Driving Value: Key Components of an Auto Dealership Valuation

As a lifelong, avid sports fan, I always enjoy watching the replays of several classic, iconic games from my childhood and teenage years: the 1986 World Series Game (aka the “Bill Buckner game”), the 1992 Elite 8 matchup between Kentucky and Duke (aka the “Laettner Shot”), and the 1992 NLCS Game 7 between my beloved Atlanta Braves and the Pittsburgh Pirates (aka the “Sid Bream Slide game”), among others. The replays have been fascinating for the memories and emotions they evoke, but it’s also interesting to see the finer details lost or blurred from my memory over time. And yes, Buckner still missed the ball, Laettner still hit that miraculous shot (unfortunately), and Sid Bream was still safe! But what made these games iconic and hold their classic value over time to today?

All of them had certain ingredients that were “controllable.” An Elite 8 or playoff game will always have greater stakes than a regular season game, and playoffs tend to have greater talent at a higher level of competition. It also just means more when it’s your team. And rivalries will always up the ante. These situations increase the likelihood of a game becoming a classic. But I also realized the games I rewatched had other uncontrollable components that contributed to their value — pressure moments, unlikely heroes, and the never-ending spirit of competition until the final out or buzzer.

Like these classic sporting events, several key value drivers impact the appreciation and ultimate value of an auto dealership. Some value drivers are controllable or can be affected by the owner, and some are outside their control.

Like most business owners, auto dealers are likely always curious about what their dealership might be worth. While there are many times they may want to know, there are life events that make them need to know the value, such as a transaction (including buy-sell), litigation, divorce, wealth transfer, etc. While valuations tend to be performed infrequently around these events, dealers can evaluate their business and improve its value by understanding and consistently focusing on the value drivers of their auto dealership.

So, what are some of the value drivers of an auto dealership?

Franchise

An auto dealership’s franchise affiliation has a major impact on value. Each franchise has a different reputation, selling strategy, target consumer demographic, etc. Public value perception of franchises tends to be unique and is most easily illustrated through Blue Sky multiples. As the Haig Report indicates, Blue Sky multiples vary over time, even if they are frequently stagnant from period to period. Auto dealerships and franchises are often grouped into broader categories, such as Luxury Franchises, Mid-Line Franchises, Domestic Franchises, Import Franchises, and/or Ultra High-Line Franchises. Dealers may not have significant influence over the value perception of their franchise, making this value driver appear “uncontrollable.” However, dealers do have the opportunity to make bolt-on acquisitions and expand their operations to more rooftops. This will likely improve foot traffic to the franchises and ultimately may improve the value of the business, particularly if they can appropriately decide which franchise to add. The prominence of additional rooftops has only increased in the last few years as consolidation and M&A activity dominate headlines in the auto dealer industry.

Real Estate/Quality of Facilities

Typically, most dealership operations are held in one entity, and the underlying real estate is held by a separate, often related entity. Several issues with real estate can affect an auto dealership’s valuation. First, the rental rate and terms should be analyzed to establish a fair market value rental rate. Since a related entity often owns the real estate, the rent may be higher or lower than the market for tax reasons or other motivations that do not reflect fair market value. Second, the quality and condition of the facilities are crucial to evaluate. Most manufacturers regularly require facility and signage upgrades, often offering incentives to help mitigate these costs. Depending on the franchise, certain OEMs now require their dealers to make substantial capital improvements surrounding the retail sale and servicing of electric vehicles. It’s important to assess whether the auto dealership has regularly complied with these enhancements and is current with the condition of its facilities. Owners seeking to drive value can do their part to ensure their facilities are up-to-date and appealing to customers.

Following the pandemic and its aftermath, facility upgrades have become less of a value driver. The shift to digital platforms has decreased the amount of foot traffic to the actual dealership. With the focus moved away from the dealer’s real estate and physical showroom, the importance of the latest and greatest signage will likely diminish. The quality of a dealer’s facilities may become less of a value driver if consumers are less dependent on those facilities.

Employees/Management

The quality and depth of management can positively impact an auto dealership’s valuation. Auto dealerships with greater management depth will generally be viewed as less risky by an outside buyer. Also, an auto dealership’s CSI (Customer Service Index) and SSI (Service Satisfaction Index) rating can influence franchise incentives and consumer perception. A strong CSI and SSI are reflections of a strong service department and a commitment to quality customer service. While franchise customer service figures are not controllable, owners can ensure their employees provide consistent, exemplary customer service, boosting reputation and driving value.

Recent Economic Performance

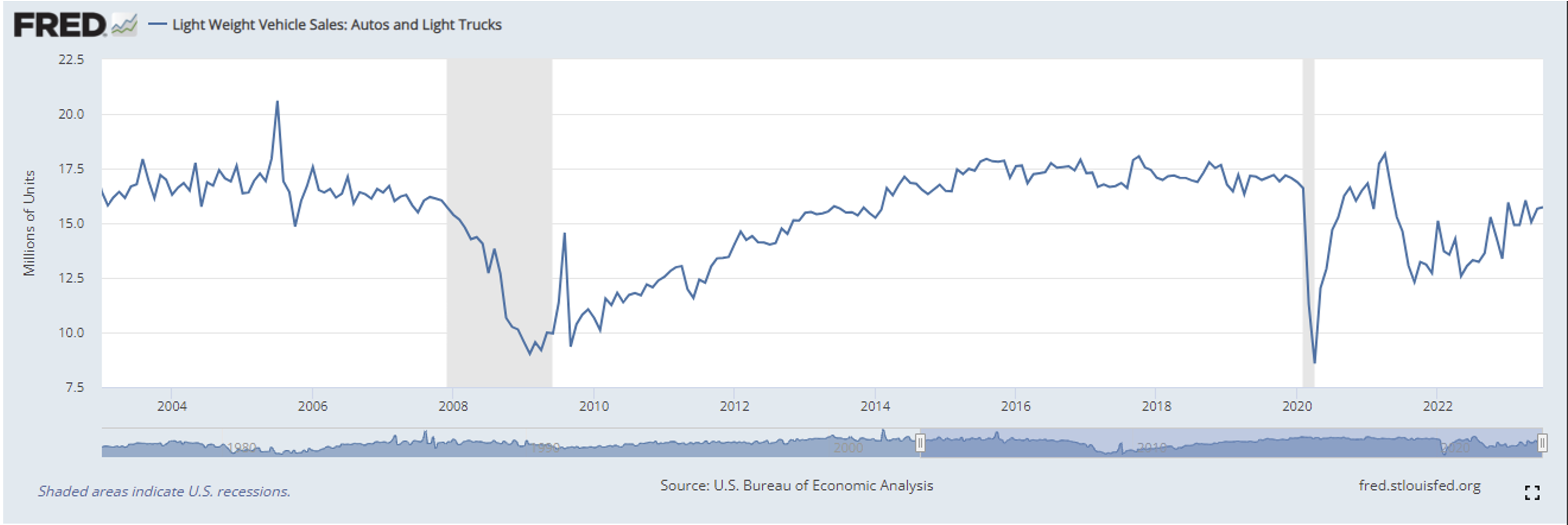

Like most industries, the auto industry is dependent on the national economy. The auto industry measures and tracks sales of lightweight automobiles and trucks at a Seasonally Adjusted Annual Rate (SAAR), an indicator of historical economic performance in the auto industry. In addition to monitoring and understanding the current month’s SAAR, the longer-term history of the SAAR and its trends also provide insight into the auto industry and an auto dealership valuation. Below is a long-term graph of the SAAR over the past 20 calendar years:

Click here to expand the image above

While dealerships tend to ebb and flow with the general economy, the industry can also be cyclical based on the average age of cars owned. Further, the last several years have been characterized by record profitability. Consider a longer period over several years to evaluate and estimate the ongoing profitability of an auto dealership. Because cars are typically owned for several years, these customers are not repeat customers except to the extent they visit the parts and service departments. All else equal, periods with high-volume sales tend to be followed by lower-volume periods. As you might expect, dealers have minimal influence over these cycles. Like the bottom of the 9th in Game 7 of the World Series, it’s just going to mean more.

Buyer Demand

Buyer demand in the transaction market can illustrate the value climate for auto dealer valuations. Typically, buyer demand is measured by the deal activity in the M&A market. The Haig Report indicated that 2022 was another strong year for acquisitions. They estimated 607 stores were acquired by public and private buyers in 2022. While the first quarter of 2023 is off to a slower pace than the first quarter of 2022, an additional 82 stores were acquired in the first three months of 2023. Increased buyer demand leads to higher multiples and, ultimately, valuations for dealers. While this is not something that dealers can directly influence themselves, adhering to the other aspects noted in this piece can increase the likelihood that dealers receive a favorable multiple.

Location/Market

The value of an auto dealership can be more complex than urban vs. rural or major metropolitan city vs. minor metropolitan city. Each store location is assigned a specific area or group of zip codes referred to as an area of responsibility or “AoR.” How do a location’s demographic characteristics align with a certain franchise? For example, a high-line auto dealership would perform better and be more valuable in a major metropolitan area with a high median income level, such as Beverly Hills, California, or South Beach in Miami, than in a midwestern city. Conversely, a mid-line store would probably fare better in areas with moderate median income.

We’ve discussed how the national economy can affect an auto dealership’s value, but in some instances, the local economy can also greatly influence performance. Certain local markets are dominated by a particular trade or industry. Examples include auto dealership locations near oil & gas refining areas, mining areas, or military bases. For example, there may be an influx in car sales as members of a particular base are deployed or return home. In such instances, a dealership is probably more dependent on local than national economic conditions. This is where it is key for owners to recognize the environment in which they operate and tailor their operations to maximize these opportunities. Like Steve Kerr said when Michael Jordan was double-teamed in Game 6 of the NBA Finals, “I’ll be ready.”

Single-Point vs. Over-Franchised Market

The amount of competition in an auto dealership’s AoR and the nearest location of a similar franchised auto dealership can also have an impact. It’s important to make the distinction that we are talking about a single-point market and not a single-point dealership. A single-point market refers to a market with only one auto dealership of a particular franchise. An over-franchised market would be a larger market that may contain several auto dealerships of a particular franchise within a certain radius. Often, an auto dealership in a single-point market would be viewed as more valuable than one in an over-franchised market competing with its own franchise for the same consumers.

Additionally, the auto dealerships of the same franchise in the same market could be drastically different in size. One may be part of a larger auto group of dealerships, while the other may be a single-point dealership location, meaning that the owner only owns that one location. For example, a dealer with one of many Ford dealerships in a city is likely to be worth less because customers going to buy a new Ford have many convenient options. Additionally, a dealer with a single-point franchise will likely lose out on customers who aren’t sure what make or model they want. If they only offer vehicles from one franchise at their location, they may draw less foot traffic due to less variety. We’ve already discussed how certain brands receive higher Blue Sky multiples and how that should factor into acquiring a new franchise. Owners looking to enhance the value of their dealership operations should also consider the saturation of franchises in their market. While a Lexus dealership may have a higher Blue Sky multiple than a Kia, if there are no other Kias in the market, they may be able to earn more in profits. Improving earnings are an easier way for owners to improve the valuation of a dealership, as multiples tend to represent other uncontrollable market influences.

Concluding Observations

As we’ve discussed, an auto dealership’s value is influenced by various factors. Some of the factors are controllable, and some are external. Like a classic sporting event, auto dealers must focus on what they can control, hoping to create value and maintain or grow it over time. To find out the value of your auto dealership today, contact one of the automotive industry professionals at Mercer Capital. Whether or not you have an upcoming life event that may necessitate a valuation, we can help you understand your progress and our process further. That way, when it comes time, you’ll be ready.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights