February 2025 SAAR

The February 2025 SAAR came in at 16.0 million units, up 3.2% from last month and 2.1% from February 2024. While February typically records one of the lowest sales volumes each year, this month’s SAAR exceeded the average of the last five Februarys (approximately 15.3 million units). February 2025 performance reflected strength in consumer demand, primarily driven by improved inventory and incentive spending.

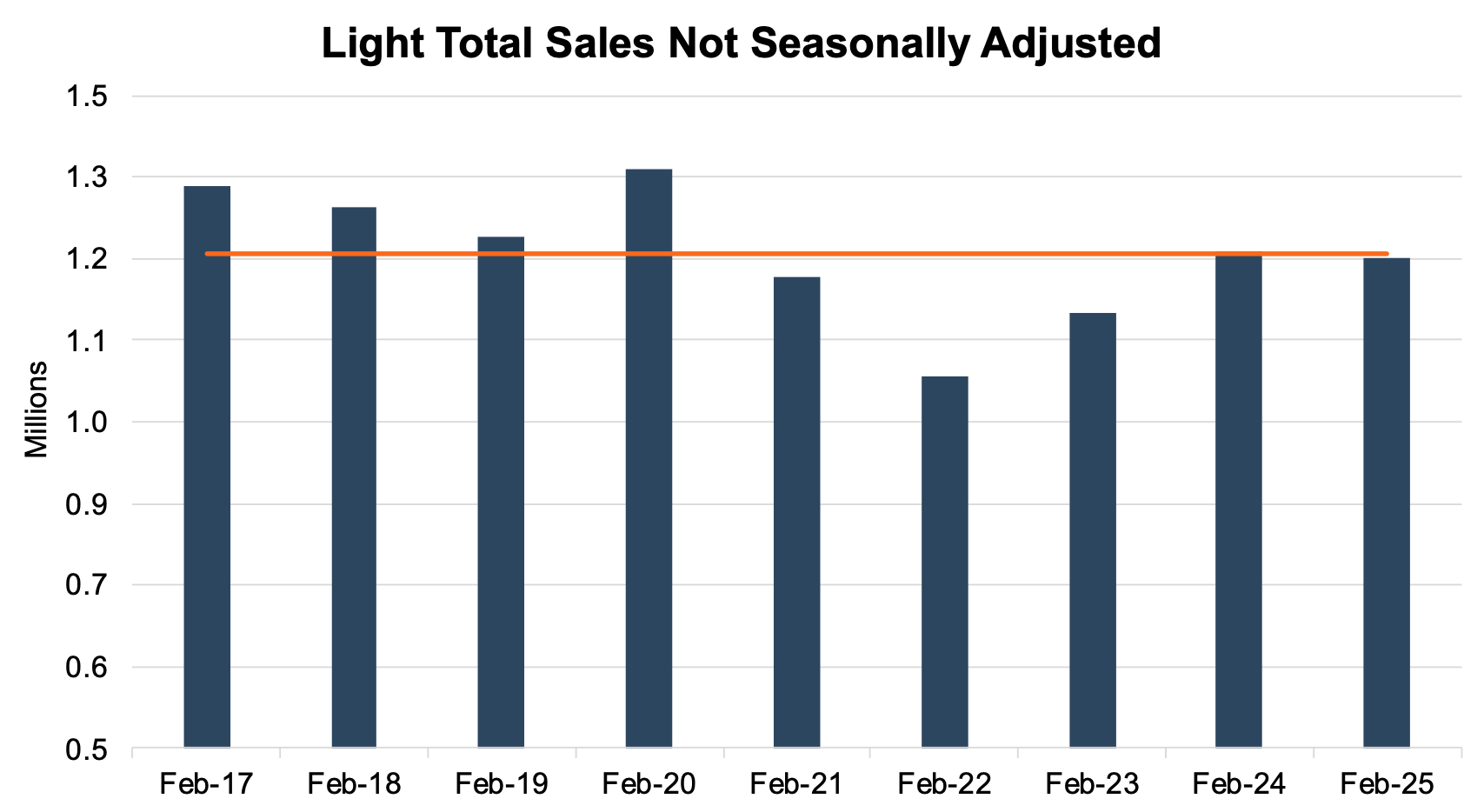

Unadjusted Sales Data

It is important to note that February 2025 has one fewer selling day than February 2024 due to the Leap year. On an unadjusted basis, the industry sold 1.22 million units in February 2025, a 10.6% increase from last month and just below February 2024’s mark. This month’s unadjusted sales finished just seven thousand units shy of the nine-year February average of 1.227 million units (2017 – 2025). See the chart below for a look at unadjusted sales over the last nine Februarys.

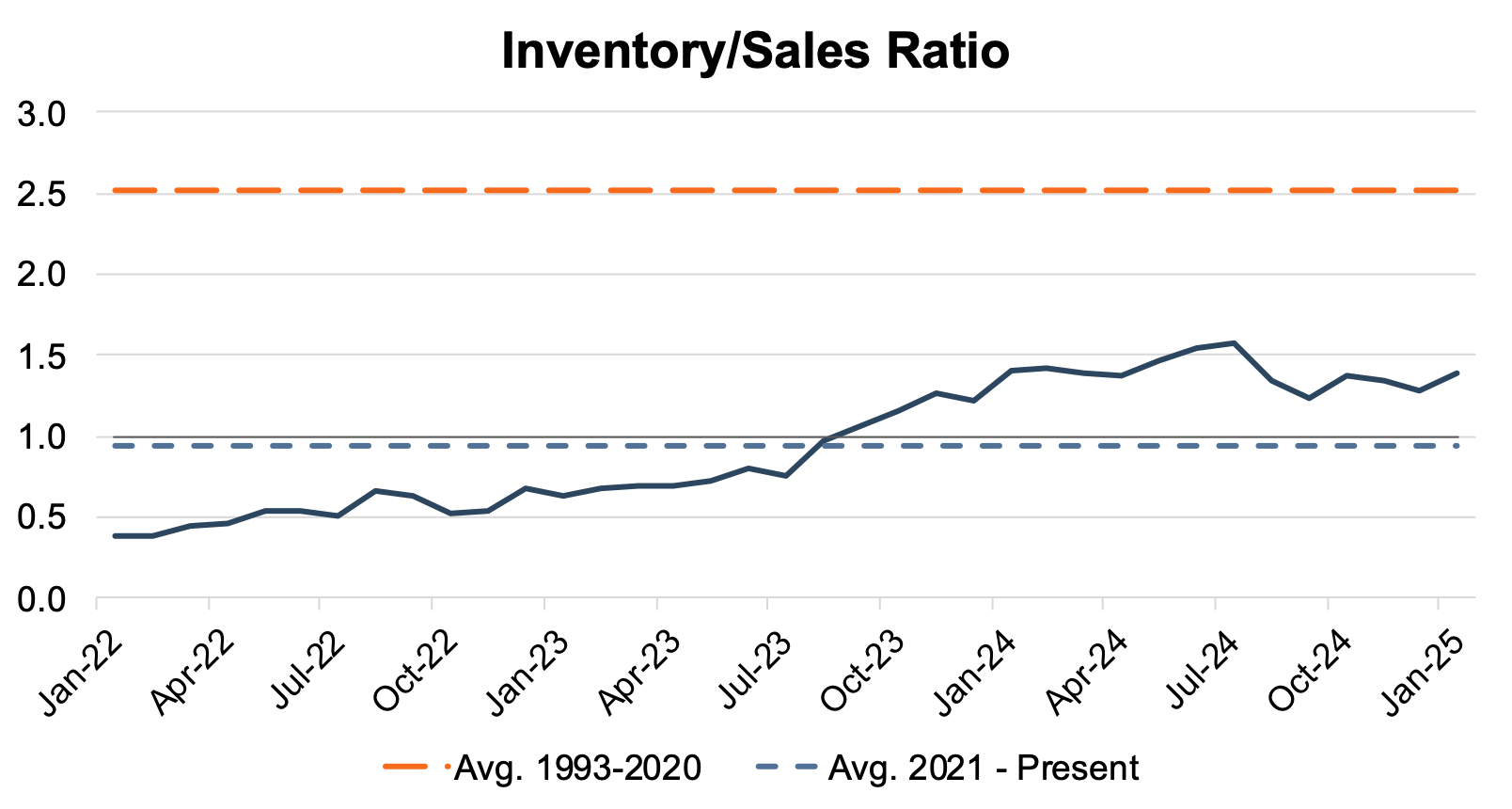

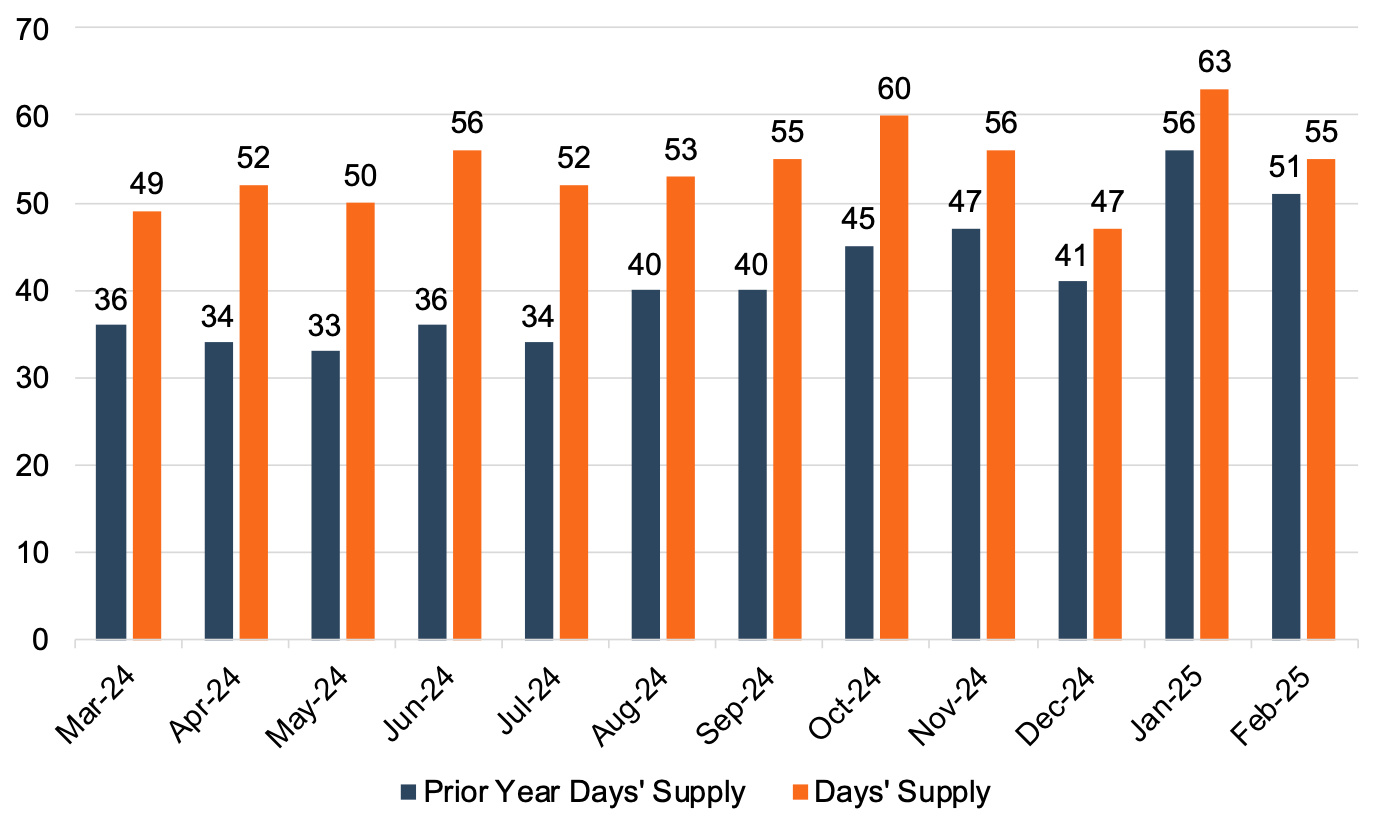

Days’ Supply

The industry’s inventory-to-sales ratio jumped to 1.40x in January 2025 from 1.29x in December 2024. The January 2025 inventory-to-sales ratio reached the highest level since July 2024 and sits in line with January 2024 (1.41x). The chart below presents the industry’s inventory-to-sales ratio over the last three years.

After a 24-month peak of 63 days in January 2025, industry-wide days’ supply dropped to 55 days in February 2025. Over the last twelve months, we have seen the margin between the current and prior month comparisons narrowing, with February 2025 days’ supply coming in just four days higher than February 2024. We will likely continue to see days’ supply hovering in the mid-50s over the next several months, allowing consumers to choose from a wider variety of inventory. The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in February:

“Consumer demand for new vehicles continues to exhibit strength. February marks the fifth consecutive month of year-over-year retail sales growth, with an 8.1% increase on a selling day-adjusted basis. The strong retail sales pace and resiliently high average transaction prices mean consumers will spend more money buying new vehicles this month than any other February on record.

Despite rising manufacturer discounts and falling retailer profits, average transaction prices remain high. The average retail transaction price for new vehicles is trending toward $44,619, up $71 (0.2%) from February 2024.”

According to King, spending on new vehicles in February 2025 will surpass February 2024 (the highest February on record) as a result of the growth in both sales and average transaction price. Even though spending on new vehicles is up in February, retailers are still experiencing declines in per-unit profitability.

Incentive Spending and Profitability

OEMs typically use incentive spending as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability. J.D. Power notes that average incentive spending per unit in February 2025 is expected to be $3,227, up 22.8% from February 2024. Incentive spending as a percentage of the average MSRP is expected to reach 6.5% during February 2025, an increase of 1.1 percentage points from this time last year.

J.D. Power points out the following regarding retailer profit per unit:

“Total retailer profit per unit—which includes vehicles gross plus finance and insurance income—is expected to be $2,171, down 11.8% from February 2024. The decline in profits is primarily driven by rising inventory levels and increased competition for new vehicle buyers. Far fewer vehicles are selling above the manufacturer’s suggested retail price (MSRP). Thus far in February, only 11.9% of new vehicles have been sold above MSRP, down from 19.2% a year ago.”

March 2025 Outlook

Mercer Capital expects the March 2025 SAAR to come in around 16.0 million as consumers continue to be drawn in by a wider array of available inventory. Even after strong February sales, the industry will continue to face uncertainties surrounding import tariffs and electric vehicle tax policy over the next several months. Make sure you subscribe to our Auto Dealer Valuation Insights blog to get updates on industry-relevant topics straight to your inbox.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights