Formula Clauses for Auto Dealerships

Pros and Cons of Using Formula Clauses in Buy-Sell Agreements

In prior pieces, we have expressed our general disdain for formula clauses. While there are many flaws and specific issues that can arise, formula clauses can also serve a valuable purpose, particularly for family members or people with an interest in an auto dealership that do not know much about the industry. In this post, we explain formula clauses, when they are used, why they are used, and why we ultimately recommend they not be used.

A formula clause explains how a business will be valued, usually as part of a buy-sell agreement, employment agreement, transfer of interests under certain circumstances, or other agreement entered between owners of a company. Formula clauses are most often used for the purposes defined in their respective governance documents. Common triggering events include death, disability, retirement, divorce, or termination of an owner.

Formula clauses typically involve a combination of accounting and valuation information. For example, formula clauses may begin with a company’s book value of equity from the most recent month’s financial statement, most recent year ended, or some average of periods. Formula clauses may also include some component of a valuation multiple such as a multiple of revenue, EBITDA, earnings, or some other financial metric. These valuation multiples are often kept static throughout the life of the buy-sell agreement.

What Are the Benefits of a Formula Clause?

Formula clauses are simple and leave little room for debate as to the value of an interest in a business. This is particularly helpful for family members that might own an interest in a dealership but have little idea of how the business works. The learning curve for auto dealerships can be quite steep, but most people can navigate to a page and line on a financial statement and do the basic math involved with adding an indication of Blue Sky value to net assets. No long division required.

This can also lead to less contentious transfers if everything goes smoothly. If partners are frequently coming and going, or minority investors have always been cashed out at a Blue Sky value of 4x LTM pre-tax income, a reasonable expectation can be set for the worth of the business and people can plan accordingly. However, this tends not to be the case, and formula clauses do not always make for the smooth ownership transitions that their writers envisioned.

What Are the Common Pitfalls of Formula Clauses?

While simplicity can be good in certain cases, there are obvious drawbacks to having such a cut and dry conclusion. Three main issues we’ve seen include:

- Formulas may be drafted by those without industry knowledge which leads to less meaningful conclusions.

- Formulas that make sense at the writing of the agreement may become stale in time.

- Rigid calculations do not allow for normalization adjustments that may be obvious to parties on both sides of an actual negotiation between a willing buyer and willing seller.

Formulas That Consider and Correctly Apply Valuation Methods Used Frequently in the Auto Dealer Industry

By its nature, the value indicated by a formula clause is unlikely to be the most analytically rigorous conclusion. This means an auto dealership valued using a formula clause is likely to be different from the value determined by a qualified business appraiser that has experience valuing auto dealerships.

An auto dealership valued using a formula clause is likely to be different from the value determined by a qualified business appraiser that has experience valuing auto dealerships.

For starters, if the formula clause starts by talking about P/E multiples or EBITDA multiples, the drafter of the agreement is likely not aware of how auto dealerships are valued. It is important that the valuation methodology that the formula clause seeks to approximate reflects how industry participants discuss value.

The multiples also must be appropriately applied. If a blue sky multiple is used to approximate intangible value, it’s important not to double count any franchise rights that may be on the books from an acquisition. If an EBITDA multiple is used, it is important that the calculation appropriately captures floor-plan interest as an operating expense and does include floor-plan debt in enterprise value.

Formula Clauses Can Become Stale Over Time, Particularly if Not Used Regularly

Valuation multiples also ebb and flow through the business cycle. If the buy-sell agreement is written to include a blue sky value of 5x LTM pre-tax income, for example, that may make sense when the document is written. Fast forward five years. Is your dealership going for the same multiple?

An easy way around this would be to have the multiple be dynamic. Haig Partners and Kerrigan Advisors publish blue sky ranges quarterly, so pinning the multiple on the most recently published range could better approximate what dealerships are going for in the marketplace when the valuation is needed.

Fast forward five years. Is your dealership going for the same multiple?

However, as my colleague here in Nashville likes to point out, our work tends to be less on the multiple and more on estimating the ongoing earnings correctly. Multiples, whether from market transactions or built up using a discount rate, are largely based on market based indications. It is up to experienced appraisers to determine what earnings stream is applicable to these multiples.

Simple Calculations Can Miss Crucial Normalization Adjustments

First, we should say that we believe a multi-year approach is appropriate. In light of heightened profits in 2020 extending into this year, other industry participants are moving toward a multi-year viewpoint as dealers looking to divest are unlikely to receive high multiples on peak profits. In previous posts, we’ve discussed some common normalization adjustments for auto dealerships. Here, we’ll give a simple example that shows the pitfalls of not making adjustments or using a multi-year approach.

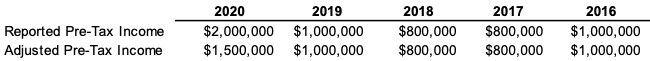

Consider a dealership with $5 million in tangible net asset value and pre-tax income levels as shown below. Also assume the dealership received a PPP loan of $500 thousand that was forgiven.

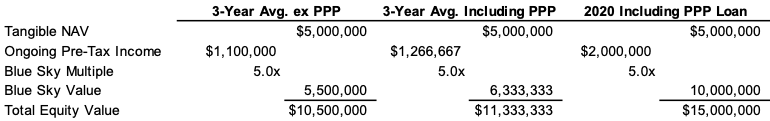

Taking a 3-year average from 2018-2020, as suggested by Haig Partners, adjusted ongoing pre-tax income would be $1.1 million. Assuming a blue sky multiple of 5.0x is applicable to this dealership, Blue Sky would be $5.5 million and the total equity would be $10.5 million.

Now, assume the 3-year average is based on pre-tax income directly off the dealer financial statement with no adjustments. While reasonable people would agree that the PPP loan is clearly an example of something that is not expected to happen every year, the formula clause does not leave room to make this adjustment. Despite only giving this period 1/3 of the weight, we see total equity value would go up by over $833 thousand or about 8%.

Taking this one step further, look at the implied value by taking the multiple based on only one year of performance. While $2 million in earnings is almost double historical levels, a formula clause with a static multiple will likely lead to overvaluation. In the example above, value increased by $4.5 million, or 43%.

These simplified examples show the potential pitfalls of formula clauses. We’re only scratching the surface of potential adjustments that might be applicable, including market adjustments to rent, owner’s compensation, discretionary expenses, non-recurring items, and any other adjustments in order to determine what a buyer of the dealership might reasonably expect to earn.

Conclusion

Hopefully, we’ve illustrated the potential issues with formula clauses that we find in buy-sell agreements. In our opinion, there is truly no substitute to having a qualified business appraiser with experience valuing auto dealerships analyze the company to determine the value of an interest in the dealership. We think there are still some benefits, particularly for those outside the business to have an idea of the value of the dealership. It is more important, however, to get the appropriate value of a business, particularly if the transaction has the potential to become contentious.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights