Demise of the Sedan

Does Recent Data Suggest the Sedan Will Follow the Station Wagon and Minivan?

As a working parent to two young boys, summers offer a blend of fun-filled activities and creativity to meet the logistics and calendar challenges of various camps and extra-curricular activities. At the start of the summer, I informed my sons that I would attempt to impart some wisdom and laughs by taking a tour of my favorite 80s and 90s movies. We’ve kicked off the summer by enjoying some classics, including Ghostbusters, Short Circuit, Honey I Shrunk the Kids, and National Lampoon’s Vacation movie. Each movie arrives with a myriad of questions from my sons about the plot lines to the outdated clothes and electronics. Sure enough, the first question I had to field from them on Vacation was, what the heck is the “family truckster” or station wagon that Chevy Chase begrudgingly picks up before departing on a cross-country family road trip to Wally World? I had to explain to my sons that while their mother drives an SUV now, it replaced the popular minivans in the 80s and 90s and the station wagons in the 70s and 80s.

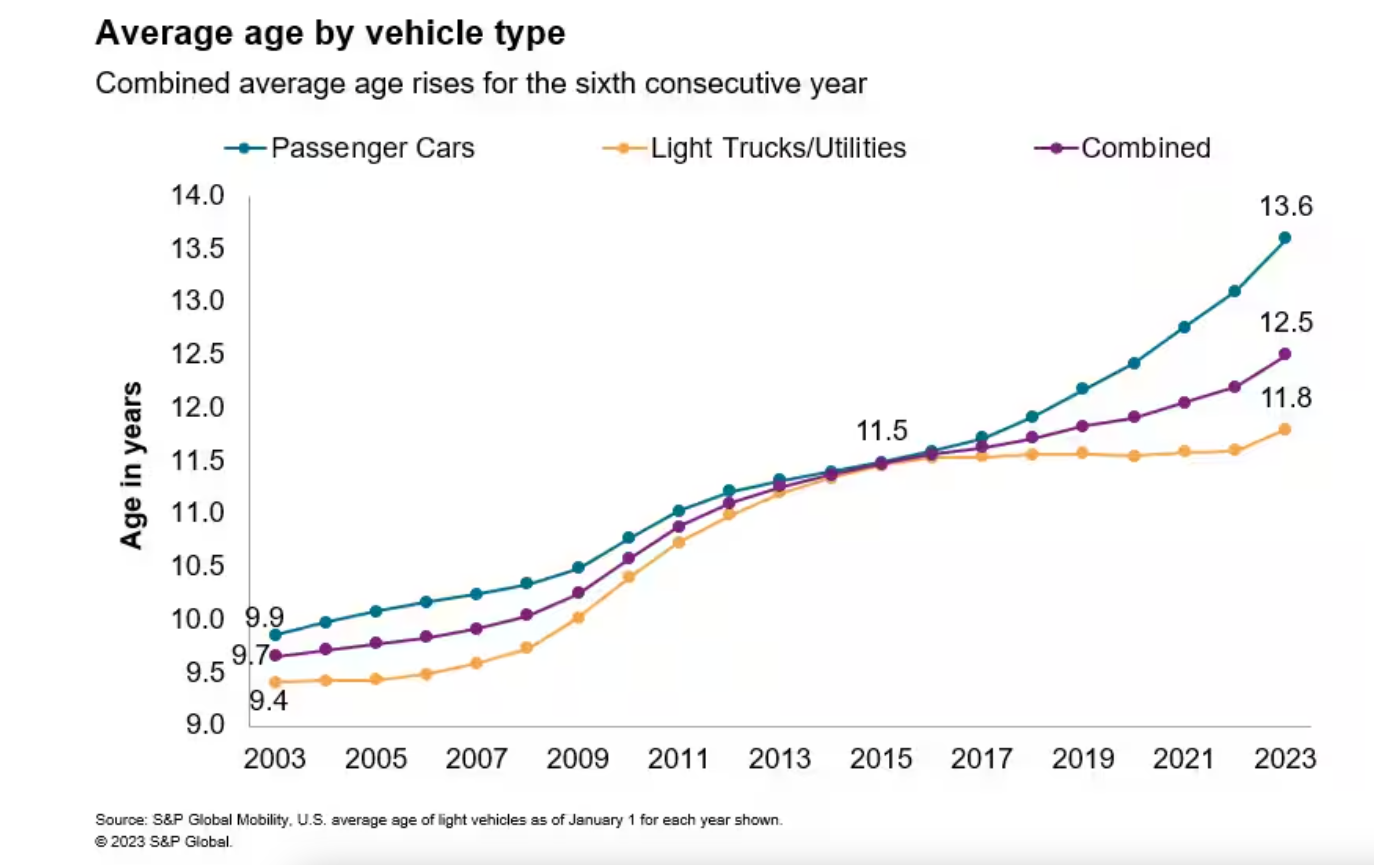

S&P Global Mobility recently published its average age of cars and light trucks data. The results made me dig deeper into the data to determine if the sedan/passenger car is being phased out like minivans and station wagons before them. Or do other trends suggest they could be making a comeback? Let’s begin with the original data: the average age of cars and light trucks on the road in the United States is 12.5 years, an increase of nearly three months over the same average from 2022. The chart below depicts the trends for passenger cars, light trucks/utilities, and the combined average age since 2003:

The results of this study should come as no surprise. The average age of the passenger car is 13.6 years, while the average age for light trucks/utilities is 11.8 years. Consumers are keeping their cars longer for several reasons. For one, supply chain issues and microchip shortages have impacted the sale of new vehicles for the last two years. Rising transaction prices and interest rates caused by inflation fears have also partially thwarted demand for much of 2023. The S&P data also points to U.S. consumers’ preference for light trucks, SUVs, and crossovers to passenger cars/sedans. Despite light trucks/SUVs/crossovers costing more to maintain, S&P predicts the total number of passenger cars will decline below 100 million for the first time since 1978 sometime within the next two years. Furthermore, S&P predicts that 70 percent or more of all vehicles in use will be light trucks/SUVs/crossovers by 2028. We’ll examine some other reasons causing the rise in preference and profitability of this category of vehicles.

Perhaps the electric vehicle data from S&P Global Mobility will give us additional insights into the trends in vehicle preferences. The average age of battery electric vehicles (BEVs) in the United States is 3.6 years in 2023, down from 3.7 years the prior year, while new registrations for BEVs increased by almost 58 percent. This data alone would suggest that more new BEVs are being purchased, decreasing the average age. However, the average lifespan of a BEV is less than other vehicles, as evidenced by 6.6 percent of BEVs sold from 2013 through 2022 no longer in use compared to only 5.2 percent of other vehicles no longer in use that sold during the same time.

Production Growth in Trucks/SUVs

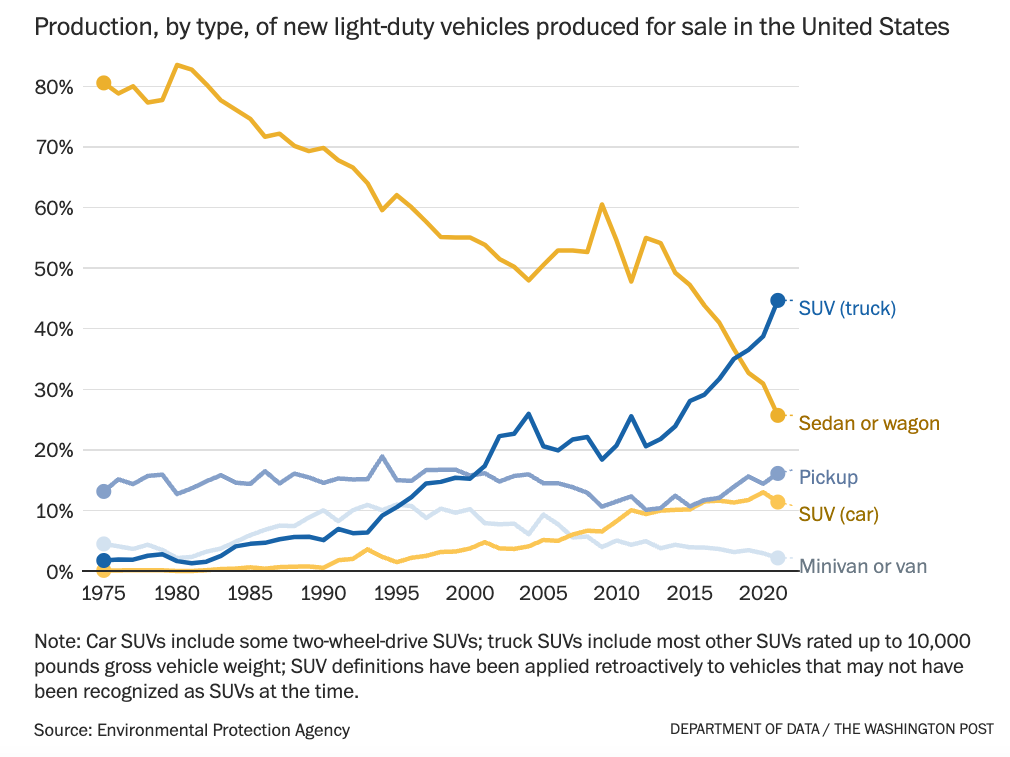

According to data released by the Environmental Protection Agency and reported in the Washington Post, the most significant area of growth in this segment has come from SUVs. As the chart displays below, sedans or wagons comprised approximately 80% of vehicle production in 1975, compared to only 25% in 2020. Conversely, SUV (trucks) comprised a meager 15% of total production compared to nearly 45% by 2020. SUV (cars) or crossovers were virtually non-existent in 1975 but accounted for over 10% of total production in 2020. Minivans and vans saw a slight erosion, while pickup trucks have remained mostly flat.

Fuel Economy for Trucks/SUVs vs. Sedans/Wagons

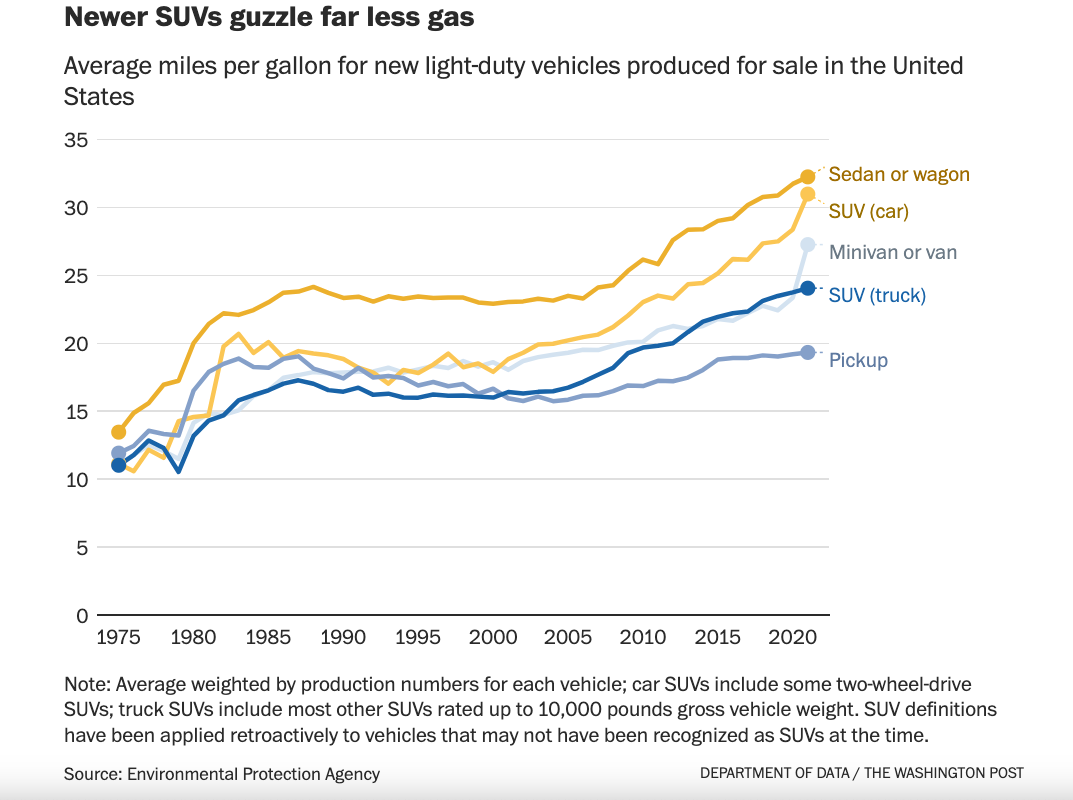

One advantage for sedans over their truck/SUV counterparts has always been fuel economy. While sedans continue to have an advantage over SUV (trucks) and pickups, newer SUV (cars)/crossovers are evening the playing field on fuel economy. As the chart below illustrates, SUV (cars) have made the greatest strides since 1975 and boast fuel economy above 30 miles per gallon, just like sedans or wagons.

According to the Federal Highway Administration, America’s fuel consumption peaked in 2004 and has declined over the past decade culminating during the pandemic. Although light trucks’ share of the overall vehicle market has doubled, and SUV adoption has soared, these fuel consumption trends are maintained.

Legislation Fueling Growth and Profitability of Trucks

While the classification of vehicles as cars or trucks has blurred over the years with newer categories of SUVs, crossovers, and now electric vehicles and BEVs, all of the data discussed so far illustrates the growth in popularity and production of trucks in the last several decades. Are trucks also more profitable than sedans? According to a recent article in the Washington Post, the popularity and profitability of trucks can be partially traced back to two events.

The first legislative factor occurred in 1964 under President Lyndon B. Johnson in response to a trade war with Europe. Coined after the lingo for a conflict between two players, otherwise known as a game of chicken, the chicken tax was a tariff imposed by President Johnson on all foreign-built work vehicles. The 25 percent tariff ensured that U.S. automakers would have a leg up on foreign truck factories.

The second legislative factor occurred in 1975 and appeared in the fine print of the Corporate Average Fuel Economy (CAFE) standards adopted by President Gerald Ford. Work and light trucks would be subject to less-strict CAFE standards than family sedans to help promote American commerce during the Middle East oil embargo. Essentially, trucks would also be immune to the gas-guzzler tax, which added $1,000 to $7,700 to the sticker price of sedans that could not achieve at least 22.5 miles per gallon in fuel economy.

Conclusion

While recent data from the average age of cars, production of vehicle types by class, and fuel economy by vehicle type might suggest that light trucks/SUVs/crossovers will continue to overtake market share, I’m not ready to author the eulogy for the demise of the sedan/passenger car just yet. While it’s true that a proliferation of more light trucks/SUVs/crossovers on the roads means that taller/heavier vehicles might also shift the road-safety equation, there still could be momentum shifting the popularity back to sedans. While legislation helped fuel the growth and profitability of trucks, perhaps in the coming years, legislation or government mandates regarding electric vehicles will tilt the scales back towards the sedan or passenger car. Other contributing factors, such as larger transaction prices, may push consumers back to the cost-efficient alternatives offered by sedans. And maybe, you’ll spot a family truckster on that cross-country family road trip this summer!

At Mercer Capital, we perform valuations of auto dealerships for owners and advisors all around the country for a variety of purposes. Additionally, we follow the auto industry closely to stay current with trends in the marketplace. These give us insight into the private dealership market, informing us on our valuation engagements. For an indication of what your dealership might be worth, contact a professional at Mercer Capital to discuss your valuation in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights