Floorplan Interest Income Fading

Part 2: Floorplan Relevant Factors

In last week’s blog, we looked at how rising interest rates and increasing vehicle production are expected to impact floorplan interest income/expense. Floorplans have been an unlikely profit center over the last two years, and there are reasons to believe that this earnings stream might dry up soon. Our discussion of the root causes behind this profit center’s emergence can be found in last week’s blog.

This week’s blog aims to take a closer look at floorplan-relevant factors and macroeconomic forces to keep an eye on throughout the coming year and beyond as dealers plan their floorplan expenditures and budgeting. These factors/forces include:

- Interest Rates

- Vehicle Prices

- Vehicle Production

- Inventory Turnover

- Floorplan Crediting

Interest rates

Since March 2022, the Federal Open Market Committee (“FOMC”) has been raising benchmark interest rates. By the end of the year, we observed the sharpest benchmark rate increase since the Volcker era, with consistent increases as seen below:

These actions have put upward pressure on all lending rates across the United States economy, making debt more expensive and cooling off the red-hot real estate and public equity markets. Interest rates in the auto industry have not been immune. According to Experian’s State of the Automotive Finance Market Q3 2022 Report, the average consumer auto loan rate in Q3 2022 was 5.16% (compared to 4.09% in Q3 2021 and 4.23% in Q3 2020). The same can be said for interest rates on floorplan liabilities. The rising cost of floorplan debt means that auto dealers are burdened with a higher interest expense on floor-planned inventory. Looking ahead, the future movement of benchmark interest rates will undoubtedly affect floorplan expenses. So what can we expect?

Last week, the Fed continued to slow its pace, down to an increase of 0.25%, from 0.50% in December and lower than the four 0.75% “jumbo” increases that were common in the back half of 2022. The S&P 500 lurched forward 1% last Wednesday and 1.5% on Thursday after Fed chair Jay Powell remarked at a press conference that “the disinflation process has started.” This outlook is certainly optimistic, at least regarding future interest rates. Perhaps we could be on the verge of an inflection point.

While some experts are staying positive, others think interest rate cuts are unlikely in the short term. For example, the World Economic Forum recently released some commentary on their expectations for interest rates in 2023. According to the forum,

“While the Fed’s decision to dial back the tempo of its latest rate hike to 50 basis points after four consecutive 75 basis point hikes was (mis)interpreted as a first step towards a less hawkish policy stance by some observers, the minutes of the December FOMC meeting, released on Wednesday, once again made clear that the chances of such a pivot are very slim.”

While parsing through the intentional language at a press conference is helpful, dealers may also find it helpful to monitor the FedWatch tool, which indicates current probabilities for future rate increases/cuts. As of today, this tool indicates a 32.8% chance the benchmark rate is below today’s current levels by December 2023.

Vehicle Prices

Even holding interest rates constant, higher vehicle prices mean higher principal balances on floorplan loans, resulting in higher floorplan interest expenses. Simply put, new and used vehicles become more expensive to keep on the lot as sticker prices rise.

During the past two years, sticker prices on new and used vehicles have risen to record heights. While there has been some giveback in used pricing recently, the constrained supply of new vehicles has kept prices elevated. While some of the last two years’ price increases were supported by low availability and lower interest rates, consumers also shifted their preferences towards larger, pricier models. As one of our colleagues is fond of saying, the cure for higher prices is even higher prices. That is to say, in 2023, we can expect consumers to trade down toward lower-priced models to combat inflation and increased interest rates, which make monthly payments less affordable.

Check out our monthly SAAR blog for regular updates and discussions of average sticker prices every month, with a new installment coming next week. As inventories recover and dealer lots continue to fill up, dealers may finally feel the pain of rising prices in the form of floorplan interest. Perhaps these shifting conditions will remind dealers to re-assess their inventory management practices. After a couple of years when inventory management meant acquiring as much inventory as possible, a more nuanced decision-making process could help dealers navigate inventory management in a high-price environment.

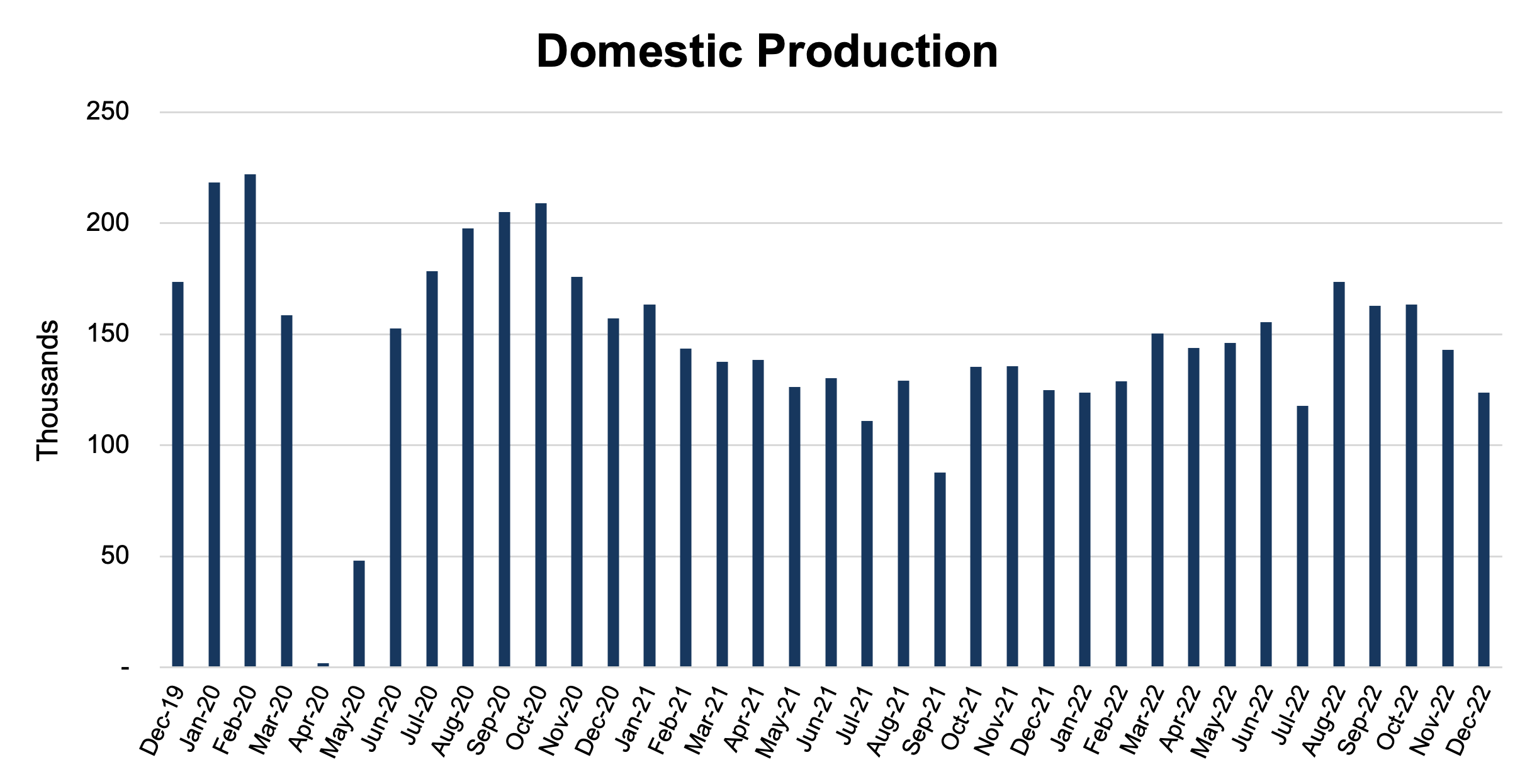

Vehicle Production

Over the past two years, vehicle production has been historically low. Due to supply chain issues throughout every phase of the auto production process, auto manufacturers have had trouble supplying dealers with the volume of units that they were accustomed to before the pandemic. However, over the last several months, production has started to recover. According to Wards Intelligence, inventory on the ground and in transit at the end of December 2022 was forecast to total 1.7 million units, an increase of 51% compared with December 2021. See the chart below for domestic auto production over the past three years.

Click here to expand the image above

Vehicle production, on its own, does not affect floorplan liabilities. However, heightened inventory availability will certainly present auto dealers with a decision. Does it make sense to return to the pre-pandemic number of units on the lot? Does your management team want to carry a larger floorplan liability, especially in the face of historically high sticker prices? These questions lead us to our next topic: inventory turnover.

Inventory Turnover

The relationship between the passage of time and floorplan income/expense is simple. The longer a vehicle sits on the lot, the more floorplan interest accrues for the dealer to pay. Dealers are heavily incentivized to turn their inventory quickly, regardless of the economic environment.

Most dealers responded to low inventory levels over the last two years by shifting to a larger number of pre-order sales, which resulted in these pre-ordered units only remaining on the lot for a couple of days or sometimes even a couple of hours. Many consumers made concessions on preferred color and trim to avoid a long wait time by buying units that were simply on the lot that day, resulting in very low average lot time for non-preordered units.

As supply chain issues (hopefully) enter their final act in 2023, inventory balances across the industry have been improving. It seems like improved supply chain conditions and replenished selling lots would be good news for dealers and consumers alike, and that may be true in some cases. However, dealers can expect floorplan interest payments to increase alongside this inventory recovery.

Floorplan Crediting

Floorplan credits are the primary reason that floorplan interest expense flipped to interest income over the last two years. Pre-COVID floorplan policies benefited dealers as fixed credits exceeded negligible floorplan interest. We believe manufacturers will revise their floorplan credit policies in the coming years to promote best practices in inventory management. Ford has already changed from a fixed floorplan credit to a cost-covering model for units that stick around on the lot for too long. Instead of providing a flat credit determined by an expected number of days on the lot, it is moving to a model that covers costs for up to 75 days based on actual days in inventory. We expect others may follow suit.

As OEMs consider changing their floorplan programs, dealers will want to ensure that they stay tuned in. The effects of a material change in floorplan credit policies would likely result in the need for working capital adjustments to make sure that dealers can safely meet their floorplan obligations. A policy change might also affect selling strategies and inventory acquisition strategies.

Conclusion

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a Mercer Capital auto dealer team member today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights