Interpreting Inflation and Interest Rates for Auto Dealers

Can Retail Vehicle Prices Continue to Soar?

Inflation and interest rates are on more people’s minds lately due to supply chain disruptions across all industries. People understand how inflation and interest rates affect their daily lives when noticing the rising cost of goods/services and the cost to borrow money to buy a house, but many don’t realize that inflation and interest rates are interconnected. Inflation and interest rates are frequently linked when discussing macroeconomics and they tend to have an inverse relationship. When interest rates go up, in theory, inflation goes down. However, there are many more factors other than inflation and interest rates impacting the economy in the real world.

In this post, we discuss how we got to our current reality, what auto dealers might expect regarding inflation and interest rates, and how it all might impact the dealership.

How Did We Get Here?

Back in April, Federal Reserve Chair Jerome Powell indicated the Fed wasn’t close to raising interest rates, labeling inflation as “transitory.” At the time, he cited strengthening economic indicators, including employment and household spending and continued vaccinations which were expected to ease uncertainty and continue the economic recovery.

According to Powell, “An episode of one-time price increases as the economy reopens is not likely to lead to persistent year-over-year inflation into the future.” Further, the Fed indicated that clogged supply chains would not affect Fed policy as they were seen as temporary and expected to resolve themselves.

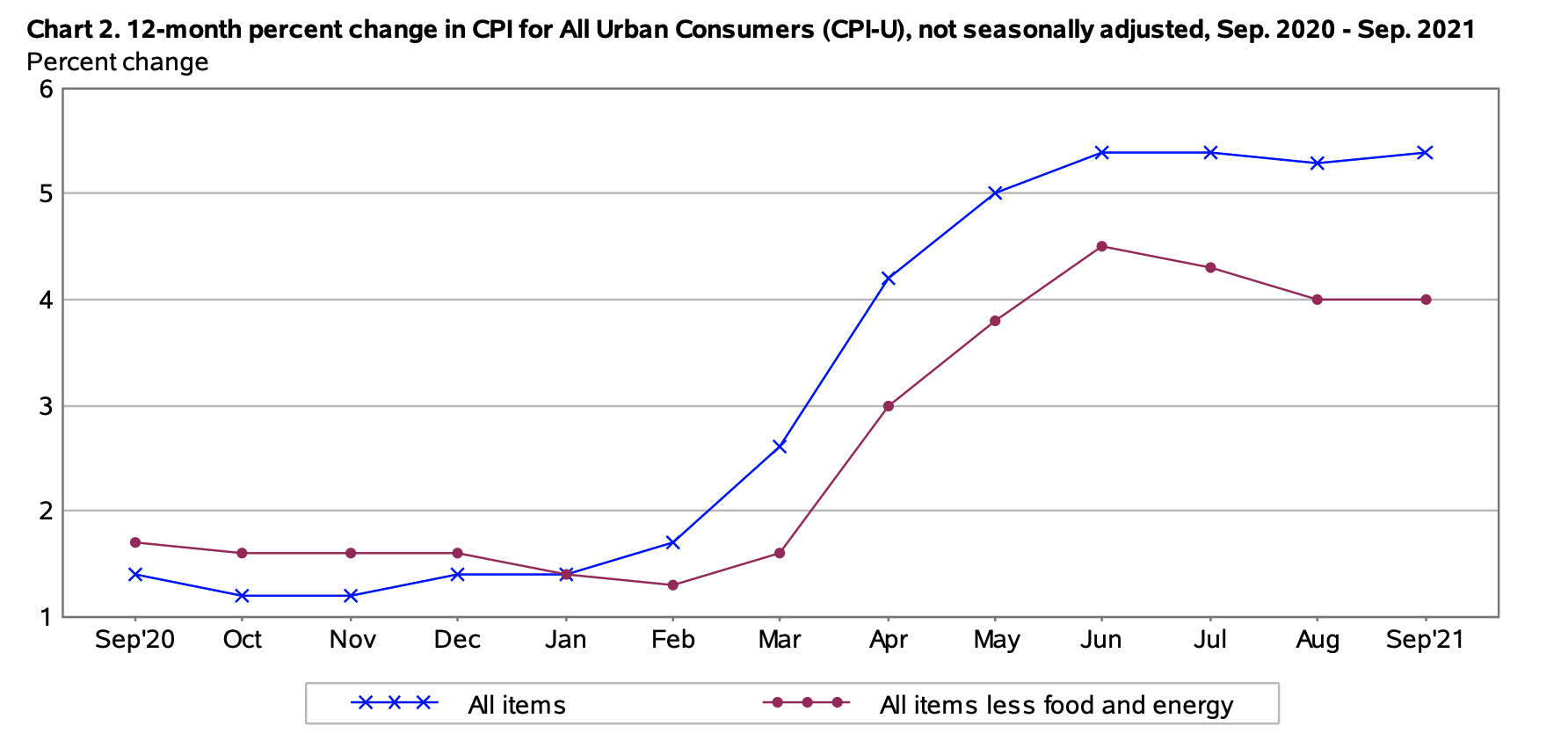

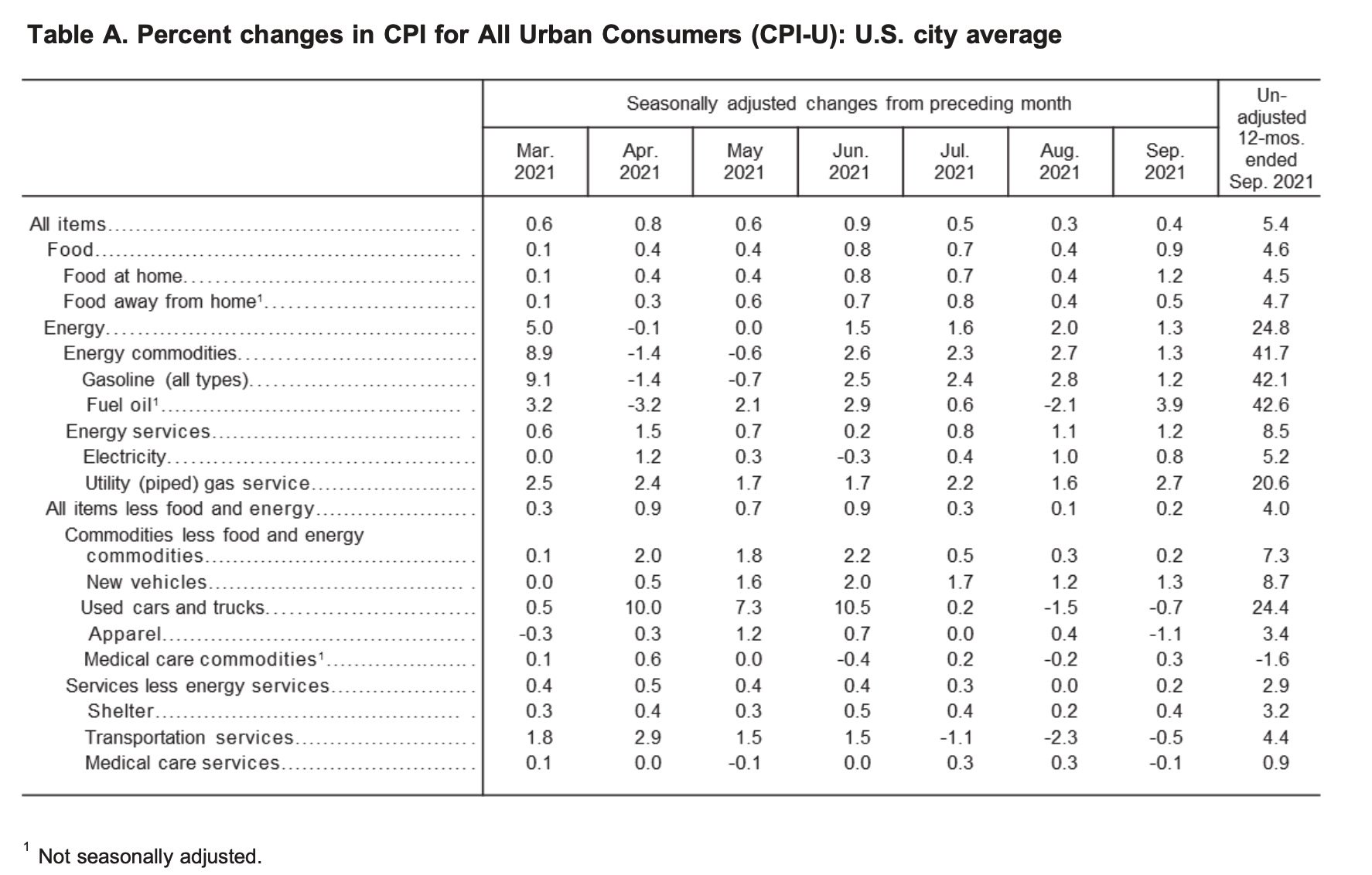

While this transitory stance appeared reasonable at the time, confidence in this stance has waned and the Fed has begun signaling it would end its accommodative policies. Below we’ve included the first chart and table in the September edition of the Consumer Price Index (“CPI”) published by the Bureau of Labor Statistics last Wednesday (October 13, 2021).

Source: Bureau of Labor Statistics- Consumer Price Index-September 2021

Source: Bureau of Labor Statistics- Consumer Price Index-September 2021

In our view, the graph of 12-month change supports the transitory view, at least in the beginning. Comparing prices in April 2021 to April 2020 is not very meaningful given the significant impediments to the economy at the time. However, as seen in the tables above, inflation has persisted on a monthly basis over the past six months. While 0.3% and 0.4% growth in the past two months is an improvement over March through July, it shows that the problem continues to linger.

Are inflationary pressures still expected to be brief and transitory?

On Tuesday, the day before September inflation numbers were published, Atlanta Federal Reserve President Raphael Bostic indicated inflationary pressures “will not be brief” and that he and his staff would no longer refer to inflation as transitory. Notably, Bostic is a voting member of the 2021 Federal Open Market Committee, and his public statement is the first to our knowledge challenging the transitory narrative. However, it shows how the Fed has evolved its stance over the past six months.

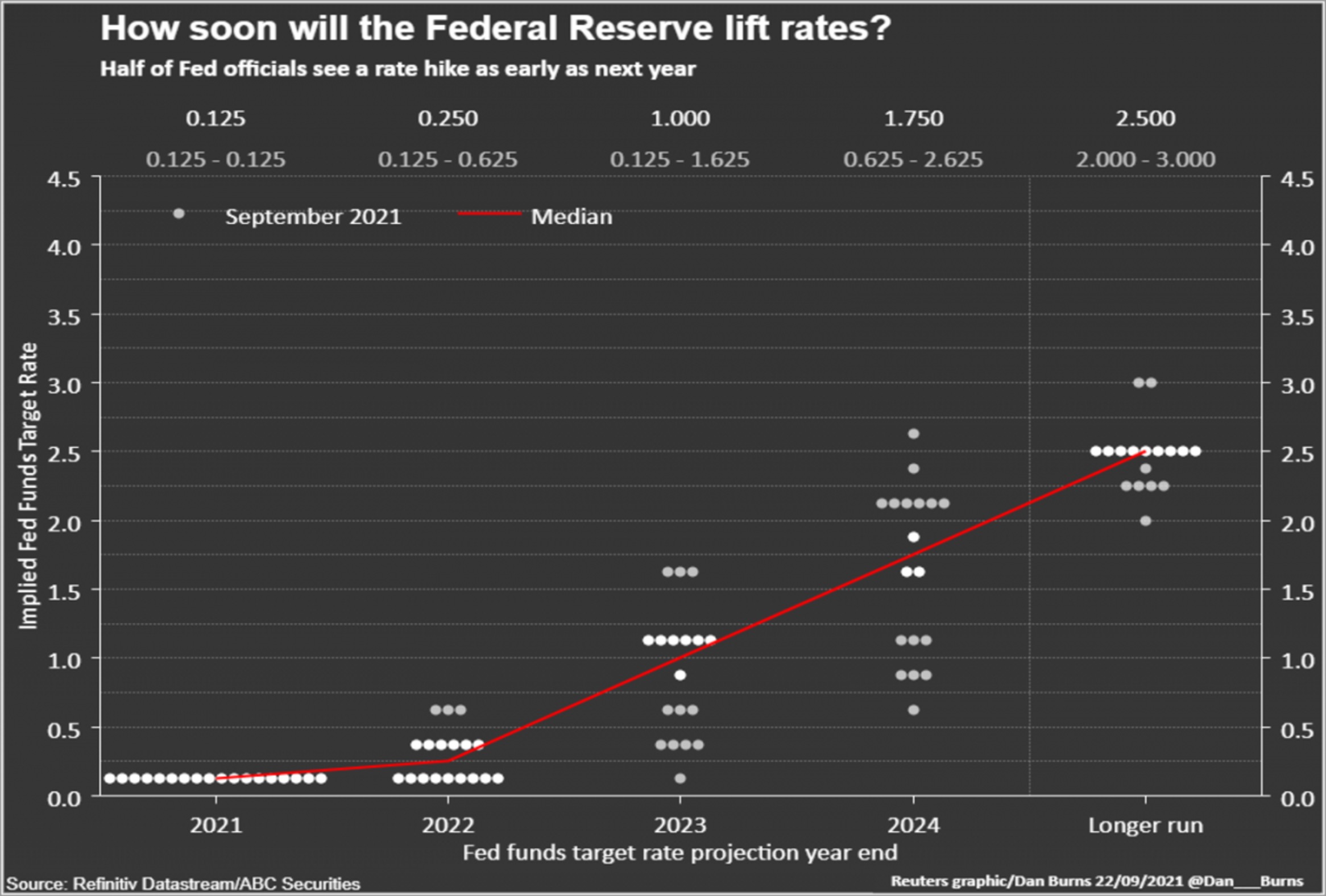

In March, the Fed signaled it wouldn’t raise the Federal Funds rate until at least 2024. In June, the Fed stood by its transitory stance but began to indicate rate hikes would come sooner as the dot plot of expectations from FOMC members indicated two rate hikes in 2023. By September, half of Fed policymakers are expected to start raising rates in 2022, as seen below.

While the timing of rate hikes is uncertain, it appears that accommodative policy will be eased in the not so distant future. What does that mean for auto dealers?

Impact of Inflation on Auto Dealerships

Notably for auto dealers, used vehicle prices surged by over 10% month-over-month in both April and June, which accounted for about a third of the total increase in the CPI for those periods. According to Cox Automotive Chief Economist Jonathan Smoke back in July, used vehicles were “the poster child illustration for transitory price hikes.” While used vehicle prices, according to the CPI, have come back down to Earth in recent months, including decreases of 1.5% and 0.7% in the past two months, new vehicles have seen monthly growth of at least 1.2% since May due to supply shortages.

New and used vehicle retail prices continue to climb to all-time highs. Even despite lower volumes, dealers are seeing higher revenues. Through August 2021, the average dealership was getting $3,668 in retail gross profit per new vehicle retailed. Through April of this year, that figure was $2,906 indicating a widening of profits for dealers on a per unit basis. This has played a role in the outsized profits achieved by auto dealers in 2021, who are likely wondering how long this can last.

In our view, prices will continue to rise in the short-term due to supply constraints. However, consumers are becoming increasingly aware of these higher costs, and new vehicle buyers are likely delaying purchases if they are able to wait. While businesses across all industries are able to point at supply shortages and COVID as reasons for higher prices right now, at some point buyers will leave the market to wait for prices to normalize.

While retail vehicle prices will eventually begin to level off, dealers are likely to remain in a strong position because dealerships have numerous complimentary profit centers. But how long will it last?

While retail vehicle prices will eventually begin to level off, dealers are likely to remain in a strong position. As we’ve discussed before, auto dealerships have numerous complimentary profit centers. If a customer can’t find the new vehicle they want, a deft salesman can get them into a used vehicle. When consumers delay purchases of a vehicle, they put more mileage on their current vehicle, driving business to the higher margin service and parts operations. With fewer vehicles put on the road in 2021 due to shortages, we see a runway for more vehicle sales, even if the profit per unit declines.

In the medium term, parts and service may be the area to watch. Fewer vehicle sales means parts and service will eventually dip in the future, though this likely won’t be felt for a few years. It will also be interesting to see where consumers get their vehicles serviced after purchasing from online used vehicle retailers that don’t have these operations.

Along with the factors already mentioned, the future path of inflation for vehicles will likely also be impacted and interconnect to the path taken by interest rates.

Impact of Interest Rates on Auto Dealerships

According to an interesting Lexington Law study on how Americans are buying cars, auto loans are used on 85% of new car purchases and 53% of used car purchases nationwide. When interest rates fall to the prevailing low levels, consumers are able to afford more expensive cars. However, the mathematical movement of lower interest rates doesn’t necessarily mean consumers will correspondingly purchase a more expensive car. Similarly, when interest rates rise, that doesn’t mean vehicle prices have to decline. Still, dealers should be aware that this is the case, at least in theory.

Interest rates matter. Auto loans are used on 85% of new car purchases and 53% of used car purchases nationwide.

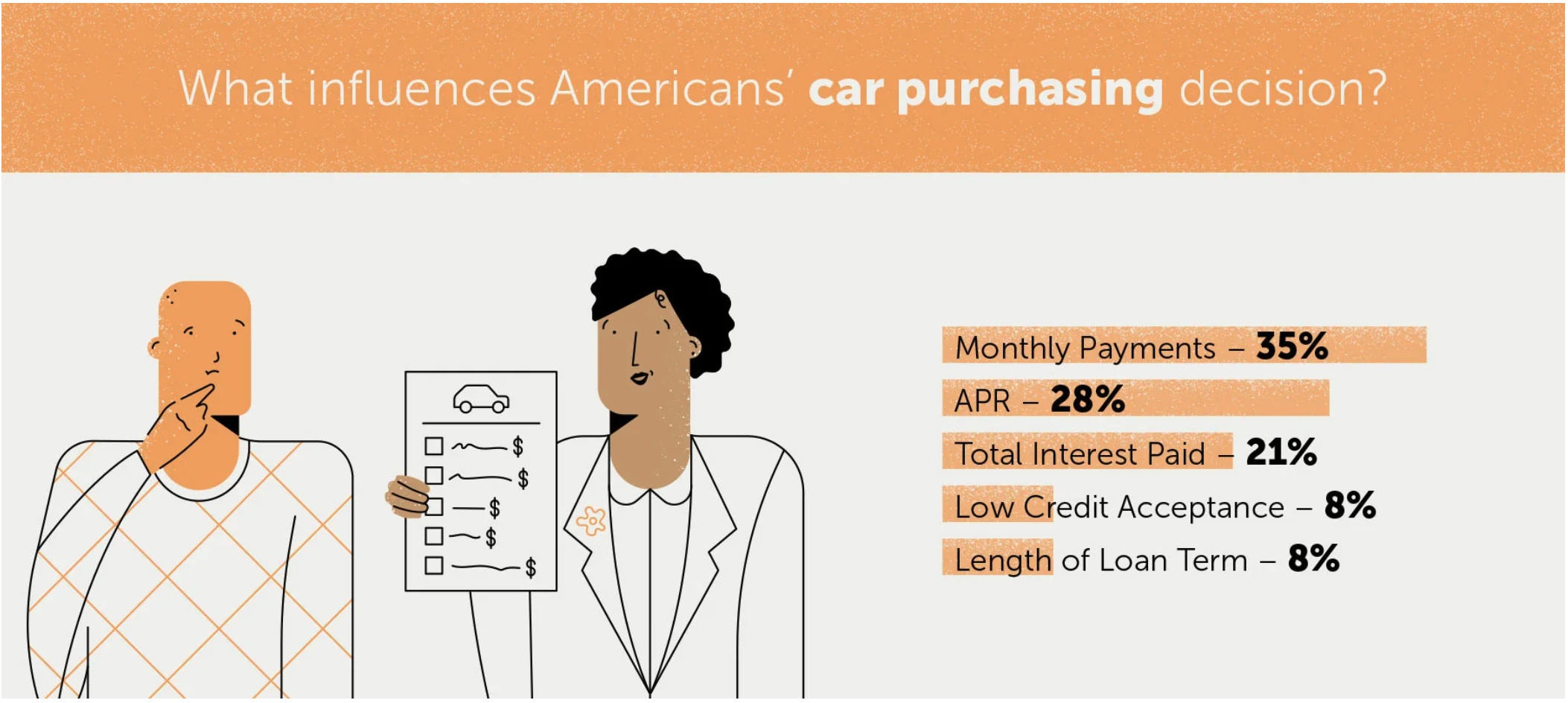

In practice, F&I departments can smooth out rising interest rates or rising vehicle prices by extending the length of loans. According to Lexington Law study, the amount of the monthly payment was the top priority for the average car buyer. It is natural for people to consider their monthly out-of-pocket costs and what they can afford, even if it leads to a longer loan term or higher interest rates. We should also note that APR and total interest paid are similar considerations, which when combined, amount to almost half of the decision.

Source: Lexington Law | Study: How Are Americans Buying Cars?

Source: Lexington Law | Study: How Are Americans Buying Cars?

Rising interest rates will increase costs to consumers and if they’re on a fixed budget, this places downward pressure on vehicle prices. In December 2015, the Fed raised rates for the first time since the Global Financial Criss. Dealers will have to lean on their past experience on how to navigate vehicle sales in an environment of rising interest rates.

Interest rates don’t only affect top line revenues for dealerships, however. The prevailing low interest environment and inventory shortage has significantly reduced one key operating expense for auto dealerships: floor-plan interest expense. Lower interest rates mean the price of keeping inventory on the lot for test drives is lower. With lower levels of inventory, interest expense is being reduced by volume as well as price. With inventories expected to normalize and interest rates expected to creep up, auto dealers will see floor plan expenses rising. It may not get back to pre-COVID levels if OEMs structurally change the level of inventories kept on dealers’ lots, but that’s another topic for another blog post.

Conclusion

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business and how it is impacted by the greater macroeconomic environment. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights