December 2024 SAAR

The December 2024 SAAR came in at 16.8 million units, just slightly higher than last month and up 4.2% from December 2023. Notably, this month’s SAAR outpaced the last three Decembers and was the highest monthly SAAR since May 2021 (17.0 million units).

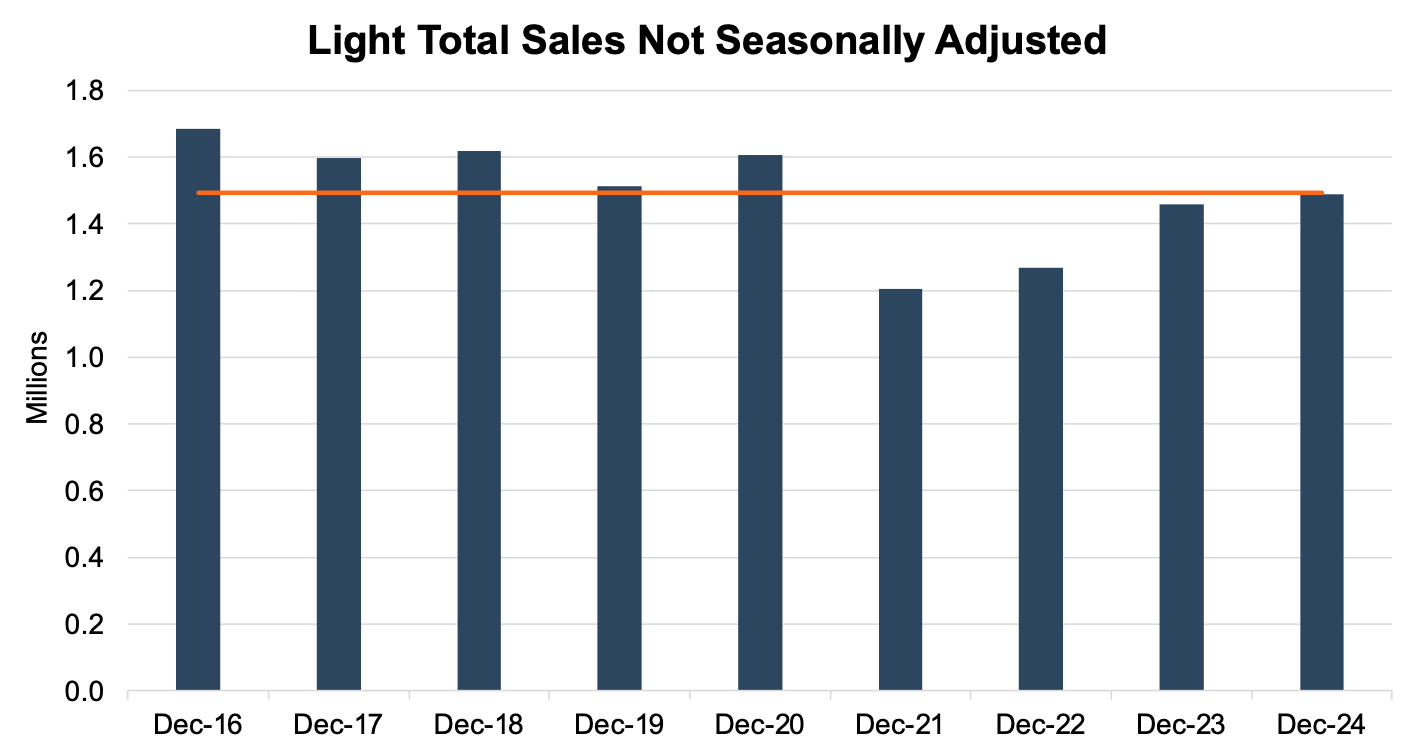

Unadjusted Sales Data

On an unadjusted basis, the industry sold 1.48 million units during December 2024, an 8.4% increase from last month and a 2.0% increase from this time last year. This month’s unadjusted sales landed four thousand units shy of the nine-year December average of 1.493 million units (2016 – 2024), emphasizing that this December’s sales volumes may be higher than recent years but remain below the pre-pandemic levels. During 2024, we have seen this trend play out almost every month as unadjusted monthly sales creep closer to their respective nine-year averages. See the chart below for a look at unadjusted sales over the last nine Decembers.

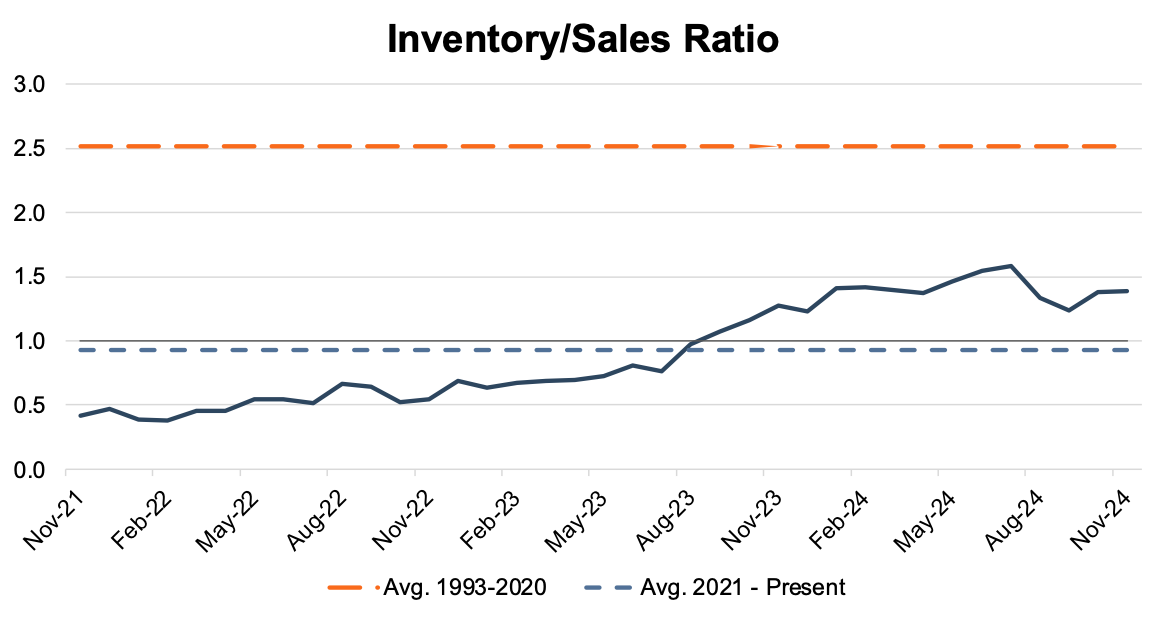

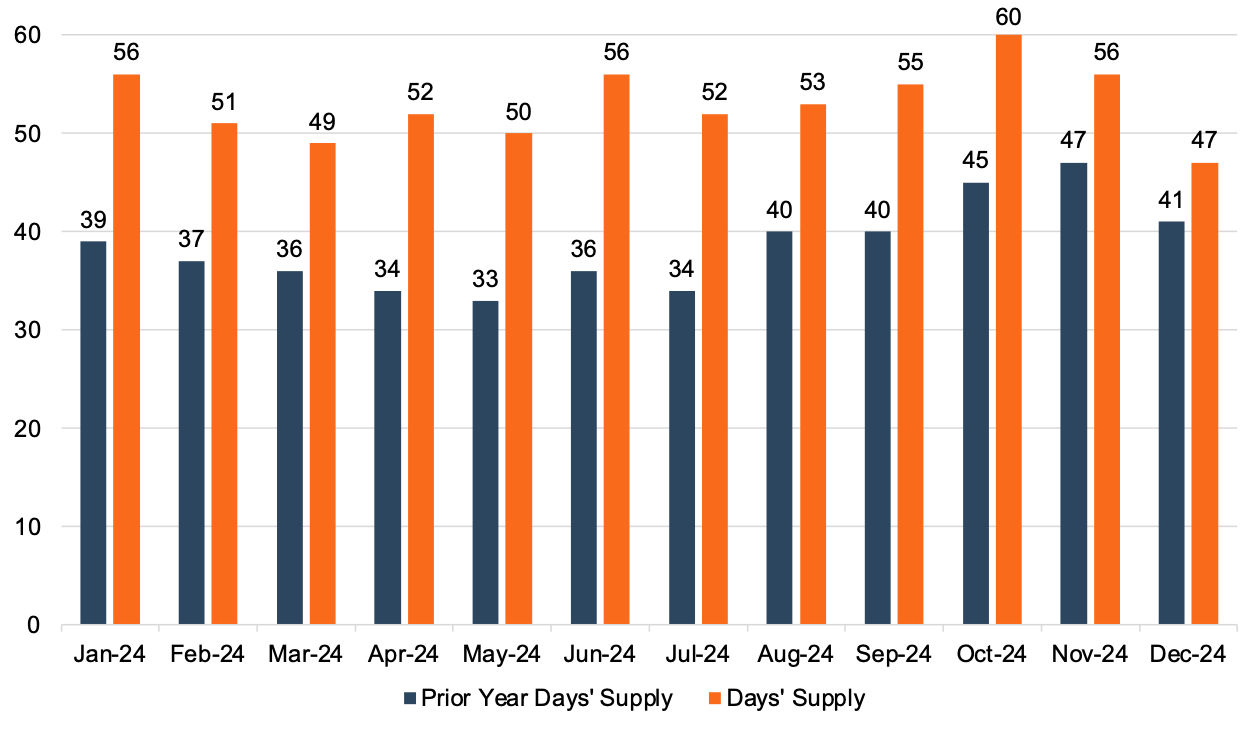

Days’ Supply

The industry’s inventory-to-sales ratio held steady in November 2024, coming in at 1.39x compared to 1.38x in October. Following major industry disruptions throughout the last several years, the November metric reflects the continued stability of the supply and demand dynamic in the market. The chart below illustrates the industry’s inventory-to-sales ratio over the last three years. We notice that while inventories have been rebuilt, they are well below pre-COVID levels when compared to sales activity.

Days’ supply came in at 47 days in December 2024. Throughout 2024, inventory levels suggest that the global supply chain has largely rebounded from the lows of the Covid-19 pandemic. Generally, the rebound of inventory levels over the last several months has driven sales increases as consumers are able to access a wider, more affordable inventory base. It is important to note that inventory levels vary significantly from brand to brand. The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence). While December 2024 was still greater than 2023, we note a decline from the recent peak of 60 days in October 2024, ending the year at a low.

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in December:

“The average retail transaction price for new vehicles is up marginally from a year ago, trending toward $46,258—up $52 or 0.1%—from December 2023. The combination of considerably higher retail sales and slightly higher transaction prices means that buyers are on track to spend nearly $56.4 billion on new vehicles this month—8.1% higher than December 2023, and the highest of any month on record.”

While transaction prices have generally been flat since last year, dealership profitability and margins will likely continue moderating as inventories and incentive spending remain elevated.

Incentive Spending and Profitability

OEMs typically use incentive spending as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability. J.D. Power notes that average incentive spending per unit in December 2024 is expected to be $3,442, up 30.7% from December 2023. Incentive spending as a percentage of the average MSRP is expected to reach 6.6% during December 2024, an increase of 1.4 percentage points from this time last year.

When it comes to retailer profit per unit, J.D. Power points out the following:

“Total retailer profit per unit—which includes vehicles gross plus finance and insurance income—is expected to be $2,107, down 19.7% from December 2023. The decline in profits is primarily driven by rising inventory levels, with fewer vehicles selling above the manufacturer’s suggested retail price (MSRP). Thus far in December, only 11.8% of new vehicles have been sold above MSRP, which is down from 19.7% in December 2023.”

January 2025 Outlook

Mercer Capital expects the January 2025 SAAR to come in around 16.5 million, primarily driven by the greater breadth of inventory available and increased affordability.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights