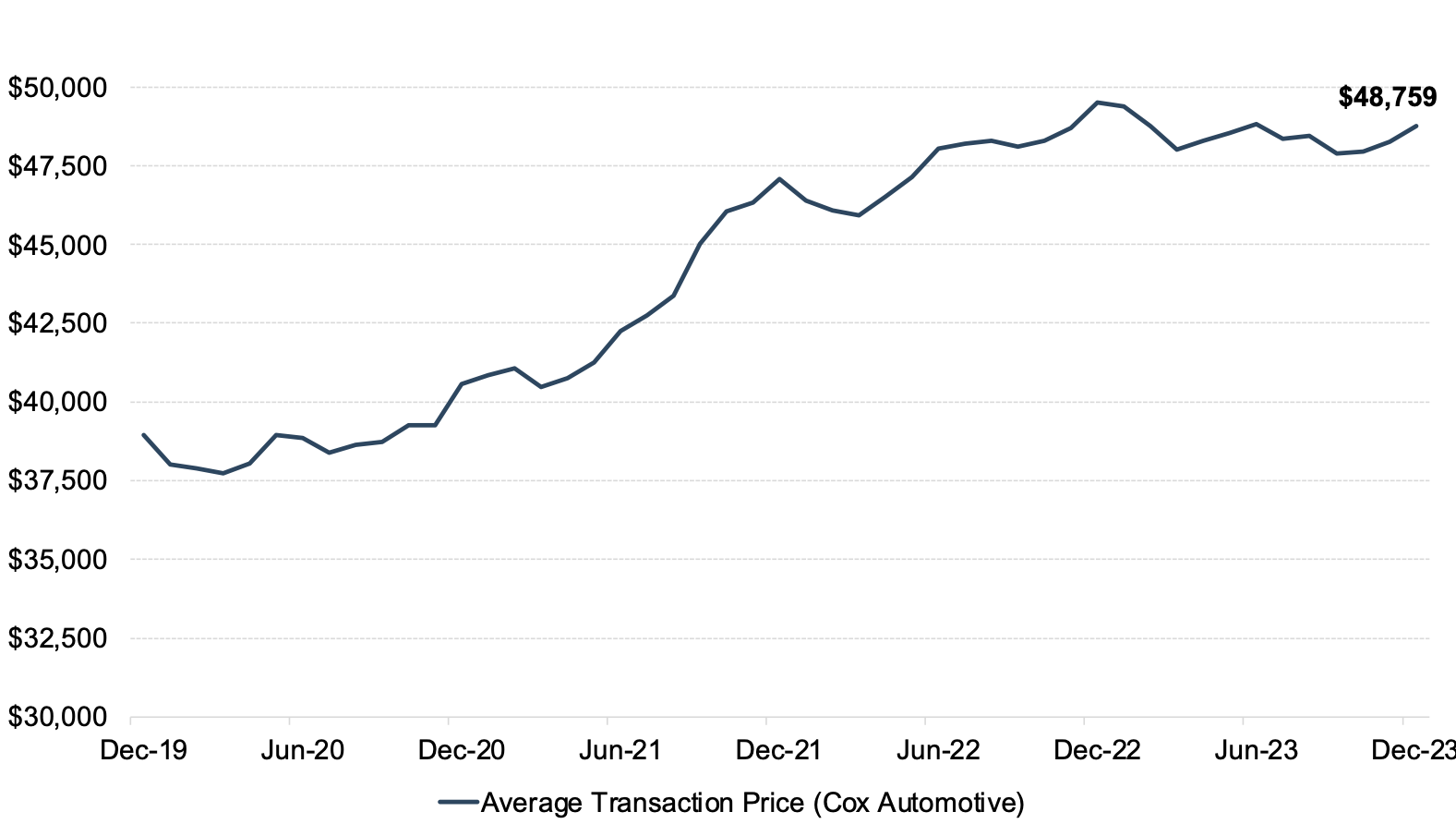

While the average used-vehicle transaction price slightly dipped in December, the average new-vehicle transaction price increased 1.3% from November. The chart below provides context around the monthly average transaction price (per Cox Automotive) from December 2019 to December 2023.

Incentive Spending

According to J.D. Power, average incentive spending per unit in December is expected to hit $2,458, up 90.7% from the historically low levels one year ago. Incentive spending as a percentage of the average MSRP is expected to reach 4.9%, reflecting an increase of 2.3 percentage points from December 2022. While incentive spending continues to trend higher in December, it is important to note that these are average figures, and some markets and vehicle make/models are still transacting closer to MSRP.

2024 Outlook

Mercer Capital’s expectation for the January 2024 SAAR remains in the 15-15.5 million range. Despite inflated pricing and elevated interest rates, we believe the recovery of inventory levels and higher incentives can generate transaction activity in the industry. Even though the last several months of the SAAR have landed closer to 15.5 million than June’s peak of 16.1 million, we believe that sales levels will likely remain strong into the new year. Mr. King indicated falling interest rates would be a tailwind to volumes in 2024. While the Fed’s dot plot indicates this is likely, we don’t anticipate a rate cut in the next few months.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights