Interest rates and inventory levels remain top of mind for auto dealers. Compared to last year, interest rates have significantly increased since the Federal Reserve began raising rates in March 2022. Inventories have also improved as the industry works through its supply chain issues. These shifts in economic trends are expected to have an impact on many aspects of auto dealer operations. In this week’s post, we talk about floorplan interest income and pose some important questions: What is floorplan interest expense, and what are floorplan credits? How have floorplan credits turned into an unlikely profit center for dealers? Can we expect this trend to continue amid changing conditions?

What Is Floorplan Interest Expense?

Back to the basics: many consumers want to test drive a vehicle before committing to the expensive, long-lived investment of a car or truck. Because of the cost of these vehicles, dealers use short-term debt financing to show the vehicles on their lots or “floor.” Floorplan loans are provided to dealers by banks, specialty lenders, and vehicle manufacturers (also known as “captives”). These loans are a type of “asset-backed” inventory financing, meaning the debt must be repaid when the vehicle is sold. Interest accrued on these loans is called floorplan interest. In the time between when the vehicle is acquired by the dealer and sold to a consumer, the dealer must pay floorplan interest expense to the lender. The longer the vehicle sits on the lot, the longer interest accrues.

What Are Floorplan Interest Credits?

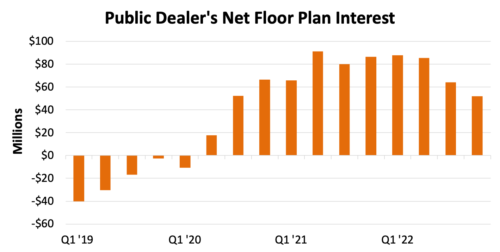

In addition to providing access to the money to acquire inventory with floorplan lines of credit, automakers also offer floorplan financial assistance payments or “credits” to dealers to help offset floorplan interest expense. The amount of credit offered depends on the manufacturer and is not typically tied to interest rates. That means net floorplan interest expense (interest expense net of credits) can be interest income. Ever since the second quarter of 2020, there has been an industry-wide persistence of net interest income from floorplan lenders. Why has this been the case for such an extended period of time?

Why Has Floorplan Been a Profit Center?

When the COVID-19 pandemic set in, the resulting economic uncertainty caused interest rates to plunge. This led to a decline in floorplan interest expense, calculated as the interest rate multiplied by the outstanding balance of the short-term debt. Several months into 2021, dealers couldn’t replenish their lots with new vehicles due to supply chain issues, which resulted in lower outstanding debt balances. These lower outstanding debt balances led to even further suppressed floorplan interest expense.

Floorplan credits are commonly based on volumes because automakers want to incentivize dealers to sell as many of their vehicles as possible. The calculations are also based on industry norms (namely, the norm that vehicles used to spend much longer on lots). In mid to late 2020 and into 2021, when dealers started selling vehicles as soon as they arrived at the dealership, floorplan credits exceeded floorplan interest expense.

See the chart below for a look into net floorplan interest from 2019-2022 for the six public auto dealers. This data is sourced from an Automotive News article, which explores the same topic as this week’s post.

Has This Happened Before?

Looking at the industry’s history, can we find a period when floorplan interest expense became interest income? The answer is yes. An example can be found after the global financial crisis in 2008. During this period, interest rates were at historical lows. That meant, depending on the brand and performance of the dealership, some but not all dealers netted a profit on floorplan. This time around, significantly depressed inventory balances added fuel to the fire and made these profits far more pervasive.

Can It Continue?

The auto industry is cyclical, just like the rest of the economy. Interest rates rose significantly in 2022 and are not anticipated to decline in the near term. Inventory balances are also increasing. Each of these pressures would lead to higher floorplan interest expense, and it is reasonable to predict that floorplan expense may again rise above the level of credits.

However, the prevailing thought in the auto retail business is that dealers will no longer carry the same inventory levels as pre-COVID, even after supply chain issues are solved. Does this mean that floorplan interest income is sustainable? We find it hard to believe that automakers will continue to provide floorplan credits that exceed floorplan interest expense, especially because the credits were initially meant to partially offset this cost, not eliminate it.

Going forward, we would anticipate that manufacturers will revise their floorplan credit policies. Ford has already made this change. Instead of providing a flat credit determined by an expected number of days on the lot, it is moving to a model that covers costs for up to 75 days based on actual days in inventory. This is intuitive, as it defrays the costs and encourages dealers to continue buying vehicles, but a quick sale no longer comes with the added benefit of a fixed credit outweighing the holding costs.

Conclusion

In next week’s post, we will continue this topic by looking at the specific factors expected to influence floorplan interest expense and floorplan credits in 2023. In combination with our 2023 expectations for the industry, we think it will be valuable for auto dealers to take a closer look at these floorplan-relevant factors:

- Interest Rates

- Vehicle Prices

- Inventory Production

- Inventory Turnover

- Floorplan Crediting