How Each Presidential Candidate’s Policies Would Impact the Auto Industry

Tale of the Tape

With the election just two weeks away, we think it’s timely to discuss the candidates’ platforms and determine the impact of their differing policies. Each candidate’s platform contains positions on many issues – some that would directly impact the automotive industry, and others that would indirectly impact the industry. A vote for one doesn’t necessarily signal a vote for the automotive industry or vice versa. While we don’t intend for this blog post to be political, we will examine each candidate’s position on four issues and discuss their impact on the automotive industry: trade policy, taxes, energy, and the environment.

Trade Policy

Under the current administration, President Trump has eliminated the Trans-Pacific Partnership and re-negotiated the North American Free Trade Agreement (NAFTA) by creating the United States-Canada-Mexico Agreement (USMCA). In addition to these agreements, Trump has created Section 301 Tariffs designed to impose taxes on vehicles that are assembled and imported from China. The latter aimed to promote more manufacturing in the United States and create new automotive plants in some key states, such as Michigan and Wisconsin. The moves have certainly forced several automakers such as Volvo, Ford, and Cadillac to shift some production for some of its models out of China to other countries in Europe to avoid the tariffs, but the direct impact these regulations have had on the creation of new manufacturing plants in the United States is unclear. Michigan, for example, has seen an increase in foreign investment in assembly plants, but not a large increase in new manufacturing plants over the last four years.

Former Vice President Biden’s stated plans don’t differ too much with the USMCA. Since the cycle of a model of new vehicle manufacturing lasts upwards of seven to ten years, the potential threat of tariffs and taxes are somewhat offset by the sheer investment commitment. Biden’s messaging seems to aim at the possibility of more parts manufacturing and the creation of new auto parts plants in the United States. This initiative would assist in the promise to create new jobs domestically by a Biden administration.

Taxes

Biden’s tax policies appear to be aimed at raising corporate income taxes to approximately 28%. Additionally, Biden would propose a 10% “offspring penalty” surtax on profits made by American companies on goods produced abroad but sold in the United States. The latter policy is sought to discourage American companies from shifting assembly and manufacturing abroad to avoid corporate taxes in the United States.

One of Trump’s early accomplishments in his first year in office was to lower the corporate income tax rate to 21%. Until the recent effects of the global pandemic, the lowered tax rates were a big contributor to the success and growth of the U.S. economy. Trump has boasted about further tax reductions in a second term, but specific information has not been provided. Under the Trump administration, the tariffs discussed previously have led to an overall increase in prices of imported automobiles since 2016.

Energy and Electric Vehicles (EVs)

The Trump administration has methodically rolled back emissions standards and mandates imposed under the prior Obama administration through the Corporate Average Fuel Economy (CAFE). Trump has also eliminated rules whereby California could set and impose tougher emissions standards than those instituted by the Environmental Protection Agency (EPA). The rollback of CAFE standards could reduce the demand for electric vehicles and sustainable batteries. Trump has also phased out, or allowed to expire, $7,500 EV tax credits for several manufacturers during his first term.

Biden is committed to cleaner energy and has adopted a “Cleaner Cars for America” Proposal. Biden would potentially discard the rollback items from the Trump administration and provide further government assistance to manufacturers of EVs by promising the government will shift 3 million fleet vehicles from gas-powered to electric-powered. Additionally, Biden’s plan would develop 500,000 new electric charging stations designed to promote consumer confidence in EVs. It is also believed Biden supports additional tax mandates to support EVs, perhaps re-enacting the EV tax credits among others.

Environment

Under his plan for cleaner energy, Biden would continue to push for further cuts in air and water pollution in addition to the energy and emissions impact discussed earlier. Biden’s energy and environment policies could eventually lead to a similar “cash for clunkers” program designed to promote electric and hydrogen-powered vehicles. It is also rumored that Biden will seek even higher fuel economy standards than those under President Obama. Specifically, Biden plans to tackle a worldwide ban on fossil fuel subsidies and a net-zero emissions policy no later than 2050.

Trump’s policies regarding the environment and government regulations are not anticipated to change much from his previous term, as he most likely will continue to favor deregulation of environmental programs and his rollbacks of CAFE, along with lower fuel prices, could lead to increased demand for SUVs and less demand for clean vehicles and EVs.

Conclusion

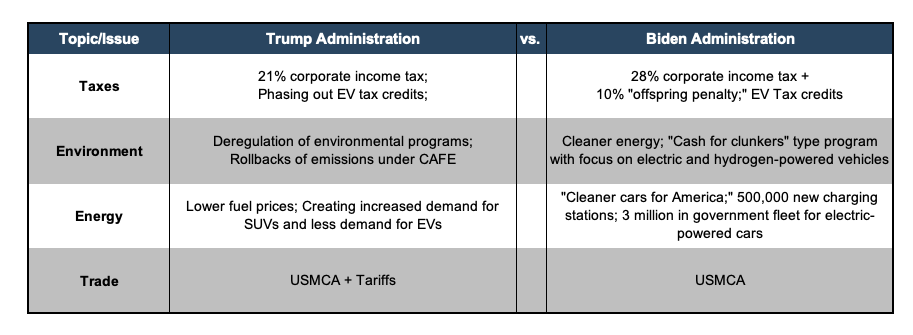

We’ve highlighted just a few categories of each candidate’s proposed plans and how they impact the automotive industry. As with all industries, the automotive industry is affected by numerous macro and micro factors that evolve over a longer period. The true impact of each candidate’s policies and the policies that have already been enacted may not be truly known for years to come. A summary of those key differences in each candidate’s proposed policies are as follows:

Consult a professional at Mercer Capital to find out the valuation of your auto dealership or how it can be impacted in the future. Mercer Capital has extensive experience providing valuations of auto dealerships for a variety of purposes.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights