Is the Hype Sustainable?

How EV Start-Ups Are Taking Advantage of SPACs to Enter the Public Market

As we mentioned in a previous blog post, the electric vehicle (EV) market has been all the rage lately, driven primarily by Tesla’s success in creating main stream electric vehicles. We’ve discussed the “Tesla Story” extensively in previous posts, and their stock has continued to rise. It was sitting around $2,200 last Friday (August 28), up from $216 last year, or an astounding 918%. Tesla split its stock 5-1 Monday and was hovering around $450 at the time of writing this post.

As expected, other companies want to capitalize on the hype that Tesla has created in the industry, with EV start-ups trying to capture a slice of the pie. This summer has been a huge one for the industry, with electric vehicle startups Nikola, Fisker, Hyiilon, Lordstown, and Canoo all either going public or announcing plans to go public. Notably, however, they are not relying on the typical, lengthy IPO route to achieve this. Instead, they are using special purpose acquisition companies (or SPACs) to hit public markets quicker. In this post, we will walk through the companies going public, the deals, pros and cons of the SPAC, and what this could mean for your dealership.

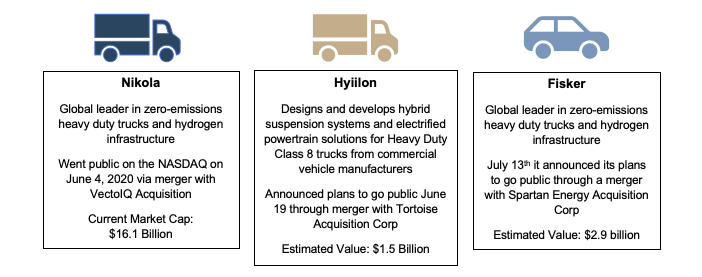

The EV Start-up Contenders

Nikola was the first of these EV start-ups to go public, announcing an IPO merger with VectoIQ Acquisition, a special purpose acquisition company, on March 3rd. After the merger was completed, the combined company was estimated to be worth $3.3 billion. Nikola was founded in 2015 and now is the global leader in zero-emission heavy duty trucks and hydrogen infrastructure. They hope to use the money raised from the public offering on the development of their electric semi trucks, of which they had around 14,000 preorders. This represents about $10 billion of potential revenue and three years of production. While the stock peaked 5 days after the offering at $79.73, the hype hasn’t lasted as its stock price has steadily declined back down to about $42 as of Monday. Despite the recent lackluster performance, future success is most likely hinging on if Nikola can deliver when they start rolling out vehicles.

Hyiilon is seeking to follow in Nikola’s footsteps; on June 19th the company announced it would merge with Tortoise Acquisition, also a SPAC. At the time of the announcement, Nikola stock was up 80% from its IPO price, an encouraging sign for Hyiilon, who differentiates itself from Nikola and Tesla by offering a hybrid solution that works with existing diesel trucks. The company plans to introduce the first carbon-negative solution that will recycle natural gas. This, paired with a lighter design, could result in greater payloads that will lead to more profitable truck routes without having to invest in a totally new fleet. According to internal metrics, the company also outperforms Tesla and Nikola in range and payload capacity. The deal is expected to close in Q3 and once this happens, the ticker symbol will change from SHLL to HYLN, and Hyiilon will officially be a publicly traded company. Hyiilon has indicated that it will use the funds from the public offering for commercialization, production, and operations growth.

While the Nikola and Hyiilon deals are in the heavy-duty truck space, Fisker, Lordstown Motors, and Canoo are EV start-ups in the standard light weight vehicle market. They announced their plans to go public through SPACs on July 13th, August 3rd, and August 18th, respectively. Fisker and Canoo both deal with traditional vehicles, though the designs are completely different. The founder of Fisker is best known for designing luxury vehicles for companies such as Ford, BMW, and Aston Martin. Looking to bring the same style to the electric vehicle market, Fisker and Spartan Energy Acquisition, a special purpose acquisition corporation backed by Apollo Global Management is expected to close in the fourth quarter, valuing the company at $2.9 billion. In a similar fashion, Canoo announced a merger with Hennessy Capital Acquisition Corp IV, another SPAC, valuing the company at $2.4 million. Canoo’s spin on the electric vehicle is a VW microbus-style van. Finally, Lordstown Motors entered the public space as well, trying to get more traction for their electric pickup truck, Endurance. Lordstown listed on its site some impressive features of the vehicle including 250-plus miles EV range, 7,500-pound towing capacity, and an 80 mph top speed. They are planning a merger with DiamondPeak that will give the company a pro forma equity value of $1.6 billion. Suffice it to say, there is a lot going on in the EV space right now.

SPACs

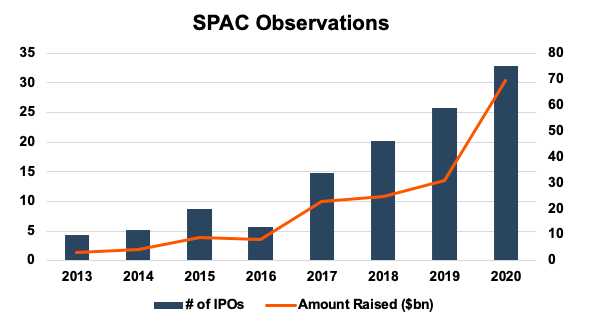

Despite some of these companies not even having a viable product yet, through the use of a SPAC rather than the traditional IPO route, these companies are all able to raise large funds from public market investors that are more averse to risk than private investors to back public development. Having mentioned the SPAC extensively above, it’s important to consider what it is specifically and why it could be considered so favorably by companies such as those in the EV industry. A special acquisition company (or SPAC) is a special type of company that goes public for the sole reason of buying another company regardless of how much it raises through an IPO. It’s for this reason that a SPAC is also known as a “blank-check” company. SPACs have become increasingly popular over the past few years, with 28 SPACs having IPO’d this year raising $8.9 billion. This is on track to reach $16.5 billion by the end of the year, a 21% increase from the prior year.

What is prompting this SPAC boom? Some theorize that it has to do with the COVID-19 pandemic. IPO roadshows have become difficult to do in the current climate and don’t work as well remotely. Furthermore, there has been a shift toward one-on-one deals rather than one-to-many capital raises. However, while these circumstances can explain the increase in 2020, they fail to account for the increase over the past decade. Another favorable attribute includes risk mitigation for the selling company. The reasoning for this is because, with a SPAC, the company negotiates the price and then signs the deal. With a traditional IPO, it is the other way around, and there is no guarantee that it will be successful. Despite all of these factors, the most compelling argument for the SPAC boom doesn’t have to do anything with the cost (the SPAC is more expensive) or risk-mitigating factors, but instead primarily has to do with its timeline. With companies in “hyped-up” industries such as the EV market or the space tourism market (looking at you, Virgin Galactic), it makes sense for them to get to market as quickly as possible in order to extract gains in the market from this hype factor. Hence, the appeal of the SPAC.

Despite all of the positives for companies, SPACs do have their drawbacks. One of these drawbacks is no reverse break fees, meaning that the potential to receive deal protection in the form of a reverse-breakup fee from the SPAC can be limited because of an inability to access the trust account cash other than post-business combination. Furthermore, since the SPAC structure is less risky for the company than an IPO, the SPAC should be compensated for this risk protection with an even bigger discount than regular IPO investors. Finally, there can be an uncertain amount of cash availability with SPACs due to a SPAC’s public stockholders having the option to elect to have their shares redeemed for cash in connection with the business combination. More investors redeeming their shares for cash means less cash for the company going public.

How Long Can the Hype be Maintained?

While in the 21st-century fads can catch on quickly and explode, they also have the potential to die out just as fast with “the next big thing” always around the corner. This seems to be the problem with companies that use SPACs to go public. Of the 222 SPAC IPOs since the start of 2015, 89 have completed mergers and taken a company public. Of these, the common shares have delivered an average loss of -18.8% and a median return of -36.1% since 2015. This is a stark contrast to traditional IPO returns which have averaged 37.2% since 2015. Behind these numbers is a common trend of an initial pop when the company is announced followed by a further jump if it is priced right when it begins trading. However, declines tend to follow these initial bursts. Only 26 SPACs in the group have had positive returns as of the end of July. It seems that while SPACs could be useful for helping a company ride the interest-wave in order to raise funding, they have to have a product that isn’t just hype-worthy but can sustain consumer interest over the years.

Key Takeaways

Though these public offerings may not initially impact dealerships directly, the surge of electric vehicle start-ups capitalizing on SPACs could mean there may be more electric vehicle alternatives to Tesla in the near future. Traditional manufacturers could ultimately try to acquire these start-ups in order to bolster their own electric vehicle offerings. For example, General Motors has invested $75 million in the Lordstown deal. If large traditional manufacturers pivot to larger EV offerings through the investment in these companies, dealerships could ultimately benefit from the larger selection being offered to consumers. Furthermore, as the use of SPACs to reach the public market increases in prominence, it is not out of the question that we see dealerships using this vehicle in the near future as well. With the main public dealers all reaching the market around the same time and there not being any new entrants in a while, the industry is overdue for some new players. While ultimately these thoughts are speculative, observing what is going on in the space can help companies prepare for what might be ahead.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights